Effective cash flow management during the year-end is crucial for businesses aiming to maintain liquidity and financial stability. Notably, a study by Jessie Hagen of U.S. Bank revealed that 82% of business failures are due to poor cash flow management.

This statistic underscores the importance of implementing robust cash flow strategies as the fiscal year concludes.

Why Cash Flow Management is Crucial at Year-End

As the fiscal year draws to a close, cash flow management during year-end becomes paramount for businesses aiming to maintain liquidity and financial stability. Effective management ensures that companies are well-prepared to meet obligations and capitalize on new opportunities in the upcoming fiscal year.

Supporting Financial Stability and Business Continuity

Robust cash flow management during year-end is essential for sustaining financial stability and ensuring uninterrupted business operations. By closely monitoring cash inflows and outflows, businesses can anticipate potential shortfalls and implement mitigation strategies.

For instance, managing cash reserves allows companies to handle unexpected expenses without disrupting daily operations.

Preparing for Year-End Expenses and Obligations

Year-end often brings a surge in expenses, including bonuses, tax payments, and inventory purchases. Proactive cash flow management during year-end enables businesses to plan for these obligations, ensuring sufficient funds are available when needed

Enhancing Flexibility for the Upcoming Fiscal Year

Effective cash flow management during year-end provides businesses with the flexibility to invest in growth opportunities as the new fiscal year begins. By optimizing cash flow, companies can allocate resources toward strategic initiatives, such as expanding product lines or entering new markets, without compromising financial health.

Minimizing the Risk of Cash Shortages

Cash shortages can severely impact a company’s ability to operate effectively. Implementing stringent cash flow management during year-end practices helps minimize this risk by ensuring that cash inflows are sufficient to cover outflows. Regular cash flow forecasting allows businesses to identify gaps and promptly take corrective actions.

Optimizing Cash Flow for Investment Opportunities

Year-end is an opportune time for businesses to assess their financial position and identify investment opportunities. Sound cash flow management during year-end ensures that companies have the necessary liquidity to invest in assets, technology, or other ventures that can drive future growth.

Also, firms with better cash flow management and reserves are more likely to invest in innovation.

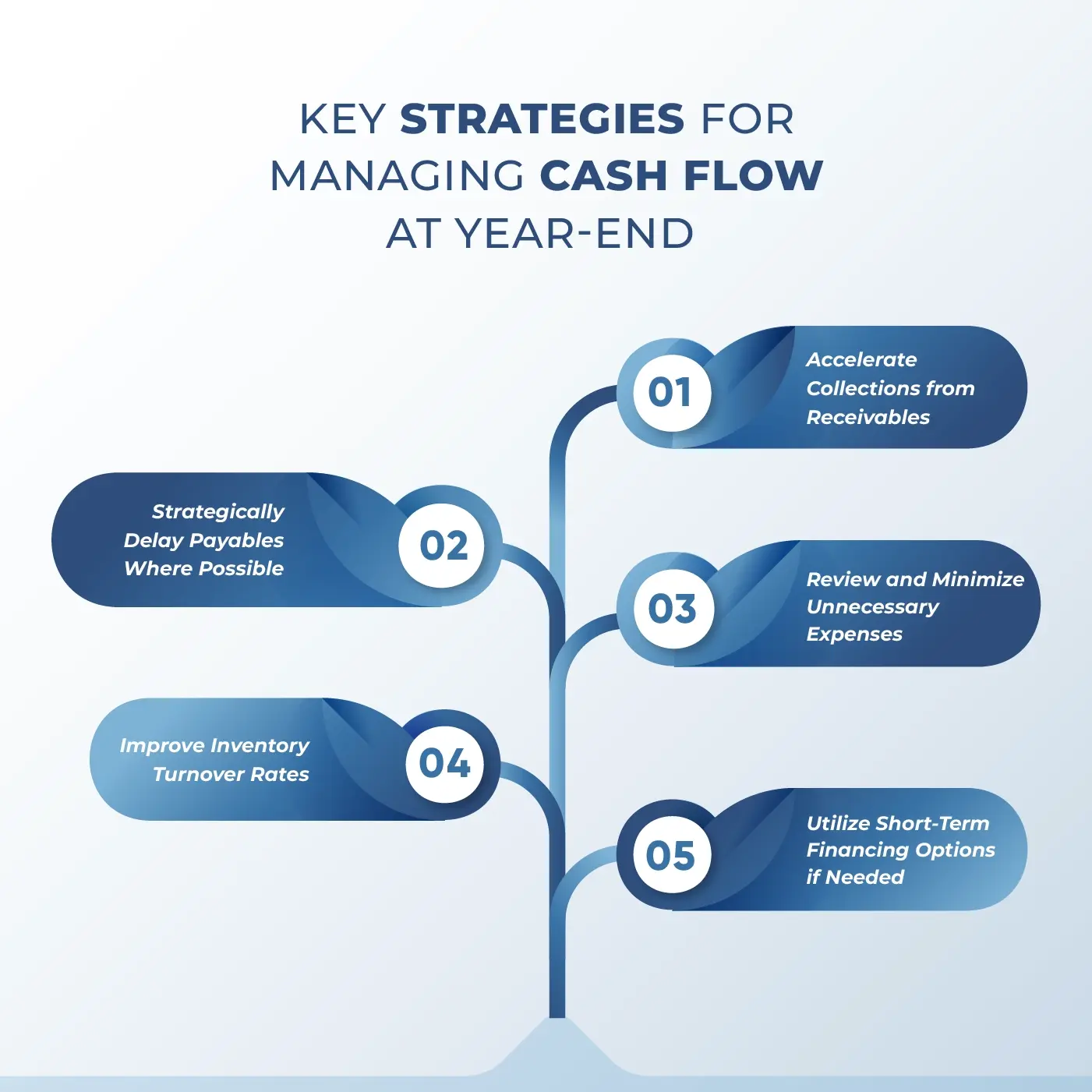

Key Strategies for Cash Flow Management During Year-End

Further, implementing effective year-end cash flow strategies becomes essential for businesses aiming to maintain liquidity and financial stability. Companies can optimize their cash flow by adopting targeted approaches, ensuring a smooth transition into the new fiscal year.

1. Accelerate Collections from Receivables

Prompt collection of outstanding receivables is crucial for bolstering cash flow. To achieve this, businesses can:

- Offer Early Payment Discounts: Providing incentives for early payments encourages clients to settle invoices sooner.

- Implement Strict Credit Policies: Assessing customer creditworthiness and setting clear payment terms can reduce the risk of late payments.

- Utilize Automated Invoicing Systems: Leveraging technology ensures timely invoice dispatch and facilitates easier tracking of payments.

According to the U.S. Small Business Administration, 20% of small businesses fail within the first year, often due to cash flow issues.

2. Strategically Delay Payables Where Possible

Managing outgoing payments effectively can enhance cash reserves. Consider the following tactics:

- Negotiate Extended Payment Terms: Collaborate with suppliers to extend payment deadlines without penalties.

- Prioritize Payments: Focus on settling high-interest debts first while deferring lower-priority payments.

- Leverage Supplier Relationships: Strong relationships may provide flexibility in payment schedules during tight cash flow periods.

3. Review and Minimize Unnecessary Expenses

Conducting a thorough review of expenses can identify areas for cost reduction:

- Audit Subscriptions and Services: Eliminate or downgrade services that no longer add value.

- Implement Energy-Saving Measures: Reducing utility costs through energy-efficient practices can result in significant savings.

- Optimize Operational Processes: Streamlining workflows can reduce labor costs and improve efficiency.

4. Improve Inventory Turnover Rates

Efficient inventory management frees up cash tied in unsold goods:

- Analyze Sales Data: Identify slow-moving items and consider discounts or promotions to clear stock.

- Adopt Just-In-Time Inventory Systems: Reducing excess inventory minimizes holding costs and aligns stock levels with demand.

- Strengthen Supplier Coordination: Collaborate closely with suppliers to adjust orders based on real-time sales trends.

5. Utilize Short-Term Financing Options if Needed

When immediate cash is required, short-term financing can provide relief:

- Establish a Line of Credit: Access to a revolving credit line offers flexibility to cover short-term expenses.

- Consider Invoice Factoring: Selling receivables to a third party can quickly convert outstanding invoices into cash.

- Explore Short-Term Loans: These can address temporary cash shortages but should be used judiciously due to potential interest costs.

By implementing these year-end cash flow strategies, businesses can enhance their financial stability and ensure they are well-positioned for the challenges and opportunities of the upcoming fiscal year.

Maintaining Liquidity Through Cash Flow Forecasting

Implementing effective year-end cash flow strategies becomes essential for businesses aiming for liquidity management and financial stability. Also, companies can optimize their cash flow by adopting targeted approaches, ensuring a smooth transition into the new fiscal year.

Accelerate Collections from Receivables

Prompt collection of outstanding receivables is crucial for maintaining cash flow stability. To achieve this, businesses can:

- Offer Early Payment Discounts: Providing incentives for early payments encourages clients to settle invoices sooner.

- Implement Strict Credit Policies: Assessing customer creditworthiness and setting clear payment terms can reduce the risk of late payments.

- Utilize Automated Invoicing Systems: Leveraging technology ensures timely invoice dispatch and facilitates easier tracking of payments.

Strategically Delay Payables Where Possible

Managing outgoing payments effectively can enhance cash reserves. Consider the following tactics:

- Negotiate Extended Payment Terms: Collaborate with suppliers to extend payment deadlines without penalties.

- Prioritize Payments: Focus on settling high-interest debts first while deferring lower-priority payments.

- Leverage Supplier Relationships: Strong relationships may provide flexibility in payment schedules during tight cash flow periods.

Review and Minimize Unnecessary Expenses

Conducting a thorough review of expenses can identify areas for cost reduction:

- Audit Subscriptions and Services: Eliminate or downgrade services that no longer add value.

- Implement Energy-Saving Measures: Reducing utility costs through energy-efficient practices can result in significant savings.

- Optimize Operational Processes: Streamlining workflows can reduce labor costs and improve efficiency.

Improve Inventory Turnover Rates

Efficient inventory management frees up cash tied in unsold goods:

- Analyze Sales Data: Identify slow-moving items and consider discounts or promotions to clear stock.

- Adopt Just-In-Time Inventory Systems: Reducing excess inventory minimizes holding costs and aligns stock levels with demand.

- Strengthen Supplier Coordination: Collaborate closely with suppliers to adjust orders based on real-time sales trends.

Utilize Short-Term Financing Options if Needed

When immediate cash is required, short-term financing can provide relief:

- Establish a Line of Credit: Access to a revolving credit line offers flexibility to cover short-term expenses.

- Consider Invoice Factoring: Selling receivables to a third party can quickly convert outstanding invoices into cash.

- Explore Short-Term Loans: These can address temporary cash shortages but should be used judiciously due to potential interest costs.

Best Practices for Year-End Cash Flow Optimization

Companies can effectively manage their cash flow during this critical period by adopting targeted strategies like:

Implementing a Cash Flow Monitoring System

A robust cash flow monitoring system is the cornerstone of effective financial management. Such a system enables real-time tracking of cash inflows and outflows, providing insights into spending patterns and identifying potential cash shortages before they become critical.

Financial software that offers real-time analytics can enhance this process, ensuring timely and informed decision-making.

Scheduling Regular Cash Flow Reviews with Finance Teams

Regular reviews of cash flow statements with finance teams foster proactive management. These meetings should analyze current cash positions, compare actual figures against forecasts, and discuss variances. By maintaining open communication, businesses can swiftly address issues and adjust strategies.

Using Data Analytics to Identify Cash Flow Patterns

Leveraging data analytics allows businesses to uncover trends and patterns in their cash flow. By analyzing historical data, companies can predict future cash flow scenarios, identify seasonal fluctuations, and make data-driven decisions.

Setting Up Emergency Cash Reserves

Establishing an emergency cash reserve acts as a financial safety net during unforeseen circumstances. This reserve should cover at least three to six months of operating expenses, providing a buffer against unexpected downturns or costs.

Regularly reviewing and adjusting the reserve amount ensures it remains adequate as the business grows.

Prioritizing Payments for High-Impact Operations

During periods of limited cash flow, it’s crucial to prioritize payments that sustain core business operations. This includes:

- Payroll: Ensuring employees are paid on time to maintain morale and productivity.

- Key Suppliers: Paying essential suppliers to prevent disruptions in the supply chain.

- Critical Services: Covering expenses for services vital to daily operations, such as utilities and technology platforms.

How an Outsourced CFO Can Assist with Year-End Cash Flow Management

Businesses often face complex financial challenges that require specialized expertise. That’s why engaging an outsourced CFO can provide invaluable support in navigating these complexities, particularly in managing year-end cash flow.

Offering Expertise in Cash Flow Analysis and Planning

An outsourced CFO brings a wealth of experience in analyzing and planning cash flow. They assess current financial positions, identify potential cash flow issues, and develop strategies to address them.

This proactive approach ensures businesses maintain sufficient liquidity to meet obligations and seize opportunities.

Helping Set Strategic Liquidity Goals for Year-End

Setting clear liquidity goals is crucial for financial stability. An outsourced CFO collaborates with management to establish these targets, aligning them with the company’s objectives. They also monitor progress toward these goals, making adjustments as necessary to ensure financial health.

Ensuring Compliance with Cash Flow Management Standards

Compliance with financial regulations and standards is essential to avoid penalties and maintain credibility. Outsourced CFOs stay abreast of the latest regulatory changes and ensure that the company’s cash flow management practices adhere to these standards. This vigilance protects the business from legal and financial risks.

Supporting Cash Flow Forecasting and Adjustment Plans

Forecasting is vital for effective financial planning for cash flow for any organization. An outsourced CFO utilizes advanced forecasting techniques to predict cash flow trends, considering seasonal variations and market conditions. They also develop contingency plans to address potential shortfalls, ensuring the business remains resilient.

Providing Insights for Long-Term Cash Flow Optimization

Beyond immediate concerns, an outsourced CFO offers strategic insights for long-term cash flow optimization. They analyze financial data to identify areas for improvement, recommend process enhancements, and implement best practices. This forward-thinking approach positions the company for sustained economic success.

Conclusion

In conclusion, prioritizing cash flow management during the year-end is essential for sustaining financial health and preparing for future growth. By adopting the strategies discussed, you can effectively achieve year-end financial stability.

Contact our expert team today for personalized assistance in optimizing your year-end cash flow.

Learn More: Improving Cash Flow in the New Year