The Guide To Mergers and Acquisitions

Guide To Mergers and Acquisitions

This year has proved to be momentous for merger and acquisition (M&A) prices, with more than $10 billion in big company mergers announced in the first few months of 2021. With acquisitions like Microsoft purchasing Kinvolk and Nuance for $19.7B, the market is growing more prone to goliath companies. Technology acquisitions have sped up dramatically. There has been about 258 global SPAC IPOs since March, surpassing the full-year annual record during 2020.

In the face of the digital revolution, mergers and acquisitions are still a strategy used by companies to grow or maintain their market share, sharpen business focus, decrease supply pricing, and eliminate competition. As a company changes focus and moves beyond the start-up phase, the owner should consider the benefits of selling their business. The primary goal is to secure an opportunity for growth or provide an area of expansion.

Effectively navigating through these transactions requires heavy negotiation that can pose unique challenges. Buyers and sellers often see each other as being seated at opposites ends of the table, which can lead negotiations awry because of issues such as:

- Inaccurate Data and Valuation Mistakes

- Integration Obstacles

- Resource Limitations

- Unexpected Economic Factors

- Lack of Planning and Strategy

To successfully navigate the sale of a company, it is helpful to understand the dynamics of all M&A activity. Below is a guide to help business owners determine whether a merger or acquisition is right for their company’s growth.

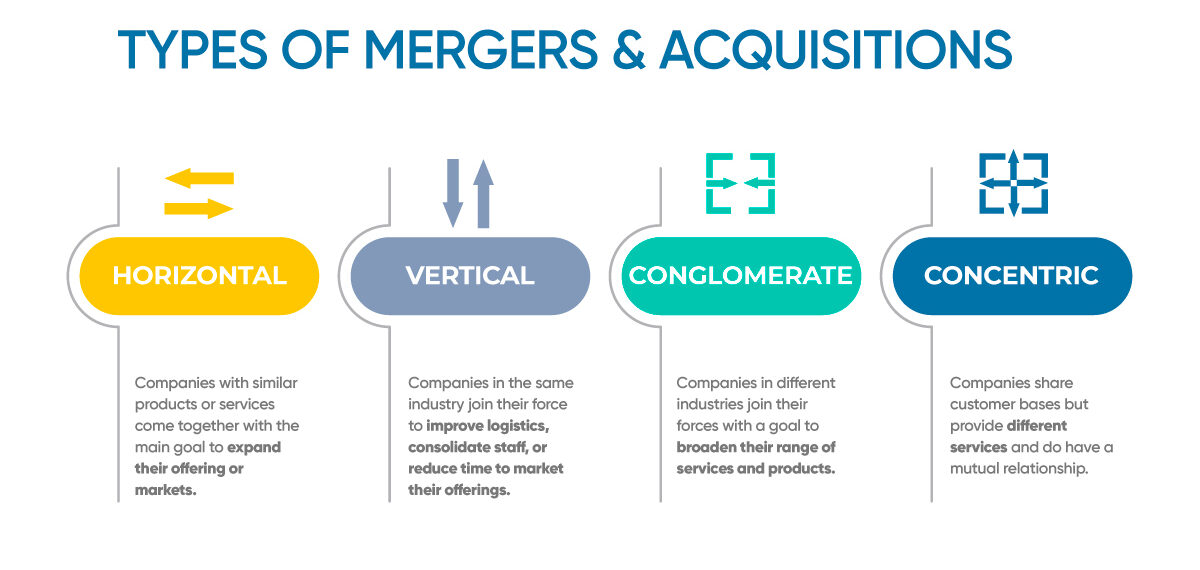

Types of Mergers and Acquisitions

Stock Acquisitions are one of the most common ways companies merge with other entities and is also the technical term for a “hostile takeover.” The majority stock in Company A has been purchased by another company or individual, with or without the cooperation from the business owner. With the majority stock belonging to Company B, the authority to make changes and control operational functions within Company A now belongs to the new owner.

Vertical Mergers happen when two companies occupy the same industry, but one feeds directly into the others production line. A clothing line purchasing a cloth manufacturer would be an example of a vertical merger. The clothing line would then be able to ensure their supply and prevent another company from causing a disruption. The clothing line would also reduce their cost of goods because the cost of materials is within their control.

Horizontal mergers work similarly to vertical mergers, but the two companies occupy the same industry and are often competitors. This type of alliance is done to beat the competition within the market and to streamline production. Exxon and Mobil merged horizontally to beat out other competitors in the oil and gas industry by combining their resources.

Conglomerates form when two companies in separate industries join to diversify their products and spread quickly into other sectors. The combined companies can control multiple markets – creating a safety net if one product area struggles. Berkshire Hathaway Inc. spans several industries, including insurance, healthcare, foodservice, and many more, and has used mergers to become one of the largest conglomerates in the world.

A Concentric Merger requires two companies in a similar, but not identical industries. This kind of alliance is beneficial when the two companies have similar production needs or distribution channels, such as a car company purchasing a tire company. The production of these two products has an overlap that allows them to streamline their process.

An Asset Purchase is used by companies who want specific assets from another company but not their current liabilities or the entirety of the business. Consider a situation where Company A has an excellent product and a productive sales team, but the production line and management were inefficient and held too many liabilities. Company B would want to purchase the rights to the product, the company name, and the sales department, but wouldn’t take on the company’s debts because it outweighs any potential profit. In this instance, Company A would most likely end up disbanding. The liability would remain with the owner, but the profitable sectors would belong to Company B.

What is an Acquisition or Sale?

Finally, the most common transaction a business owner might consider is an Acquisition or Sale as an easy way to exit their company. Once a sale is complete, the company’s original owner has the option to remain a partial stockholder but isn’t part of the business’s operational functions. An acquisition can be an owner’s way of passing their business on to their children, or a transition into retirement.

While all these varieties of mergers and acquisitions are a viable option for most companies in an economic sense, they might not be culturally compatible. Most smaller companies’ mergers are often impractical, fundraising through partial stock acquisition is a much better option. Other companies might find the acquisition of another company will help them streamline production and make them stronger competitors in their market. Successful transactions require careful thought and due diligence, having someone with years of experience on your side can help with making the right decision.

How We Can Help

Mergers and Acquisitions are complex, and companies often spend months working through negotiations and doing their due diligence. We can help you learn more about this process and guide you through so that you can make the best decision for your company.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: The Complete Guide to SPACs, IPOs, and Reverse Mergers