Outsourcing Accounting Applies to More Than Just Small Business Growth

Small business financial management is the backbone of success. However, managing financial operations in-house can be challenging and resource-intensive for many companies, particularly SMEs. By delegating accounting functions to specialized professionals, businesses can access expertise, advanced technology, and scalable solutions.

Notably, 37% of SMEs outsource accounting and finance functions, highlighting a growing trend toward leveraging external expertise. This statistic underscores the undeniable value of outsourcing as a strategic approach to cutting costs and enhancing operational efficiency.

Why Outsource Accounting?

Outsourcing accounting services has become a strategic move for businesses aiming to enhance efficiency and focus on core operations. By delegating financial tasks to specialized firms, companies can access expert financial guidance without the overhead of maintaining an in-house accounting department.

Definition and Scope of Outsourced Accounting

Outsourced accounting involves contracting external professionals to handle various financial functions, including:

- Bookkeeping

- Payroll processing

- Tax Preparation

- Financial Reporting

This approach allows businesses to leverage specialized expertise tailored to their specific needs.

Key Reasons Businesses Choose to Outsource

Several compelling factors drive companies to outsource their accounting functions:

- Cost Savings: Outsourcing can be more economical than hiring in-house accountants. Businesses save on salaries, benefits, and training costs. For instance, the SBA notes that outsourcing certain business functions can significantly reduce costs.

- Access to Expertise: Outsourced firms employ professionals with extensive experience and up-to-date knowledge of financial regulations, ensuring compliance and accuracy.

- Scalability: As a business grows, its accounting needs become more complex. Outsourcing provides the flexibility to scale services up or down based on current requirements.

- Focus on Core Business Activities: Delegating financial tasks allows management to concentrate on strategic initiatives and core competencies, driving business growth.

- Advanced Technology: Outsourced accounting firms often utilize the latest software and technologies, offering clients enhanced financial reporting and analytics capabilities.

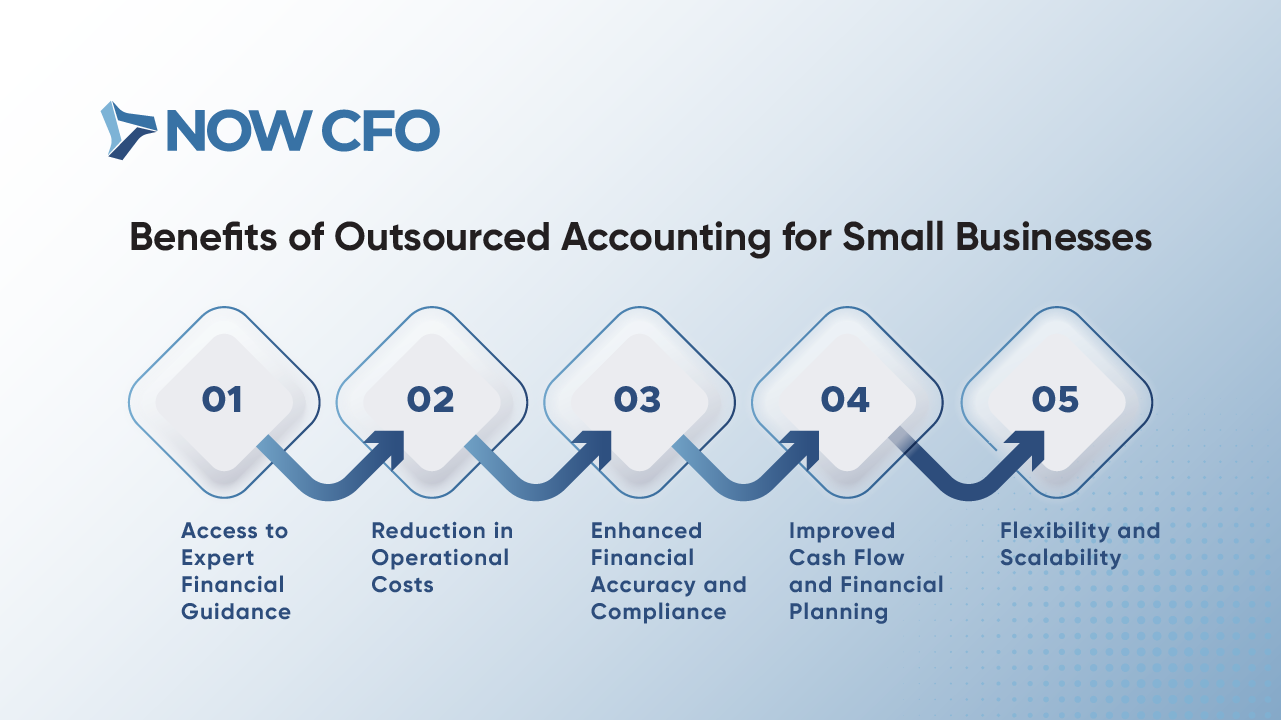

Benefits of Outsourced Accounting for Small Businesses

Outsourced accounting services offer significant advantages for small businesses. From gaining professional financial guidance to reducing costs and enhancing operational efficiency, these services enable small enterprises to overcome common financial hurdles.

Moreover, outsourcing empowers business owners to focus on core operations without compromising financial accuracy.

Access to Expert Financial Guidance

One of the most prominent benefits of accounting outsourcing is access to expert advice. SMEs and non-profits often lack the resources to hire full-time financial professionals with specialized expertise. Outsourcing gives them access to accountants and financial advisors who are well-versed in industry regulations, compliance requirements, and modern economic practices.

For instance, a small retail business can benefit from tax advice tailored to seasonal revenue fluctuations. Outsourced experts provide actionable insights that ensure compliance with tax laws while optimizing savings. As a result, businesses can confidently navigate complex financial landscapes.

Reduction in Operational Costs

Outsourcing accounting can result in significant cost reductions. Unlike maintaining an in-house team, businesses save on salaries, employee benefits, office space, and technology expenses. According to the U.S. Bureau of Labor Statistics, the average annual salary for an accountant is around $80,000, excluding additional costs like training and software.

Outsourced services are cost-efficient because they offer scalable solutions. Small businesses pay only for their services, which is especially beneficial during fluctuating business cycles.

Enhanced Financial Accuracy and Compliance

Outsourcing accounting tasks minimizes errors and improves compliance. Professional accounting firms use advanced tools and rigorous processes to ensure accurate and up-to-date financial records. Moreover, these firms stay abreast of changing regulations, ensuring businesses avoid fines and penalties.

For example, tax compliance can be overwhelming for small business owners juggling multiple responsibilities. Outsourced accountants handle this efficiently, reducing the risk of audits or legal challenges.

Improved Cash Flow and Financial Planning

Cash flow management is critical for small businesses. Outsourced accountants provide detailed cash flow analysis and forecasting, helping companies make informed decisions about investments and expenses. They also assist in creating realistic budgets and strategic financial plans tailored to a company’s growth trajectory.

Flexibility and Scalability

Finally, outsourced accounting offers unmatched flexibility and scalability. Businesses can scale services up or down based on specific needs, such as during a growth phase or economic slowdown. This adaptability eliminates the complexities of hiring or downsizing staff, making it an ideal solution for dynamic business environments.

Beyond Small Business: How Outsourced Accounting Benefits Mid-Sized and Large Organizations

As businesses expand, their financial operations become increasingly complex, necessitating efficient and scalable solutions. Outsourcing accounting functions offers mid-sized and large organizations the opportunity to streamline processes, access specialized expertise, and enhance scalability to meet evolving demands.

Streamlined Financial Processes for Efficiency

Outsourcing accounting enables organizations to optimize their financial workflows by leveraging the expertise of specialized service providers. These providers implement standardized procedures and advanced technologies to manage payroll processing, accounts payable and receivable, and financial reporting.

By entrusting these functions to external experts, companies can reduce processing times, minimize errors, and ensure compliance with regulatory standards. This operational efficiency allows internal teams to focus on strategic initiatives that drive business growth.

Access to Specialized Financial Expertise

Engaging outsourced accounting services grants organizations access to a diverse pool of financial professionals with specialized knowledge in tax compliance, risk management, and international accounting standards.

This access ensures that the company remains compliant with evolving regulations and can effectively navigate complex financial landscapes. For instance, a multinational corporation can benefit from the expertise of accountants proficient in various countries’ tax laws, thereby avoiding legal pitfalls and optimizing tax strategies.

Enhanced Scalability for Growing Needs

As businesses grow, their financial needs evolve. Outsourced accounting services provide the flexibility to scale operations seamlessly. For example, during rapid expansion or acquisitions, organizations often encounter a surge in financial responsibilities. Outsourced accountants can adapt quickly to these demands by allocating additional resources or expertise.

Additionally, scaling with outsourced accounting during economic downturns becomes easier. Unlike in-house teams, outsourcing eliminates the complexities of layoffs or resource reallocation. This adaptability ensures that businesses can maintain financial control regardless of market conditions.

Advanced Reporting and Financial Insights

Mid-sized and large organizations require detailed financial insights to make informed decisions. Outsourced accounting firms employ cutting-edge technologies and reporting tools to deliver actionable data. This includes real-time dashboards, predictive analytics, and customized financial reports highlighting key performance indicators.

For instance, outsourced providers can analyze trends in revenue, expenses, and profit margins, enabling companies to identify growth opportunities or potential risks. Such insights play a pivotal role in shaping strategies for market expansion or cost optimization.

Support for Strategic Financial Planning

Strategic financial planning is critical for sustaining growth in competitive markets. Outsourced accountants collaborate closely with organizations to develop long-term financial strategies aligned with their business goals. This includes identifying cost-saving opportunities, optimizing tax structures, and planning investments to maximize returns.

Outsourced accounting partners bring experience and analytical capabilities to support these efforts, ensuring robust financial health and resilience.

Key Areas Where Outsourced Accounting Provides Value

Outsourcing accounting functions allows businesses to enhance efficiency and focus on core operations. Companies can benefit from expert management and compliance in critical areas by delegating specific financial tasks to specialized service providers.

Payroll Processing and Management

Managing payroll internally can be time-consuming and complex, especially with varying tax laws and regulations. Outsourced accounting services ensure accurate and timely payroll processing, reducing errors and ensuring compliance with federal and state laws. This not only saves time but also mitigates the risk of costly penalties.

Tax Compliance and Planning

Navigating the complexities of tax regulations requires specialized knowledge. Outsourced accountants stay updated with the latest tax laws, ensuring businesses remain compliant and take advantage of available deductions and credits. This proactive approach to tax planning can result in significant cost savings.

Financial Statement Preparation and Reporting

Accurate financial statements are crucial for informed decision-making and maintaining stakeholder trust. Outsourced accounting professionals prepare comprehensive financial reports that adhere to industry standards and regulatory requirements, ensuring transparency and accuracy in financial reporting.

Accounts Payable and Receivable Optimization

Efficient accounts payable and receivable management is vital for maintaining healthy cash flow. Outsourced services streamline these processes by implementing effective tracking and follow-up systems, reducing late payments, and improving cash management.

Budgeting and Forecasting Support

Effective budgeting and forecasting are essential for informed decision-making and strategic planning. Outsourced accounting professionals bring specialized expertise to develop realistic budgets and accurate financial forecasts that align with the company’s goals and market trends.

This support enables businesses to allocate resources efficiently and anticipate future financial needs.

Audit Preparation

Preparing for audits requires meticulous organization and comprehensive documentation. Outsourced accountants assist in compiling necessary financial records, ensuring compliance with auditing standards, and identifying potential issues before they arise. This proactive approach facilitates a smoother audit process and helps maintain regulatory compliance.

SEC & SOX Compliance

Adherence to Securities and Exchange Commission (SEC) regulations and Sarbanes-Oxley Act (SOX) requirements is mandatory for publicly traded companies. Outsourced accounting services provide the expertise to navigate these complex regulatory landscapes, ensuring accurate financial reporting and robust internal controls.

This compliance not only avoids legal penalties but also enhances investor confidence.

Inventory Management

Efficient inventory management is crucial for businesses that handle physical goods. Outsourced accountants implement systems to track inventory levels, manage reorder points, and analyze inventory turnover rates. This optimization reduces holding costs, prevents stockouts, and improves cash flow management.

Common Misconceptions About Outsourced Accounting

Outsourced accounting services offer numerous benefits, yet several misconceptions deter businesses from leveraging them. Addressing these myths can help organizations make informed decisions about their financial management strategies.

Only Suitable for Small Businesses

A prevalent misconception is that outsourced accounting is exclusively beneficial for small enterprises. In reality, companies of all sizes can gain from outsourcing financial functions. Mid-sized and large organizations often face complex accounting needs that require specialized expertise.

Outsourcing provides access to professionals adept at handling intricate financial tasks, ensuring compliance and efficiency.

Lack of Control Over Financial Data

Another common myth is that outsourcing leads to losing control over financial information. Businesses fear that entrusting sensitive data to external parties increases risks. However, reputable outsourced accounting firms implement stringent security measures and maintain transparent communication channels.

These practices ensure that clients retain control and have real-time access to their financial data, fostering trust and collaboration.

Outsourcing Leads to Communication Issues

Concerns about potential communication barriers often discourage businesses from outsourcing accounting functions. They worry that external accountants may not fully understand their needs or company culture. However, many outsourced accounting firms prioritize establishing clear communication protocols and invest time in understanding their clients’ operations.

Regular updates, dedicated account managers, and advanced collaboration tools facilitate seamless interaction, ensuring that the outsourced team aligns with the company’s objectives. Research indicates that businesses that maintain open communication with their outsourcing partners achieve higher satisfaction and better outcomes.

Costly for Mid-Sized and Large Companies

Some believe outsourcing accounting services is more expensive than maintaining an in-house team, especially for larger organizations. Contrary to this belief, outsourcing can be cost-effective. It eliminates expenses related to recruitment, training, salaries, and benefits associated with full-time employees.

How to Choose the Right Outsourced Accounting Partner

Selecting an appropriate outsourced accounting partner is a critical decision that can significantly influence your business’s financial health and operational efficiency. To make an informed choice, consider the following key factors:

Assessing Expertise and Industry Fit

Evaluate the firm’s experience and proficiency, particularly within your industry. An accounting partner with a proven track record in your sector will be familiar with industry-specific regulations and challenges, ensuring compliance and tailored financial strategies.

For instance, if you operate a technology startup, partnering with accountants experienced in the tech industry can provide insights into R&D tax credits and software capitalization.

Evaluating Technology and Integration Capabilities

In today’s digital era, an accounting firm’s technological competence is paramount. Ensure that the partner utilizes advanced accounting software compatible with your existing systems. This compatibility facilitates seamless data integration, real-time financial reporting, and efficient communication.

Additionally, inquire about their use of automation tools, which can enhance accuracy and reduce manual errors.

Understanding Service Scope and Flexibility

Clearly define the range of services you require and assess whether the accounting firm can accommodate these needs. Some firms offer comprehensive solutions, including bookkeeping, payroll processing, tax planning, and financial analysis, while others may specialize in specific areas.

Additionally, consider the firm’s ability to scale services in response to your business’s growth or seasonal fluctuations. Flexibility is essential to ensure the partnership can adapt to changing business demands.

Ensuring Data Security and Confidentiality

Protecting sensitive financial information is non-negotiable. Investigate the firm’s data security measures, including encryption protocols, access controls, and compliance with data protection regulations such as GDPR or CCPA.

A reliable accounting partner should have robust cybersecurity policies to safeguard your data against breaches and unauthorized access.

Verifying Transparency in Reporting and Communication

Effective communication and transparent reporting are the cornerstones of a successful partnership. Establish expectations regarding the frequency and format of financial reports and ensure that the firm is responsive to inquiries.

Open lines of communication facilitate prompt issue resolution and foster a collaborative relationship.

Conclusion: Unlocking the Potential of Outsourced Accounting for Sustainable Growth

Partnering with an outsourced service provider can give your business the expertise and support needed for accounting efficiency improvement. Whether you aim to streamline operations, ensure compliance, or gain strategic financial insights, our team is here to assist. Contact NOW CFO and schedule a consultation through our website to discuss how we can tailor our services to meet your needs.

Outsourcing Can Benefit Businesses of Any Size

As a business owner, you are no stranger to the complex financial challenges of running a successful enterprise. Managing your accounting and financial reporting can take time and effort, removing your focus from core business activities. Outsourcing your accounting needs provides access to specialized expertise, reduces operational costs, increases efficiency, and improves compliance. All of which allow you to focus on your business. 66% of U.S. companies with 50 or more employees outsource, while 29% of U.S. companies with fewer than 50 employees outsource. NOW CFO specializes in providing outsourced accounting services to businesses of all sizes. Their team of experienced financial professionals can help you improve your financial reporting, forecasting, and analysis.

Outsourcing has become a popular business strategy that can benefit companies of any size and can help you reduce costs, improve efficiency, and access specialized expertise, whether a small startup or a large corporation. By outsourcing non-core functions such as accounting, HR, and IT, businesses can free up resources and focus on their core competencies. Outsourcing also helps companies access new markets and talent pools, enabling them to expand their operations and grow their business. Additionally, outsourcing allows companies to quickly adapt to market changes while improving their agility and competitiveness. Overall, outsourcing is an effective way for businesses to achieve their goals and stay ahead of the competition.

Benefits of Outsourcing

Additionally, outsourcing frees up time and resources for larger companies to focus on their core business activities and strategic goals. Some of the benefits of outsourcing your accounting services include the following:

- Access to specialized expertise: Outsourced accountants provide access to experienced financial professionals who helps your company improve its financial reporting, forecasting, and analysis.

- Cost savings: By outsourcing your accounting services, reduces the cost of hiring and training internal staff and investing in accounting software and infrastructure. For example, outsourcing accounting processes generally save between 30% and 75% of current costs while improving quality and timeliness.

- Scalability: Outsourced services scale up or down as needed, allowing you to adjust your accounting services to meet the changing needs of your business.

- Improved accuracy and compliance: Outsourced professionals are up to date on the latest accounting regulations and standards, ensuring that your financial reporting is accurate and compliant.

- More time for core business activities: Outsourcing your accounting services frees up time and resources for your company to focus on its core business activities and strategic goals.

Outsourcing Promotes Further Growth

In addition, outsourcing promotes further business growth by enabling them to focus on their core competencies, reducing costs, improving efficiency, accessing specialized expertise, and gaining access to new markets and talent pools. As businesses face pressure to remain competitive in today’s dynamic and ever-changing market, outsourcing allows them to adapt quickly and effectively. By outsourcing non-core functions, companies frees up resources to invest in their core competencies, ultimately driving growth and success. As such, outsourcing will likely continue to be a popular and effective strategy for businesses of all sizes in the years to come.

Outsourcing your accounting services with NOW CFO provides your business with the specialized expertise, cost savings, scalability, accuracy, and time savings necessary to succeed in today’s competitive marketplace. It creates a more prosperous and sustainable business in the long run than continuing in-house hiring, firing, and adjusting. NOW CFO is a company that specializes in providing outsourced accounting services to businesses of all sizes. Contact us today to talk about your accounting needs.