Rounds of Funding for Start-Ups

What is Rounds of Funding for Start-ups?

Having your business and dream come to life is an exciting time. As a start-up or small business, you will eventually reach a point where you grow beyond your current means to reach the next level of success and growth. This can be nearly impossible without some form of outside funding. There are different rounds of funding, and each one is meant to help your company in a different way.

Challenge: In the start-up lifecycle stage, it is likely you have overestimated money needs and the time to market. It is important to not spend the small amount of cash that you do have. You need to learn what profitable needs your clients have and do a check to see if your business is on the right track.

Focus: Start-ups require establishing a customer base and market presence along with tracking and conserving cash flow. Businesses focus on marketing to their target consumer segments by advertising their comparative advantages and value propositions.

Rounds of Funding Types:

Most successful startups have put in a lot of effort to raise capital through rounds of external funding. These funding rounds provide outside investors the opportunity to invest cash in a growing company in exchange for equity.

It is not uncommon for startups to engage in what is known as seed funding or angel investor funding. These funding rounds are followed by Series A, B and C funding rounds. Series A, B and C are necessary for a business that decides bootstrapping or merely surviving off the generosity of friends, family and the depth of their own pockets, will not suffice.

- Pre-Seed Funding

- Crowdfunding

- Friends & Family

- Party Round

- Piggy Round

- Convertible Debt

- Angel Investors

- Micro VCs

- University Program

- Owner

Before any round of funding begins, analysts undertake a valuation of the company. Valuations are made from many different factors, including management, proven track record, market size and risk. Some of the key distinctions between funding rounds has to do with the valuation of the business, maturity level and growth.

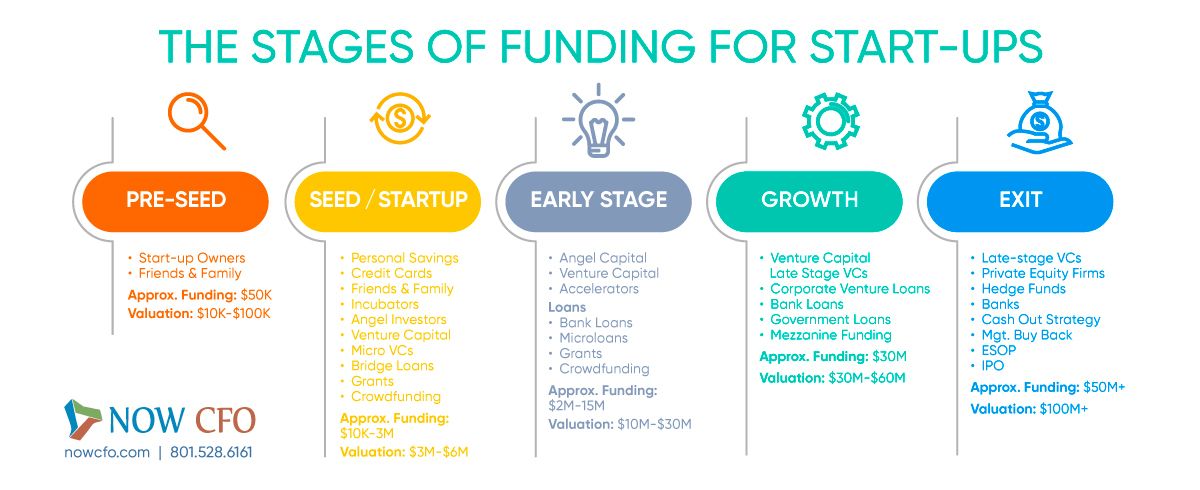

Rounds of Funding:

Pre-Seed: This is the earliest stage of funding for a new company when they are getting their operations up and off the ground. The pre-seed funders are the founder themselves, family, friends and other close supporters. In this stage, any investors are not typically partaking of any equity in the company since it is so early on.

Seed: This is the first official equity funding stage and the first official money that a business raises. This funding will help to finance the first steps of the business including hiring a team, market research and product development. The types of investors in this stage include friends and family, incubators, venture capitalists and more. One of the most common investors is an “angel investor.”

Angel investors tend to appreciate riskier ventures such as start-ups and expect an equity stake in the company in exchange for their investment. Seed funding rounds can generate anywhere from $10,000 to $2 million. Sometimes, this round of funding is all a business will need to get off the ground and not ever make it to a Series A or B funding round.

Series A: This round of funding is used to further optimize its user base and product offerings. Firms going through Series A funding rounds to be valued at up to $23 million typically and raise approximately $2 million to $15 million. The investors tend to come from traditional venture capital firms.

Series B: This round is about taking businesses past the development stage and to the next level. This round is used to grow the company to meet increased levels of demand. The average estimated capital raised in a Series B round is $33 million. Companies undergoing a Series B funding round are well-established companies and have valuations between around $30 million and $60 million, with an average of $58 million.

Series C: Businesses that make it to this level are quite successful and gain up to hundreds of millions of dollars in funding through Series C rounds, prepared to continue to develop on a global scale. In Series C, groups such as hedge funds, investment banks, private equity firms, and large secondary market groups accompany the type of investors involved.

These companies utilize Series C funding to help boost their valuation in anticipation of an IPO. At this point, companies are sitting at valuations in the area of $118 million+ Typically, a company will end its external equity funding with Series C. However, some companies can go on to Series D and even Series E rounds of funding as well.

Funding Checklist:

- Executive Summary

- Business Overview

- Operations Plan

- Market Analysis

- Products and Services

- Sales and Marketing

- Competitive Analysis

- Management Team

- Financial Plan

- Projections

HOW WE CAN HELP:

Seeking funding is an exciting time in any business’s life cycle, but it requires carefully plotted pitch and meticulous financials. Seeking funding as a startup or small business is not going to be easy, but we know your business is worth it, and we can help you be as prepared as possible going in.

An outsourced CFO will not only save you valuable funds as your start-up is getting off the ground and things are already tight, but it will also add extreme value to your company. A CFO is an integral part of preparation for funding and for working with investors. You could be losing out on millions of dollars by not having a CFO, as an investor will have more trust and faith in your company and the financials with a CFO on board.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Internal Controller, bookkeeping and payroll services and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Step-by-Step Series A Funding Prep Guide