What is the Difference Between an Outsourced CFO vs Full-Time CFO?

Effective financial leadership influences a company’s stability, growth trajectory, and attractiveness to investors. BLS states business and financial occupations (which include CFO roles) are projected to have about 963,500 job openings annually through 2033, reflecting strong and sustained demand. This highlights the increasing significance of strategic roles, such as those held by CFOs.

A full-time CFO offers depth, consistency, and strong internal leadership, while an outsourced model delivers flexibility, expert insights across industries, and cost efficiency. The difference between outsourced and in-house CFO becomes clear as business owners weigh ongoing strategic influence against variable-budget contexts.

Understanding the CFO Role in Modern Business

Before diving into specifics, it’s essential to recognize how CFOs anchor financial strategy and growth. This section explores their multifaceted responsibilities in today’s fast-paced business environment.

Key Responsibilities of a CFO

Responsible for steering a company’s financial health, a CFO guides budgeting, forecasting, and financial reporting to ensure accurate, timely decision-making. They oversee risk management, capital allocation, and cash flow optimization.

This role extends to compliance, tax strategy, financial controls, and foundational elements supporting strategic initiatives.

- Develops and monitors budgets and forecasts

- Conducts variance analysis to guide corrective action

- Manages liquidity to meet short-term obligations and growth needs

- Ensures GAAP compliance, internal controls, and audit readiness

- Guides investment decisions and capital structure planning

The Evolving Need for Strategic Financial Leadership

As markets become more volatile, businesses are increasingly looking for CFOs who contribute strategically, not just operationally. Leaders must anticipate economic shifts, optimize resource allocation, and translate financial insights into growth strategies. They also liaise with executives and investors to align financial performance with long-term vision.

Their role evolves as businesses scale: from number-crunching to shaping mergers, fundraising, and competitive positioning. Thus, the difference between outsourced and in-house CFO models often hinges on strategic capacity, not just cost.

Operational vs. Strategic Financial Oversight

Operational oversight involves day-to-day financial tasks, such as transactions, accounting, payroll, and compliance. Strategic oversight drives long-term planning, capital structuring, and value creation initiatives.

| Aspect | Operational Oversight | Strategic Oversight |

|---|---|---|

| Focus | Short-term accuracy and compliance | Long-term growth and investor impact |

| Activities | Bookkeeping, reconciliation | Budgeting, forecasting, scenario planning |

| Key Metrics | Daily cash flow, audit findings | ROI, EBITDA margin, capital efficiency |

| Typical Leaders | Corporate accountants, controllers | CFOs, finance strategists, and outsourced CFO teams |

How CFOs Impact Growth and Investor Confidence

CFOs help companies grow by supporting fundraising efforts, optimizing capital structure, and ensuring financial discipline. They create visibility into performance, which builds investor trust.

By presenting accurate forecasts and well-articulated growth strategies, CFOs reduce perceived risk. Their oversight enhances EBITDA margins and strategic agility, reinforcing full-time CFO benefits or justifying an outsourced CFO cost comparison for businesses seeking flexibility without sacrificing credibility.

Common Industries using different CFO models

Different sectors favor different CFO arrangements based on capital intensity, regulatory demands, and growth cycles:

- Tech startups often lean toward outsourced CFO services for scalable expertise during fundraising phases (e.g., seed to Series B).

- Manufacturing and retail, with complex inventory and cost structures, typically hire full-time CFOs.

- Private equity-backed firms may combine both: in-house CFOs supported by outsourced teams to tackle audit, compliance, and M&A projects.

What is a Full-Time CFO?

A full-time CFO provides dedicated leadership and oversight in businesses with consistent financial activity and complex operations. Let’s explore the core aspects of this model.

Employment Structure and Compensation

Full-time CFOs are W-2 employees entitled to salary, bonuses, equity, and benefits like health insurance and retirement. A full-time CFO also expects structured performance incentives tied to company KPIs, aligning their goals tightly with organizational success.

Typical Background and Expertise

Most full-time CFOs hold a business degree, accounting, or business. 54.2 % of CFO have a business degree, and 25.9% have a degree related to accounting.

In regulated industries, CFOs often pursue MBAs, CPAs, or CMAs. Their backgrounds equip them with expertise in compliance, investor relations, and complex financial modeling, which is essential for executive decision-making and risk management.

In-House Leadership Benefits

A full-time CFO delivers strategic acumen rooted in deep organizational insight cultivated over time.

- Cultural integration: They understand internal values, priorities, and team dynamics.

- Real-time decision support: Immediate access enables swift responses to financial challenges.

- Long-term accountability: Continuity fosters confidence among stakeholders, enabling sustained growth.

These advantages make a full-time CFO invaluable, especially when rigorous oversight and consistent leadership are essential within an established finance function.

When a Full-Time CFO is a Strategic Necessity

A full-time CFO becomes essential when a company faces significant financial complexity, such as managing public company reporting, multiple funding rounds, or large-scale M&A. In such scenarios, strategic financial leadership is critical for aligning resources, engaging investors, and navigating regulatory landscapes.

An in-house CFO ensures integrated budgeting, forecasting, and compliance oversight for growing enterprises seeking to scale efficiently, rather than relying on outsourced CFO services. Their continual presence enhances credibility with banks, investors, and board members while enabling proactive financial planning.

Limitations of the Full-time CFO Model for SMEs/SMBs

While a full-time CFO offers depth, SMEs may find this model cost-prohibitive and inflexible. High salaries and benefits, and often lengthy hiring processes, can strain budgets. Moreover, such businesses may not always require specialized financial leadership year-round.

- Fixed cost burden

- Risk of underutilization

- Less agility in scaling resources

These constraints often drive SMBs to evaluate outsourced CFO services as a more economical alternative.

Learn More: Fractional CFO vs Full-Time CFO

What is an Outsourced CFO?

Many firms are transitioning from an in-house model and now embrace the outsourced CFO model, which leverages flexible financial leadership through service agreements instead of full-time hires. This section unpacks how this model delivers value.

Engagement Model and Service Scope

Outsourced CFOs operate under a contractual or retainer structure, providing part-time, project-based, or continuous financial leadership. The engagement model adapts to client needs, ranging from monthly advisory sessions to interim full-time support during high-growth periods such as fundraising or M&A.

A service-level agreement (SLA) clearly defines the scope of services, which encompasses financial planning, analysis, capital strategy, and risk management. Clients pay based on deliverables and time commitment without assuming the benefits, equity, or long-term salary obligations of full-time CFO hiring considerations.

This model offers scalability: firms can tap into an outsourced CFO when needed, while avoiding fixed-cost burdens during slower periods. Organizations define the engagement scope clearly, aligning deliverables with internal capacity.

Flexibility and Cost-Efficiency

Bridging from engagement models, outsourced CFOs shine through enhanced adaptability and fiscal efficiency. Two key advantages stand out:

- Variable Cost Model

- Businesses pay only for hours, or defined services executed, avoiding the salary and benefit expenses of a full-time CFO cost comparison.

- This model suits evolving needs, from basic financial planning and scaling to complex forecasting during growth phases.

- Scalable Expertise

- Outsourced CFOs offer on-demand support for quarterly financial reviews, strategic capital raising, or interim crisis management.

- They integrate when needed, scaling down during quieter periods, delivering professional financial oversight without overstaffing.

According to a SEC study, finance outsourcing can yield 20 to 45% cost savings for mid-market enterprises. Companies gain strategic insight by flexibly engaging seasoned financial executives while optimizing budgets, embodying the outsourced CFO cost comparison benefits.

Breadth of Industry Experience

Outsourced CFOs typically consult across diverse industries, including technology, manufacturing, healthcare, private equity, and beyond. This cross-industry insight allows them to import best practices from one sector into another, driving innovation and operational efficiency.

Working with multiple clients, they monitor trends in capital raising, regulatory compliance, and financial systems. For example, they may introduce successful SaaS subscription models from tech into service firms or import cost-control tactics from manufacturing into retail.

Clients benefit from this broader view, gaining access to strategic frameworks, benchmarking data, and agile methodologies that enable rapid performance and improvements in financial operations.

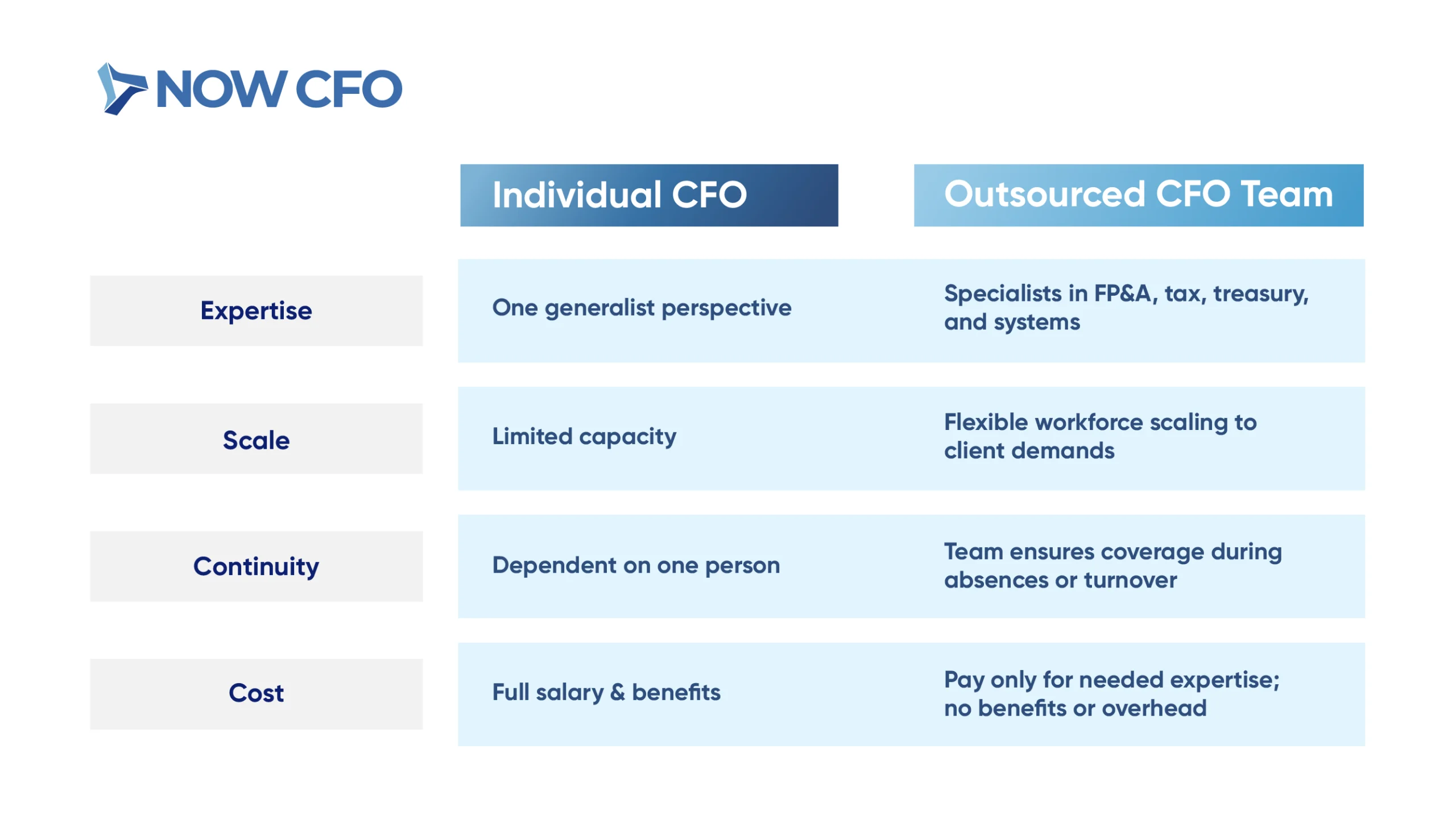

Team-Based Approach vs Individual Leadership

Outsourced CFOs who move into a team structure often provide integrated services rather than solo leadership. A cohesive team can efficiently address multiple facets of financial management.

Standard Services Offered by Outsourced CFOs

Connecting from team dynamics, outsourced CFO providers offer a broad array of services tailored to client needs:

- Budgeting & Forecasting: Prepare rolling forecasts and scenario analyses.

- Cash Flow Management: Implement liquidity models and working capital strategies.

- Financial Reporting & KPI Dashboards: Build executive dashboards with EBITDA, revenue growth, and burn rate KPIs.

- Capital Strategy & Fundraising: Prepare pitch decks, investor outreach, and due diligence support.

- Systems & Process Optimization: Integrate ERP and BI tools and automate reporting flows.

- Risk & Compliance Oversight: Support audit readiness, implement internal controls, ensure regulatory compliance.

- Interim Advisory During Transitions: Support during leadership changes, M&A, or strategic pivots.

For More: What is an Outsourced CFO

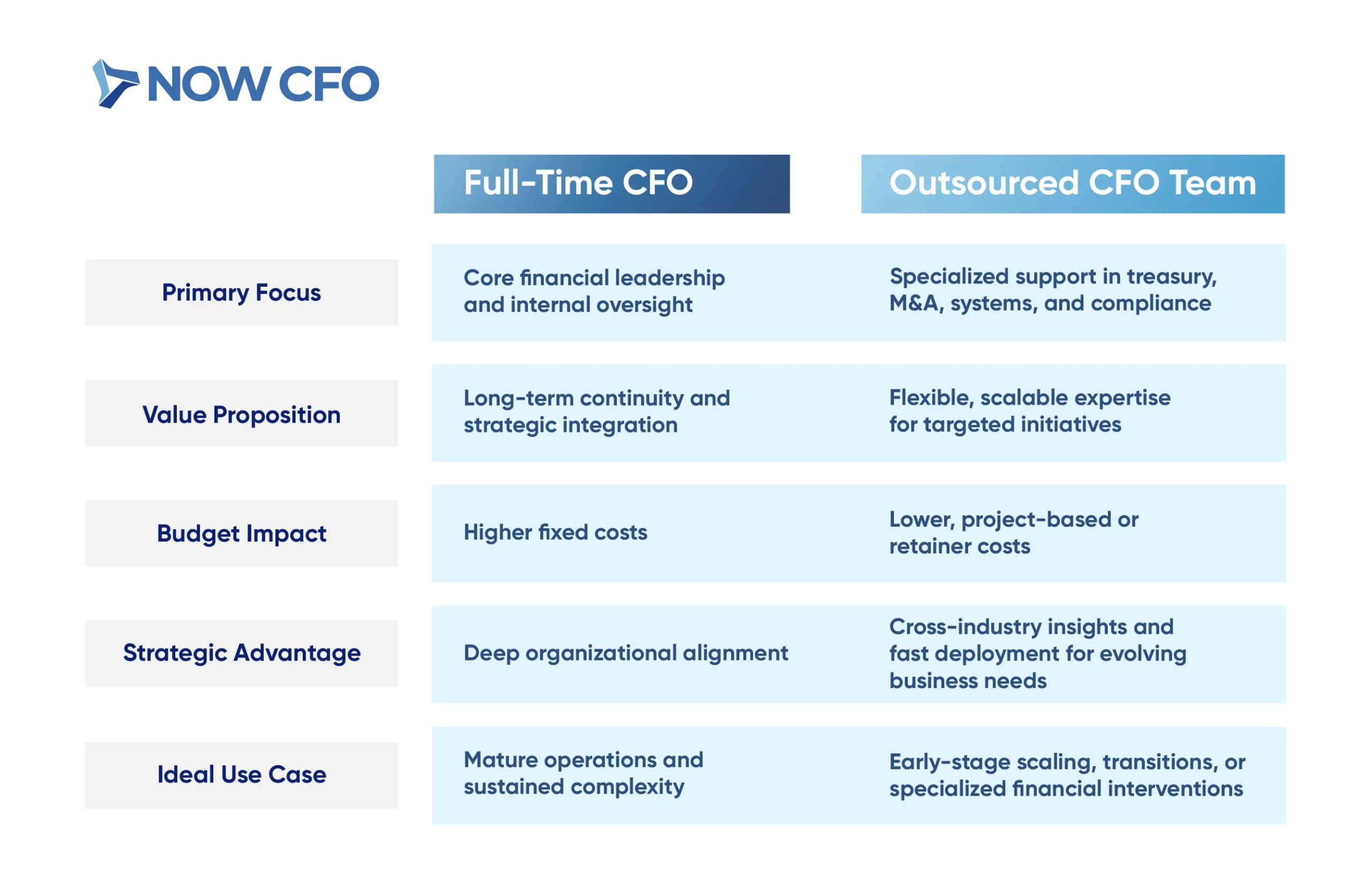

Outsourced CFO vs Full-Time CFO: Key Differences

Building on the differences in individual services, this section contrasts the outsourced CFO and full-time CFO models across core dimensions that influence choosing exemplary financial leadership.

Cost Structure and Salary Comparisons

When comparing costs, businesses must weigh fixed versus flexible spending. A full-time CFO typically commands a base salary between $300,000 to $400,000 plus benefits, bonuses, and equity, resulting in a fully loaded cost of 1.25 to 1.4 times the base salary.

In contrast, an outsourced CFO cost comparison shows a variable fee structure, often retainer-based or hourly, ranging from $3000 to $10,000 per month, depending on expertise.

Fixed vs Variable Expenses

- Full-time CFOs create long-term financial commitments and have less spending flexibility.

- Outsourced CFOs support fluctuating budgets, with costs scaling to services delivered.

Total Compensation vs Service-Based Pricing

- A full-time CFO’s hidden costs, benefits, taxes, and recruiting inflate total spend.

- Outsourced CFOs enable transparent expenses tied to defined deliverables.

Scalability and Flexibility

Moving from cost, scalability further distinguishes the two models:

Flexible Engagement Levels

- Outsourced CFOs allow scaling up during fundraising seasons or budgeting cycles, then dial back to advisory roles during steady periods.

- Full-time CFOs provide consistent oversight but struggle to match rapid changes in business cycles.

Adjustable Resource Allocation

- Outsourced teams can expand to include specialists, e.g., tax or treasury experts, without long-term hires.

- In-house CFOs may need full-time roles added to address skill gaps or surges in workload.

Access to Specialized Skill Sets

Unlike a single in-house CFO, outsourced CFO services tap into a collective of specialists: FP&A experts, tax advisors, and systems integration consultants. This team-based depth supports nuanced challenges like international compliance or technology transformations.

In contrast, a full-time CFO has generalist abilities but often lacks the breadth to address every specific financial need.

Firms dealing with specialized demands, e.g., SaaS revenue recognition or IFRS reporting, benefit from outsourced teams who bring tested solutions across industries, offering a clear difference between outsourced and in-house CFO regarding expertise.

Onboarding and Ramp-Up Time

Next, consider how quickly each model adds value:

Rapid Launch vs Hiring Cycle

- An outsourced CFO can begin within weeks, integrating deliverables with minimal disruption.

- Hiring a full-time CFO often includes months of recruiting, notice periods, and compensation negotiations.

Accelerated Impact vs Organizational Onboarding

- Because outsourced professionals have worked across multiple systems and sectors, they mitigate ramp-up time.

- Full-time CFOs must acclimate to company culture, internal politics, and legacy systems, which delays strategic impact.

Business Lifecycle Alignment

Startups and mid-stage companies may lack the scale for a full-time CFO and instead benefit from outsourced CFO services like fundraising, budgeting, and systems buildout. As organizations mature, enter public markets, and manage complex acquisitions, they often shift towards in-house CFP.

These models align closely with company needs: full-time CFO benefits emerge during sustained complexity, while strategic financial leadership options via outsourced models serve variable growth periods and targeted challenges.

Pros and Cons of Each CFO Model

Having compared structures and alignment to business needs, we now assess the outsourced CFO vs. full-time CFO by exploring distinct advantages, drawbacks, and hybrid approaches.

Advantages of Hiring a Full-time CFO

Hiring a full-time CFO ensures deep integration and consistent financial leadership, which is pivotal for scaling companies. These executives offer real-time strategic guidance, build long-term stakeholder trust, and align financial planning with corporate culture. They also develop robust internal teams and systems tailored to your operations.

- Continuous Alignment: Full-time CFOs embed within leadership, enabling seamless budget execution and real-time decision support.

- Stakeholder Confidence: A permanent finance head signals maturity to investors and lenders.

- Long-Term Oversight: They manage ongoing compliance, audits, and complex financial governance.

Disadvantages of a Full-Time Hire

Despite its benefits, hiring a full-time CFO can pose risks, especially for smaller organizations:

- High Fixed Costs: Expect substantial salary, benefits, equity, and hiring overhead—even when strategic needs fluctuate.

- Skill Gaps: One individual often can’t cover emerging areas like fintech, M&A, or tax reform.

- Rigid Structure: Scaling the role up or down proves difficult during growth or downturn cycles.

Benefits of Outsourcing CFO Services

Opting for outsourced CFO services delivers powerful benefits for resource-conscious firms:

- Cost Efficiency: You pay only for services used—no salaries, benefits, or long-term commitments.

- Expertise on Demand: Access experienced CFOs and specialist consultants across industries.

- Agility: Scale support during peak periods (e.g., audit, budgeting) and reduce during stable cycles.

- Accelerated Onboarding: Vendors typically onboard within weeks, enabling quick strategic impact.

Drawbacks of an Outsourced Approach

While scalable, outsourcing carries some drawbacks:

- Limited Cultural Integration: External CFOs may lack institutional knowledge and team rapport.

- Availability Constraints: Shared resources can slow response during simultaneous client needs.

- Less Control: Decision-making may feel diluted compared to a full-time, entrenched executive.

How to Balance In-House and External Leadership

Striking a balance often yields the best outcomes:

When Should You Hire a Full-Time CFO vs an Outsourced CFO?

Deciding between a full-time CFO and an outsourced CFO depends heavily on your company’s stage, complexity, and strategic direction. Here’s a breakdown of when each model aligns best.

Evaluating Your Company’s Growth Stage

At early stages (pre-revenue to Series A), resource-strapped startups benefit from an outsourced CFO who provides financial guidance without long-term commitments. Their flexible engagement supports fundraising, budgeting, and systems building.

As the company evolves into later stages (Series B, growth, or pre-IPO), financial needs intensify, requiring full-time oversight for scaling operations, regulatory compliance, and investor relations. A full-time CFO brings institutional knowledge, ensures continuous financial leadership, and supports complex strategic initiatives for long-term value creation.

Assessing Financial Complexity and Volume

Outsourced CFO services can efficiently cover needs like cash-flow modeling, quarterly forecasts, and board reports when operations remain simple, limited transactions, no cross-border finances. They aggregate experience across clients and adjust support as volumes change.

However, dedicated leadership becomes essential once financial complexity increases (e.g., multi-entity consolidation, global tax regimes, high-volume transactions). A full-time CFO can build internal teams, manage compliance, and embed controls, maintaining depth and consistency in financial oversight.

Budget Considerations and ROI

As finance needs grow, so do related costs. Let’s compare these two factors:

| Factor | Full-Time CFO | Outsourced CFO |

|---|---|---|

| Fixed vs Variable Cost | Comes with salary, benefits, equity, and hiring expenses, creating substantial fixed costs. | Offers pay-as-you-go pricing via retainers or deliverables—provides cost control and flexibility. |

| Return on Investment | Delivers higher ROI in later-stage firms via long-term strategic planning and team leadership. | Provides faster ROI for early-stage or turnaround companies through focused financial interventions. |

Operational Bandwidth and Internal Team Structure

When internal finance teams are small and rely on basic accounting tools, bringing in an outsourced CFO provides instant expertise and leadership without disrupting existing operations. They complement controllers or bookkeepers with strategic oversight.

Adding dedicated roles like FP&A, tax, treasury, and a full-time CFO as the finance function grows ensures cohesion, mentorship, and consistent leadership. They serve as a fulcrum for the team, aligning financial operations with broader organizational goals.

Strategic Goals and External Partnerships

Connecting with prior assessments, alignment with external objectives matters:

- Fundraising and M&A: Companies preparing for external investment or acquisitions need specialized financial guidance. An outsourced CFO often has direct experience rolling out investor decks, due diligence, and engagement processes.

- Long-term strategic growth: Firms targeting IPOs, strategic partnerships, or sustained scaling benefit from a full-time CFO who navigates extended processes, builds credibility with investors, and oversees continuous growth planning.

Conclusion

Outsourced CFO vs full-time CFO hinges on matching your company’s stage, budget flexibility, and strategic objectives. A full-time CFO provides continuous oversight and deeper institutional insight, while an outsourced CFO delivers on-demand expertise, cost transparency, and industry’s best practices.

Ready to determine which model aligns best with your goals? You can schedule a complimentary consultation session. Our team at NOW CFO is here to guide your decision, whether through beyond-the-multiples advice, a financial leadership audit, or a brief diagnostic call.