What are Financial Statements?

Financial statements are written records that convey the business activities and the financial performance of a company. These statements are audited by government agencies, accountants, and firms. Investors and analysts rely on this important financial data to make predictions about the future direction of the company and their stock price.

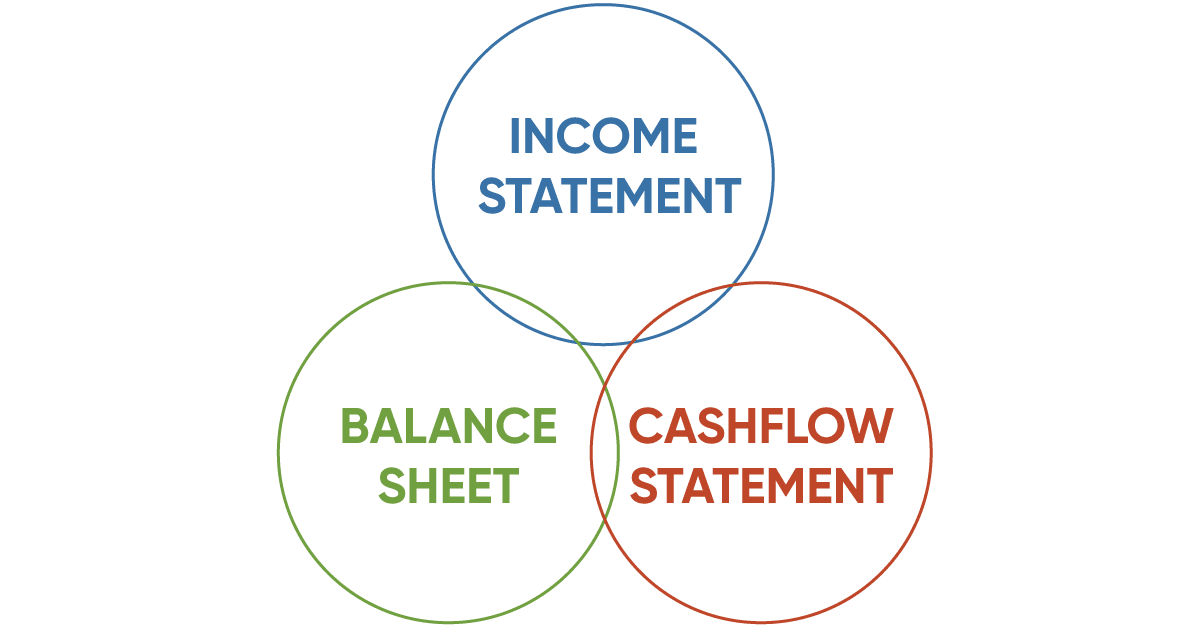

The financial statements will be included in company’s audit and annual report, which is one of the most vital resources of finance. There are three main financial statements:

- Balance Sheet

- Income Statement

- Cash flow Statement

| Income Statement | Balance Sheet | Cash Flow | |

| Time | Period of time | A point in time | Period of time |

| Purpose | Profitability | Financial position | Cash movements |

| Measures | Revenue, expenses, profitability | Assets, liabilities, shareholders’ equity | Increases & decreases in cash |

| Starting Point | Revenue | Cash balance | Net income |

| Ending Point | Net income | Retained earnings | Cash balance |

Balance Sheet: What Is It?

Balance Sheet Formula: Assets= (Liabilities + Owner’s Equity)

The last key financial statement is the balance sheet. The balance sheet provides overview of a company’s assets, liabilities, and stockholders equity. These will generally be taken and provided at the end of the fiscal year. The balance sheet will tell you how assets are funded, and assets listed on the balance sheet are in order of liquidity.

What Is Included In The Balance Sheet?

Assets: Cash and cash equivalents such as certificates of deposits. Account’s receivables and inventory are also assets.

Shareholder’s equity: Shareholder’s equity is a company’s total assets minus its total liabilities. It represents the money that would be returned to the shareholders if the assets were liquidated, and the company’s debt is paid off.

Liabilities: Debt including long term debt, wages payable and dividends payable.

Income Statements: Why Are They So Important?

Income Statement Formula: Net Income=(Revenue−Expenses)

Another important financial document is the Income Statement, which covers a specific period of time, unlike the balance sheet. It provides an overview of revenues, expenses, net income, and earnings per share. It is typically two to three years’ worth of data to compare. This is usually the first thing that an investor or analyst will look at since it shows the performance of the business, showing the sales revenue at the top.

The income statement is also known as a profit and loss statement, the statement of revenue and expenses. This statement will allow you to see the net income profit.

Types of Revenue: Operating revenue is revenue earned by selling the company’s products or services, and non-operating revenue is income earned from things other than the business activities such as interested earned on cash in the bank, rental income, income from an advertisement display, etc.

Types of Expenses: Expenses include the cost of goods sold, selling, general and administrative expenses, depreciation of amortization, and research and development. Typical expenses include the usual employee wages, sales commissions, and utilities. The main purpose of this statement conveys details or profitability and the financial results of business activities.

Cash Flow Statement: What Does it Mean?

The cashflow statement measures how well a company generates cash to pay its debit obligations, fund its expenses, and fund investments. This statement is the completion piece to the balance sheet and income statement. This statement is important because it will allow investors to understand how a company’s operations are running, and where their money is coming from and how it is being spent.

There is no formula for the cash statement in comparison to the balance sheet and income statement, but there are three components that report cash flow accurately. They are:

-Operating Activities: Sources and uses of cash from running the business and selling its products or services.

-Investing Activities: Any sources and uses of cash from a company’s investments into the long-term future of the company.

-Financing Activities: Sources of cash from investors or banks, and uses of cash paid to shareholders

How NOW CFO Can Help with Financial Statements

Our team is efficient and skilled at producing accurate financial statements in a timely manner that will salsify regulatory agencies, auditors, lenders and investors. Our financial reporting manager consultants will help you gain the confidence you need for your company to impress auditors and investors.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced, fractional, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Annual Operating Plan