Expert financial guidance is crucial for sustained growth today. However, many SMEs find the cost of a full-time CFO prohibitive. This financial barrier has increased the adoption of fractional CFO services, offering businesses access to seasoned financial expertise without full-time expense.

Notably, 66% of SMEs face financial challenges, with 43% citing difficulties in managing operational expenses, highlighting the need for strategic, flexible financial leadership.

Why Asking the Right Key Questions for Fractional CFOs Matters

Selecting a fractional CFO is a pivotal decision for your business. By posing the correct fractional CFO inquiries, you ensure that the professional aligns seamlessly with your company’s financial objectives.

Understanding Your Business’s Unique Financial Needs

Every enterprise operates within its distinct financial landscape, influenced by industry trends, market position, and internal capabilities. Recognizing these nuances is essential when considering fractional CFO services.

A tailored financial strategy can address cash flow inconsistencies or funding requirements. Notably, a study highlighted that SMEs often experience significant income volatility, with over 20% reporting unexpected income drops.

By thoroughly assessing your financial situation, you can identify areas where virtual CFO services can provide the most value, ensuring their expertise is directed toward your business’s critical needs.

Aligning Expectations with Fractional CFO Capabilities

Establishing clear expectations is foundational to a successful partnership with a fractional CFO. These professionals offer various services, from strategic planning to financial analysis. Understanding their capabilities’ scope allows you to align your business objectives with their expertise effectively.

For instance, if your goal is to enhance financial decision-making, a fractional CFO can assist in implementing data-driven strategies. HBS emphasizes that data-driven approaches lead to more confident and informed business decisions.

Reducing Risk Through Informed Decision-Making

Informed financial decisions are crucial in mitigating risks and steering your business toward sustainable growth. Engaging with a fractional CFO as a service enables access to specialized knowledge, facilitating prudent financial choices.

Approximately 20% of SMEs fail within their first year, often due to financial mismanagement. A fractional CFO can help navigate complex financial landscapes, reducing the likelihood of costly errors.

How Targeted Questions Uncover Strategic Value

Asking specific, targeted virtual CFO questions during the selection process reveals insights into their strategic approach. For example, inquiring about their experience with financial forecasting can enhance their ability to anticipate and plan for the future.

Effective financial forecasting is linked to better resource allocation and risk management, contributing to overall business success. Delving into such areas ensures that the fractional CFO’s strategies align with your company’s long-term objectives.

Leveraging NOW CFO’s Expertise to Address Common Concerns

Partnering with a reputable firm like NOW CFO can alleviate businesses’ common financial concerns. Our team of seasoned professionals offers comprehensive fractional CFO services tailored to meet diverse business needs.

By choosing NOW CFO, you can access a wealth of experience and a proven track record in enhancing financial performance across various industries.

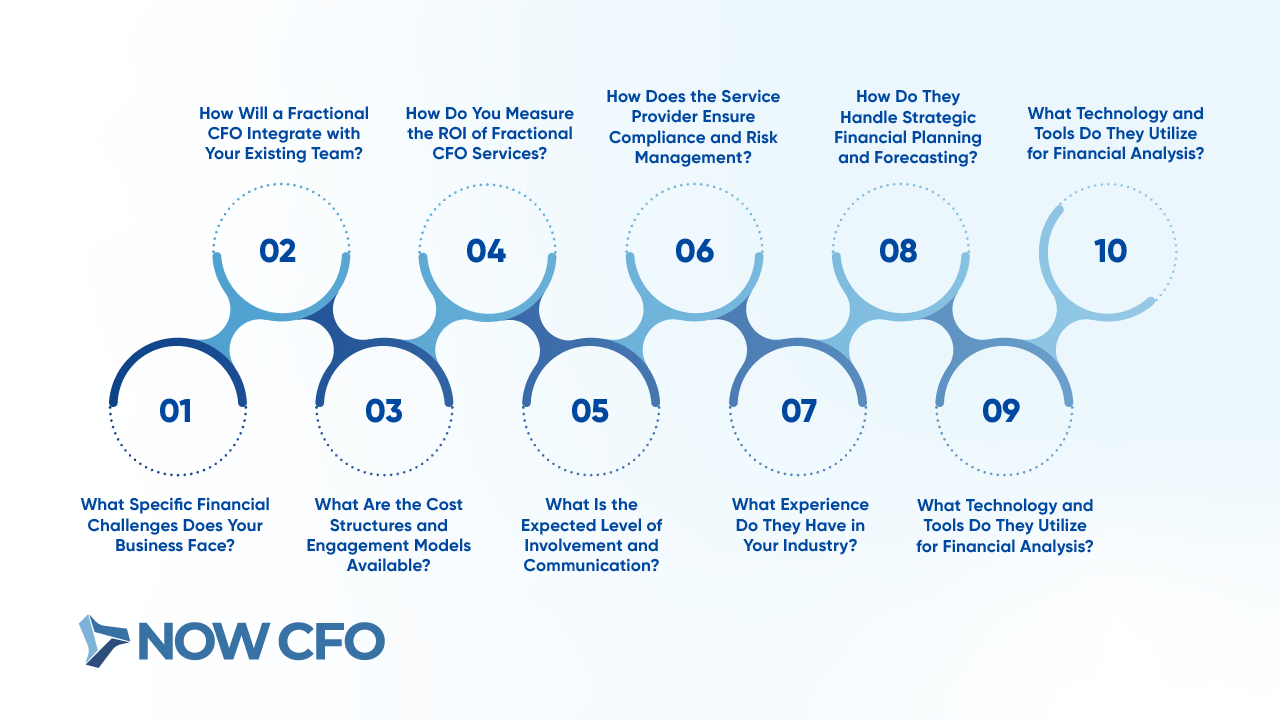

The 10 Crucial Questions For Fractional CFO Services

When considering fractional CFO services, it is imperative to investigate specific aspects to ensure a seamless fit for your business. You can uncover insights that align with your company by asking targeted outsourced financial leadership questions.

What Specific Financial Challenges Does Your Business Face?

Identifying your company’s unique financial hurdles is the first step toward effective financial management. Understanding these challenges enables an interim CFO to tailor strategies that address your needs, whether managing cash flow, securing funding, or optimizing expenditures.

How Will a Fractional CFO Integrate with Your Existing Team?

Seamless integration of a CFO into your current team is crucial for cohesive operations. Discussing their approach to collaboration, communication, and alignment with your company’s culture ensures that they complement your existing structure. For instance:

- Collaboration Tools: Understanding their proficiency with the platforms your team uses.

- Communication Frequency: Establishing expectations for regular updates and meetings.

- Decision-Making Process: Clarifying how they will be involved in strategic financial decisions.

What Are the Cost Structures and Engagement Models Available?

Understanding the financial commitment involved in hiring a fractional CFO is essential. Different providers offer various pricing models, such as hourly rates, monthly retainers, or project-based fees.

Inquiring about these structures helps you assess affordability and value. Additionally, discussing engagement models clarifies how the arrangement will function practically. By evaluating these factors, you can select a model that aligns with your budget and operational preferences.

How Do You Measure the ROI of Fractional CFO Services?

Assessing the ROI for fractional CFO services ensures their contributions translate into tangible benefits. KPIs include:

- Revenue Growth: Tracking increases attributable to strategic financial planning.

- Cost Savings: Measuring reductions in expenses due to improved financial management.

- Cash Flow Improvement: Monitoring enhanced liquidity positions over time.

What Is the Expected Level of Involvement and Communication?

Clarifying the extent of the fractional CFO’s involvement ensures alignment with your business needs. Determine:

- Availability: How many hours per week or month will they dedicate?

- Responsiveness: Expected turnaround times for inquiries or tasks.

- Reporting: Frequency and format of financial reports and due diligence.

How Does the Service Provider Ensure Compliance and Risk Management?

Ensuring adherence to financial regulations and mitigating risks is paramount. Inquire about the fractional CFO’s approach to:

- Regulatory Compliance: Staying updated with laws pertinent to your industry.

- Risk Assessment: Identifying and addressing potential financial vulnerabilities.

- Internal Controls: Implementing processes to prevent fraud and errors.

What Experience Do They Have in Your Industry?

Industry-specific experience enables a fractional CFO to navigate sector challenges effectively. Discuss their familiarity with:

- Market Trends: Understanding dynamics that impact your industry.

- Regulatory Environment: Knowledge of industry-specific compliance requirements.

- Competitive Landscape: Insights into strategies employed by similar businesses.

How Do They Handle Strategic Financial Planning and Forecasting?

Strategic planning and accurate forecasting are vital for long-term success. Inquire about their methodologies for:

- Budgeting: Developing comprehensive financial plans aligned with business goals.

- Forecasting Models: Utilizing data-driven approaches to predict financial performance.

- Scenario Analysis: Evaluating potential outcomes based on varying business conditions.

What Technology and Tools Do They Utilize for Financial Analysis?

Leveraging advanced tools enhances the accuracy and efficiency of financial analysis. Discuss the fractional CFO’s proficiency with:

- Accounting Software: Familiarity with platforms like QuickBooks or Xero.

- Data Analytics: Utilizing tools for in-depth financial data examination.

- Reporting Dashboards: Implementing systems that provide real-time financial insights.

Can They Provide References or Case Studies Demonstrating Success?

Requesting references or case studies offers insights into the outsourced CFO’s track record. Look for:

- Client Testimonials: Feedback from businesses they’ve previously assisted.

- Success Stories: Examples of financial improvements achieved for other clients.

- Performance Metrics: Data showcasing their impact on past engagements.

Learn More: Fractional CFO vs Full-Time CFO

How NOW CFO Addresses These Questions For Fractional CFO Services

Selecting the right fractional CFO services involves addressing key concerns to ensure alignment with your business objectives. NOW CFO offers comprehensive solutions tailored to meet these needs effectively.

Tailored Solutions That Match Your Financial Challenges

Understanding that each business faces unique financial hurdles, NOW CFO provides customized strategies to address specific challenges. Whether enhancing cash flow management, preparing for mergers and acquisitions, or implementing robust financial controls, our team develops solutions that align with your company’s goals.

This personalized approach ensures that strategies are practical and relevant to your industry’s dynamics. 82% of small businesses fail due to poor cash flow management. By focusing on tailored financial strategies, NOW CFO aims to mitigate risks and promote business sustainability.

Seamless Integration with Your In-House Finance Team

Effective collaboration between external consultants and internal staff is vital for successful financial management. NOW CFO emphasizes seamless integration with your existing finance team, fostering a collaborative environment that enhances operational efficiency.

Our professionals work alongside your staff, ensuring knowledge transfer and cohesive strategy implementation. This partnership approach minimizes disruptions and leverages collective expertise to drive financial performance.

Research indicates that companies with collaborative teams are five times more likely to be high-performing. By promoting integration, NOW CFO contributes to building high-performing teams within your organization.

Learn More: Integrating a Fractional CFO into Your Financial Team

Transparent Cost Models with Clear ROI Metrics

Budget considerations are crucial when engaging fractional CFO services. NOW CFO offers clear and transparent cost structures, allowing businesses to understand the investment required and the value delivered. We provide detailed breakdowns of services and associated costs, ensuring no hidden fees.

Furthermore, NOW CFO establishes clear ROI metrics, enabling you to measure the effectiveness of their services. This transparency aids in budgeting and demonstrates the tangible benefits of our financial expertise.

NOW CFO’s commitment to transparent cost models aligns with these findings, fostering trust and clarity in financial engagements.

Robust Communication Protocols and Regular Reporting

Consistent and clear communication is the foundation of any successful partnership. NOW CFO implements robust communication protocols, ensuring you are informed and engaged throughout the engagement.

We provide regular financial reports, updates, and strategic insights, facilitating informed decision-making. Scheduled meetings and accessible strategic CFO consulting ensure your concerns are promptly addressed and strategies adjusted as needed.

According to a report, organizations with effective communication practices are 3.5 times more likely to outperform their peers. NOW CFO’s emphasis on communication supports this advantage, enhancing your company’s financial management capabilities.

Proven Expertise in Risk Management and Compliance

NOW CFO brings proven risk management and compliance expertise, ensuring your business adheres to applicable laws and standards. They conduct thorough risk assessments, develop mitigation strategies, and establish internal controls to safeguard your assets.

This approach minimizes potential liabilities and promotes a culture of compliance within your organization. By leveraging the expertise of the NOW CFO, your business can strengthen its risk management framework.

Learn More: How a Fractional CFO Can Enhance Financial Efficiency and Risk Management

Industry-Specific Experience and Strategic Financial Insights

Industry knowledge enhances the relevance and effectiveness of financial strategies. NOW CFO’s team possesses diverse experience across various sectors, enabling them to provide insights tailored to your industry’s challenges and opportunities.

Our expertise allows us to develop strategic financial plans considering market trends, competitive landscapes, and regulatory environments. By leveraging industry-specific knowledge, NOW CFO helps position your business for sustained growth and competitiveness.

Additional Considerations When Evaluating Fractional CFO Services

Furthermore, critical considerations for a fractional CFO must be made to ensure they align with your organization’s long-term objectives.

Assessing Long-Term Value vs. Short-Term Needs

Engaging fractional CFO services can address immediate financial challenges, such as cash flow management or financial reporting. However, evaluating how these services contribute to your organization’s enduring growth and stability is crucial.

For instance, while a fractional CFO can implement immediate cost-saving measures, consider their capacity to develop long-term financial strategies that support scalability and profitability.

Comparing Fractional CFO Services with Full-Time CFO Roles

Understanding the distinctions between fractional CFO services and full-time CFO positions is vital. A full-time CFO offers dedicated daily involvement in your company’s financial operations, providing continuous oversight and immediate decision-making capabilities.

Conversely, a fractional CFO engages on a part-time basis, offering strategic insights without the commitment of a full-time salary. This arrangement can be cost-effective for companies that do not require constant financial oversight.

However, it’s essential to recognize that a fractional CFO may not be present for all daily decisions, which could impact responsiveness in fast-paced environments.

Evaluating the Scalability of the CFO Service

As your business evolves, so do its financial management needs. Assess whether the fractional CFO services can scale accordingly. For example, a flexible engagement model service can adapt to your company’s growth phases.

This flexibility ensures that the financial leadership scales in tandem with your business, providing consistent support without necessitating a full-time hire prematurely.

Learn More: Fractional CFO vs Fractional Controller

Understanding Contractual Terms and Engagement Flexibility

Clear comprehension of the contractual terms governing fractional CFO services is imperative. Key considerations include:

- Duration: Is the engagement short-term, long-term, or open-ended?

- Termination Clauses: What notice is required to alter or end the agreement?

- Scope of Work: Are the responsibilities and deliverables explicitly defined?

Engagement flexibility is also crucial. The ability to adjust the level of service based on evolving business needs ensures that you receive appropriate support without being locked into rigid arrangements.

Ensuring Cultural and Operational Alignment with Your Organization

The effectiveness of fractional CFO services is significantly influenced by how well they integrate with your company’s culture and operations. A fractional CFO should possess the requisite financial expertise and resonate with your organization’s values, communication styles, and decision-making processes.

This alignment fosters seamless collaboration, ensuring that financial strategies are implemented effectively and harmoniously within your team dynamics.

How NOW CFO’s Evaluation Framework Simplifies the Selection Process

Navigating the selection of fractional CFO services can be complex. NOW CFO streamlines this process through a comprehensive fractional CFO evaluation criteria framework that aligns with your business needs.

- Needs Assessment: Conducting an in-depth analysis of your company’s financial health and identifying areas requiring attention.

- Customized Matching: Pairing your business with a fractional CFO whose expertise and experience align with your industry and financial challenges.

- Flexible Engagements: Offering adaptable service models that can evolve with your business, ensuring scalability and continuity.

Conclusion: Questions For Fractional CFO Services

Selecting the right part-time CFO services is pivotal to ensuring a partnership that aligns with your business objectives and drives financial success. By posing these ten crucial questions for fractional CFO services in this guide, you equip your organization with insights to make informed decisions.

At NOW CFO, we are committed to providing tailored, scalable CFO solutions that address your unique challenges. Schedule a free consultation with our team today to explore how to choose a fractional CFO for your company’s growth.