Stages of the Business Life Cycle: Funding, Growth & the Financial Services You Will Need Along the Way

What Is The Stages Of The Business Life Cycle?

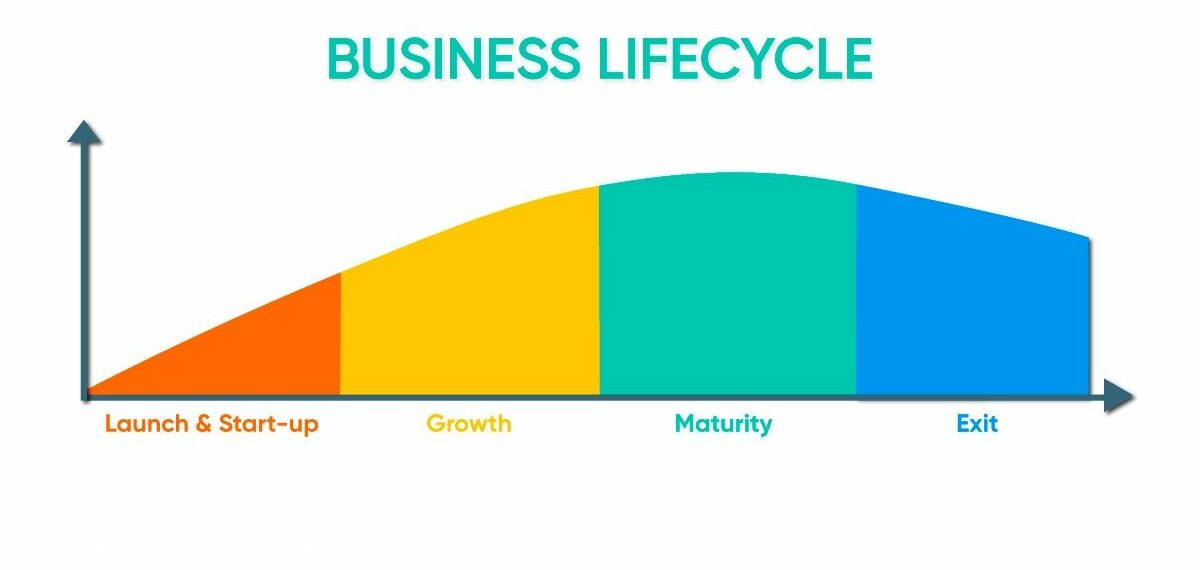

The business life cycle is the progression of a business in phases over time, from creation to full maturity, all the way to the exit of a company. Every business goes through phases of a life cycle: startup, growth, maturity and exit or decline. Understanding which phase your company is in can make a huge difference in the strategic planning and operations of your business. Through out each stage, there will be necessary funding financial services needed to help gain more funding and to take your business to the next level of growth.

Stages Of The Business Life Cycle

-

Launch/Development and Start-Up

The first stage of a company’s life cycle is the launch and start-up phase. This stage is by far the most risky and hectic phase of a business. But it is also the most important to lay a solid foundation for your business. Many start-ups, approximately 90%, fail. Reasons for the extremely high failure rate of so many start-ups include money running out, being in the wrong market, a lack of research, bad partnerships, ineffective marketing, and not being an expert in the industry.

During the launch phase, sales are low, but slowly and steadily increasing. Businesses focus on marketing to their target consumer segments by advertising their comparative advantages and value propositions. As revenue is low and initial startup costs are high, businesses are prone to incur losses in this phase.

- Challenge: In the start-up life cycle stage, it is likely you have overestimated money needs and the time to market. It is important to not spend the small amount of cash that you do have. You need to learn what profitable needs your clients have and do a check to see if your business is on the right track.

- Focus: Start-ups must establish a customer base and gain market presence along with tracking and conserving cash flow.

- Funding Sources: Owner, friends, family, suppliers, customers, or grants

There are numerous financial services and documents that will need to be in order to have a successful start-up and to prepare for the next stages and growth of the company.

Start-Up Funding Financial Services & Documents Needed

| STEP 1- Funding Prep Checklist | STEP 2- Due Diligence Checklist | Step 3- Funding Checklist |

| Capital Raise Roadmap (next 2 yrs.)Product Dev. Roadmap (next 2 yrs.)

Financial Projections (next 2 yrs.) Financial Statements (last 1-2 yrs.) Financial Models: current/previous yr. Valuation Pitch deck: 10-12 slides |

Set up Virtual Data RoomBusiness & Operational Docs (Pitch Decks, Road Maps)

Legal Docs (Articles of Incorporation, Corporate Bylaws) Cap table, Term sheets Financial Statements & Projections Agreements & Contracts (Buy-sell, IP, Leases, Contracts) |

Term SheetInvestors Rights Agreement

Stock Purchase Agreement Post-Funding Checklist: Use of Proceeds Burn Rate Analysis Waterfall Chart / Waterfall Analysis Investor Reports Post-Money Valuation |

2. Growth & Expansion

In the growth and expansion stage of the business, revenue is increasing as well as the customer base. Many new opportunities will arise, but with opportunities come challenges such as facing the competitors in your market and industry. This stage will require better business practices along with automation and outsourcing to improve productivity. The company will evolve into manageable but not explosive growth, strong profits, and a more routine business life.

- Challenge: The biggest challenge companies face in this stage is dealing with the constant range of issues bidding for more time and money. Effective management is required, as is a possible new business plan.

- Focus: Businesses in the growth life cycle are focused on running the business in a more formal fashion to deal with increased sales and customers. Better accounting and management systems will have to be set up; thus, the team will grow.

- Money Sources: Banks, Hedge Funds, Late-Stage VCs, Private Equity Firms

As cash flow increases and the company is better able to cover expenses, the business becomes more attractive to investors. When and if there is a need for more funding to get your business over the hump with more facilities or employees, this will be the time to reach out to investors.

Business owners often make mistakes at this phase, such as hiring the wrong people, investing in the wrong things, or just not keeping your eye on the prize due to a wide range of new demands of your time. This is also a phase where it will be important to have a CFO to make sure that the CEOs time does not get devoted to the wrong things.

Growth Financial Services & Documents Needed

| STEP 1- Funding Prep Checklist | STEP 2- Due Diligence Checklist | Step 3- Funding Checklist |

| Capital Raise Roadmap (next 5 yrs.)Product Dev. Roadmap (next 5 yrs.)

Financial Projections (next 5 yrs.) Financial Statements (last 2-5 yrs.) Financial Models (current/previous yr.) Valuation Pitch deck (12-15 slides) Transaction Proposal (12-20 slides) |

Business & Operational Docs (Pitch Decks, Road Maps)Legal Docs: Articles of Incorporation, Corporate Bylaws

Cap table, Term sheets Financial Statements & Projections Agreements & Contracts: Buy-sell, IP, Leases, Contracts |

Term SheetInvestors Rights Agreement

Stock Purchase Agreement Post-Funding Checklist: Use of Proceeds Burn Rate Analysis Waterfall Chart / Waterfall Analysis Investor Reports Post-Money Valuation Post-Closing Valuation |

3. Maturity & Exit

In this stage, there is an opportunity for your business to cash out substantially on all the effort and years of hard work, or it can also mean to close the business. Changes in the economy, society, or market conditions can decrease sales and profits. It may quickly end many small companies. Mergers and Acquisitions are common in this stage, as well as IPOs and SPACs.

It is crucial to get a proper valuation of your company in this stage. Looking back at the operations, management, and competitive barriers make the company worth more to the buyer as well as setting up legal buy-sell agreements along with a business transition plan.

- Challenge: Businesses in the decline stage of the life cycle will be challenged by dropping sales, profits, and negative cash flow. The biggest issue is how long the business can support negative cash flow. Consider if it may be time to move on to the final life cycle stage—exit.

- Focus: Search for new opportunities and business ventures. Cutting costs and finding ways to sustain cash flow is vital for the exit stage.

- Money Sources: Find a valuation partner. Consult with your accountant and financial advisers for the best tax strategy for selling or closing out the business.

The main challenge during this phase will be fending off all the competitors that will be constantly trying to knock you down. There is certainly still some risk, and it’s important to try to find ways to launch new products and expand into new market areas. The horizon in this stage is bright, as there is a big opportunity for the business to cash out on all the effort and years of hard work, or a new era of growth through acquisitions and mergers.

Maturity/Exit Financial Services & Documents Needed:

| STEP 1- Funding Prep Checklist | STEP 2- Due Diligence Checklist | Step 3- Funding Checklist |

| Capital Raise Roadmap (next 5-10 yrs.)Product Dev. Roadmap (next 5-10 yrs.)

Financial Projections (next 5-10 yrs.) Financial Statements (last 5-10 yrs.) Financial Models (current/next 5 yr.) Valuation Pitch deck (15-20 slides) Transaction Proposal (20-30+ slides |

Business & Operational Docs: Pitch Decks, Road MapsLegal Docs: Articles of Incorporation, Corporate Bylaws

Cap table, Term sheets Financial Statements & Projections Agreements & Contracts: Buy-sell, IP, Leases, Contracts |

Term SheetInvestors Rights Agreement

Stock Purchase Agreement Post-Funding Checklist: SEC Reports Quarterly Reports Investor Reports Market Valuation |

How Can We Help

NOW CFO has years of funding experience in multiple industries. With our expertise, we have helped companies prepare for their first round of funding by identifying and addressing any discrepancies that could be red flags to investors.

Preparing to receive funding is a rigorous process, and it is crucial that you hire an outsourced CFO to guide each step of the way. Through the help of an interim CFO, you can rest easy knowing your financials are in order. Investors are looking for security, which an outsourced CFO can provide by adding a degree of credibility to your financials.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, Bookkeeping and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Growth and Expansion Stage