In M&A, financial due diligence is a critical safeguard for investors and acquiring firms. By delving into financial statements, cash flow analyses, and potential liabilities, stakeholders can make informed decisions that align with their strategic objectives.

Engaging a skilled fractional CFO to lead the financial due diligence process can further enhance the quality and depth of the evaluation. These professionals bring specialized expertise in identifying financial risks, assessing operational efficiencies, and ensuring compliance with regulatory standards.

What Is Financial Due Diligence?

Financial due diligence involves a comprehensive evaluation of a company’s financial health, essential for informed decision-making in mergers, acquisitions, or investments. This process provides a clear understanding of the target company’s economic status, ensuring transparency and minimizing potential risks.

Definition of Financial Due Diligence

Financial due diligence is the thorough analysis of a company’s financial records and statements. This examination assesses the accuracy of financial reporting, identifies underlying issues, and evaluates the company’s overall economic stability. Key components include:

- Reviewing Financial Statements: Analyzing balance sheets, income statements, and cash flow statements to verify accuracy.

- Assessing Financial Controls: Evaluating internal controls to ensure proper financial management.

- Identifying Liabilities: Detecting undisclosed debts or obligations that could impact future performance.

Importance of Financial Due Diligence

Conducting due diligence is crucial for several reasons:

- Risk Mitigation: Identifies potential financial pitfalls, allowing investors to make informed decisions.

- Valuation Accuracy: Ensures the company’s valuation reflects its financial position.

- Regulatory Compliance: Verifies adherence to financial regulations, reducing legal risks.

- Strategic Planning: Provides insights into financial strengths and weaknesses, aiding future business strategies.

The Role of Financial Due Diligence in Mergers and Acquisitions

In M&A, financial due diligence is vital. It helps acquirers understand the target company’s financial condition, ensuring the transaction is beneficial. This process involves:

- Evaluating Profitability: Determining if the company generates sustainable profits.

- Analyzing Cash Flow: Assessing the liquidity and financial flexibility of the business.

- Identifying Financial Risks: Spotting any financial issues affecting the merger or acquisition.

According to the FDIC, thorough due diligence is essential for banks considering relationships with financial technology companies. This highlights the importance of evaluating financial conditions to assess a company’s ability to fulfill obligations.

Key Steps in Conducting Financial Due Diligence

Embarking on financial due diligence requires a systematic process to ensure a deep understanding of the target company’s economic stability. This structured approach minimizes risks and provides insights crucial for mergers, acquisitions, and investment decisions.

Reviewing Historical Financial Performance and Trends

This first step involves evaluating the company’s financial records over the past three to five years. Historical data provides a clear picture of the company’s performance, enabling stakeholders to identify patterns and anomalies.

Key aspects to analyze:

- Revenue Trends: Look for steady growth or declines.

- Expense Patterns: Check for unusual spikes or reductions that could signal hidden issues.

- Profitability: Assess net margins to understand the company’s capacity for sustainable growth.

Evaluating Profitability, Revenue, and Growth Potential

Financial metrics like gross profit margins, EBITDA, and net profit ratios highlight operational efficiency. This analysis should also involve comparing the company’s performance with industry benchmarks to evaluate its competitiveness.

Example Metrics:

- Gross Margin: Above 40% in some industries indicates robust operations.

- Net Profit Margin: Healthy levels differ by sector but usually range from 10%-20%.

Assessing Liabilities, Debts, and Contingencies

Liabilities, whether disclosed or hidden, significantly impact a company’s valuation. This step includes examining:

- Loan Agreements: Ensure terms are favorable and manageable.

- Contingencies: Legal disputes or unresolved liabilities could lead to financial loss.

Analyzing Cash Flow and Working Capital

Positive cash flow is a critical indicator of financial health. Review operating cash flow and working capital ratios to determine if the business can cover immediate expenses.

Checklist for Cash Flow Analysis:

- Monthly inflow and outflow consistency.

- Adequate working capital for unexpected expenses.

Examining Compliance with Tax and Regulatory Requirements

Lastly, verify the company complies with tax laws and regulations. Tax audits or unpaid obligations could severely impact profitability. Ensure that prior tax filings align with federal and state requirements.

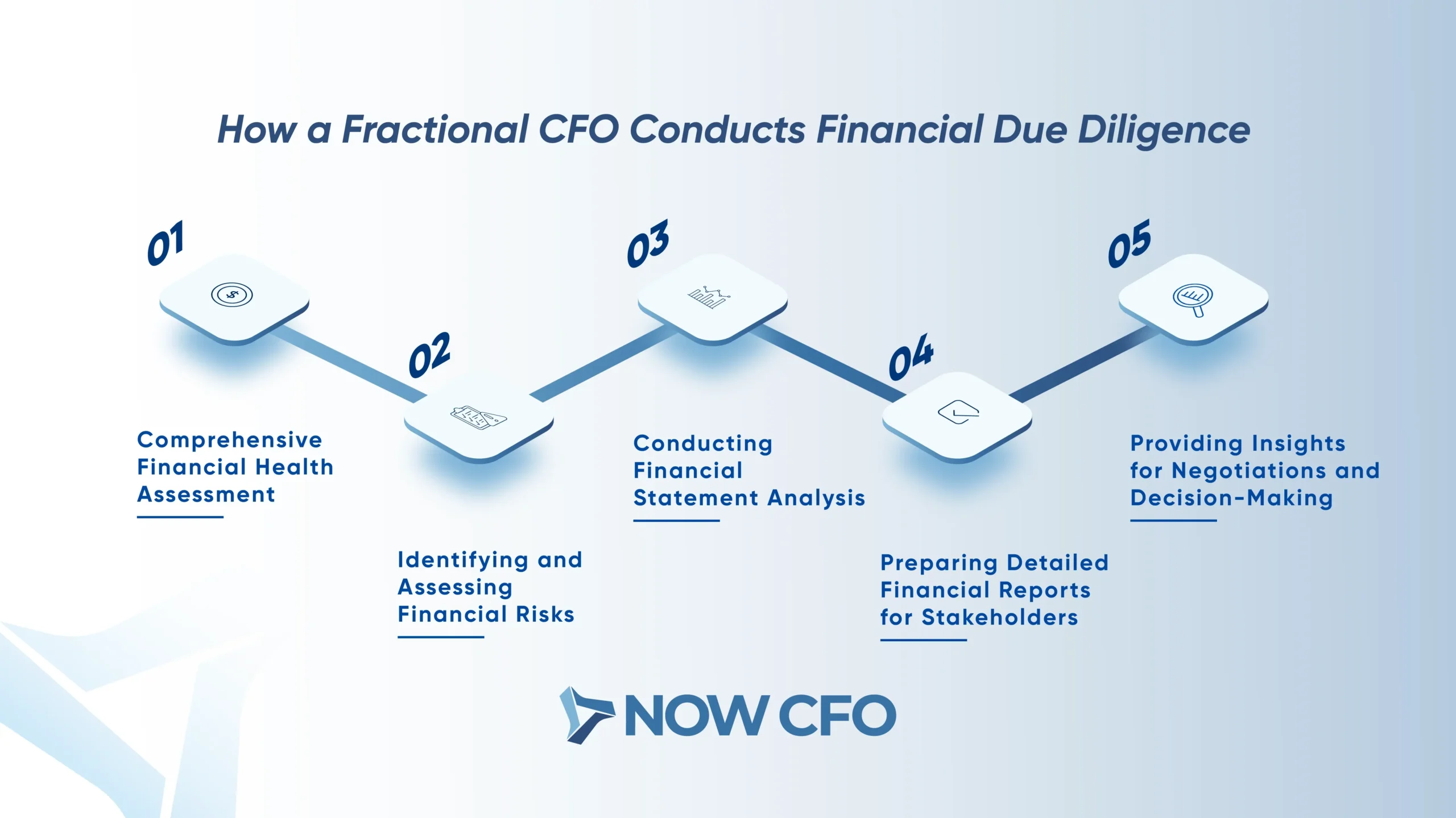

How a Fractional CFO Conducts Financial Due Diligence

Engaging a fractional CFO for financial due diligence provides businesses with expert financial analysis without the commitment of a full-time executive. This approach thoroughly evaluates a company’s financial health, crucial for informed decision-making in mergers, acquisitions, or investments.

Comprehensive Financial Health Assessment

A fractional CFO begins by meticulously reviewing financial statements, including balance sheets, income, and cash flow statements. This analysis identifies trends, anomalies, and potential red flags. For instance, they assess revenue consistency, expense management, and profitability indicators to gauge financial stability.

Identifying and Assessing Financial Risks

Identifying potential financial risks is a critical component of the due diligence process. A fractional CFO evaluates factors such as high debt levels, off-balance-sheet liabilities, or pending litigations that could impact the company’s financial standing. By pinpointing these risks, they help stakeholders make informed decisions.

Conducting Financial Statement Analysis

Beyond surface-level reviews, a fractional CFO delves into the quality of earnings, scrutinizing revenue sources to distinguish between recurring and non-recurring income. This distinction is vital for accurate financial forecasting and valuation. They also assess the adequacy of economic controls and compliance with accounting standards.

Preparing Detailed Financial Reports for Stakeholders

After thorough analysis, the fractional CFO compiles comprehensive reports that present findings clearly and concisely. These reports highlight key financial metrics, potential risks, and areas requiring attention, providing stakeholders with the necessary information to make strategic decisions.

Providing Insights for Negotiations and Decision-Making

Armed with in-depth financial insights, a fractional CFO advises on valuation, deal structuring, and negotiation strategies. Their expertise ensures that financial aspects are accurately represented and potential pitfalls are addressed, facilitating smoother transactions.

Risks Identified in Financial Due Diligence

Financial due diligence is a powerful tool for uncovering hidden risks that could derail business transactions. By identifying these risks, stakeholders can protect their investments and ensure smoother mergers, acquisitions, or partnerships.

Hidden Liabilities or Debt Issues

Hidden liabilities, such as off-balance-sheet debts, pending lawsuits, or unrecorded financial obligations, can heavily impact a business’s economic health. These liabilities often surface after a deal is finalized, creating unexpected financial strain.

Examples of Hidden Liabilities:

- Undisclosed vendor disputes

- Environmental cleanup obligations

- Unpaid employee benefits or pensions

A thorough review of contracts, loan agreements, and compliance reports helps uncover these obligations before closing a deal.

Overstated Revenues or Understated Expenses

Manipulated financial statements can mislead stakeholders into overvaluing a company. For instance, inflating revenues by prematurely recognizing income or understating operational expenses may present a skewed view of profitability.

Impact: Investors may overpay for a company, only to discover unsustainable profit margins later.

Weak Cash Flow Management

Cash flow issues can disrupt operations and growth. A detailed examination of cash flow statements reveals if a company has sufficient liquidity to meet obligations like payroll, supplier payments, and investments.

Tax Compliance or Legal Liabilities

Non-compliance with tax regulations or existing lawsuits can severely affect profitability. Tax liens or disputes with regulatory bodies are red flags requiring immediate attention. For instance, in 2024, General Motors agreed to pay a $145.8 million penalty after the U.S. Environmental Protection Agency found excess emissions from around 5.9 million vehicles.

Misaligned Financial Projections

Overly optimistic financial forecasts often fail to consider market volatility or realistic growth potential. A fractional CFO is crucial in validating projections and aligning them with historical performance and industry benchmarks.

Benefits of Financial Due Diligence for Mergers and Acquisitions

Financial due diligence is not just a procedural requirement in M&A; it is a strategic tool that ensures transparency, mitigates risks, and maximizes stakeholder value. Each benefit underscores its indispensable role in successful transactions.

Ensuring Transparency in Financial Transactions

Transparency is vital in M&A. Financial due diligence offers a detailed and accurate view of a company’s financial health, uncovering discrepancies and verifying the integrity of economic data. This builds trust between the buyer and seller, a cornerstone for a successful deal..

Identifying Potential Risks and Opportunities

Due diligence reveals risks (e.g., high debt levels) and growth opportunities (e.g., undervalued assets). This dual focus allows acquirers to make informed decisions, enabling them to avoid pitfalls and invest in areas of strength.

Example:

Identifying a profitable yet underutilized business unit could enhance post-merger strategies, resulting in greater profitability.

Supporting Negotiations with Accurate Financial Data

Reliable data is critical during price and term negotiations. Accurate financial due diligence ensures valuations are based on hard evidence rather than assumptions, leading to fairer pricing and fewer disputes.

Reducing Uncertainty in Investment Decisions

Financial due diligence consulting eliminates ambiguities about a company’s fiscal standing. Investors can proceed confidently, knowing their decisions are backed by comprehensive analysis.

Enhancing Stakeholder Confidence

For stakeholders, due diligence demonstrates a commitment to robust governance and transparency. It assures regulators, employees, and investors of the process’s integrity, fostering confidence and smoother integration.

How to Assess Financial Health During Due Diligence

Assessing a company’s financial health during due diligence is crucial for making informed investment decisions. This process involves evaluating key financial ratios and metrics, analyzing cash flow sustainability and profitability, reviewing debt-to-equity and liquidity ratios, identifying operational efficiency through economic data, and comparing industry benchmarks for better insight.

Evaluating Key Financial Ratios and Metrics

Financial ratios provide a snapshot of a company’s performance and economic stability. Key ratios include:

- Current Ratio: This measure of liquidity is calculated by dividing current assets by current liabilities. A ratio above 1 indicates that the company can cover its short-term obligations.

- Return on Equity (ROE): This measure assesses profitability by dividing net income by shareholder equity. A higher ROE signifies efficient use of equity capital.

- Gross Profit Margin: Calculated by dividing gross profit by total revenue, indicating the percentage of revenue exceeding the cost of goods sold. Higher margins suggest better financial health.

Analyzing Cash Flow Sustainability and Profitability

Sustainable cash flow is vital for ongoing operations and growth. Analyzing cash flow statements helps determine if a company generates sufficient cash from its core activities. Positive cash flow indicates operational efficiency, while negative cash flow may signal potential issues.

Reviewing Debt-to-Equity and Liquidity Ratios

Debt-to-equity and liquidity ratios assess a company’s financial leverage and ability to meet short-term obligations:

- Debt-to-Equity Ratio: Calculated by dividing total liabilities by shareholder equity, this ratio indicates the proportion of debt used to finance assets. A higher ratio suggests greater financial risk. For instance, Moody’s Corporation had a D/E ratio 9.11 at the end of 2019 due to several acquisitions.

- Quick Ratio: This measure measures immediate liquidity by dividing liquid assets by current liabilities. A ratio above 1 indicates good short-term financial health.

Identifying Operational Efficiency Through Financial Data

Operational efficiency reflects how well a company utilizes its resources to generate revenue. Efficiency ratios, such as inventory and accounts receivable turnover, provide insights into management effectiveness. Higher turnover ratios indicate efficient operations.

Comparing Industry Benchmarks for Better Insight

Comparing a company’s financial metrics to industry benchmarks helps assess its competitive position. Benchmarks provide context for evaluating performance, profitability, and efficiency. For instance, an industry average debt-to-equity ratio can be a reference point to determine if a company’s financial leverage is within a reasonable range.

How to Choose the Right Fractional CFO for Financial Due Diligence

Selecting the right fractional CFO is pivotal to successful financial due diligence. Their expertise directly impacts the quality of financial evaluations and the success of mergers, acquisitions, or investment due diligence. Here’s how to choose the ideal candidate.

Look for Experience in M&A Due Diligence

The complexity of mergers and acquisitions requires a fractional CFO with prior experience in Mergers and acquisitions due diligence.

What to check:

- The number of M&A deals they have overseen.

- Specific industries they have worked in.

Assess Their Ability to Identify Financial Risks

A skilled fractional CFO can uncover potential risks like hidden liabilities, misrepresented revenues, or compliance issues.

How to assess:

- Ask for case studies demonstrating financial risk management.

- Review their approach to risk mitigation.

Verify Their Expertise in Financial Health Assessment

The right CFO should excel at evaluating financial statements, cash flow, and profitability.

Credentials to consider:

- Professional certifications (e.g., CPA, CMA).

- Expertise in using CFO financial analysis tools like QuickBooks or SAP.

Confirm Their Track Record in Supporting Successful Transactions

A proven track record in facilitating successful transactions demonstrates their reliability.

What to request:

- Client testimonials or references.

- Data showing the financial outcomes of previous engagements.

Ensure Alignment with Your Business’s Goals

The CFO should understand your business’s vision and align their strategies accordingly.

Questions to ask:

- Have they worked with businesses of your size and industry?

- How do they tailor their approach to unique business needs?

Conclusion

Engaging a skilled fractional CFO to lead the financial due diligence services can further enhance the quality and depth of the evaluation. These professionals bring specialized expertise in identifying financial risks, assessing operational efficiencies, and ensuring compliance with regulatory standards.

At NOW CFO, our experienced fractional CFOs specialize in delivering comprehensive CFO due diligence services tailored to your unique business needs. Contact NOW CFO today to ensure your next big financial move is built on a foundation of trust and precision.