The 8 Steps of the Accounting Cycle

What Is The 8 Steps Of The Accounting Cycle?

Besides the obvious accounting systems and proper bookkeeping, the accounting cycle is what makes a business go round by organizing their accounting processes to make them more efficient and robust. The accounting cycle is a workflow that formalizes the process of recording, classifying, and summarizing a business’ financial transactions over a fiscal year.

The accounting team will follow each of the steps of the accounting cycle throughout the year at different points, instead of doing all the tasks at once. This will ensure less stress across the team and better accuracy since transactions will be less likely to be forgotten or recorded.

The accounting cycle process will depend on if a bookkeeper is using single-entry or double-entry bookkeeping systems.

Single entry

A single-entry bookkeeping system is used by small business’ who use cash-basis accounting and focus on incoming and outgoing cash flow. There is typically a low volume of activity and is like a personal checkbook. Transactions are recorded such as cash, tax-deductible expenses, and taxable income.

Double entry

Majority of business’ use double-entry bookkeeping for their accounting needs. Double entry is the basis for accrual accounting, which can be more complicated. A characteristic of double-entry bookkeeping is that each account has two columns, and each transaction is in two accounts, thus two entries are made for each transaction-a debit one accounting and a credit in the other.

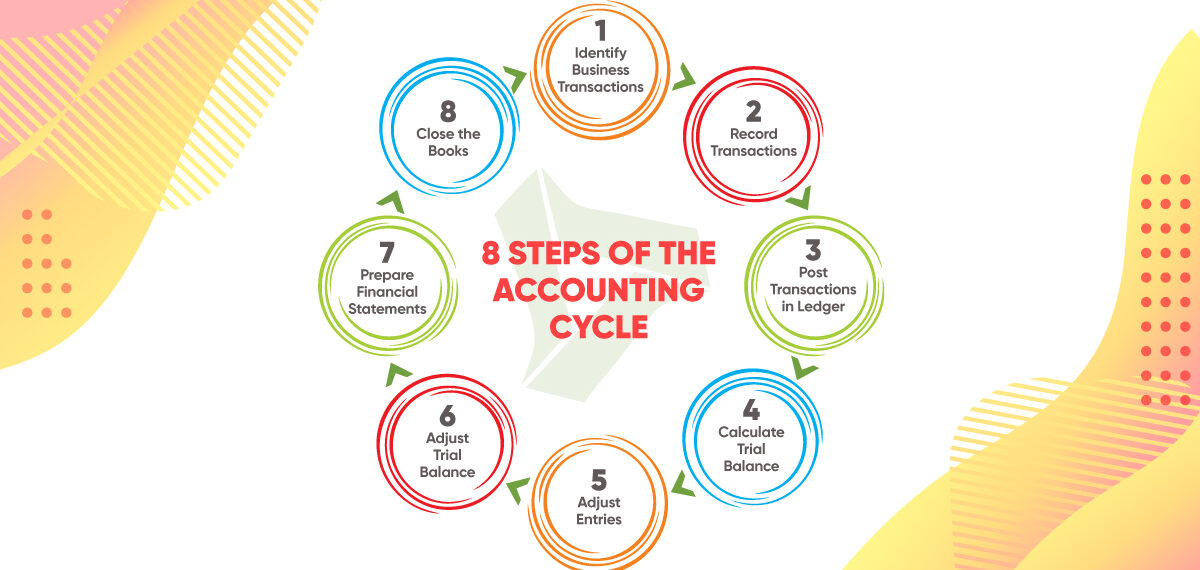

The 8 Steps of the Accounting Cycle

-

Identify Business Transactions

It is important to only include transactions that are directly related to the company’s financial activities. These are things such as expenses, purchases, revenue, and debt payoff.

-

Record transactions in the journal

After business’ transactions have been identified, it should be recorded somewhere, sometimes called a book of original entry.

-

Post transactions to the general ledger

After recording the transaction in a journal, the transaction is recorded in the general ledger. This is often times called the book of final entry. The general ledger, which is a commonsense term in the accounting world. The entries in the general ledger are changes made to each of your accounts, and transactions are posted to the account impacted. It is now highly unlikely that companies are not using software that serves as the general ledger. This part of the accounting cycle is not necessary for business’ using a single-entry account system since there is only one account being handled. The journal or cash book will serve as a general ledger.

-

Calculate the trial balance

What exactly is a trial balance? The trial balance is known as list of all the general ledger accounts in the ledger of a business. It will contain the name of each nominal ledger account and the value of that ledger balance. It will hold either a debit balance, or a credit balance. The trial balance is calculated at the end of an accounting period, which depending on the business, is a month, quarter, or a year. It is essentially a test of accuracy to check that the credit and debit entries match. To calculate the trial balance, all debit and credit balances are added together. If they are not equal, there must an error somewhere.

-

Adjust entries

An outsourced accountant will have to account for accruals and deferrals in the records.

-

Adjust trial balance/worksheet

If the total debit and credit totals on a trial balance are unequal, the bookkeeper or staff accountant will have to adjust the entries and determine where the errors came from as long as the trial balance is checked and fixed, it does not matter when it is done.

-

Prepare financial statements

The financial statements will be put together by the finance department after all entries have been adjusted and the trial balance is calculated. These statements include income and cash flow statements, and balance sheets.

-

Close the books

The last step in the accounting cycle is closing the business’ books and financial activity for that accounting period. Revenue and expense accounts are zeroed and closed out The only account that remains unclosed is the balance sheet. This is the time to start setting up for the upcoming accounting period.

Why is the Accounting Cycle Important?

-

Compliance

The accounting cycle is necessary to ensure that the business stays compliant with government regulations and tax codes. Since the government requires companies of all sizes to disclose their financial results and pay taxes on their profits, it is crucial that the financials are accurate and timely to avoid fines and audits.

-

Efficiency

If followed properly, the accounting cycle allows for the finance department to have a clear roadmap to follow when recording information. Processes will be streamlined and there is less room for errors.

-

Time Management

The accounting cycle allows accountants to better manage their time because there is a set process in place. This allows the team to set realistic goals to complete each step and have a timeline to follow.

-

Internal Analysis

The reports that will come from the end of the accounting cycle will create immense insight into the business’ performance and financial well-being. This will in return help the business decide which processes and systems need to be optimized.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: The Responsibilities of an Accounting Manager