Turnaround vs. Restructuring: The Differences You Need to Know

Businesses often encounter financial challenges that necessitate strategic interventions. Understanding the distinction between turnaround vs. restructuring is crucial for organizations aiming to restore stability and profitability.

Notably, in 2023, there was a 68% increase in corporate bankruptcies compared to the previous year, underscoring the importance of timely and appropriate corrective actions.

This article delves into the key differences between turnaround and restructuring strategies, providing insights to help businesses navigate financial distress effectively.

What is Business Turnaround?

Companies often face challenges threatening their viability. Understanding the concept of a business turnaround is crucial for organizations aiming to navigate periods of financial distress and return to profitability.

Defining Business Turnaround and Its Purpose

A business turnaround refers to a series of strategic actions implemented by an organization’s management to reverse a period of decline and restore financial health. The primary purpose of a turnaround is to identify the root causes of underperformance, address them effectively, and guide the company back to profitability and sustainable growth.

This process often involves comprehensive changes in management practices, operational procedures, and strategic focus to realign the company’s objectives with market demands.

Key Strategies in a Turnaround Plan

Implementing a successful turnaround plan typically encompasses several key strategies:

- Retrenchment: Reducing costs by downsizing non-essential operations and improving efficiency.

- Repositioning: Altering the company’s market position through product innovation or entering new markets.

- Replacement: Introducing new leadership to bring fresh perspectives and drive change.

- Renewal: Revitalizing the organizational culture and processes to foster innovation and adaptability.

These strategies aim to stabilize the company’s financial status, enhance operational performance, and rebuild stakeholder confidence.

When to Implement a Turnaround Strategy

Recognizing the appropriate time to implement a turnaround strategy is vital for its success. Indicators that a company may need to consider a turnaround include consistent financial losses, declining market share, deteriorating cash flow, and operational inefficiencies.

External factors such as economic downturns or increased competition can also necessitate a turnaround. Proactively identifying these signs allows management to initiate corrective actions before the situation becomes irreparable, thereby increasing the likelihood of a successful recovery.

What is Corporate Restructuring?

In today’s dynamic business environment, companies often face challenges that necessitate significant organizational changes. Understanding the corporate restructuring process is essential for businesses that navigate financial difficulties and enhance operational efficiency.

Defining Restructuring and Its Role in Business Recovery Strategies

Corporate restructuring involves comprehensively reorganizing a company’s internal structure, operations, or finances to address challenges and improve performance. This process may include altering the organizational hierarchy, modifying operational procedures, or renegotiating financial obligations.

The primary goal is to restore profitability, enhance efficiency, and ensure long-term sustainability. Restructuring plays a pivotal role in business recovery by enabling companies to adapt to market changes, reduce costs, and optimize resource allocation.

For instance, many firms restructure to remain competitive and financially viable during economic downturns.

Key Elements of the Restructuring Process

The restructuring process encompasses several critical elements:

- Financial Restructuring: Adjusting the capital structure by refinancing debt, converting debt to equity, or renegotiating terms with creditors to improve liquidity.

- Operational Restructuring: Streamlining operations by eliminating redundancies, optimizing processes, or outsourcing non-core activities to enhance efficiency.

- Organizational Restructuring: Reconfiguring the company’s hierarchy, which may involve merging departments, downsizing, or redefining roles to improve communication and decision-making.

- Asset Divestiture: Selling off non-core or underperforming assets to raise capital and focus on core business areas.

When Restructuring is the Right Option for a Company

Companies should consider corporate restructuring under several circumstances:

- Persistent Financial Losses: Continuous decline in profits or debts may necessitate restructuring to prevent insolvency.

- Operational Inefficiencies: Identifying and addressing process inefficiencies can lead to cost savings and improved performance.

- Strategic Realignment: Shifts in market dynamics or company strategy may require restructuring to realign resources and focus on new objectives.

- Regulatory Compliance: Changes in laws or regulations might compel a company to restructure to remain compliant.

Key Differences Turnaround vs. Restructuring

Understanding the distinctions between turnaround and restructuring is crucial for businesses facing financial challenges. While both strategies aim to restore stability and profitability, they differ in objectives, approaches to debt management, and impacts on leadership and organizational structure.

Objective and Scope of Each Strategy

A financial turnaround focuses on revitalizing a company’s operations to return to profitability. This approach involves identifying and addressing internal issues such as declining sales, operational inefficiencies, or poor management practices.

In contrast, restructuring entails significant changes to a company’s financial or operational framework, often in response to severe economic distress. This process may involve modifying debt arrangements, reorganizing business units, or altering ownership structures to improve financial stability.

Approaches to Debt Management in Turnaround vs. Restructuring

In a turnaround, debt management improves cash flow through enhanced operational performance. The company aims to meet its debt obligations by increasing revenues and reducing costs without renegotiating terms.

Conversely, restructuring often involves direct intervention in the company’s debt structure. This can include renegotiating terms with creditors, consolidating debts, or converting debt into equity.

The objective is to reduce the immediate financial burden and create a more manageable debt profile, providing the company with the breathing room needed to implement broader strategic channels.

Impact on Company Leadership and Organizational Changes

Implementing a turnaround typically requires existing leadership to adopt new strategies and improve operational practices. While management may change, the emphasis is on enhancing current leadership effectiveness and making incremental adjustments to the organizational structure.

Restructuring often involves more substantial changes to leadership and organizational structure. This consists of appointing new executives, redefining management roles, or overhauling governance frameworks.

The aim is to align leadership and organizational design with the restructured company’s strategic objectives, ensuring that the new structure supports long-term sustainability.

When to Choose Turnaround Over Restructuring

Determining whether to implement a business turnaround strategy or pursue restructuring is crucial while facing financial challenges. Each approach serves different purposes and is suitable under specific circumstances.

Signs Your Business Needs a Turnaround

A turnaround strategy focuses on revitalizing a company’s operations to restore profitability. Indicators that a business may benefit from turnaround management include:

- Declining Revenue: Consistent drops in sales figures suggest underlying issues in product offerings or market positioning.

- Excess Inventory: Too much inventory is costly and strains capital and cash flow.

- High Employee Turnover: A significant increase in staff departures can indicate internal dissatisfaction, affecting productivity.

- Customer Attrition: Losing clients to competitors may indicate declining service quality or outdated products.

Addressing these issues typically involves operational changes, such as improving product quality, enhancing customer service, and optimizing internal processes.

When Restructuring Is the Best Solution for Your Company

Restructuring involves reorganizing a company’s financial and operational structures to address more profound financial distress or strategic misalignment. Situations warranting restructuring include:

- Unsustainable Debt Levels: When debt obligations overwhelm the company’s ability to meet them, restructuring debt terms becomes necessary.

- Persistent Cash Flow Issues: Ongoing liquidity problems that threaten daily operations may require restructuring to realign expenses with revenues.

- Strategic Misalignment: If the company’s structure no longer supports its strategic goals, restructuring can better realign operations to suit market demands.

- Regulatory Compliance Challenges: Changes in laws or regulations that the current structure cannot accommodate may necessitate restructuring.

Factors to Consider in Making the Decision

Choosing between a financial turnaround and restructuring requires careful evaluation of several factors:

- Severity of Financial Distress: Assess whether issues are operational inefficiencies or more profound financial insolvency.

- Time Constraints: Determine the urgency of intervention needed to prevent further decline.

- Stakeholder Impact: Consider how each approach will affect employees, customers, creditors, and investors.

- Resource Availability: Evaluate the company’s capacity to implement necessary changes, including management expertise and financial resources.

Engaging early, through an out-of-court restructuring, is often the most viable and pragmatic option. Having the right advisors is crucial here.

Key Players Involved in Turnaround vs. Restructuring

In navigating the complexities of turnaround and restructuring, several key players are pivotal in steering companies back to financial health.

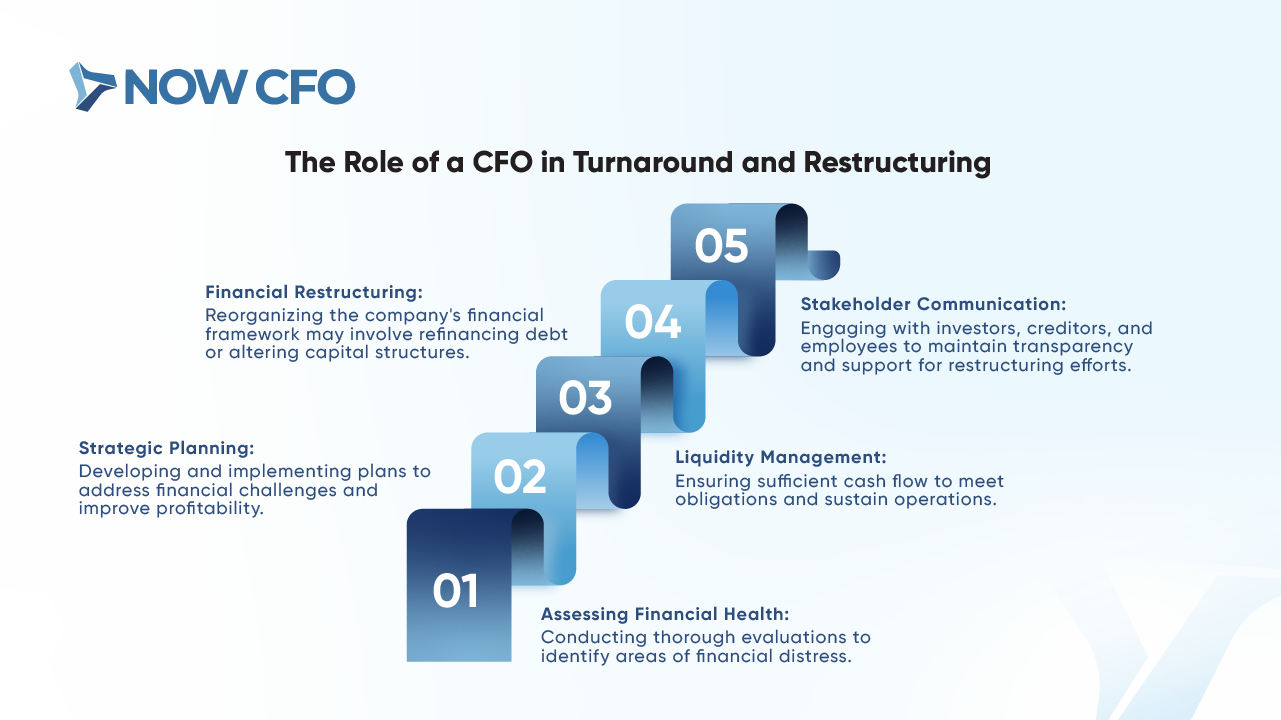

The Role of a CFO in Turnaround and Restructuring

The CFO is a strategic leader during turnaround and restructuring processes. They analyze financial data to identify inefficiencies and implement corrective measures. By benchmarking against industry peers, CFOs can pinpoint areas for improvement.

They also develop economic models to project outcomes of various strategies, aiding in informed decision-making. Furthermore, CFOs communicate with stakeholders, including creditors and investors, to build confidence in the company’s recovery plan.

Legal and Financial Advisors’ Role in Restructuring

Legal and financial advisors are crucial in the restructuring phase. They ensure compliance with regulations, negotiate with creditors, and manage contractual obligations.

Financial advisors assess the company’s economic structure, provide valuation services, and recommend strategies to optimize capital structure. Their expertise facilitates negotiations and helps formulate a feasible restructuring plan that aligns with legal requirements and financial realities.

Outsourced CFOs and Turnaround Specialists

When there are insufficient internal resources, companies may engage outsourced CFOs and turnaround specialists. These professionals bring specialized skills and experience in crisis management.

Outsourced CFOs temporarily offer financial leadership, providing objective assessments and strategic planning. Turnaround specialists focus on rapid performance improvement, often taking interim management roles to implement necessary changes swiftly. Their external perspective can be invaluable in identifying issues and executing turnaround strategies effectively.

Common Pitfalls in Turnaround and Restructuring Efforts

Embarking on turnaround and restructuring initiatives is essential for companies aiming to regain financial stability. However, these processes are fraught with challenges that can impede success.

60% of restructuring efforts fail due to poor execution, resistance to change, or lack of stakeholder buy-in.

Challenges in Implementing a Turnaround Plan

Implementing a successful turnaround plan involves several hurdles:

- Lack of Clear Vision: Without a well-defined strategy, efforts can become disjointed, leading to inconsistent actions.

- Resistance to Change: Employees may be reluctant to adopt new processes, hindering progress.

- Insufficient Communication: Failing to convey the plan’s objectives can result in misunderstandings and lack of alignment.

- Inadequate Resource Allocation: Not dedicating sufficient resources can stall critical initiatives.

Addressing these challenges requires strong leadership, effective communication, and meticulous planning.

Risks Involved in the Corporate Restructuring Process

Corporate restructuring carries inherent risks:

- Employee Morale Decline: Layoffs or significant changes can demotivate staff, reducing productivity.

- Customer Perception Issues: Clients may view restructuring as a sign of instability, affecting loyalty.

- Operational Disruptions: Reorganizing departments can temporarily hamper workflow efficiency.

- Legal and Compliance Challenges: Overlooking regulatory requirements can lead to legal complications.

Mitigating these risks involves transparent communication, careful planning, and compliance with all legal obligations.

By being aware of these common pitfalls, companies can better navigate the complexities of turnaround and restructuring efforts, enhancing their chances of a successful recovery.

Case Studies: Successful Turnarounds vs. Restructuring Efforts

Examining real-world examples of turnaround and restructuring efforts provides valuable insights into strategies that can lead to corporate recovery.

Case Study 1: A Business Turnaround Success Story

In the early 2000s, LEGO faced significant financial challenges, including declining sales and mounting debt. By 2003, the company was $800 million in debt, with sales declining by 30% yearly.

LEGO refocused on its core products, streamlined operations, and divested non-core assets to address these issues. This strategic shift led to a remarkable recovery, transforming LEGO into one of the most profitable toy manufacturers globally.

Case Study 2: How Restructuring Saved a Company from Financial Collapse

A luxury retailer, Neiman Marcus, faced severe financial distress due to heavy debt burdens and changing consumer behaviors. In May 2020, the company filed for Chapter 11 bankruptcy protection, initiating a comprehensive restructuring plan. This plan included renegotiating debt terms, closing underperforming stores, and optimizing operations.

By September 2020, Neiman Marcus emerged from bankruptcy with a strengthened balance sheet, reduced debt, and a renewed focus on its digital platform, positioning the company for sustainable growth.

These case studies illustrate how tailored turnaround and restructuring strategies can effectively address financial challenges and lead to successful corporate recovery.

Conclusion: Turnaround vs. Restructuring

Navigating financial distress requires a well-defined approach. Understanding turnaround vs. restructuring allows businesses to choose the most effective recovery solution. While a financial turnaround strengthens operations to regain profitability, restructuring business debt focuses on redefining financial obligations for stability.

For expert CFO guidance in selecting and implementing the right recovery strategy, NOW CFO provides customized financial solutions to help businesses regain control and achieve long-term success. Contact our team today for a consultation.

Learn More: The Role of an Outsourced CFO in Business Restructuring