New-Year Expense Optimization for Profitability

As businesses enter 2025, strategic cost management becomes essential for enhancing profitability. By aligning budgets with overarching business objectives, organizations can position themselves to navigate market challenges and capitalize on emerging opportunities.

This proactive approach safeguards the company’s financial health and fosters sustainable growth in an increasingly competitive landscape.

Why New-Year Expense Optimization Sets the Tone for Success

Starting the year with new-year expense optimization sets a strong foundation for businesses to thrive in 2025. A revealed that 79% of companies implemented cost-cutting measures in response to economic challenges, but only 53% felt these measures were effective.

Thoughtfully managing costs ensures that resources are channeled toward strategic goals, creating room for growth and resilience against unforeseen challenges. With the right approach, businesses can unlock sustainable profitability while positioning themselves ahead of competitors.

The Link Between Expense Control and Long-term Profitability

Expense control is a critical driver of profitability. Businesses can maximize their returns by reducing waste and reallocating funds toward high-impact areas. According to Deloitte, 73% of organizations prioritize enterprise-wide cost reduction over targeted initiatives.

For instance, examining fixed and variable costs like rent and operational supplies often reveals hidden inefficiencies during audits.

- Businesses that systematically optimize expenses report an average profit margin increase.

- Additionally, keeping controllable costs in check ensures better cash flow, making it easier to reinvest in growth opportunities.

Furthermore, focusing on financial optimization strategies improves operational stability. This ensures your organization remains financially secure even during periods of economic turbulence.

Preparing for Market Challenges and Opportunities

The ability to adapt to market shifts is often the difference between survival and success. By implementing 2025 budget strategies, businesses create a buffer to absorb potential risks, such as inflation or supply chain disruptions.

Moreover, optimized expenses allow for agile investments in new technologies or emerging markets.

Here’s how expense optimization helps businesses navigate uncertainty:

- Strengthened Cash Reserves: Savings from cost reductions provide liquidity for emergencies.

- Strategic Flexibility: Funds can be redirected toward promising ventures or marketing campaigns.

- Improved Stakeholder Confidence: A clear focus on cost-saving ideas for businesses builds trust with investors and partners.

The Bigger Picture: Sustained Growth

Ultimately, new-year expense optimization boils down to proactive planning and disciplined closing execution. Starting the year with cost optimization boosts immediate profitability and lays the groundwork for long-term success.

Key Areas to Focus on in Early 2025

Starting the year with clear priorities in new-year expense optimization ensures businesses stay on track to achieve their goals. Early efforts to refine financial practices help lay a strong foundation for long-term success.

Among surveyed companies by Deloitte, 37% had less than 10% cost-reduction targets over 24 months, while 36% aimed for reductions between 10% and 20%.

Below are the critical areas businesses should address to kickstart the year effectively.

Reviewing Last Year’s Financial Performance

Begin by analyzing your 2024 financial reports. Identify trends and discrepancies in income, balance sheets, and cash flow statements. This review provides a roadmap for what worked well and where improvements are needed.

Actionable Tips:

- Compare actual expenses with the budget to spot deviations.

- Highlight areas with consistent overages or underperformance.

Identifying Recurring Inefficiencies

Inefficiencies, such as outdated processes or redundant expenses, often go unnoticed but can significantly impact profitability. For example, unoptimized workflows may lead to higher labor costs or delayed projects.

Key Areas to Review:

- Overlapping software subscriptions.

- Underutilized equipment or assets.

- Manual processes that could be automated.

Moreover, focusing on cost-saving ideas for businesses ensures that these inefficiencies are identified and resolved efficiently.

Reallocating Resources for Better ROI

Not all investments yield equal returns. Reallocating resources from low-performing areas to high-impact initiatives can maximize ROI.

Examples of Smart Reallocation:

- Shift marketing budgets to channels with higher lead generation rates.

- Invest in employee training programs to boost productivity.

Using 2025 budget strategies like ROI analysis ensures that resources are used optimally.

Embracing Sustainability to Reduce Costs

Homes and commercial buildings consume 40% of the energy used in the United States, with a significant portion wasted due to inefficiencies. However, sustainability is no longer optional; it’s a business imperative. By adopting eco-friendly practices, businesses can cut costs and appeal to environmentally conscious customers.

Practical Steps:

- Conduct an energy audit to find cost-saving opportunities in utilities.

- Transition to digital invoices and reports to save paper costs.

- Implement waste reduction programs in manufacturing or service delivery.

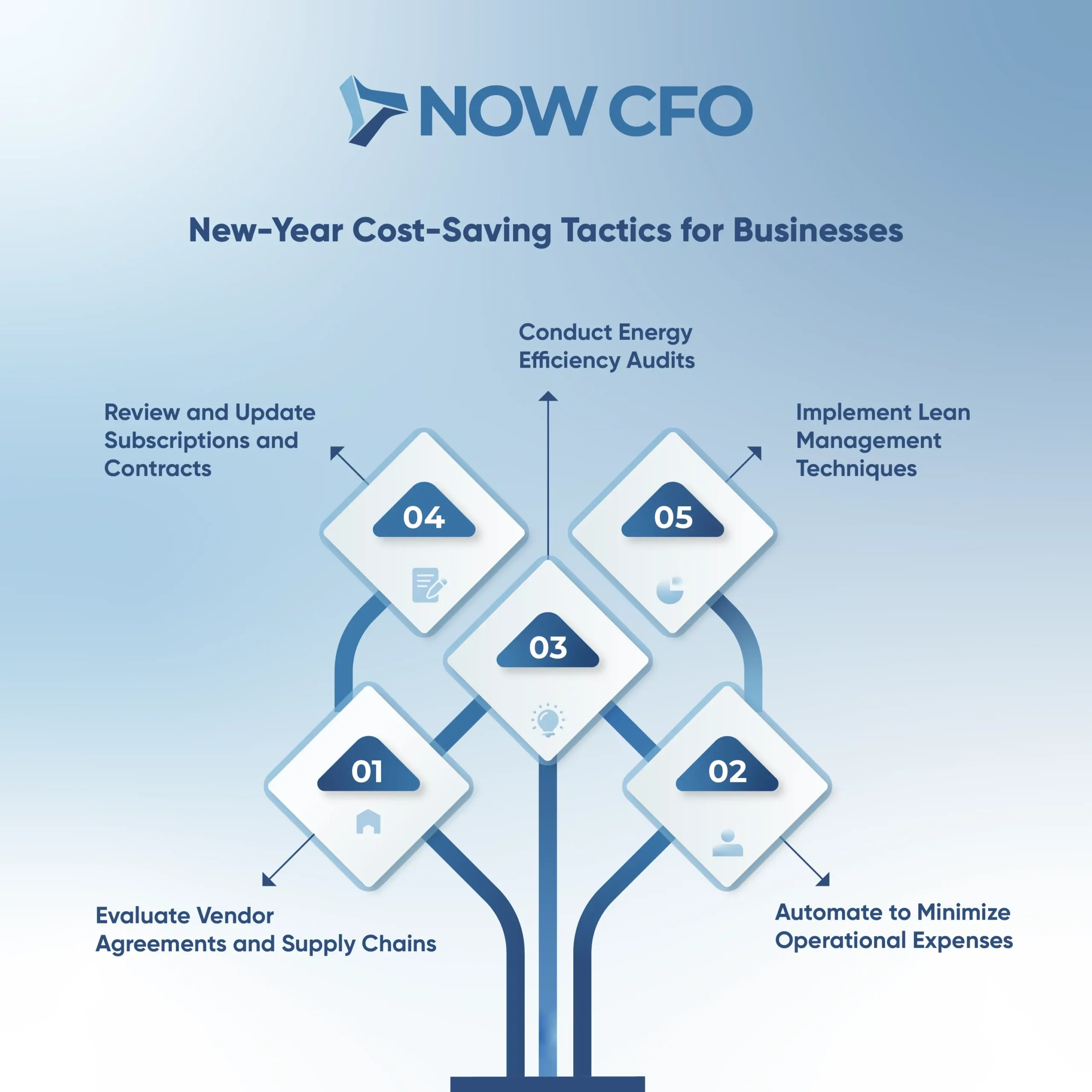

New-Year Cost-Saving Tactics for Businesses

Starting the year with effective new-year expense optimization strategies is essential for businesses to thrive in 2025. By focusing on cost-saving areas such as vendor agreements, automation, energy efficiency, subscriptions, and lean management, companies can unlock hidden savings while driving operational efficiency.

1. Evaluate Vendor Agreements and Supply Chains

Reviewing vendor contracts is a simple yet powerful step to cut costs. Start by comparing terms with current market rates to ensure your business receives competitive pricing. Also, renegotiating bulk orders or considering alternative suppliers often leads to better deals.

- Actionable Tip: Consolidate vendors where possible to lower administrative costs.

- Impact: Optimizing supply chains reduces expenses and improves delivery timelines, enhancing customer satisfaction.

Incorporating these tactics early ensures businesses maximize their financial flexibility for growth investments.

2. Automate to Minimize Operational Expenses

Automation reduces reliance on manual processes, saving time and money. Tools for payroll, CRM, and invoicing eliminate errors while allowing employees to focus on high-value tasks.

Example Tools:

- Use project management platforms like Asana to streamline workflows.

- Implement automated customer support through chatbots.

Moreover, automation aligns with financial optimization strategies, enhancing efficiency and improving ROI.

3. Conduct Energy Efficiency Audits

Energy is often a hidden cost that businesses overlook. Conducting an energy audit identifies inefficiencies and suggests improvements that can lead to significant savings. The cost of energy audits varies, ranging from $0.12 to $0.50 per square foot.

- Quick Wins: Install energy-efficient lighting and consider programmable thermostats.

- Stat Insight: Small businesses implementing energy-saving upgrades can reduce utility costs by up to 30%.

Not only does this lower expenses, but it also supports sustainability goals.

4. Review and Update Subscriptions and Contracts

Many businesses lose money on unused or redundant subscriptions. Review all recurring costs to identify unnecessary services and negotiate better deals on essential ones.

Steps to Take:

- Audit your subscriptions annually.

- Combine tools into integrated platforms for cost efficiency.

This process aligns with cost-saving ideas for businesses, ensuring spending aligns with actual needs.

5. Implement Lean Management Techniques

Adopting lean management techniques fosters a culture of continuous improvement. Businesses improve productivity while reducing costs by focusing on value-added processes and eliminating waste.

Practical Implementation:

- Use employee feedback to identify inefficiencies.

- Optimize workflows through regular process reviews.

Lean management techniques also prepare businesses to handle market fluctuations, which ties directly into 2025 budget strategies.

Best Practices for Financial Forecasting in 2025

Effective financial forecasting is the backbone of sound business decision-making, especially when planning new-year expense optimization initiatives. By following proven strategies, businesses can better anticipate market changes and allocate resources wisely, ensuring financial stability throughout 2025.

Setting Quarterly Goals and KPIs

Quarterly goals provide a roadmap for monitoring financial health over manageable timeframes. Paired with KPIs, they help businesses track progress and stay aligned with strategic objectives.

Examples of KPIs to Monitor:

- Gross profit margin to measure profitability trends.

- The current ratio for liquidity assessment.

- Debt-to-equity ratio to evaluate financial leverage.

Businesses can proactively address discrepancies and make informed adjustments by consistently reviewing these metrics.

Leveraging Technology for Real-Time Budget Tracking

In today’s fast-paced market, relying on outdated financial tools is a risk businesses can’t afford. Modern budgeting software, such as QuickBooks or NetSuite, provides real-time cash flow and spending insights.

Advantages of Real-Time Tracking:

- Immediate visibility into financial performance.

- Alerts for overspending or budget deviations.

- Enhanced collaboration through cloud-based access.

Planning for Inflation and Market Volatility

To navigate economic uncertainty, businesses must prepare for potential inflation and market volatility. Scenario planning is a critical tool that models various financial outcomes and ensures resilience.

Steps for Effective Scenario Planning:

- Identify key variables like inflation rates or supply chain costs.

- Create best- and worst-case financial scenarios.

- Update forecasts quarterly to reflect real-time data.

This proactive approach aligns with financial optimization strategies and keeps businesses ahead of market disruptions.

How to Align 2025 Budgets with Strategic Goals

Aligning your budget with new-year expense optimization strategies ensures that every dollar spent directly supports your business’s long-term objectives. Companies can achieve financial clarity and promote sustainable growth by following practical steps.

Steps to Prepare a Forward-Looking Budget

The foundation of a forward-looking budget lies in aligning finances with your company’s mission and priorities.

- Review Organizational Vision and Objectives: Start by revisiting your business’s strategic goals. Are you prioritizing market expansion, customer retention, or operational efficiency? Clarifying these objectives helps ensure that the budget supports your overarching mission.

- Define Specific Financial Targets: Break down your goals into quantifiable targets, such as a 10% increase in revenue or a 15% reduction in operating expenses. These targets act as guideposts for spending and resource allocation.

- Integrate Departmental Plans: Collaborate with department heads to align their budgets with company-wide goals. This creates a unified strategy where marketing, operations, and R&D contribute to the same objectives.

- Allocate Resources for Unforeseen Opportunities: Set aside a contingency fund to address unexpected opportunities or challenges during the year.

Balancing Cost Reductions with Growth Investments

Effective budgeting requires balancing two priorities: reducing unnecessary expenses and investing in growth. While cost-cutting can improve margins, underinvesting in critical areas may stifle progress.

- Example: Reduce savings from automating routine processes into marketing campaigns targeting high-growth customer segments. This dual focus ensures immediate savings and positions the business for expansion.

- Best Practices: Analyze ROI for existing investments and prioritize initiatives with proven impact on revenue or customer satisfaction.

Engaging Teams in Budget Planning for Accountability

Involving employees in budgeting fosters accountability and aligns team efforts with organizational goals.

- Cross-functional collaboration ensures that sales, finance, and operations input reflects a realistic view of resource needs.

- Transparency in budget planning builds trust among employees and encourages them to take ownership of financial targets.

Leveraging Outsourced Financial Expertise in 2025

Outsourcing financial expertise has emerged as a powerful solution for businesses aiming for new-year expense optimization to enhance financial decision-making without the burden of hiring full-time CFOs.

Fractional CFOs and financial consulting services bring advanced tools, industry insights, and tailored strategies that help companies thrive in an increasingly competitive market.

Benefits of Partnering with Fractional CFOs

Fractional CFOs offer flexible access to top-tier financial expertise, allowing businesses to gain strategic guidance on demand. This approach reduces the cost of hiring a full-time CFO, as businesses only pay for services when needed.

- Cost Efficiency: Avoid expenses tied to salaries, benefits, and bonuses. On average, outsourcing CFO services saves businesses significantly compared to in-house alternatives.

- Strategic Expertise: Fractional CFOs provide critical financial insights, helping businesses with financial forecasting, risk management, and strategic planning.

With these benefits, companies can maintain agility in managing finances while focusing resources on core operations.

Access to Advanced Financial Tools and Insights

Outsourced CFOs bring advanced financial tools that enhance reporting, budget tracking, and profitability analysis. Many of these tools offer real-time data, enabling companies to make informed decisions quickly.

- Advanced Technology: Tools like cloud-based accounting software and KPI dashboards provide deeper insights into operational efficiency.

- Improved Financial Reporting: Accurate and detailed financial reports improve stakeholder communication and strategic alignment.

Leveraging these resources ensures businesses stay ahead of market trends while maintaining financial transparency.

Tailoring Expense Optimization Plans for Different Industries

No two industries operate similarly, and a one-size-fits-all approach rarely delivers results. Outsourced CFOs analyze industry-specific financial metrics to design tailored optimization plans.

- Example: Retail businesses may focus on inventory turnover rates, while service industries prioritize labor cost efficiency.

- Outcome: Custom strategies lead to targeted cost reductions, improving profitability.

Conclusion

Initiating the year with a comprehensive expense optimization plan is pivotal for achieving sustained profitability and growth throughout 2025. Businesses can build a robust financial framework by focusing on critical areas such as economic forecasting, aligning budgets with strategic goals, and more.

A well-executed new-year expense optimization strategy ultimately catalyzes long-term success. If you need any guidance or help, remember to contact Now CFO for expertise.