As a business owner, you may think filing taxes means calling a CPA sometime before April 1, but business taxes are a bit more complicated than that. Before you can pick up the phone, take a second to evaluate if you really are ready to file your taxes and if you are in need of tax preparation services.

When you take your financial information to a CPA, they typically must reorganize it. The messier your financials, the more time they spend organizing. Maybe your balance sheet is from October instead of December; maybe your profit and loss statement (P&L) is missing a deal from the last week of December; or maybe you just have a box of receipts labeled finance. There is nothing wrong with being a little disorganized, but that disorganization means your CPA will have to spend more time cleaning up your financials before they can file your taxes. At a rate of $150-400 per hour, that clean up time ultimately costs you a significant amount. Instead, save your wallet some heartache and take the time to prepare your taxes before sending them off to be filed.

Now, you might be thinking, I do not have time to prepare my taxes. My accounting department is already overworked! That’s where a third-party tax preparation service, like NOW CFO, comes in. We do everything from reviewing a balance sheet to fixing your inventory management. We cannot file your taxes, but we can help with everything else beforehand. More importantly, it will cost less per hour than a CPA firm. So, let’s talk about how you know you’re ready to call a CPA.

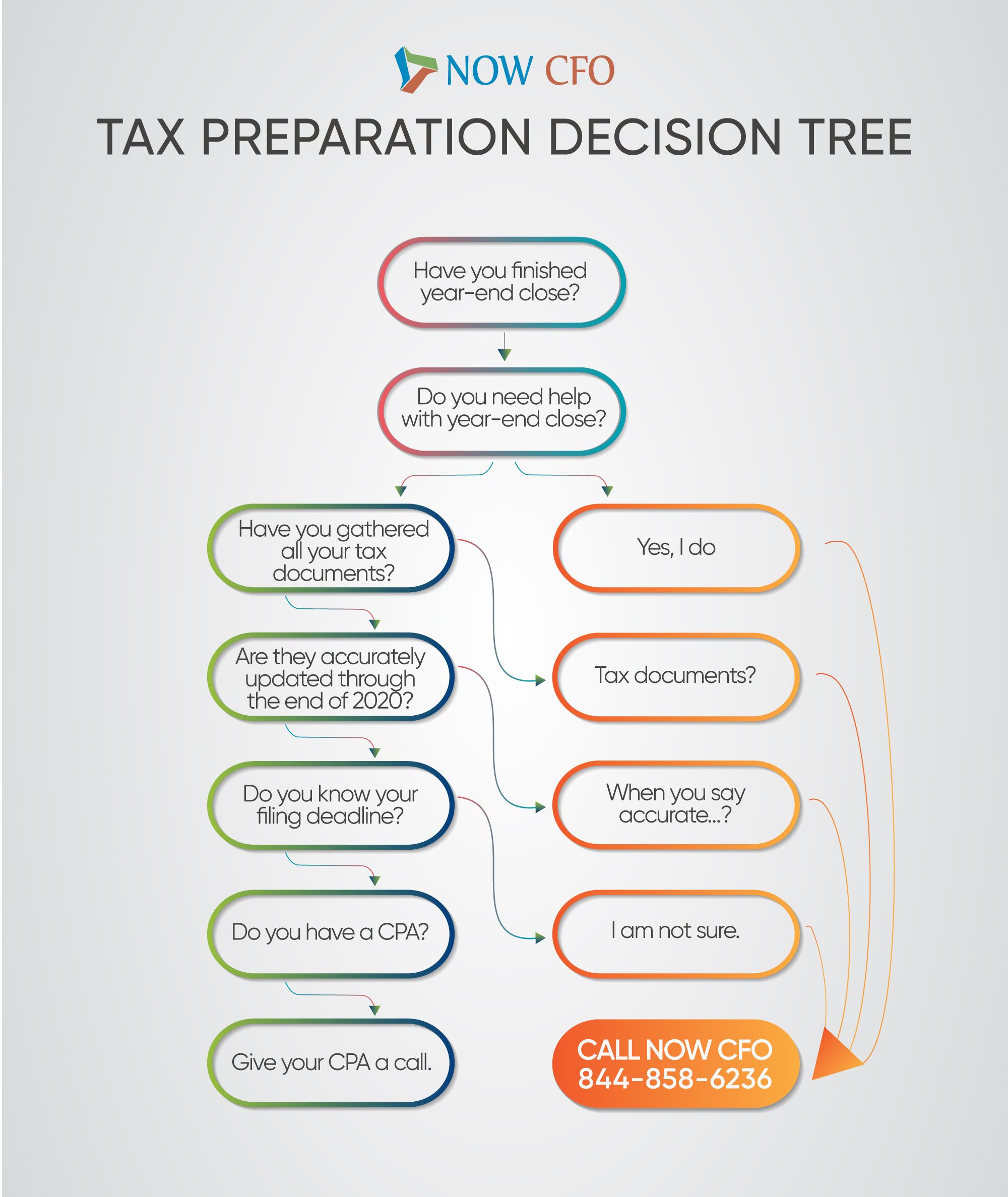

Have you finished year-end close?

The sooner you can wrap up last year and start preparing your taxes, the better. CPA firms are overwhelmed during tax season. So, the sooner the CPA gets your tax information, the more prepared and focused their service will be. If you are at the end of January and your team is struggling to complete month-end close, much less year-end close, it might be a good time to get some help. We work on a project basis, so you only pay for the hours you need.

Have you gathered all your tax documents?

Most CPAs need the following:

- Last year’s tax return

- Profit & loss statement

- Balance sheet

- Asset purchases & disposals

- Bank statements

- Credit card statements

- Payroll records

- Receipts

- Income statement

All the above documents need to be accurate and up to date through December 31st. Reviewing all this information can be overwhelming for accounting departments while they are also forecasting the new year and building budgets. When it feels like too much or you are worried your sleep-deprived team needs a break, call NOW CFO. We have a fresh eye, and we can slot in wherever your current team most needs the help.

Do you know your filing deadline?

Taxes are complex, and tax law is continuously changing. Not to mention the fact that 2020 was a difficult year for everyone, financially and otherwise. If your in-house accounting team has questions or is worried about regulations, bringing in a third-party resource can really help. NOW CFO specifically specializes in tax preparation, and we are well-versed in the laws and changes year over year—even in 2020.

Gain Financial Visibility Into Your Business

We provide outsourced, fractional, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.