Preparing for Year-End Audits: A Comprehensive Guide for Businesses

As the fiscal year draws to a close, businesses must prepare for the year-end audit, which is essential for ensuring financial accuracy and compliance.

Notably, a study by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their annual revenues to fraud, underscoring the importance of thorough audits.

Why Year-End Audits Are Important for Businesses

Year-end audits are pivotal for businesses, ensuring financial accuracy and compliance. Understanding their significance can lead to more effective preparation and execution.

Ensuring Financial Accuracy and Transparency

Accurate financial records are the backbone of any successful business. The year-end audit checklist is a comprehensive review that verifies that all financial statements reflect the company’s financial position. This process helps identify discrepancies, errors, or fraudulent activities, thereby maintaining the integrity of financial reporting.

For instance, the U.S. Government Accountability Office (GAO) emphasizes that performance audits are essential to help governments identify and address challenging national and global problems.

Meeting Regulatory and Compliance Requirements

Compliance with financial regulations is non-negotiable. The year-end audit checklist ensures businesses adhere to applicable laws and standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Non-compliance can lead to penalties, legal issues, and damage to the company’s reputation. According to the IRS, audit rates for individual income tax returns have decreased over the years, highlighting the importance of internal compliance measures.

Enhancing Credibility with Investors and Stakeholders

Transparency in financial reporting builds trust among investors, stakeholders, and creditors. A clean audit report indicates sound financial health and responsible management, making the business more attractive to potential investors and partners. This credibility can lead to better financing opportunities and favorable terms in business dealings.

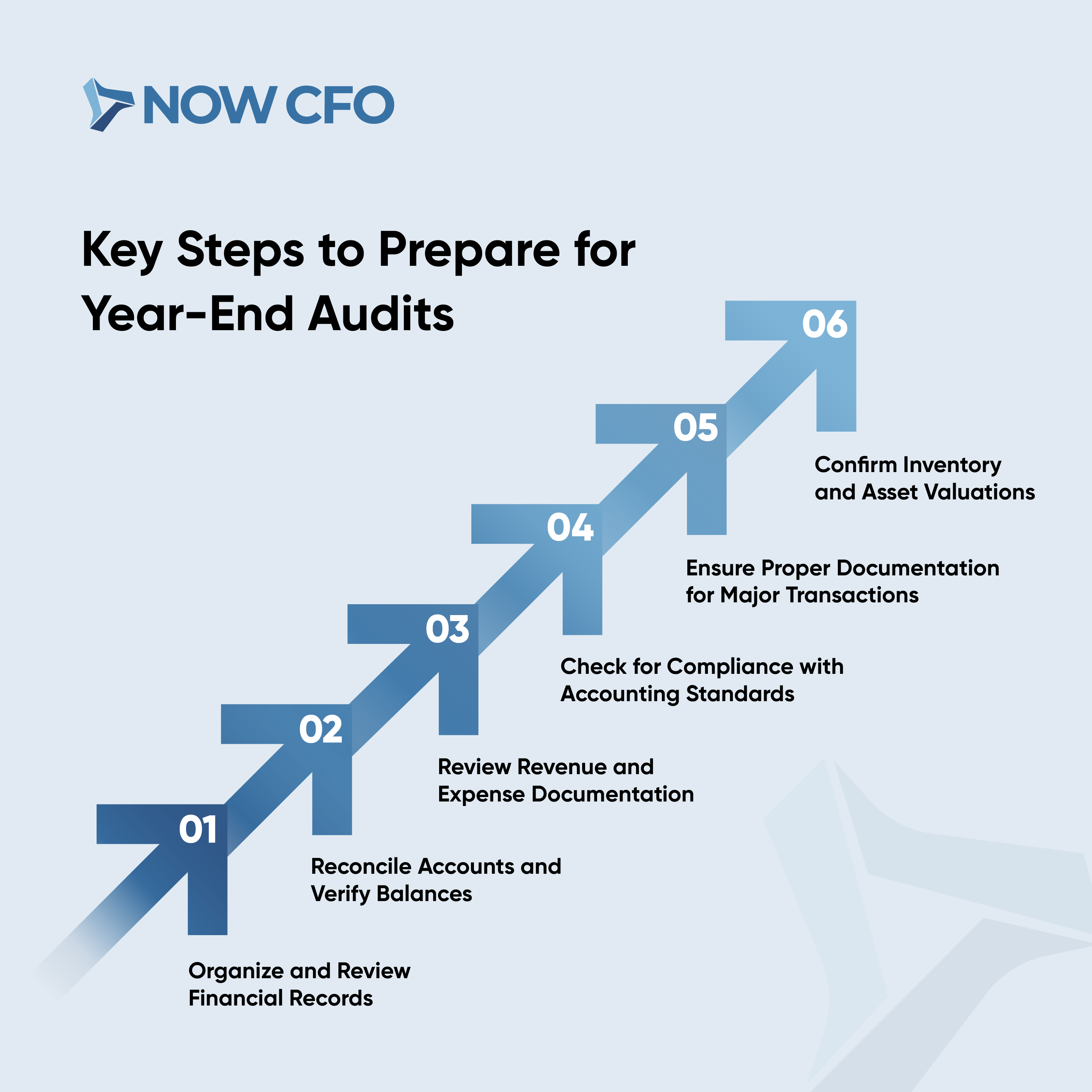

Key Steps to Prepare for Year-End Audits

Transitioning from understanding the importance of the year-end audit checklist, it’s crucial to delve into the key steps to prepare for them before closing the books. Implementing these steps ensures a smooth and efficient audit process.

1. Organize and Review Financial Records

Begin by systematically organizing all financial documents, including invoices, receipts, and bank statements. Maintaining a well-structured filing system facilitates easy retrieval during the audit. Regularly reviewing these records helps identify discrepancies early, allowing for timely corrections.

2. Reconcile Accounts and Verify Balances

Account reconciliation involves comparing internal financial records with external statements to ensure consistency. This process helps detect errors or fraudulent activities. For instance, reconciling bank statements with internal ledgers can uncover unauthorized transactions.

3. Review Revenue and Expense Documentation

Thoroughly examine all revenue streams and expense reports. Ensure that appropriate documentation, such as contracts or receipts, supports each transaction. This practice verifies the legitimacy of transactions and provides a clear audit trail.

4. Check for Compliance with Accounting Standards

Adherence to accounting standards like GAAP or IFRS is vital. Regularly updating accounting policies and procedures ensures compliance. Additionally, staying informed about regulation changes helps maintain accurate financial reporting.

5. Ensure Proper Documentation for Major Transactions

Significant transactions, such as acquisitions or large capital expenditures, require detailed documentation. This includes contracts, board approvals, and valuation reports. Proper documentation provides transparency and supports the legitimacy of these transactions during the audit.

6. Confirm Inventory and Asset Valuations

Conducted physical inventory counts and verified asset valuations. Ensure that the recorded values reflect the current market conditions and depreciation. Accurate asset valuation is crucial for financial statements and can impact tax obligations.

Preparing Financial Statements for Audit

Transitioning from organizing financial records, the next critical step in year-end audit requirements for businesses is meticulously preparing financial statements. This process ensures that all financial data is accurately represented and complies with relevant standards.

Creating Accurate Balance Sheets, Income Statements, and Cash Flow Statements

Begin by compiling comprehensive balance sheets that detail assets, liabilities, and equity. Ensure that all entries are up-to-date and reflect the company’s financial position as of the year-end date. Next, prepare income statements that summarize revenues and expenses, providing insight into profitability over the fiscal year.

Validating Financial Statements for Compliance and Accuracy

After drafting the financial statements, validating them for accuracy and compliance with accounting standards such as GAAP or IFRS is imperative. This involves cross-referencing figures with supporting documents and ensuring all calculations are correct.

Verify that the statements adhere to regulatory requirements and industry best practices. Implementing internal controls can significantly enhance the accuracy of financial reporting.

Identifying Key Metrics and Areas for Auditor Focus

Auditors often concentrate on specific financial metrics and areas with higher risks. Identifying these areas in advance can facilitate a smoother audit process. Key metrics include:

- Revenue Recognition: Ensure that revenue is recorded in the correct accounting period.

- Expense Classification: Verify that expenses are appropriately categorized.

- Asset Valuation: Confirm that assets are valued accurately and depreciation is calculated correctly.

By proactively addressing these areas, businesses can demonstrate thoroughness and transparency, fostering trust with auditors and stakeholders.

Internal Controls and Compliance for Year-End Audits

To ensure a seamless process, it is imperative to transition from preparing financial statements to focusing on internal controls for audits and compliance. Implementing robust internal controls not only safeguards assets but also enhances the accuracy of financial reporting.

Implementing Internal Controls to Ensure Accuracy

Establishing adequate internal controls is crucial for maintaining financial integrity. These controls include:

- Segregation of Duties: Assigning different individuals to handle various financial tasks reduces the risk of errors and fraud.

- Authorization Protocols: Requiring approvals for significant transactions ensures oversight and accountability.

- Regular Reconciliations: Comparing internal records with external statements helps identify discrepancies promptly.

Conducting Internal Reviews Before the External Audit

Performing internal audits before the external audit can identify potential issues early. This proactive approach allows for corrective actions, streamlining the external audit process. Internal reviews should focus on:

- Compliance with Policies: Ensuring adherence to internal policies and procedures.

- Accuracy of Financial Data: Verifying that financial records are complete and accurate.

- Risk Assessment: Identifying areas susceptible to errors or fraud.

Establishing Policies to Prevent Compliance Violations

Developing and enforcing clear policies is vital to prevent compliance violations. These policies should cover:

- Code of Conduct: Outlining acceptable behaviors and ethical standards.

- Regulatory Compliance: Ensuring adherence to laws and regulations relevant to the industry.

- Training Programs: Educating employees on audit compliance requirements and reporting mechanisms.

Monitoring and Addressing Financial Risks

Continuous monitoring of financial activities helps identify and mitigate risks promptly. Implementing risk management strategies, such as:

- Regular Risk Assessments: Evaluating potential financial threats and their impact.

- Control Activities: Establishing procedures to address identified risks.

- Information and Communication: Ensuring relevant information is communicated effectively across the organization.

How an Outsourced CFO Can Support Year-End Audit Preparation for Businesses

Businesses often seek specialized expertise to enhance their year-end audit checklist preparation. Engaging an outsourced CFO can provide invaluable support in this critical phase.

Streamlining Financial Reporting and Reconciliation

An outsourced CFO brings a wealth of experience in financial reporting and reconciliation. They can:

- Standardize Financial Statements: Ensure consistency across all reports, facilitating more accessible analysis and review.

- Implement Efficient Reconciliation Processes: Develop streamlined procedures to identify and rectify discrepancies promptly.

- Enhance Data Accuracy: Utilize advanced tools and methodologies to maintain precise financial records.

Ensuring Compliance with Regulatory Standards

Navigating the complex landscape of financial regulations requires specialized knowledge. An outsourced CFO can:

- Stay Updated on Regulatory Changes: Monitor and interpret new laws and standards affecting financial reporting.

- Develop Compliance Strategies: Create tailored plans to ensure adherence to all relevant regulations.

- Conduct Compliance Audits: Perform internal reviews to identify and address potential compliance issues before external audits.

The Federal Deposit Insurance Corporation (FDIC) emphasizes the importance of robust internal and external audit programs to maintain compliance.

Assisting in Documentation and Recordkeeping

Proper documentation is the backbone of a successful audit. An outsourced CFO can:

- Organize Financial Records: Establish systematic filing systems for easy retrieval and review.

- Ensure Comprehensive Documentation: Verify that appropriate records support all transactions.

- Maintain Audit Trails: Keep detailed logs of financial activities to facilitate transparency and accountability.

Providing Strategic Insights for Improving Audit Efficiency

Beyond operational tasks, the role of CFO in audit preparation is to offer strategic guidance to enhance the processes. They can:

- Identify Process Improvements: Analyze current practices to recommend more efficient workflows.

- Train Staff on Best Practices: Educate team members on effective audit preparation techniques.

- Facilitate Communication with Auditors: Serve as a liaison to ensure clear and open dialogue between the business and external auditors.

Working Efficiently with External Auditors

Internal preparations and collaboration with external auditors are crucial for a seamless year-end audit checklist. Working with external auditors ensures transparency and accuracy in financial reporting.

Preparing Audit Teams and Key Personnel

Begin by assembling a dedicated audit team comprising finance staff and relevant department heads. To streamline the process, assign clear roles and responsibilities to each member. Ensure all team members are well-versed in the company’s financial systems and records.

Facilitating Open Communication with Auditors

Establishing open lines of communication with external auditors fosters a collaborative environment. Schedule regular meetings to discuss the audit timeline, expectations, and potential issues.

Addressing Auditor Requests and Questions Promptly

Responding promptly to auditor inquiries demonstrates professionalism and aids in maintaining the audit schedule. Ensure your team is prepared to provide necessary documents and explanations without delay. Timely responses can prevent bottlenecks and facilitate a smoother audit process.

Establishing a Clear Timeline for the Audit Process

Develop a detailed timeline outlining each audit phase, from initial planning to final reporting. Share this timeline with your internal team and the external auditors to align expectations. Regularly monitor progress against this schedule and adjust to accommodate unforeseen challenges.

Tips for Reducing Audit Risks and Avoiding Common Pitfalls

It is essential to transition from understanding the importance of internal controls to focusing on reducing audit risks and avoiding common pitfalls. Implementing effective strategies can significantly enhance the efficiency and accuracy of the audit process.

Ensuring Consistency in Financial Records

Maintaining consistent financial records is crucial for a smooth audit. Inconsistencies can lead to misunderstandings and potential audit findings. To achieve consistency:

- Standardize Accounting Procedures: Implement uniform accounting methods across all departments.

- Regular Training: Educate staff on accounting standards and updates.

- Periodic Reviews: Conduct regular internal reviews to ensure adherence to established procedures.

Avoiding Last-Minute Adjustments to Financial Statements

Making last-minute changes to financial statements can raise red flags during an audit. Such adjustments may indicate underlying issues or errors. To prevent this:

- Early Reconciliation: Regularly reconcile accounts throughout the fiscal year.

- Timely Error Correction: Address discrepancies as soon as they are identified.

- Close Monitoring: Keep a close watch on financial transactions to detect and rectify issues promptly.

Double-Checking for Potential Compliance Issues

Ensuring compliance with relevant laws and regulations is paramount. Non-compliance can lead to penalties and damage to reputation. To mitigate this risk:

- Stay Informed: Keep abreast of changes in financial regulations.

- Regular Audits: Conduct periodic internal audits to assess compliance levels.

- Consult Experts: Seek advice from legal and financial professionals when necessary.

Creating Backup Documentation for Key Transactions

Having backup documentation readily available supports the validity of financial transactions during an audit. This practice ensures transparency and accountability. To implement this:

- Organize Records: Maintain a systematic filing system for all financial documents.

- Digital Copies: Store electronic copies of important documents for easy access.

- Secure Storage: Ensure that physical and digital records are stored securely to prevent unauthorized access.

Benefits of Thorough Year-End Audit Preparation

Transitioning from implementing internal controls and compliance measures, it’s essential to recognize the benefits of thorough year-end audit preparation for businesses. Diligent preparation streamlines the audit process and yields significant advantages for the organization.

Improved Financial Accuracy and Reliability

Meticulous audit preparation ensures that financial records are accurate and reliable. Businesses can identify and rectify discrepancies by systematically organizing and reviewing financial documents before the audit commences. This proactive approach minimizes errors and enhances the credibility of financial statements.

Reduced Audit Adjustments and Compliance Risks

Thorough preparation reduces the likelihood of significant audit adjustments. After properly maintaining and preparing financial records for an audit, auditors are less likely to find discrepancies that require correction.

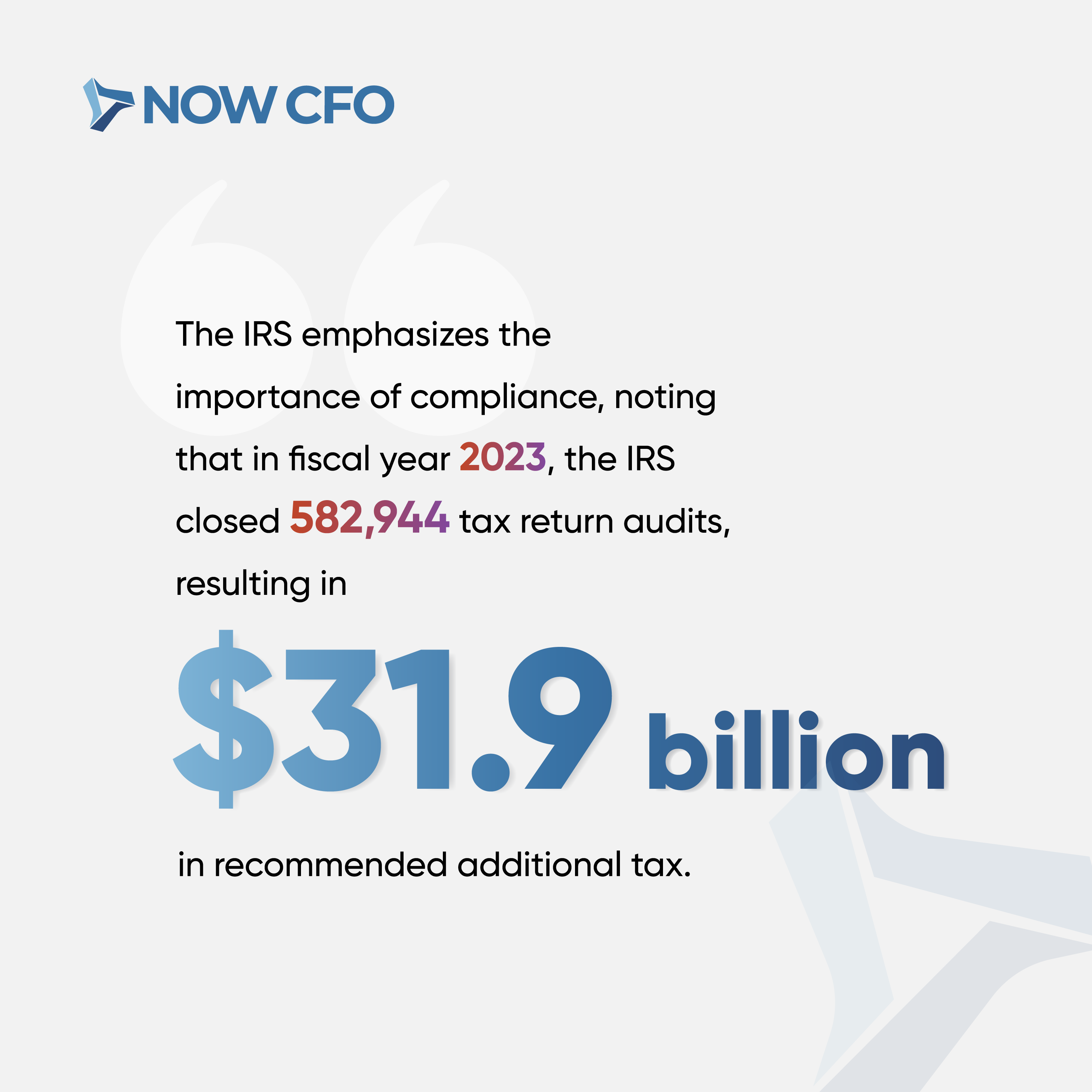

Additionally, ensuring compliance with relevant regulations mitigates the risk of penalties and legal issues. The IRS emphasizes the importance of compliance, noting that in fiscal year 2023, the IRS closed 582,944 tax return audits, resulting in $31.9 billion in recommended additional tax.

Enhanced Investor Confidence and Stakeholder Relations

Accurate and transparent financial reporting fosters trust among investors and stakeholders. A well-prepared audit demonstrates the organization’s commitment to financial integrity, which can lead to increased investment and stronger business relationships.

Better Foundation for Strategic Financial Planning

Comprehensive audit preparation provides a clear understanding of the organization’s financial health. This clarity enables informed decision-making and strategic planning. By identifying financial strengths and weaknesses, management can develop effective strategies for growth and sustainability.

Conclusion

In conclusion, meticulous preparation for the year-end audit checklist ensures compliance and strengthens financial integrity. By implementing the strategies discussed, businesses can confidently navigate the audit process. Contact our team of experts today for personalized assistance in optimizing your financial audit readiness.