Cash flow optimization is the foundation of a resilient financial engine, ensuring companies can meet obligations, seize growth opportunities, and weather unexpected shocks. By fine-tuning the timing of receipts and disbursements, businesses maintain healthy working capital and reduce reliance on external financing.

An outsourced CFO brings structured liquidity management and advanced cash flow forecasting to transform raw data into strategic action. When 69 percent of small businesses report variability in monthly cash balances, unpredictable cycles can disrupt payroll, supplier relationships, and investment plans.

What is Cash Flow Optimization and Why is it Important?

Effective cash flow optimization underpins every aspect of a company’s financial strategy. By ensuring income and expenses align, businesses maintain liquidity management, working capital optimization, and fund growth opportunities.

Defining Cash Flow Optimization

Cash flow optimization involves strategically managing the inflow and outflow of cash to maximize a company’s ability to meet obligations, invest in growth, and weather financial storms. It starts with accurate tracking of receipts and disbursements, empowering leaders to allocate resources efficiently.

Optimized cash flow reduces reliance on high-cost financing, such as emergency lines of credit, and strengthens the balance sheet. Only 54 percent of small business owners report a good understanding of financial management before starting a business.

An outsourced CFO applies best practices to refine cash flow cycles. Through continuous monitoring, they spot potential shortfalls early and adjust tactics, safeguarding the business against liquidity crises.

The Role of Cash Flow Management in Financial Health

Building on a solid definition, cash flow management translates data into decisions that sustain operations and fund strategic initiatives. By regularly reviewing cash positions, leadership makes informed choices about investments, hiring, and debt repayment. Effective management balances short-term needs with long-term ambitions, reducing reliance on external funding.

Key benefits include:

- Enhanced Liquidity: Ensures bills, payroll, and suppliers are paid on time.

- Risk Mitigation: Identifies cash gaps before they impact solvency.

- Strategic Flexibility: Frees capital for marketing, R&D, or expansion projects.

- Stronger Credit Profile: Maintains healthy working capital, improving loan terms and vendor relationships.

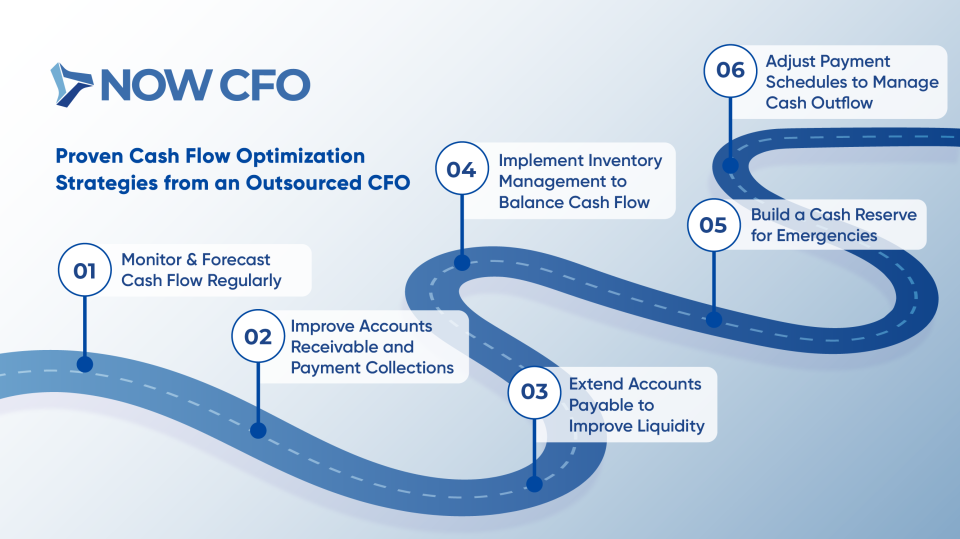

Proven Cash Flow Optimization Strategies from an Outsourced CFO

An outsourced CFO brings discipline and expertise to cash flow optimization, translating financial data into actionable strategies. Below are some core tactics they employ to strengthen liquidity management.

1. Monitor and Forecast Cash Flow Regularly

An outsourced CFO establishes a rolling forecast framework, updating cash projections weekly and monthly. By reconciling actuals against forecasts, they spot variances early and recalibrate assumptions. This continuous cycle sharpens decision-making, ensuring the company has timely insights to address shortfalls or capitalize on surplus cash.

They integrate drivers: such as sales pipelines and expense commitments, into dynamic models, enabling scenario analysis. Through centralized dashboards, leadership views real-time liquidity metrics, improving both operational agility and strategic planning.

2. Improve Accounts Receivable and Payment Collections

Optimizing accounts receivable accelerates cash inflows, and outsourced CFO conditions clients on faster payment cycles. They implement clear payment terms, incentivize early settlements with discounts, and enforce late-fee policies for overdue invoices.

By deploying automated invoicing and reminders, they reduce human error and administrative delays. Detailed aging reports highlight delinquent accounts, prompting targeted follow-up. In parallel, they negotiate installment plans for large customers, balancing relationship preservation with timely collections.

3. Extend Accounts Payable to Improve Liquidity

Leveraging accounts payable effectively preserves cash longer. An outsourced CFO negotiates extended terms, such as NET 60 instead of NET 30, with key vendors, aligning outflows with receivable timing.

They prioritize payables by cost of capital: slowing payments to low-risk suppliers while honoring critical ones that offer early-payment discounts. Electronic payment platforms automate scheduling, minimizing late fees and manual errors. By staggering disbursements, they maintain operational continuity without straining cash reserves.

4. Implement Inventory Management to Balance Cash Flow

Balancing stock levels is crucial for cash flow optimization. An outsourced CFO collaborates with operations to refine inventory management, reducing excess carrying costs and freeing up liquid capital.

Key actions include:

- ABC Analysis: Classify items by value and turnover, focusing on high-impact SKUs.

- Just-In-Time (JIT): Schedule deliveries to match production or sales cycles.

- Safety Stock Calibration: Maintain minimal buffers based on lead-time variability.

- Vendor-Managed Inventory (VMI): Shift reorder responsibilities to suppliers for select lines.

5. Build A Cash Reserve for Emergencies

A robust cash reserve safeguards against unexpected downturns. An outsourced CFO advises setting aside a target buffer; often three to six months of operating expenses.

They structure automated transfers to this reserve from operating accounts, ensuring consistency. Periodic stress tests simulate scenarios (e.g., revenue dips, cost spikes) to validate reserve adequacy. Maintaining this emergency fund enhances financial stability and growth, reducing dependency on high-cost credit during crises.

6. Adjust Payment Schedules to Manage Cash Outflow

Fine-tuning outgoing payments smooths cash trajectories. An outsourced CFO aligns payroll, rent, and vendor disbursements with projected inflows, often shifting non-critical payments toward later cycles.

They leverage ACH and virtual card payments, optimizing float and capturing rebates. Seasonal adjustments: such as accelerating payables during peak revenue months and deferring during slow periods, further stabilizing liquidity. This deliberate cadence prevents cash crunches and supports ongoing business growth without external funding.

Learn More: Benefits of hiring an outsourced CFO

How an Outsourced CFO Helps Businesses Optimize Cash Flow

An outsourced CFO transforms raw financials into strategic insights that drive cash flow optimization.

Using Financial Data for Cash Flow Forecasting

An outsourced CFO harnesses detailed historical data to build rolling cash projections. They update models weekly, comparing forecasts to actuals and refining cash flow optimization assumptions. This proactive planning prevents surprises and informs spending decisions.

By integrating driver-based forecasting (e.g., linking receivables to sales pipelines), they pinpoint timing gaps and adjust strategies in real time.

Identifying Cash Flow Gaps and Managing Risks

Accurate forecasts highlight periods when outflows outstrip inflows. An outsourced CFO conducts variance analysis to spot these cash flow gaps, then prioritizes corrective actions:

- Gap Quantification: Measure shortfalls by week or month.

- Risk Assessment: Evaluate solvency risk under worst-case scenarios.

- Contingency Planning: Pre-arrange lines of credit or short-term financing.

- Expense Controls: Delay non-critical spend or renegotiate terms.

Balancing Short-Term And Long-Term Cash Flow Cycles

An outsourced CFO ensures a harmony between immediate obligations and future investments. They design a phased approach to funding operations while reserving capital for growth:

Key cycle metrics:

| Cycle Type | Focus | Time Horizon | Example Metric |

|---|---|---|---|

| Short-Term | Operational liquidity | 0–3 months | Days Cash on Hand |

| Long-Term | Strategic investments | 1+ year | Free Cash Flow Growth |

Through this tailored framework, they maintain operational flexibility without jeopardizing working capital or business growth.

Advising on Financing Options to Enhance Liquidity

When internal measures fall short, an outsourced CFO evaluates optimal funding sources. They compare:

- Bank Lines of Credit: Flexible revolvers for seasonal needs.

- Invoice Factoring: Converts receivables into immediate cash.

- Short-Term Loans: Bridges one-off timing gaps.

- Equity Infusions: Bolsters reserves without debt service.

They conduct cost-benefit analyses ensuring each option aligns with the company’s risk tolerance and financial health goals. By structuring financing strategically, they reinforce cash flow optimization and seize growth opportunities without undue leverage.

Learn More: What does an outsourced CFO do

Tips for Effective Cash Flow Planning and Forecasting

Building on strategic guidance, these tips ensure your cash flow optimization efforts translate into reliable liquidity management.

Creating Accurate Cash Flow Forecasts

Accurate forecasts start with a driver-based model that links revenue streams and expense commitments. An outsourced CFO builds detailed templates, pulling data from your ERP and accounting systems to project daily, weekly, and monthly cash positions.

They layer in seasonality, payment terms, and capital expenditures to simulate multiple scenarios. By benchmarking forecasted inflows against historical trends, they refine assumptions continuously.

Adjusting Forecasts for Seasonal Business Fluctuations

Seasonal swings can distort cash projections if unaddressed. An outsourced CFO applies historical seasonality factors to smooth out peaks and troughs. They adjust line items (e.g., payroll, inventory purchases) in line with expected revenue surges or lulls.

Advance estimates show U.S. retail and food services sales rose 4.5% from March through May 2025 compared to the same period a year ago; highlighting the importance of seasonal adjustment in forecasts.

Leveraging Financial Metrics to Guide Cash Flow Decisions

With forecasts in place, key metrics transform data into decisions. An outsourced CFO tracks:

- Days Sales Outstanding (DSO): Measures the average collection period.

- Days Payable Outstanding (DPO): Gauges your payment efficiency.

- Cash Conversion Cycle (CCC): Combines DSO, DPO, and inventory turnover to assess overall flow.

Using Cash Flow Projections to Support Business Planning

Cash projections inform more than liquidity; they underpin strategic decisions. An outsourced CFO integrates forecast outputs into budgeting, capital investment planning, and hiring strategies. They evaluate:

- New Product Launches: Impact on working capital.

- Facility Expansions: Timing of cash outflows.

- Debt Repayments: Optimal schedules aligned with forecasted inflows.

Learn More: Outsourced CFO for your Business

Common Cash Flow Pitfalls and How to Avoid Them

Recognizing and rectifying common missteps is essential for cash flow optimization. An outsourced CFO identifies these traps early, streamlining liquidity management and preserving working capital.

Overlooking Accounts Receivable Aging Reports

Ignoring detailed aging schedules prevents you from spotting overdue invoices before they strain cash. An outsourced CFO reviews AR aging weekly, categorizing receivables by age: current, 30–60 days, 61–90 days, and beyond. This visibility drives targeted collection efforts and negotiations, accelerating inflows and strengthening cash flow optimization.

Underestimating Cash Flow Needs For Business Growth

Failure to project financing gaps can stall expansion. An outsourced CFO quantifies future cash requirements by aligning planned investments with forecasted inflows. They stress-test these assumptions under conservative revenue scenarios to ensure resilience.

Key Actions:

- Calculate incremental cash needs for each growth initiative.

- Model best-, base-, and worst-case revenue scenarios.

- Incorporate buffer for unexpected costs (~10 percent of projected spend).

- Review forecast variance monthly, adjusting plans dynamically.

Failing to Account for Seasonal Cash Flow Fluctuations

Seasonal revenue shifts can mislead planning if unaddressed. An outsourced CFO overlays historical seasonality indices onto base forecast; ensuring expense schedules (e.g., inventory purchases, staffing) match expected cash availability.

Preventive Measures:

- Calculate monthly seasonality factor from past 3–5 years of sales data.

- Adjust payables and receivables timing to smooth troughs.

- Establish short-term credit arrangements for lean months.

- Reforecast cash flow at each quarter to refine seasonal assumptions.

Ignoring The Impact Of Delayed Client Payments

When clients pay late, unplanned gaps emerge. An outsourced CFO implements clear payment terms (e.g., NET 30), automated reminders, and selective late-fee policies. They monitor individual client payment patterns, flagging repeat delinquents for revised credit terms or prepayment requirements.

Benefits of Cash Flow Optimization for Business Growth

Optimizing cash flow through strategic cash flow optimization efforts yields tangible benefits that propel business growth.

Enhanced Liquidity And Financial Flexibility

By prioritizing cash flow optimization, companies unlock immediate access to working capital, reducing reliance on external credit. An outsourced CFO structures cash reserves and negotiates flexible payment terms, preserving cash for strategic use.

This enhanced liquidity management allows swift responses to opportunities—such as bulk purchasing discounts or rapid hiring, without jeopardizing day-to-day operations.

Improved Decision-Making with Clear Financial Data

Clear, real-time financial insights transform decision-making:

- Visibility: Dashboards highlight cash positions and forecast variances.

- Prioritization: Teams allocate resources to high-ROI projects.

- Scenario Analysis: “What-if” models guide risk versus reward assessments.

- Accountability: KPIs (e.g., Days Cash on Hand) track performance against targets.

Ability to Seize New Growth Opportunities

When working capital is predictable, businesses can pursue expansion—launching new products, entering markets, or acquiring competitors. An outsourced CFO uses cash flow forecasting to model funding needs and timing, securing resources before commitments arise.

With a reliable cash runway, companies can invest confidently in R&D, marketing campaigns, or capital equipment purchases that fuel business growth.

In a national survey, employer startups (those with at least one employee) enjoyed a 49% survival rate over two years; compared to just 27% for nonemployer firms, illustrating how structured financial reserves support lasting growth.

Stronger Relationships with Suppliers And Clients

Consistent cash availability enhances credibility. An outsourced CFO negotiates favorable terms with suppliers while ensuring on-time payouts. Suppliers prioritize customers who pay punctually, often granting better pricing or priority allocations.

Simultaneously, clients appreciate transparent billing and reliable service, boosting retention and referrals. By embedding cash flow optimization into vendor and customer interactions, businesses reinforce trust and secure advantageous partnerships that underpin long-term success.

How to Choose the Right Outsourced CFO for Cash Flow Optimization

Selecting an outsourced CFO who excels at cash flow optimization ensures your company gains expert liquidity management support. The right partner combines technical skills with industry insight to safeguard working capital and drive sustainable growth. Below are key criteria to evaluate candidates.

Look For Experience in Liquidity Management

When vetting candidates, prioritize professionals with a proven history of enhancing cash flow optimization through robust liquidity management. Look for credits handling cash reserves, negotiating vendor terms, and structuring short-term financing during downturns.

Their track record should include documented improvements in days cash on hand and working capital ratios.

Assess Their Expertise in Cash Flow Forecasting and Planning

A seamless transition from liquidity to forecasting underscores strategic foresight. Gauge candidates on:

- Model Complexity: Ability to build driver-based rolling forecasts.

- Scenario Analysis: Proficiency with “what-if” projections under varying receivables and payables.

- Tool Fluency: Experience with ERP-integrated forecasting software.

- Review Cadence: Process for updating forecasts weekly or monthly and reconciling variances.

Verify Their Track Record in Improving Cash Flow Stability

Building forecasting skills, proven stabilizers demonstrate sustained impact. Examine past engagements for:

- Variance Reduction: Decrease in forecast-to-actual cash discrepancies.

- Credit Lines Secured: Successful negotiation of flexible lines of credit.

- Reserve Growth: Expansion of emergency cash buffers by target percentages.

- Cost Controls Implemented: Introduction of expense-review protocols reducing monthly outflows.

Ensure Alignment with Your Business’s Financial Goals

Finally, confirm that the outsourced CFO’s approach aligns with your strategic vision. They should understand your growth targets, whether scaling headcount, entering new markets, or launching products.

Clear communication on risk tolerance, investment priorities, and reporting preferences fosters a collaborative partnership that drives both financial stability and long-term value.

Conclusion: Achieving Business Growth Through Cash Flow Optimization

A deliberate approach to cash flow optimization secures the foundation for future growth. By partnering with an outsourced CFO, you benefit from expert liquidity management, precise cash flow forecasting, and proactive scenario analysis.

Ready to fortify your financial footing and unlock agile capital for new initiatives? Schedule a complimentary strategy session to discover how professional cash flow optimization can transform your business.