What Are the Responsibilities of an Accounting Manager?

Effective financial management is the backbone of any successful business, and accounting managers are pivotal in achieving it. These professionals oversee essential tasks like budgeting, economic analysis, and compliance, ensuring organizations stay on track.

Notably, 82% of small businesses fail due to poor cash-flow management. Understanding the responsibilities of an accounting manager is vital for maintaining financial health. Their expertise in budgeting, economic analysis, and regulatory compliance ensures accurate financial reporting and strategic decision-making.

The Role of an Accounting Manager in Modern Businesses

Today, accounting manager duties have evolved to meet the growing demands of financial leadership. As organizations strive for efficiency and compliance, accounting managers are the backbone of financial operations.

Let’s delve into their critical tasks, starting with managing day-to-day operations and fostering collaboration between teams and leadership.

Managing Daily Financial Operations

An accounting manager’s primary responsibility is to oversee the smooth running of daily financial activities. This includes supervising transactions, reviewing ledger entries, and ensuring all processes align with established accounting standards.

- They monitor cash flow, ensuring that inflows and outflows are accurately tracked.

- Reconciling accounts regularly minimizes errors and maintains financial transparency.

Additionally, accounting managers oversee payroll processing and vendor payments, ensuring timeliness and accuracy. Their role extends to implementing automation tools for tasks like invoicing, which enhances efficiency and reduces manual errors.

Bridging Communication Between Teams and Leadership

Beyond daily operations, accounting managers are critical links between financial teams and company leadership. They interpret complex financial data into actionable insights that guide strategic decisions.

- Regularly presenting performance metrics enables leadership to align financial goals with broader business objectives.

- Providing forecasts based on market trends ensures proactive decision-making.

Moreover, accounting managers foster collaboration by encouraging cross-departmental communication. This synergy helps resolve bottlenecks and ensures a cohesive approach to financial planning.

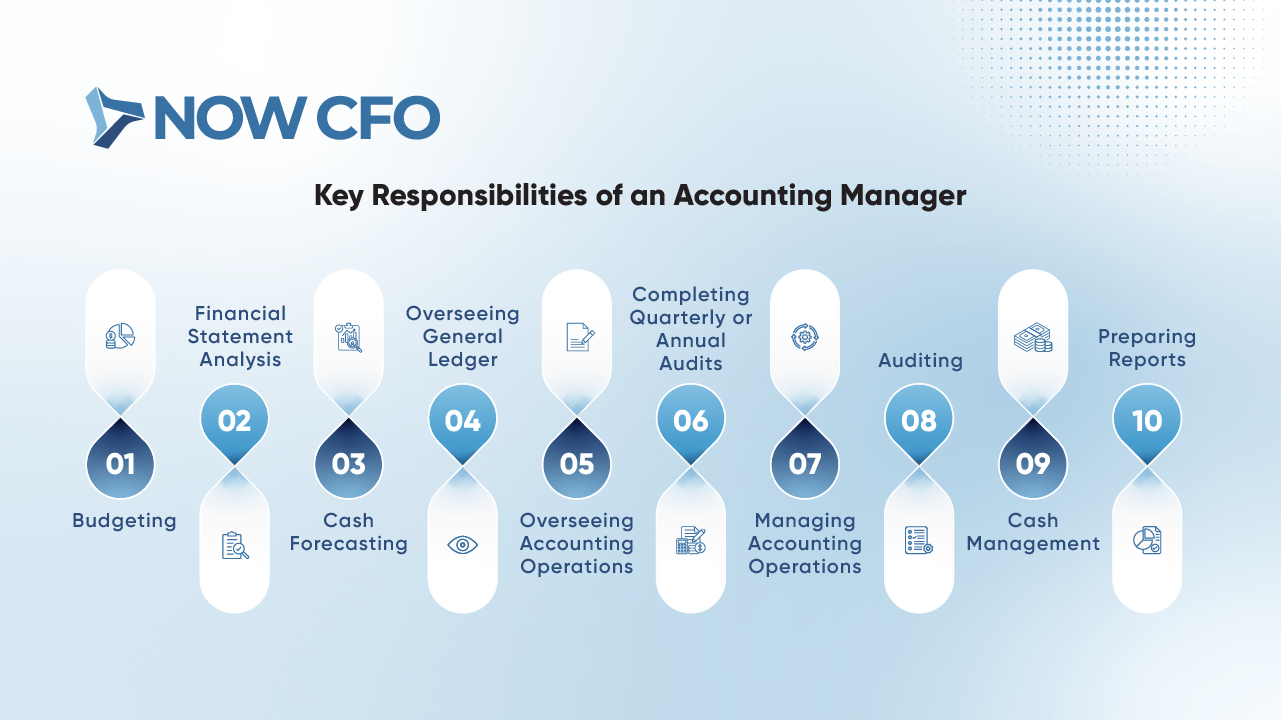

Key Responsibilities of an Accounting Manager

Responsibilities of an accounting manager encompass various tasks that ensure a company’s financial stability and compliance. From creating budgets to overseeing ledgers, accounting managers play a vital role in aligning financial processes with organizational goals.

Budgeting

Budgeting is a cornerstone responsibility for accounting managers. They develop comprehensive budgets that align with an organization’s objectives and ensure resources are allocated effectively.

- Collaborating with department heads, they gather projected expenses and revenue data.

- Accounting managers also monitor budget adherence throughout the year, adjusting as needed to accommodate changing priorities.

Their role in budgeting doesn’t end with preparation. They track key metrics, such as variance percentages, to compare actual spending against projections. For example, identifying a 15% increase in overhead costs might prompt a review of vendor agreements or operational expenses.

Financial Statement Analysis

Accounting managers also critically analyze financial statements. By reviewing income statements, balance sheets, and cash flow statements, they gain insights into a company’s financial health.

- They identify trends, such as revenue growth or expense patterns, to recommend actionable strategies.

- Ensuring accuracy in these documents helps maintain compliance with regulatory standards.

For example, spotting a consistent decline in operating margins can lead to cost-reduction strategies or pricing adjustments. According to the GAO, accurate financial reporting is a primary factor in maintaining investor confidence.

Cash Forecasting

Accounting managers also oversee cash forecasting, a process essential for maintaining liquidity and meeting financial obligations.

- They predict future cash inflows and outflows based on historical data and upcoming transactions.

- Regular updates to cash flow forecasts help mitigate the risk of shortfalls, ensuring timely payments to vendors and employees.

Forecasting is essential for businesses navigating seasonal fluctuations or market volatility. For example, a retail company might forecast additional cash needs during the holiday season to prepare for increased inventory costs.

Advanced tools and software often assist in this process, improving the accuracy of projections and allowing businesses to plan for contingencies effectively.

Overseeing General Ledger

Maintaining the general ledger is fundamental to a company’s accounting system, and accounting managers ensure its integrity.

- They supervise entries to ensure accuracy and compliance with accounting principles.

- Regular reconciliations verify that all transactions are correctly categorized and balanced.

This oversight extends to resolving discrepancies quickly, preventing potential reporting errors. By doing so, accounting managers maintain a reliable financial record that serves as the foundation for audits and reports.

Overseeing Accounting Operations

Finally, accounting managers take responsibility for the broader scope of accounting operations. This involves leading teams, delegating tasks, and implementing systems to streamline workflows.

- Ensuring timely and accurate completion of financial tasks such as payroll and accounts payable.

- Monitoring KPIs like invoice processing times to identify areas for improvement.

By leveraging technology like ERP systems, accounting managers optimize operations while reducing manual errors.

Completing Quarterly or Annual Audits

Accounting managers play a pivotal role in facilitating quarterly or annual audits. They act as the company’s and external auditors’ liaison, ensuring the process runs smoothly.

- They prepare audit schedules, ensuring all financial records are complete and accurate.

- Additionally, they address auditor queries and provide supporting documentation for transactions.

Managing Accounting Operations

Beyond audits, accounting managers oversee the day-to-day operations of the accounting department.

- They assign tasks to accounting staff, such as managing accounts payable and receivable.

- Ensuring the accuracy and timeliness of these operations prevents bottlenecks in financial workflows.

Moreover, they implement best practices and training for their teams, ensuring adherence to company policies and industry regulations.

Auditing

In addition to external audits, other key tasks of an accounting manager include conducting internal audits to review financial processes and controls.

- They identify inefficiencies, such as redundant processes or unnecessary expenditures, and recommend corrective actions.

- By addressing gaps proactively, accounting managers reduce the risk of fraud or regulatory violations.

Internal audits foster a culture of accountability and ensure the organization is always audit-ready.

Cash Management

Effective cash management is another key area of responsibility. Accounting managers monitor cash flow to ensure the organization has sufficient liquidity to meet its obligations.

- They oversee bank reconciliations, manage fund transfers, and optimize the use of cash reserves.

- Advanced forecasting tools enable them to identify potential cash shortages and plan accordingly.

Preparing Reports

Finally, accounting managers excel in preparing detailed financial reports for stakeholders.

- These reports, including profit and loss statements and performance summaries, clearly show the company’s financial health.

- Accounting managers ensure reports adhere to standard formats and include key metrics relevant to decision-makers.

Essential Skills for an Effective Accounting Manager

Responsibilities of an accounting manager demand diverse skills to ensure efficiency and strategic leadership. These competencies, from financial acumen to technical expertise, enable accounting managers to navigate complex challenges and drive organizational success. Let’s explore some critical skills, starting with economic analysis and leadership capabilities.

Financial Analysis and Problem-Solving

An accounting manager’s ability to analyze financial data and solve problems is paramount.

- They assess performance metrics such as profit margins and cost ratios to identify trends and anomalies.

- With this data, they develop actionable strategies to enhance profitability or reduce expenses.

For example, a detailed variance analysis might reveal unnecessary spending in a specific department, allowing the organization to reallocate resources effectively. This skill is essential for maintaining financial health and aligning expenditures with strategic goals.

Additionally, problem-solving involves addressing unexpected financial issues, such as cash flow shortages or compliance discrepancies. Accounting managers excel at devising immediate solutions while implementing preventative measures for the future.

Leadership and Communication Skills

Leadership is central to managing accounting teams and collaborating across departments.

- Accounting managers mentor team members, delegating tasks based on their strengths and fostering professional growth.

- Strong communication skills enable them to explain financial data to non-financial stakeholders clearly and promptly.

Moreover, accounting managers are often involved in cross-functional projects. Their ability to bridge gaps between financial insights and operational strategies ensures organizational alignment.

Technical Expertise in Accounting Software

Technical proficiency in accounting software is indispensable for modern accounting managers.

- They use enterprise solutions such as QuickBooks, NetSuite, or SAP to manage ledgers, generate reports, and automate tasks.

- Expertise in data analytics tools helps them precisely interpret large volumes of financial data.

By leveraging these technologies, accounting managers improve accuracy, reduce manual workloads, and enhance operational efficiency.

Attention to Detail

An accounting manager’s work revolves around precision, making attention to detail an indispensable skill.

- They meticulously review financial statements, ensuring every entry is accurate and reconciled.

- Minor errors, such as misreported numbers, can lead to significant consequences like compliance violations or financial loss.

For example, even a tiny rounding error in financial reporting could result in discrepancies during audits, undermining the organization’s credibility. By maintaining high levels of detail orientation, accounting managers build trust with stakeholders and ensure reliable financial processes.

Regulatory and Policy Knowledge

Staying updated with regulations and policies is another critical responsibility of accounting managers.

- They monitor changes in tax laws, financial reporting standards, and industry regulations.

- Their expertise ensures that the organization complies with legal requirements, avoiding penalties and reputational damage.

For instance, compliance with the Sarbanes-Oxley Act (SOX) is crucial for publicly traded companies. Accounting managers are vital in implementing SOX controls to maintain transparency and accountability.

Moreover, regulatory knowledge anticipates potential risks and takes proactive measures, reinforcing the role of an accounting manager in business.

Communication Skills

Effective communication is at the heart of an accounting manager job description. Beyond crunching numbers, they must convey complex financial information clearly and concisely.

- They regularly present reports and financial forecasts to leadership, translating data into actionable insights.

- Additionally, accounting managers foster collaboration by coordinating with teams across departments.

Strong communication skills also help them navigate high-stakes situations, such as explaining discrepancies during audits or negotiating with external stakeholders. According to a study by McKinsey, organizations with clear communication strategies are 25% more likely to achieve financial success.

Whether sharing results with executives or guiding their teams, accounting managers rely on communication to align financial objectives with broader business goals.

Challenges Faced by Accounting Managers

Accounting managers navigate a complex landscape, balancing strategic planning with daily operations while adapting to ever-changing regulations.

Balancing Strategic Planning and Daily Tasks

Accounting managers often juggle long-term strategic initiatives with immediate operational demands. This dual responsibility can lead to challenges in prioritization and resource allocation.

- Time Management: Allocating sufficient time for strategic planning amidst daily tasks requires practical time management skills.

- Delegation: Empowering team members to handle routine tasks can free managers to focus on strategic objectives.

Adapting to Changing Regulations

The regulatory environment for accounting is continually evolving, posing significant challenges for accounting managers.

- Continuous Learning: Staying updated with new laws and standards is essential to ensure compliance.

- Process Implementation: Integrating regulatory changes into the accounting cycle requires careful planning and execution.

How Accounting Managers Support Business Success

Accounting managers are pivotal in driving business success by enhancing efficiency and providing strategic insights.

Driving Efficiency Through Optimized Financial Processes

Accounting manager responsibilities in financial operations is to boost organizational efficiency. By implementing advanced accounting systems and automating routine tasks, they reduce manual errors and accelerate workflows. This optimization leads to better resource management and improved cash flow, directly contributing to enhanced business performance.

- Process Improvement: Identifying and eliminating bottlenecks in financial procedures.

- Technology Integration: Adopting software solutions that automate invoicing, payroll, and reporting.

These measures enable companies to allocate resources more effectively, supporting day-to-day operations and long-term strategic goals.

Supporting Strategic Decision-Making With Data Insights

Beyond operational efficiency, accounting managers provide critical data insights that inform strategic decisions. They identify trends and opportunities by analyzing financial data and offering actionable information to guide business strategies. This analytical support is essential for effective planning and resource optimization.

- Financial Analysis: Evaluating performance metrics to guide investment and growth decisions.

- Strategic Planning: Collaborating with leadership to align financial goals with business objectives.

Through these contributions, accounting managers ensure that financial data supports operational efficiency and strategic decision-making, driving overall business success.

Conclusion

Accounting managers are instrumental in ensuring businesses achieve financial stability and strategic growth. Their ability to manage operations, optimize processes, and provide actionable insights makes them invaluable for companies striving to succeed in today’s competitive environment.

If you want to strengthen your financial leadership, NOW CFO’s accounting managers can provide the expertise you need. Please schedule a consultation or visit our website to learn more about the responsibilities of an accounting manager. Let’s work together to take your business to the next level!