How Do You Reconcile a Bank Statement?

In order to complete a bank reconciliation, the account balance as reported by the bank is compared to the general ledger of a business.

If the balances do not match, the business must identify the reasons behind this and reconcile the differences. This is to ensure that every item is accounted for and the balances match. A reconciliation statement will be prepared. It is important to note that the dates need to match and to use the ending bank balance. Attention to detail is key.

What is Cash VS. Accrual Accounting?

You only need to reconcile bank statements if you use the accrual method of accounting. If, on the other hand, you use cash basis accounting, then you record every transaction at the same time the bank does; there should be no discrepancy between your books and your bank statement.

- Cash-basis accounting recognizes revenues when cash is received and expenses when they are paid. This method does not recognize accounts receivable or accounts payable. Many small businesses opt to use cash-basis because it is simpler to maintain. It is easy to determine when a transaction has occurred, since it is a matter of looking whether the money is in or out of the bank.

Accrual accounting:

- Accrual accounting is a method in which revenues and expenses are recorded when they are earned, regardless of when the money is received or paid. For example, an accountant would record revenue when a project is complete, rather than when the business gets paid a month later. The upside of accrual-basis is that it paints a more realistic picture of income and expenses during a given period, therefore providing a long-term picture of the business that cash accounting can’t provide.

How Does It Work?

1. Compare the Deposits

The deposits must match the business records in the bank statement. The amounts in each deposit recorded should be compared in the debit side of the bank column of the cashbook, with the credit side of the bank statement and credit side of the bank column.

2. Adjust the Bank Statements

The bank statements may need to be adjusted to the corrected balance. You must add deposits in transit, deduct outstanding checks and add or deduct any bank errors. These instances can happen when checks or other things are written in the last few days of the month.

A deposit in transit is money that has been received by a company and recorded in the company’s accounting system. The cash accounts general ledger should be compared to the bank statement to spot any errors.

3. Adjust the Cash Account

By adding interest or deducting monthly charges and overdraft fees, you can adjust the cash balances in the business account. Businesses need to take bank charges, NSF checks and errors into account.

Bank charges are services charges and feeds deducted for the banks processing of the business checking account. It can be charges from overdrawing your account, and if they have earned any interest on your bank account balance, they must be added to the cash account.

An NSF (not sufficient funds) is a check that has not been honored by the bank due to insufficient funds in the organizations bank accounts. Errors in a cash account result in an incorrect amount being entered o or an amount being omitted from the records which could increase or decrease the cash account in the books.

4. Compare the Balances

After adjusting the balances as per the bank and books, the adjusted amounts should be the same. If they are not, then you will have to repeat the reconciliation process again. Once they are equal, business will prepare journal entries for the adjustments to the balance per books.

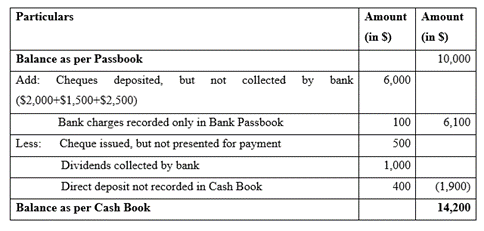

Below is an example of a bank reconciliation:

How Do We Do it?

Reconcile All Bank Accounts

Within the transactions, the Consultant will take any transactions that do not fall within a general category to the business owner and determine what type of expense/income it is. This helps to understand anomalies or outliers.

Figure Out The Exceptions

Once accounts are reconciled, the Consultant can then go in and create cash-basis reports retroactively for the months needed. This can include an income statement, balance sheet, P&L, etc.

Create Cash-Basis Reports

Once the business is caught up on their cash-basis reporting, they can consider implementing Generally Accepted Accounting Principles (GAAP), which means moving towards accounting on an accrual basis.

Consider GAAP

Once the business is caught up on their cash-basis reporting, they can consider implementing Generally Accepted Accounting Principles (GAAP), which means moving towards accounting on an accrual basis.

NOW CFO strategy and analysis level resources have extensive experience with bank reconciliations. Our high-level accountants can assist in the execution of your reconciliation or catch-up. Under any structure, our consultants bring our mission of your continued success and growth to your project and will be sure that your financials are clean, accurate and timely.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, Inventory Management and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Guide to Bank Reconciliations and Catch-Ups