Companies face increasing financial complexities that demand expert oversight. However, not all businesses can afford or require a full-time CFO. This is where outsourced CFO services come into play, offering strategic financial leadership flexibly.

Recent trends indicate a significant shift towards the outsourced CFO model. According to WSJ, over 80% of early-stage businesses in the U.S. don’t have a CFO, leaving them vulnerable to cash flow issues and missed growth opportunities. Let’s understand how to overcome common challenges when hiring an outsourced CFO.

Understanding the Need for an Outsourced CFO

As businesses grow, the demand for strategic financial leadership intensifies. According to a survey by CPA.com and Bill.com, 80% of businesses reported that outsourced accounting services gave them more time to focus on their core operations, highlighting the efficiency of outsourcing financial functions.

Many organizations, especially SMEs, find themselves at a crossroads, needing expert financial guidance without the overhead of a full-time executive. This is where the concept of an outsourced CFO becomes invaluable.

Why Businesses Turn to Outsourced CFO Services

Agility and expertise are vital in the current business scenario. Companies often face financial challenges that require seasoned professionals. Engaging an outsourced CFO allows businesses to access top-tier financial acumen tailored to their needs.

Moreover, the flexibility of outsourced arrangements means companies can scale services up or down based on current requirements, ensuring cost-effectiveness. This model is particularly beneficial for startups and growing businesses that need strategic financial oversight without the commitment of a full-time hire.

The Role of an Outsourced CFO in Modern Business

An outsourced CFO plays a multifaceted role, adapting to each organization’s unique needs. Key responsibilities include:

- Strategic Financial Planning: Developing long-term financial strategies aligned with business goals.

- Budgeting and Forecasting: Creating detailed budgets and financial forecasts to guide decision-making.

- Cash Flow Management: Monitoring and optimizing cash flow to ensure operational stability.

- Financial Reporting: Providing accurate and timely financial reports for stakeholders.

- Risk Management: Identifying financial risks and implementing mitigation strategies. In addition, risk management in CFO outsourcing includes a thorough evaluation of contracts, performance KPIs, and legal safeguards.

- Compliance Oversight: Ensuring adherence to financial regulations and standards.

- Investor Relations: Communicating financial performance and strategies to investors.

Key Benefits of Hiring an Outsourced CFO

Engaging an outsourced CFO offers several advantages:

- Cost Efficiency: Access to high-level financial expertise without the expense of a full-time executive.

- Flexibility: Services can be tailored and scaled according to business needs.

- Objective Perspective: An external CFO brings unbiased insights, aiding in impartial decision-making.

- Access to Expertise: Benefit from a professional with diverse industry experience and knowledge.

- Enhanced Financial Strategy: Improved financial planning and analysis capabilities.

- Time Savings: Allows business owners to focus on core operations while financial matters are expertly managed.

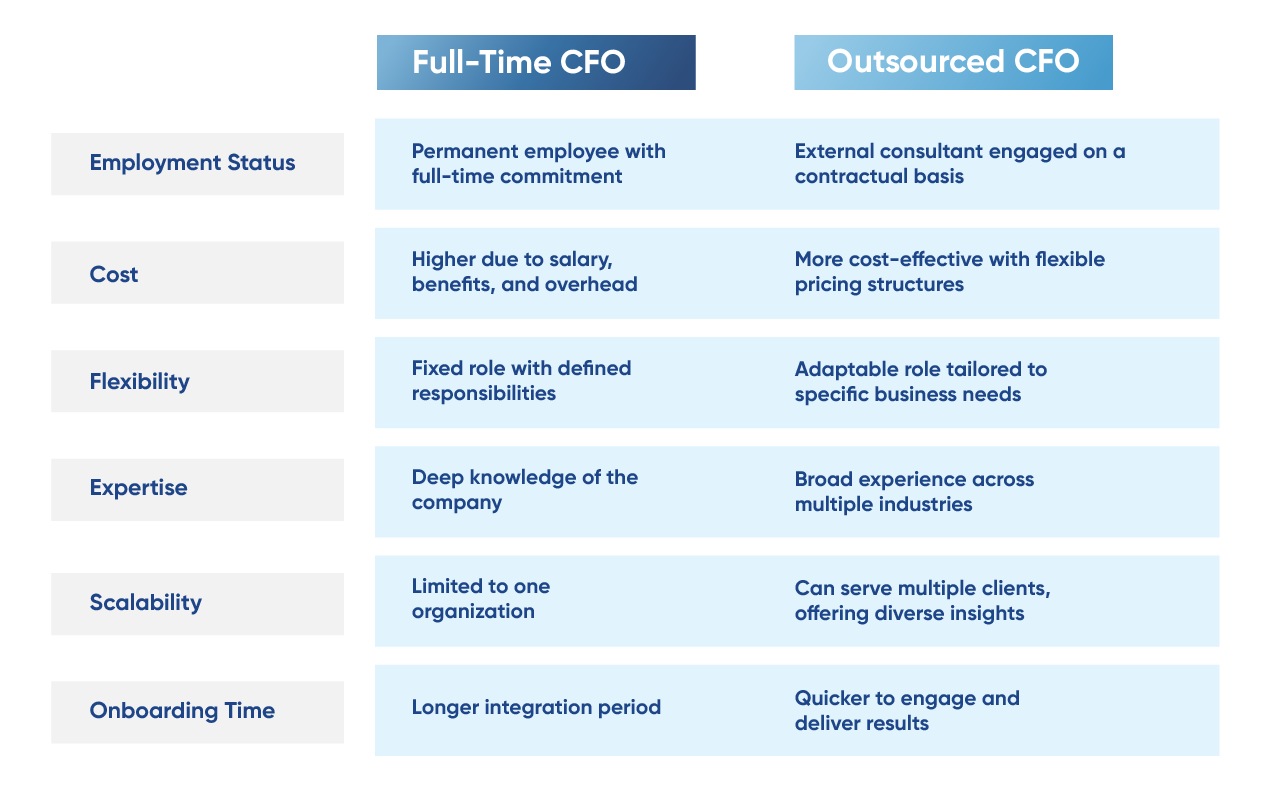

The Difference Between a Full-Time CFO and an Outsourced CFO

The table below compares key aspects of a full-time CFO and an outsourced CFO to understand the practical differences better.

When to Consider Outsourcing CFO Functions

Businesses should contemplate engaging an outsourced CFO under several circumstances. Rapid growth phases often demand sophisticated financial oversight that internal teams are not ready to handle.

Similarly, the expertise of an external CFO can be invaluable during periods of financial restructuring or when preparing for investment rounds. Additionally, startups and SMEs that cannot justify the cost of a full-time CFO can still benefit from high-level financial guidance through outsourcing.

The Common Challenges When Hiring an Outsourced CFO

Engaging an outsourced CFO offers numerous advantages, yet the process has hurdles. Understanding outsourced CFO hiring challenges is crucial for businesses aiming to make informed decisions and maximize the benefits of outsourcing financial leadership.

Businesses can avoid costly setbacks by being aware of the common mistakes when hiring a CFO, such as neglecting to clarify expectations or underestimating cultural misalignment.

Finding a CFO with the Right Industry Experience

Identifying an outsourced CFO who possesses relevant industry experience is a significant challenge. Each industry has unique financial dynamics, regulatory requirements, and market conditions.

A CFO with specific industry knowledge can provide tailored insights and strategies that align with the company’s goals. Without this expertise, businesses face a steep learning curve, leading to potential missteps in financial planning and execution.

Ensuring Clear Communication and Collaboration

Effective communication is the backbone of any successful partnership, which is true when working with an outsourced CFO. Outsourced CFO hiring challenges often arise due to differences in time zones, communication styles, and expectations.

Establishing clear communication channels and setting regular check-ins can mitigate misunderstandings and ensure that both parties are aligned. Additionally, leveraging collaborative tools and platforms can facilitate seamless interaction and information sharing.

Managing Expectations and Deliverables

To effectively manage expectations and deliverables when hiring an outsourced CFO, consider the following:

- Define Clear Objectives: Establish specific goals and outcomes expected from the CFO’s engagement.

- Set Realistic Timelines: Agree on achievable deadlines for deliverables to ensure timely execution.

- Regular Progress Reviews: Schedule periodic evaluations to assess performance and address any concerns promptly.

- Document Agreements: Maintain written records of responsibilities, expectations, and deliverables to avoid ambiguities.

- Feedback Mechanisms: Implement channels for continuous feedback to foster improvement and alignment.

Understanding Cost Structures and Pricing Models

Outsourced CFO services’ cost structures and pricing models can be complex. It’s essential to comprehend the various components that contribute to the overall cost:

- Hourly Rates vs. Fixed Fees: Determine whether the CFO charges or offers a fixed service fee by the hour.

- Scope of Services: Understand what services are included in the pricing and any additional costs for extra services.

- Contract Duration: Long-term contracts offer cost savings but require a longer commitment.

- Performance-Based Fees: Some CFOs offer pricing models tied to performance metrics or outcomes.

- Hidden Costs: Be vigilant about potential hidden costs, such as travel expenses or software subscriptions.

Aligning Strategic Goals with Financial Leadership

Integrating a solid financial strategy and outsourced CFO services enables leadership teams to base every major decision on real-time data and strategic foresight. This alignment ensures financial strategies support overarching business goals, facilitating growth and stability.

Challenges arise if the CFO lacks a comprehensive understanding of the company’s vision, leading to misaligned priorities. Regular strategic planning sessions and open communication can bridge this gap, ensuring that the CFO’s financial guidance propels the company towards its desired outcomes.

How to Successfully Integrate an Outsourced CFO

Integrating an outsourced CFO into your organization requires a strategic approach to ensure alignment with your company’s goals and culture. This process involves clear communication, defined roles, and the effective use of technology to facilitate collaboration.

Setting Clear Roles and Responsibilities

To establish a productive relationship with an outsourced CFO, it’s essential to:

- Define Scope of Work: Clearly outline the CFO’s responsibilities, including financial planning, reporting, and strategy development.

- Establish Decision-Making Authority: Determine the CFO’s level of authority in financial decisions to avoid confusion.

- Set Performance Metrics: Identify key performance indicators (KPIs) to measure the CFO’s effectiveness.

- Clarify Reporting Structure: Specify who the CFO reports to and how often updates are expected.

- Document Expectations: Create a written agreement detailing all roles and responsibilities to ensure mutual understanding.

Establishing Effective Communication Channels

Effective communication is crucial for the success of an outsourced CFO partnership. To facilitate this:

- Regular Meetings: Schedule consistent meetings to discuss financial performance and strategic initiatives.

- Use Collaborative Tools: Implement platforms like Slack or Microsoft Teams for real-time communication.

- Shared Document Access: Utilize cloud-based services such as Google Drive for easy access to financial documents.

- Feedback Mechanisms: Establish channels for continuously providing and receiving feedback to improve collaboration.

Aligning Business Strategy with Financial Insights

An outsourced CFO is pivotal in aligning financial management with business strategy. The CFO can provide insights that inform strategic decisions, such as market expansion or cost optimization, by analyzing financial data. This alignment ensures financial planning supports the company’s long-term goals and enhances overall performance.

Leveraging Technology for Seamless Collaboration

Technology facilitates efficient collaboration with an outsourced CFO. Key tools include:

- Cloud Accounting Software: Platforms like QuickBooks Online allow real-time access to financial data.

- Project Management Tools: Applications such as Asana or Trello help track financial projects and deadlines.

- Secure File Sharing: Services like Dropbox Business ensure safe and organized document exchange.

- Video Conferencing: Tools like Zoom facilitate face-to-face meetings, fostering better communication.

Monitoring Performance and Key Financial Metrics

Regular monitoring of financial performance is essential when working with an outsourced CFO. Focus areas include:

- Budget Adherence: Tracking actual spending against budgeted figures to identify variances.

- Cash Flow Analysis: Assessing the timing and amounts of cash inflows and outflows.

- Profitability Metrics: Evaluating gross and net profit margins to gauge financial health.

- ROI: Measuring the effectiveness of investments and strategic initiatives.

How NOW CFO Helps Overcome Common Challenges When Hiring an Outsourced CFO

At NOW CFO, we understand that hiring an outsourced CFO comes with its own set of challenges. That’s why we’ve developed comprehensive solutions to address common challenges when hiring an outsourced CFO, ensuring seamless integration.

Tailored CFO Solutions for Different Business Needs

Recognizing that every business has unique financial requirements, we offer customized CFO services to align with your goals. Our approach includes:

- Fractional Engagements: Providing part-time CFO services for businesses that need strategic financial oversight without the commitment of a full-time executive.

- Project-Based Support: Assisting with specific financial projects such as mergers, acquisitions, or system implementations.

- Interim Leadership: Stepping in during transitional periods to maintain financial stability and continuity.

Experienced CFOs with Industry-Specific Expertise

Our team comprises seasoned CFOs with extensive experience across various industries, including technology, healthcare, manufacturing, and non-profit. We take pride in thoroughly evaluating CFO experience and expertise before assigning any consultant.

This industry-specific knowledge allows us to:

- Provide Relevant Insights: Understanding the nuances of your industry enables us to offer tailored financial strategies.

- Ensure Compliance: Staying abreast of industry regulations to keep your business compliant.

- Drive Growth: Leveraging industry trends to identify opportunities for expansion and profitability.

Transparent Pricing and Scalable Engagement Models

We openly address CFO outsourcing risks and solutions, ensuring our clients are informed and empowered to make strategic decisions that minimize uncertainty.

We believe in clarity and flexibility when it comes to pricing. Our models include:

- Hourly Rates: Ideal for short-term projects or consultations.

- Monthly Retainers: Providing ongoing support with predictable costs.

- Project-Based Fees: Tailored pricing for specific initiatives.

Hands-On Support and Personalized Financial Guidance

Our commitment goes beyond numbers; we immerse ourselves in your business to provide:

- Strategic Planning: Collaborating on long-term financial goals and roadmaps.

- Operational Support: Assisting with day-to-day financial operations to ensure efficiency.

- Decision-Making Assistance: Offering insights and analysis to inform critical business decisions.

Our hands-on approach is key in overcoming financial leadership gaps, especially for organizations in transition or restructuring phases.

Key Considerations Before Hiring an Outsourced CFO

Engaging an outsourced CFO can be transformative for your business. It offers strategic financial leadership without the overhead of a full-time executive.

However, evaluating several key factors is crucial before maximizing the benefits and mitigating potential risks.

Assess Your Business’s Financial Needs

Before seeking an outsourced CFO, assess your company’s current finances. Further, determine whether you require cash flow management, budgeting, financial forecasting, or strategic planning assistance.

For instance, if your business is experiencing rapid growth, you need a CFO skilled in scaling operations and securing funding. Conversely, a CFO with turnaround experience would be more appropriate if you’re facing financial challenges.

Choosing the Right Level of CFO Engagement

Determining the appropriate level of engagement with an outsourced CFO depends on your business’s size, complexity, and financial goals. Options include:

- Fractional CFO: Ideal for small businesses needing strategic guidance without a full-time commitment.

- Project-Based CFO: Suitable for specific initiatives like mergers, acquisitions, or system implementations.

- Interim CFO: This is best for transitional periods, such as searching for a permanent CFO.

Learn More: Outsourced CFO Vs Fractional CFO

We also offer virtual CFO services, enabling flexible support for companies that need remote financial leadership without geographical limitations.

Assessing the Track Record and Reputation of a CFO Provider

Understanding how to find the right outsourced CFO involves vetting credentials, assessing cultural fit, and aligning expertise. When evaluating potential outsourced CFO providers, consider the following:

- Client Testimonials: Seek feedback from current or past clients to gauge satisfaction and performance.

- Industry Experience: Ensure the provider has experience in your specific industry to understand unique challenges and regulations.

- Certifications and Credentials: Verify professional qualifications, such as CPA or CMA designations.

- Case Studies: Review documented successes in similar business scenarios.

- References: Request and contact references to validate the provider’s reliability and effectiveness.

Thoroughly, vetting providers helps mitigate common challenges when hiring an outsourced CFO.

Ensuring Compatibility with Your Company Culture

Cultural alignment between your business and the outsourced CFO is vital for a harmonious working relationship. Consider:

- Communication Style: Does the CFO’s approach align with your team’s preferences?

- Decision-Making Process: Is their decision-making collaborative or authoritative, and does this fit your organizational style?

- Adaptability: Can the CFO adjust to your company’s pace and work environment?

- Values Alignment: Do their professional values resonate with your company’s mission and ethics?

Making a Smooth Transition to an Outsourced CFO

Successful CFO transition planning includes onboarding procedures, knowledge transfer, system integration, and cultural alignment protocols.

Some steps you can take are:

- Begin by clearly defining the CFO’s role, responsibilities, and objectives.

- Establish communication protocols and integrate them into your existing financial system.

- Provide access to necessary data and resources to enable informed decision-making.

- Additionally, key stakeholders should be involved in onboarding to facilitate acceptance and cooperation.

- Regularly review performance and provide feedback to ensure alignment with your business goals.

A structured transition plan enhances the effectiveness of the outsourced CFO and supports your company’s financial health.

Conclusion: Common Challenges When Hiring an Outsourced CFO

Engaging an outsourced CFO offers a cost-effective solution, providing expert financial guidance tailored to your company’s needs. Businesses can harness the full potential of outsourced CFO services by addressing common challenges and implementing strategic solutions.

At NOW CFO, we deliver customized financial strategies that drive growth and stability. Our team of experienced professionals is dedicated to helping you counter common challenges when hiring an outsourced CFO.

Ready to elevate your financial strategy? Schedule a free consultation with our experts today and discover how NOW CFO can support your business’s success.