As the fiscal year concludes, businesses have a pivotal opportunity to implement tax planning strategies for year-end. Proactive measures like hiring an outsourced CFO can lead to substantial tax savings and improved financial health.

For instance, contributing to retirement plans can reduce taxable income. 401(k) contribution limits are set at $23,000 for 2024, plus a $7,500 catch-up for those aged 50 or older. By strategically managing deductions and credits, companies can minimize tax liabilities and position themselves for success in the upcoming year.

The Importance of Tax Planning Strategies for Year-End

Transitioning into the final months of the fiscal year, businesses face a critical opportunity to assess their financial strategies.

Year-end tax planning helps maximize savings through eligible deductions and reduces tax liabilities, fostering better economic outcomes. Understanding its importance can set the foundation for compliance, stability, and growth.

How Tax Planning Impacts Financial Health

Effective tax planning strategies for year-end are pivotal in a company’s financial health and accountant’s sanity. Businesses can lower their taxable income by accelerating deductions or deferring income, reducing their tax bill significantly.

Additionally, optimizing depreciation schedules ensures that resources are better allocated toward productive investments rather than unnecessary tax expenditures.

Benefits of Proactive Year-End Tax Strategies

Proactive planning doesn’t just save money; it improves operational flexibility and reduces stress during tax season. Here are the key benefits:

- Increased Cash Flow: Businesses retain more capital by taking full advantage of tax credits and year-end deductions. For example, the IRS allows Section 179 to deduct up to $1.16 million on equipment purchases in 2023.

- Penalty Prevention: By reviewing financial records before the year-end, businesses can avoid errors that may lead to audits or fines. According to the IRS, small businesses incur $2 billion annually in late-filing penalties.

- Enhanced Budgeting: With tax obligations under control, forecasting, and allocation for the upcoming year become more reliable.

Aligning Tax Planning with Business Goals

Tax planning is most effective when integrated with business objectives. For instance, aligning capital purchases with tax incentives, such as bonus depreciation, ensures a dual operational and tax advantages benefit. Additionally, reviewing payroll structures in December helps to optimize bonus payments and manage overall liabilities.

Key Tax Planning Strategies for Maximizing Deductions

Implementing effective tax planning strategies for year-end is crucial for businesses aiming to maximize deductions and reduce tax liabilities. Companies can significantly enhance their financial health and ensure tax compliance by proactively managing financial activities before the fiscal year concludes.

Accelerate Expenses to Increase Deductions

One effective strategy is to accelerate deductible expenses into the current tax year. Prepaying rent, utilities, or office supplies can achieve this. By doing so, businesses can increase their deductible expenses, lowering taxable income.

For instance, purchasing necessary equipment before year-end allows for immediate deduction under Section 179. This section permits companies to deduct the total purchase price of qualifying equipment and software financed or purchased during the tax year.

Defer Income to Reduce Current Tax Liabilities

Deferring income to the next tax year can be beneficial, especially if you anticipate being in a lower tax bracket. This can be accomplished by delaying invoicing for services or goods until late in the year to receive payment in the following year. However, it’s essential to consider the potential impact on cash flow and ensure that this strategy aligns with your overall financial plan.

Take Advantage of Section 179 Deduction for Equipment Purchases

The Section 179 deduction allows businesses to deduct the total purchase price of qualifying equipment and software purchased or financed during the tax year. This incentive is designed to encourage companies to invest in themselves.

Maximize Retirement Plan Contributions

Contributing to retirement plans not only prepares for the future but also provides immediate tax benefits. For example, contributions to a Simplified Employee Pension (SEP) IRA or a 401(k) plan are tax-deductible, reducing taxable income for the year.

However, the contribution limits vary depending on the type of plan and the taxpayer’s age, so it’s essential to consult with a tax advisor to determine the optimal contribution amount.

Similarly, the Small Business Health Care Tax Credit is designed to help small businesses afford health insurance for their employees. Eligibility criteria and credit amounts vary, so it’s advisable to consult with a tax professional to identify applicable credits.

Reducing Tax Liabilities with Smart Year-End Planning

Implementing thoughtful tax planning strategies for year-end is crucial for businesses aiming to reduce liabilities and enhance financial health. By strategically managing financial activities before the fiscal year concludes, companies can optimize tax outcomes and ensure evolving tax compliance.

Reviewing Revenue and Expense Recognition

Adjusting the timing of revenue and expenses can significantly impact taxable income. By deferring income to the next fiscal year and accelerating deductible expenses into the current year, businesses can lower their taxable income, thereby reducing tax liabilities.

Adjusting Payroll and Bonus Payments

Strategically, timing payroll and bonus distributions can influence the tax year these expenses are deducted. Issuing employee bonuses before year-end enables businesses to claim year-end deductions, thus lowering taxable income.

According to the IRS, bonuses are deductible in the year they are paid, providing immediate tax benefits. However, ensuring these payments are reasonable and align with standard compensation practices to withstand IRS scrutiny is crucial.

Optimizing Inventory Levels and Cost of Goods Sold (COGS)

Effective inventory management directly affects the COGS, impacting taxable income. By conducting a thorough inventory review and writing down obsolete or unsellable stock, businesses can increase COGS, thereby reducing taxable income.

Planning Charitable Contributions and Donations

Making charitable contributions by year-end is a great strategy for maximizing tax deductions. The IRS allows businesses to deduct contributions made to qualified organizations, subject to certain limitations based on taxable income.

Ensuring Compliance with Tax Regulations at Year-End

As the fiscal year draws to a close, ensuring compliance with tax regulations becomes a critical priority for businesses. Proactive measures to adhere to tax laws mitigate the risks of audits and strengthen financial stability. Below are essential tax planning strategies for year-end to stay compliant.

Understanding Changes in Tax Law and Regulations

Tax laws frequently evolve, introducing new opportunities and challenges. Businesses should stay updated on recent changes, such as adjustments to deduction limits, credit eligibility, or filing requirements.

For example, the IRS recently increased the standard mileage rate for business travel in 2023 to 65.5 cents per mile, affecting expense reporting. Keeping abreast of these updates ensures businesses capitalize on available tax benefits while avoiding penalties.

Reviewing Business Tax Filings for Accuracy

Year-end is an opportune time to audit financial records and ensure error-free tax filings. Double-checking records, reconciling discrepancies, and addressing inconsistencies safeguard against such risks.

Preparing Documentation for Deductions and Credits

Proper documentation is essential to claiming credits and maximizing tax deductions. Businesses should compile and organize receipts, invoices, and other financial records substantiating expenses. For example, charitable contributions must include acknowledgment letters from recipient organizations to be deductible.

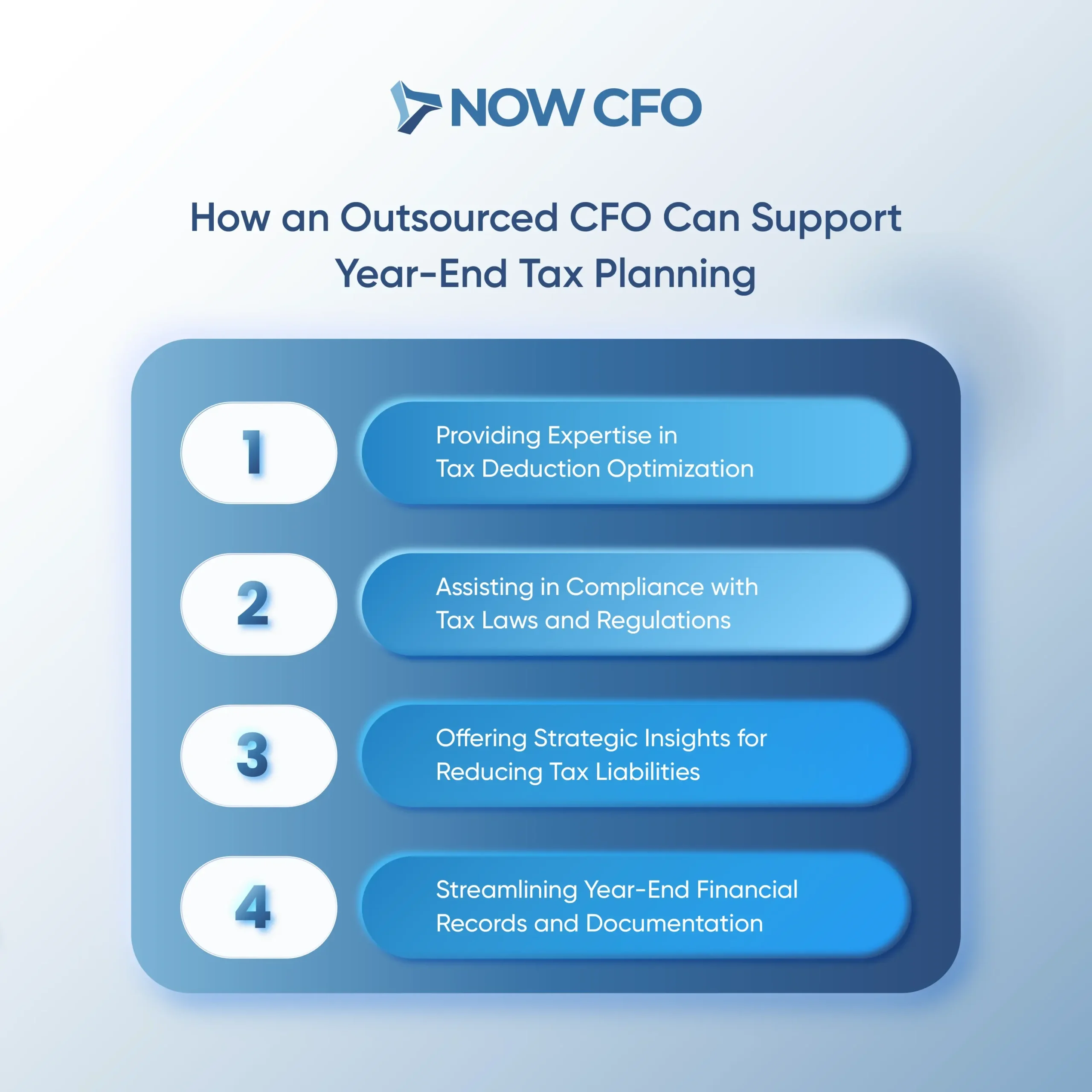

How an Outsourced CFO Can Support Tax Planning Strategies for Year-End

Engaging an outsourced CFO can significantly enhance a company’s tax planning strategies for year-end accounts by providing specialized expertise and strategic financial management. This approach offers several key benefits:

Providing Expertise in Tax Deduction Optimization

An outsourced CFO brings in-depth knowledge of tax laws and regulations, enabling businesses to identify and maximize eligible deductions. They can implement strategies such as accelerating expenses or deferring income to optimize tax outcomes.

Assisting in Compliance with Tax Laws and Regulations

Navigating complex tax codes requires meticulous attention to detail. An outsourced CFO ensures that all financial activities comply with current tax laws, minimizing the risk of audits and penalties. They stay updated on legislative changes and adjust financial strategies accordingly, ensuring the company remains compliant and avoids costly fines.

Offering Strategic Insights for Reducing Tax Liabilities

Beyond routine tax preparation, an outsourced CFO provides strategic planning to minimize tax liabilities. They analyze the company’s financial position and develop tailored strategies, such as utilizing tax credits and optimizing depreciation schedules, to reduce the overall tax burden. This strategic oversight aligns tax planning with the company’s long-term financial goals.

Streamlining Year-End Financial Records and Documentation

Efficient year-end tax planning for small businesses requires organized and accurate financial records. An outsourced CFO oversees the preparation and maintenance of financial documents, ensuring that all records are comprehensive and readily available for tax filings. This organization facilitates a smoother tax filing process and provides a clear financial overview for stakeholders.

Best Practices for Successful Tax Planning Strategies for Year-End

Adequate tax planning strategies for year-end are crucial for businesses aiming to maximize deductions and ensure compliance with tax regulations. Implementing best practices can significantly reduce the risk of errors and associated penalties.

Organize and Review Financial Statements

Maintaining well-organized financial records is the foundation of accurate tax preparation. Regularly updating and reviewing financial statements, such as income statements and balance sheets, ensures that all transactions are accurately recorded.

Maintain Consistency in Financial Documentation

Consistency in financial documentation is vital for accurate reporting. Utilizing standardized accounting methods and documentation practices helps maintain uniformity across financial records. This consistency is essential for compliance and provides a clear financial picture, aiding strategic decision-making.

Prepare for Audits with Detailed Records

Comprehensive documentation is crucial in the event of an audit. Maintaining detailed records of all financial transactions, including receipts, invoices, and contracts, provides the necessary evidence to substantiate claims made in tax filings.

Implement a Year-End Checklist for Tax Preparation

Developing a comprehensive year-end tax preparation checklist ensures that all necessary tasks are completed timely. This checklist should include reviewing financial statements, verifying the accuracy of reported income and expenses, and ensuring all eligible deductions and credits are claimed.

Benefits of Proactive Tax Planning Strategies for Year-End

Year-end tax planning is essential for businesses aiming to optimize their financial health and ensure compliance with tax regulations. Implementing strategic tax measures before the fiscal year concludes offers several significant benefits:

Enhanced Financial Flexibility for the New Year

Businesses can defer or accelerate deductions by strategically managing income and expenses, effectively reducing taxable income for the current year. This approach results in immediate tax savings, providing additional capital that can be reinvested into the business or used to improve cash flow.

Reduced Risk of Penalties and Compliance Issues

Engaging in year-end tax planning ensures that all financial activities comply with current tax laws, minimizing the risk of audits and penalties. By reviewing financial records and ensuring accurate reporting, businesses can avoid common pitfalls that lead to compliance issues.

Improved Cash Flow Management and Budgeting

A wholesome business tax planning provides a clear picture of tax liabilities, allowing businesses to allocate resources more effectively. This foresight aids in budgeting and financial planning, ensuring sufficient funds are available to meet tax obligations without disrupting operational cash flow.

Additionally, understanding upcoming tax liabilities enables businesses to make informed decisions about investments and expenditures.

Conclusion

As the year draws close, proactive year-end tax planning becomes indispensable to managing a business’s financial health. Businesses can significantly reduce tax liabilities by hiring outsourced CFO, maximizing tax deductions, deferring income, and optimizing credits.

Contact our experts to achieve these business tax planning strategies for year-end outcomes. With thoughtful preparation, you can transform tax season from a stressful period into a valuable opportunity for growth and stability.