The importance of working capital management underlies robust operations and growth. CFOs who master this discipline avoid cash shortfalls, reduce reliance on high-cost credit, and enhance profitability.

Among 10K SMEs survey, 44 % of small business owners report having less than three months of cash reserves. By tracking receivables, optimizing inventory, negotiating payables, and forecasting cash flow, finance leaders reinforce resilience against market fluctuations.

What is Working Capital Management and Why Is It Important?

CFOs must grasp the importance of working capital management to maintain liquidity and fund operations seamlessly. Before delving into its critical role, let’s clarify what is working capital in financial management, so you can appreciate why this discipline underpins long-term viability.

Defining Working Capital in Financial Management

Working capital equals current assets (cash, accounts receivable, inventory) minus current liabilities (short-term payables, accrued expenses). This metric gauges a firm’s day-to-day liquidity and its capacity to cover immediate obligations. Effective working capital planning ensures companies avoid cash shortfalls and reduce dependence on high-cost borrowing.

According to SBA, community banks held 1,441,109 outstanding commercial and industrial loans, totaling over $94 billion. Such lending highlights how working capital facilitates access to crucial funding and supports financial stability and growth.

Why Effective Working Capital Management is Crucial for Business Health

Working capital management empowers CFOs to optimize cash flow management and liquidity management, reducing reliance on costly debt. Below are key reasons why robust working capital controls drive business health:

- Enhances Liquidity: Maintaining optimal inventory and receivables frees cash, lowering the need for external funding and interest expenses.

- Improves Profitability: Streamlined collections and negotiated payables terms shorten the cash conversion cycle, boosting return on assets.

- Mitigates Risk: Ongoing forecasting and monitoring prevent shortfalls, guarding against operational disruptions.

- Supports Growth: Efficient practices free up cash for strategic investments in marketing, R&D, and expansion.

Key Components of Working Capital Management

CFOs must master four pillars of working capital: accounts receivable, inventory, payables, and cash flow, to sustain liquidity and operational health.

Managing Accounts Receivable and Optimizing Collection

Effective receivables management begins with accounts receivable, where CFOs set clear credit policies, monitor aging schedules, and leverage automated reminders to expedite customer payments. By DSO, businesses shorten the cash conversion cycle, bolstering liquidity and minimizing reliance on short-term financing.

According to the Fiscal Treasury, the Prompt Payment interest rate for January 1–June 30, 2025, stands at 4.625%, a tangible cost of delayed payments. Early payment discounts and strict invoicing protocols encourage timely remittance, improving operational efficiency through working capital.

Controlling Inventory Levels to Balance Cash Flow

Building on strong receivables, CFOs tackle inventory control to optimize capital management.

- Just-in-Time Ordering: Align purchases with production schedules to avoid excess stock and reduce holding costs.

- ABC Analysis: Categorize inventory by value and turnover rate, focusing resources on high-impact SKUs.

- Safety Stock Calculations: Set buffer levels based on demand variability and lead times to prevent stockouts.

- Cycle Counting: Conduct periodic counts to improve accuracy and minimize obsolescence.

The total business inventories-to-sales ratio fell to 1.38 in April 2025 compared to last year, reflecting tighter liquidity management practices to free up working capital.

Managing Accounts Payable and Negotiating Payment Terms

Just as inventory control liberates cash, effective management of accounts payable elevates CFO working capital optimization, allowing firms to defer outflows without straining supplier relationships. Key tactics include:

- Negotiate Extended Terms: Secure 60- or 90-day payment agreements to delay cash disbursements and lengthen the cash conversion cycle.

- Early-Payment Discounts: Weigh discounts (e.g., 2%/10 net 30) against the cost of earlier cash usage to achieve net savings.

- Centralize Processing: Implement e-invoicing and automated approvals to reduce errors and late fees.

- Vendor Financing: Partner on consignment inventory or supply-chain financing to maintain stock while preserving liquidity.

Maintaining Adequate Cash Flow for Operational Efficiency

Maintaining adequate cash flow requires continuous forecasting, scenario planning, and daily liquidity monitoring. CFOs deploy rolling 13-week cashflow projections, stress-test scenarios, and integrate real-time bank feeds to identify potential shortfalls and surpluses.

By centralizing cash management, finance teams can allocate funds dynamically for payroll, supplier payments, and unforeseen expenses. Despite these measures, many firms lack sufficient buffers: only 28% of small businesses have cash reserves to cover three or more months of operations.

The Role of CFOs in Optimizing Working Capital for Success

CFOs align working capital management with growth targets, forecast liquidity, track performance metrics, and implement controls to drive expansion.

Aligning Working Capital Strategies with Business Growth Goals

To sync liquidity with strategic objectives, CFOs craft policies that reflect expansion phases. They initiate growth initiative, embedding capital optimization in corporate roadmaps.

- Define DSO and DPO benchmarks tied to revenue targets and product launches.

- Coordinate cash conversion cycle objectives with capital-raising schedules.

- Incorporate liquidity management metrics into board-level performance reviews.

Forecasting Cash Flow for Better Financial Planning

Accurate projections underpin the importance of working capital management, enabling CFOs to anticipate liquidity gaps and invest wisely. For example, profits from current production rose from $229.8 billion to $281.3 billion in 2024, underscoring volatility CFOs must capture in working capital planning.

Profits from Current Domestic Production rose from $229.8 billion to $281.3 billion in 2024

Source: U.S. Bureau of Economic Analysis (BEA)

They integrate historical data and market indicators.

- Rolling 13-week Forecasts: Update weekly cashflow models to reflect evolving sales patterns, seasonal peaks, and expense timing, reducing surprises.

- Scenario Analysis: Model best, expected, and worst-case cash scenarios to stress-test balances, allocate buffers, and guide cash flow management decisions.

Using Financial Data to Monitor and Adjust Working Capital Performance

CFOs develop real-time dashboards tracking DSO, DPO, inventory turnover, and cash conversion cycle metrics with strategic KPIs. They integrate ERP and treasury data to visualize trends, enabling swift identification of deviations and actionable insights.

Through monthly variance analysis, finance teams compare actual vs. forecast cash flows, refining CFO working capital optimization tactics. They leverage predictive analytics to model the impact of sales, procurement, and payment delays.

Implementing Financial Controls to Mitigate Liquidity Risks

CFOs establish credit approval limits, dual-signature requirements, and automated alerts to enforce liquidity management policies. They segment cash pools by business unit, centralize treasury functions, and conduct regular reconciliations to detect anomalies.

Strategies for Optimizing Working Capital Management

To execute the importance of working capital management, CFOs deploy targeted tactics that accelerate cash inflows, streamline inventory, extend payables, and harness digital tools for sustained financial stability and growth.

Streamlining Accounts Receivable to Reduce Days Sales Outstanding (DSO)

By tightening receivables, CFOs shrink the cash conversion cycle and reinforce working capital management.

- Establish clear credit policies and automated invoicing to cut approval delays.

- Send digital payment reminders and enable online portals for faster collections.

- Review aging reports weekly to prioritize overdue accounts.

- Employ selective receivables financing or factoring to accelerate inflows.

Improving Inventory Turnover for Better Cash Flow Management

Next, boosting inventory turnover complements receivables efforts by converting stock into cash more rapidly. CFOs benchmark against best-in-class metrics to inform working capital planning and CFO working capital optimization.

| Strategy | Avg. Inventory Turnover (times/year) |

|---|---|

| Middle Market Strategy | 27.9 |

| Hybrid Strategy | 14.11 |

| Terminal Market Strategy | 13.99 |

Optimizing Accounts Payable Terms to Maximize Working Capital

By extending payment terms without harming supplier relations, CFOs enhance liquidity management. They negotiate 60- to 90-day terms, aligning disbursements with projected cash inflows.

Centralized e-invoicing and automated approvals streamline processing, reducing manual errors and late-fee risk. Partnering on supply-chain financing lets businesses hold stock while preserving cash, driving operational efficiency through working capital.

Leveraging Technology for Real-Time Cash Flow Monitoring

Finally, CFOs leverage modern platforms for data-driven visibility:

- Treasury Management Systems (TMS): Integrate with ERP for daily cash-position dashboards.

- API-Enabled Bank Feeds: Automate inflow/outflow updates for real-time accuracy.

- AI-Driven Forecasts: Generate predictive alerts on cash shortfalls or surpluses.

Benefits of Effective Working Capital Management

continuous optimization of receivables, inventory, payables, and cash reserves delivers tangible benefits.

Improved Liquidity and Cash Flow Flexibility

CFOs who fine-tune cash flow, shorten the cash conversion cycle, ensuring funds are available for payroll, suppliers, and unexpected expenses. Effective liquidity management via optimized receivables and inventory buffers reduces reliance on revolving credit and enhances operational resilience.

Adopting robust capital planning not only supports liquidity but also fuels financial stability and growth.

Greater Financial Stability and Reduced Dependency on External Financing

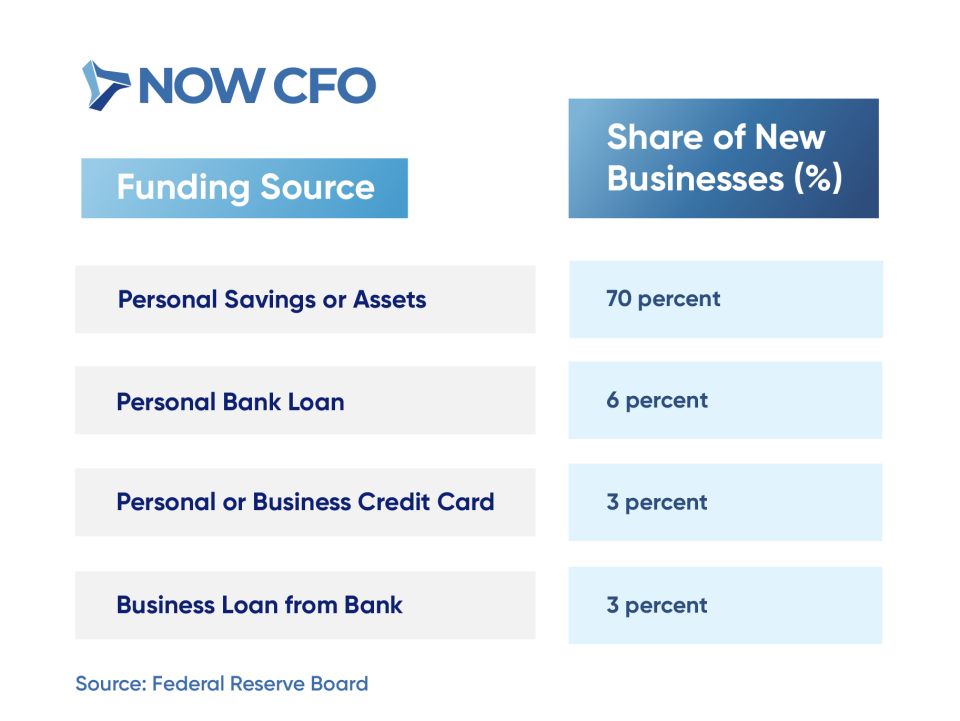

Reducing reliance on debt strengthens balance sheets and shields firms from credit-market volatility.

Source: Federal Reserve Board

Enhanced Operational Efficiency and Cost Control

By streamlining payables, companies lower transaction costs and strengthen supplier partnerships. Key tactics include:

- Centralize Approvals: Automate invoice route to reduce processing time and late fees.

- Dynamic Discounting: Leverage early-payment discounts aligned with cash-flow forecasts.

- Consignment Inventory: Shift holding costs to suppliers while maintaining stock availability.

- Supply-Chain Financing: Partner with platforms that extend payment terms without supplier strain.

Ability to Fund Growth Initiatives and New Investments

CFOs maintain robust working capital planning by establishing cash buffers, rolling forecasts, and centralized treasury controls to track inflows and outflows daily. This disciplined cash flow management approach empowers teams to deploy surpluses for core activities and reduces dependence on external credit.

How CFOs Drive Business Growth Through Working Capital Optimization

Building on these benefits, CFOs leverage robust capital management to propel expansion and strategic investment. They align liquidity cushions with growth plans, ensuring that funding for new projects never lags operational needs.

Notably, the credit availability remains a challenge for over a quarter of small businesses, underscoring the need for internal cash optimization over external financing.

Supporting Expansion Plans with Adequate Working Capital

CFOs ensure that expansion strategies never stall for lack of funds. They establish target liquidity cushions and secure flexible credit to back growth initiatives.

- Set a target current ratio (e.g., 1.5–2.0) to underwrite new locations or product launches.

- Maintain committed lines of credit or SBA-backed facilities to bridge timing gaps.

- Allocate surplus cash to high-ROI expansion projects rather than low-yield reserves.

- Use asset-based lending to release capital tied up in receivables and inventory.

- Integrate working capital planning into annual budgeting cycles.

Managing Risk While Scaling Operations

As firms scale, CFOs balance liquidity management with prudent risk controls. They stress-test cashflow models under varying growth scenarios to identify pinch points. By centralizing treasury operations, finance teams detect emerging shortfalls and adjust operational efficiency through working capital levers before they escalate.

Identifying Opportunities to Free Up Cash for Strategic Investments

To fund new ventures without external borrowing, CFOs mine existing operations for liquidity. They systematically review processes to uncover hidden cash sources:

- SKU Rationalization: Eliminate slow-moving products to reduce inventory carrying costs.

- Vendor Rebates: Renegotiate contracts for volume or early-payment discounts.

- Bank Account Consolidation: Implement sweep accounts to concentrate idle balances.

- Dynamic Discounting: Offer suppliers accelerated payments in exchange for price reductions.

- Sale-and-Leaseback: Monetize owned equipment without disrupting operations.

- Contract Renegotiations: Extend payment terms to align outflows with inflows.

Ensuring Long-Term Financial Health with Strong Liquidity Management

Effective cash flow management underpins ongoing importance of working capital management by embedding liquidity controls into daily routines. CFOs deploy rolling cash-flow forecasts and real-time bank integrations to spot deviations within hours, not days.

They tier cash into operational, strategic, and contingency buckets to prevent overspending. Regular balance-sheet stress tests ensure reserves withstand market disruptions, cementing the firm’s ability to invest, innovate, and outlast competitors.

How to Choose the Right CFO for Working Capital Management

Selecting a CFO with deep liquidity expertise cements the importance of working capital management in your organization’s DNA. The ideal candidate combines proven capital planning skills with formal credentials.

Look for Expertise in Cash Flow and Liquidity Management

CFO selection begins by prioritizing candidates with proven expertise in cash flow management. Their hands-on experience ensures the company maintains operational flexibility and controls borrowing costs.

- Confirm they have built and maintained rolling cash forecasts and stress-tested liquidity scenarios.

- Verify they have led CFO working capital optimization projects to sustain uninterrupted operations.

Assess Their Ability to Manage Accounts Receivable and Payable

As accounts receivable and payable are pivotal to working capital management, assess each candidate’s track record in shortening the cash conversion cycle. Strong CFOs establish clear credit policies to reduce DSO and negotiate favorable DPO terms

They centralize invoicing, leverage automated reminders, and monitor aging reports to enforce discipline.

Verify Their Track Record in Supporting Business Growth Through Working Capital Optimization

Begin by examining tangible outcomes: look for CFOs who have translated working capital improvements into growth funding.

- Documented reductions in cash conversion cycle.

- Case studies demonstrating freed-up cash deployed to new product launches or market expansions.

- Measurable improvements in liquidity ratios.

Ensure Strong Analytical Skills and Financial Insight

Effective CFOs dissect large datasets to uncover cash-flow drivers, using advanced analytics to optimize cash flow management. They build customized dashboards tracking DSO, DPO, and inventory turnover, enabling proactive adjustments.

Their financial insight guides scenario planning and sensitivity analyses, ensuring the company can navigate volatility. Candidates should demonstrate proficiency with ERP systems and BI tools, translating raw data into actionable working capital strategies.

Conclusion: Driving Business Success Through Strategic Working Capital Management

As CFOs implement these strategies, the importance of working capital management becomes clear: improved liquidity supports growth, risk mitigation, and sustainable profitability. By mastering accounts receivable, inventory management, payables, and forecasting, finance leaders can convert working capital into a strategic asset.

To discuss how these principles apply to your organization, schedule a complimentary consultation with our experts. At NOW CFO, we combine deep financial analysis with practical guidance to elevate your efforts.