Cash flow is the lifeblood of any business, yet it’s often the most overlooked aspect of financial management. According to a study, 82% of SMEs fail due to poor cash flow management.

This guide will explore how an outsourced CFO can be a game-changer in managing your company’s cash flow. From forecasting and budgeting to real-time financial oversight, an outsourced CFO brings expertise and tools to ensure your business survives and thrives.

By leveraging the services of an outsourced CFO, businesses can transform reactive financial practices into proactive strategies, paving the way for sustainable growth and stability.

Why Cash Flow Management is Critical for Business Health

Cash flow is vital for a business, supporting its operations, growth, and resilience during financial challenges. Effective cash flow management with an outsourced CFO ensures companies maintain liquidity, meet obligations, and make informed strategic decisions.

The Link Between Cash Flow and Business Sustainability

A robust cash flow system is essential for business longevity. Without it, even profitable companies can face insolvency.

- Operational Continuity: Adequate cash flow ensures that daily operations, such as payroll and inventory purchases, proceed without disruption.

- Strategic Flexibility: Positive cash flow provides the flexibility to invest in growth opportunities, research, and development.

- Cash Flow Risk Mitigation: Maintaining healthy cash reserves allows businesses to navigate unforeseen expenses or economic downturns.

Identifying Cash Flow Bottlenecks Early

Early detection of cash flow issues is crucial to prevent financial crises. Common bottlenecks include delayed receivables, excessive inventory, and unplanned expenses.

- Delayed Receivables: Slow customer payments can strain cash resources.

- Inventory Management: Overstocking ties up cash that could be used elsewhere.

- Unplanned Expenses: Unexpected costs can disrupt cash flow if not anticipated.

Common Cash Flow Pitfalls Growing Companies Face

As businesses expand, they often encounter cash flow challenges that can impede growth.

- Rapid Scaling: Expanding too quickly without adequate cash reserves can lead to liquidity issues.

- Inefficient Billing Processes: Delays in invoicing and collections can create cash shortages.

- Underestimating Expenses: Failing to account for increased operational costs can strain cash flow.

Cash Flow vs. Profitability: Understanding the Difference

It’s essential to distinguish between cash flow and profitability. A company can be profitable on paper but still face cash shortages.

- Profitability: Reflects the company’s earnings after expenses.

- Cash Flow: Indicates the actual cash available for operations.

For instance, a business might record profits from sales made on credit, but if customers delay payments, the company may struggle to cover immediate expenses. Dynamic cash flow forecasting can bridge this gap, providing a clearer picture of financial health.

Impact of Poor Cash Management on Business Decisions

Inadequate cash management can lead to detrimental business decisions, affecting long-term success.

- Missed Opportunities: Lack of funds can prevent investment in growth initiatives.

- Increased Borrowing: Cash shortages may lead to high-interest loans, increasing the financial burden.

- Operational Disruptions: Inability to meet financial obligations can halt operations.

Learn More: Role of an Outsourced CFO in Accounting Clean-Up

How an Outsourced CFO Enhances Cash Flow Oversight

Maintaining a transparent and proactive approach to cash flow is essential in today’s dynamic business environment. An outsourced CFO is pivotal in strategic financial oversight, ensuring that businesses are reactive and strategic in their financial management.

Conducting a Cash Flow Health Assessment

To begin with, an outsourced CFO conducts a comprehensive cash flow health assessment. This involves analyzing historical cash flow statements, identifying patterns in receivables and payables, and assessing the timing of cash inflows and outflows. By doing so, the CFO can pinpoint areas where cash flow may be strained and develop strategies to address these issues.

Key components of this assessment include:

- Evaluating Liquidity Ratios: Understanding the company’s ability to meet short-term obligations.

- Analyzing Working Capital: Assessing the efficiency of current assets and liabilities.

- Reviewing Cash Conversion Cycles: Determining the time to convert investments into cash. AFP

Creating and Monitoring Real-Time Dashboards

Implementing real-time financial monitoring dashboards is crucial for transitioning from assessment to action. These dashboards provide up-to-the-minute insights into cash positions, enabling swift decision-making.

Real-time dashboards focus all eyes on a single version of the truth that can be easily understood and digested.

Benefits of real-time dashboards include:

- Immediate Visibility: Quickly identify cash shortages or surpluses.

- Enhanced Forecasting: Adjust projections based on current data.

- Improved Communication: Share accurate financial information with stakeholders promptly.

Establishing Rolling Forecasts and Weekly Cash Flow Projections

Building upon real-time monitoring, establishing rolling forecasts and weekly cash flow projections is essential. Unlike static budgets, rolling forecasts are continuously updated, providing a more accurate financial outlook.

Research from McKinsey indicates that businesses that respond to changes in market conditions faster see a 20% to 30% improvement in economic performance.

Advantages of rolling forecasts include:

- Agility: Adapt quickly to market changes.

- Accuracy: Reflect current business conditions.

- Strategic Planning: Align financial goals with operational activities.

Leveraging KPIs to Improve Liquidity

Leveraging KPIs is vital to enhance financial oversight further. KPIs such as the current ratio, quick ratio, and days sales outstanding provide financial liquidity strategies and operational efficiency.

Key KPIs to monitor include:

- Current Ratio: Measures the ability to pay short-term obligations.

- Quick Ratio: Assesses immediate liquidity without inventory.

- Days Sales Outstanding (DSO): Evaluates the average collection period for receivables.

Setting Up Internal Controls to Track Inflows and Outflows

Establishing robust internal controls is another critical step. These controls ensure accurate tracking of cash movements, prevent fraud, and promote financial integrity.

Essential internal controls include:

- Segregation of Duties: Dividing responsibilities among different individuals to reduce risk.

- Regular Reconciliations: Ensuring that financial records match actual cash balances.

- Authorization Protocols: Implementing approval processes for transactions.

Establishing Minimum Cash Thresholds and Triggers

Finally, setting minimum cash thresholds and triggers is essential for proactive financial management. These thresholds act as early warning systems, alerting businesses to potential cash shortfalls.

Key considerations include:

- Determining Baseline Cash Levels: Identifying the minimum cash required for operations.

- Setting Alert Triggers: Establishing notifications for when cash levels approach critical points.

- Developing Financial Contingency Plans: Preparing strategies to address potential cash deficits.

Learn More: Outsourced CFO Services for Audit Preparation

Short-Term Cash Flow Strategies with an Outsourced CFO

Effective cash flow management with an outsourced CFO is crucial for maintaining financial stability and business continuity. By implementing targeted short-term strategies, businesses can navigate immediate financial challenges and lay the groundwork for sustainable growth.

Prioritizing Vendor Payments and Negotiating Terms

An outsourced CFO can help companies manage vendor payment prioritization. This approach ensures critical suppliers are paid on time during cash cycle optimization.

Strategies include:

- Categorizing vendors based on their importance to operations.

- Negotiating extended payment terms without incurring penalties.

- Consolidating purchases to leverage bulk discounts.

Improving Collections and AR Processes

Enhancing accounts receivable management is vital for accelerating cash inflows. An outsourced CFO can implement systems to streamline collections and reduce outstanding receivables.

Key actions:

- Implementing automated invoicing to ensure timely billing.

- Setting clear payment terms and communicating them effectively.

- Monitoring AR aging reports to identify and address overdue accounts promptly.

Delaying Non-Essential Capital Expenditures

Postponing non-critical capital expenditure can preserve cash during periods of financial uncertainty. An outsourced CFO can assess planned investments and recommend deferrals where appropriate.

Considerations:

- Evaluating the ROI of planned expenditures.

- Identifying alternative solutions that require less capital.

- Reassessing project timelines to align with cash flow projections.

Accelerating Customer Invoices and Deposits

Prompt invoicing and encouraging early payments can significantly improve cash flow. An outsourced CFO can develop strategies to expedite customer payments.

Tactics include:

- Issuing invoices immediately upon delivery of goods or services.

- Offering discounts for early payments.

- Requesting deposits for large or long-term projects.

Monitoring Daily and Weekly Cash Balances

Regular monitoring of cash balances allows businesses to make informed financial decisions. An outsourced CFO can establish processes for tracking cash flow daily and weekly.

Benefits:

- Identifying trends in cash inflows and outflows.

- Anticipating shortfalls and planning accordingly.

- Burn rate analysis and collections strategy.

Managing Payroll Timing and Compliance Risks

Payroll is a significant expense that requires careful planning. An outsourced CFO can help manage payroll timing to align with cash flow while ensuring compliance with labor laws.

Approaches:

- Scheduling payroll to coincide with peak cash availability.

- Exploring flexible payment options for contractors or part-time staff.

- Ensuring compliance with tax withholding and reporting requirements.

Long-Term Planning for Sustainable Cash Flow

Long-term cash flow planning is essential for sustainable business growth. An outsourced CFO provides strategic insights and tools to ensure financial stability and scalability.

Building Strategic Budgets with Cash Flow in Mind

Strategic budgeting aligns financial planning with business objectives. An outsourced CFO integrates cash flow forecasting into the budgeting process, ensuring that budgets are realistic and adaptable.

Key steps include:

- Revenue Projections: Estimating future income based on market trends.

- Expense Management: Identifying fixed and variable costs.

- Capital Allocation: Prioritizing investments that yield the highest returns.

Forecasting Seasonal and Cyclical Cash Flow Patterns

Understanding seasonal and cyclical trends is vital for managing cash flow. An outsourced CFO analyzes historical data to predict high and low cash flow periods.

Considerations include:

- Sales Fluctuations: Identifying peak and off-peak periods.

- Inventory Management: Adjusting stock levels to match demand.

- Operational Costs: Planning for variable expenses.

Supporting Capital Planning and Financing Needs

Capital planning involves assessing future financial requirements for growth and expansion. An outsourced CFO cash planning evaluates funding options and develops strategies to meet these needs.

Key activities:

- Investment Analysis: Determining the viability of potential projects.

- Financing Strategies: Exploring loans, equity, or alternative funding sources.

- Risk Assessment: Evaluating financial risks associated with investments.

Modeling Cash Scenarios and Contingency Planning

Scenario modeling prepares businesses for various financial situations. An outsourced CFO develops models to assess the impact of different variables on cash flow.

Scenarios may include:

- Best-Case: Optimistic projections based on favorable conditions.

- Worst-Case: Conservative estimates accounting for potential challenges.

- Most Likely: Realistic expectations based on current trends.

Aligning Cash Flow Goals with Growth Objectives

Aligning cash flow with growth objectives ensures that financial resources support business expansion. An outsourced CFO collaborates with leadership to synchronize financial planning with strategic goals.

Focus areas:

- Goal Setting: Defining clear, measurable growth targets.

- Resource Allocation: Distributing funds to priority areas.

- Performance Monitoring: Tracking progress and adjusting plans as needed.

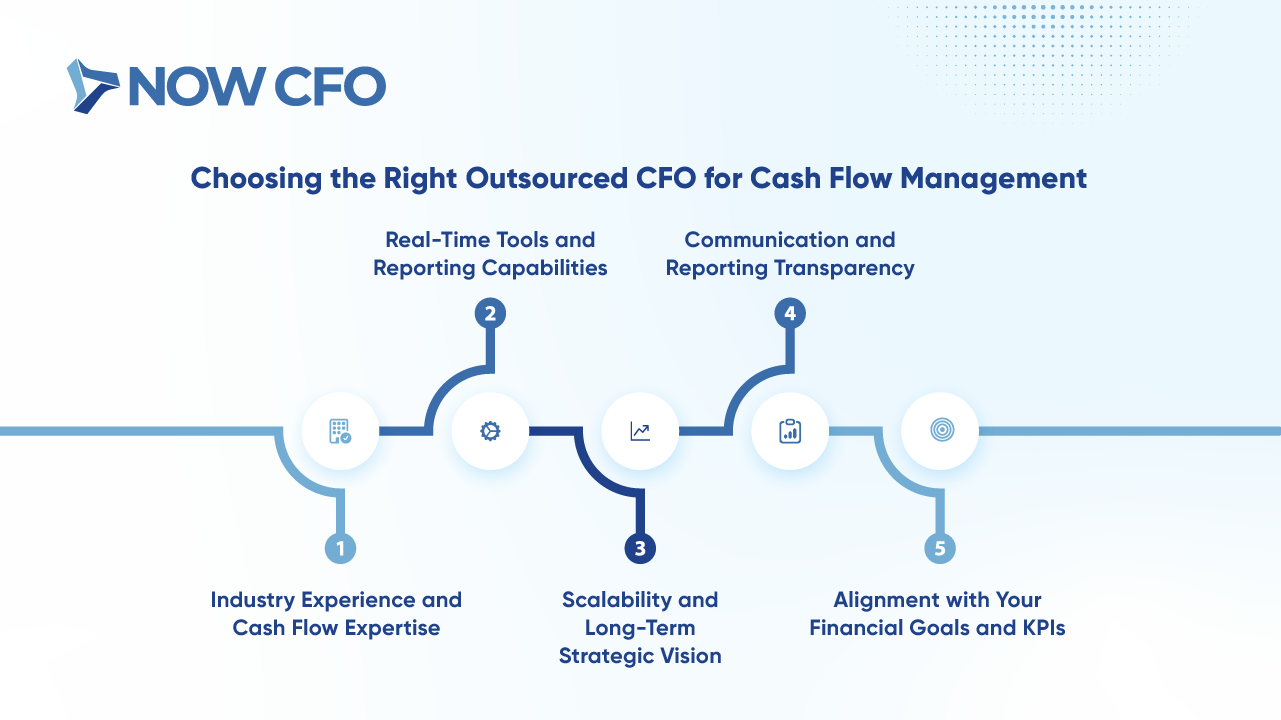

Choosing the Right Outsourced CFO for Cash Flow Management

Selecting the right partner for cash flow management with an outsourced CFO is pivotal to achieving financial stability and growth. The following criteria can guide businesses in making an informed choice.

Industry Experience and Cash Flow Expertise

An outsourced CFO with industry-specific experience brings tailored insights into cash flow challenges and opportunities. Their familiarity with sector-specific financial dynamics enables proactive strategies for managing liquidity and forecasting.

Key considerations:

- Track Record: A history of successfully managing cash flow in similar industries.

- Regulatory Knowledge: Understanding of industry-specific compliance requirements.

- Benchmarking: Ability to compare financial metrics against industry standards.

Real-Time Tools and Reporting Capabilities

Effective cash flow management with an outsourced CFO relies on access to real-time financial data. Advanced reporting tools facilitate timely decision-making and enhance financial transparency.

Essential features:

- Integrated Dashboards: Consolidate financial data for comprehensive analysis.

- Automated Alerts: Notify stakeholders of significant financial changes.

- Customizable Reports: Tailor financial reports to specific business needs.

Scalability and Long-Term Strategic Vision

A scalable outsourced CFO adapts to the evolving financial needs of a growing business. Their strategic vision supports long-term objectives and ensures sustainable cash flow management.

Strategic advantages:

- Flexible Engagements: Adjust services as business needs change.

- Growth Planning: Develop financial strategies aligned with expansion goals.

- Resource Optimization: Efficient allocation of financial resources to support growth.

Communication and Reporting Transparency

Transparent communication ensures that stakeholders are informed and confident in financial decisions. An outsourced CFO should provide clear, consistent reporting and be accessible for discussions.

Communication best practices:

- Regular Updates: Scheduled financial reviews and reports.

- Open Channels: Availability for queries and consultations.

- Clarity: Use of understandable language in financial reporting.

Alignment with Your Financial Goals and KPIs

An outsourced CFO should align their services with the company’s financial goals and KPIs. This alignment ensures that financial strategies support overall business objectives.

Alignment strategies:

- Goal Setting: Collaborate to define clear financial objectives.

- Performance Monitoring: Track progress against established KPIs.

- Strategic Adjustments: Adapt financial plans to meet evolving goals.

Learn More: Outsourced CFO vs Fractional CFO

Conclusion: Take Control of Cash Flow with the Right Financial Partner

Effective cash flow management with an outsourced CFO leads to strategic growth and financial resilience. By partnering with an outsourced CFO, you confidently counter financial uncertainties.

Don’t let cash flow challenges dictate the future of your business. Take the first step towards financial stability by exploring how an outsourced CFO can help with scenario planning for your unique needs. Whether you’re looking to optimize working capital or improve budgeting and cash reserves, the right expertise can make all the difference.

Contact us today to discover how our outsourced CFO services can help your business achieve its financial goals and build a resilient future.