What is a SPAC, or Special Purpose Acquisition Company?

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an IPO for the purpose of acquiring an existing company. Also known as “blank check companies,” SPACs have been around for decades. Recently, they have become more popular, attracting big-name underwriters and investors.

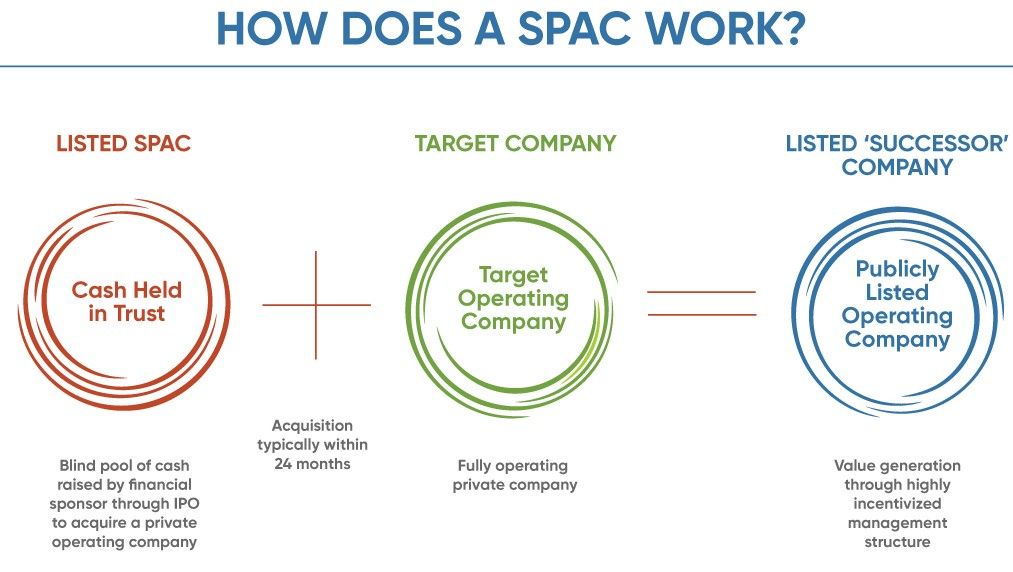

How Does a SPAC Work?

SPACs are typically formed by investors or sponsors with expertise in a specific industry or business sector. With creating the SPAC, the founders have at least one acquisition target in mind, but it is not identified to avoid extensive disclosures during the IPO process. This is why they are referred to as “blank check companies”, because IPO investors have no idea what they are actually investing in.

The money SPACs raise in an IPO is placed in an interest-bearing trust account. These funds cannot be disbursed except to complete an acquisition or to return the money to investors if the SPAC is liquidated.

When a special purpose acquisition company, or SPAC, identifies its acquisition target, it usually commits the funding it raised in its SPAC IPO along with a private investment round known as a PIPE that provides additional capital to help the business grow.

Learn More: SPAC vs IPO

Why Private Companies Are Choosing SPACs

- From Aug 2020 through Jan 2021, more than 50 SPACs had been formed in the U.S. having raised around $21.5 billion.

Reputation:

- Largest-ever SPAC: Bill Ackman, founder of Pershing Square Capital Management, sponsored his own SPAC, Pershing Square Tontine Holdings, raising $4 billion in its offering on July 22.

- Most high-profile deal: Richard Branson’s Virgin Galactic: Venture Capitalist Chamath Palihapitiya’s SPAC Social Capital Hedosophia Holdings bought a 49% stake in Virgin Galactic for $800 million before listing the company in 2019.

Advantages to SPAC

Selling to a SPAC can be an attractive option for the owners of a smaller company, which are often private equity funds:

- Selling to a SPAC can add up to 20% to the sale price compared to a typical private equity deal

- Offers business owners essentially a faster IPO process under the guidance of an experienced partner

- Less worry about the swings in broader market sentiment

What is a Reverse Merger?

A reverse takeover, reverse merger, or reverse IPO is the acquisition of a private company by an existing public company so that the private company can bypass the lengthy and complex process of going public.

The shareholders of the private company usually receive large amounts of ownership in the public company and control of its board of directors. Generally, reverse mergers succeed for companies that don’t need the capital right away. Look for companies trying to raise at least $500,000 and are expected to do sales of at least $20 million during the first year as a public company.

What is an Initial Public Offering (IPO)?

An Initial Public Offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. Public share issuance allows a company to raise capital from public investors.

- IPOs provide companies with an opportunity to obtain capital by offering shares through the primary market.

- Companies hire investment banks to market, gauge demand, set the IPO price and date, and more.

- An IPO can be seen as an exit strategy for the company’s founders and early investors, realizing the full profit from their private investment.

KEY TAKEAWAYS

- A special purpose acquisition company is formed to raise money through an initial public offering to buy another company.

- At the time of their IPOs, SPACs have no existing business operations or even stated targets for acquisition.

- Investors in SPACs can range from well-known private equity funds to the public.

- SPACs have two years to complete an acquisition, or they must return their funds to investors.

Pros |

Cons |

|

Traditional IPO |

Fundraising | Lengthy Process |

| Publicity and credibility | Execution risk | |

| Higher banking fees | ||

SPAC IPO |

Lower execution risk | Due Diligence Risk |

| Strategic partnership with sponsor | Lack of readiness for public scrutiny | |

| Faster path to becoming public | May be considered lower quality | |

| Dilution from the sponsor’s promote (~20%) | ||

HOW CAN WE HELP?

1. Accounting for Complex Transactions

Provide expertise on accounting for new merger/acquisition, stock compensation, complex debt/equity (Services Include: ASC 805, ASC 718 & 480, ASC 480, 815, 470)

2. Audit Preparation & SEC/Financial Reporting

Manage Audit with CPA Firm & complete required GAAP & IFRS & supervise entire IPO process, including public filings/ footnote prep (Services Include: SEC Form S-X/F-1, 10-K, 10- Q, 8-K filings, OTC/Private annual. & qtly statements)

3. Adoption of New Accounting Standards

Determine result new standards will have on financial statements (Services Include: ASC 606, ASC 842, ASC 326)

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced, fractional CFO, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: The Guide To Mergers and Acquisitions