Financial Ratios for Better Business Decisions

What is Financial Ratios?

Financial ratios are crucial tools that provide insights into a company’s operational effectiveness, financial health, and market performance. These metrics help managers, investors, and analysts make informed business decisions by quantifying aspects of a company’s performance into simple numbers. Understanding and applying financial ratios can reveal strengths and weaknesses in a company’s strategy and operations, guiding strategic decisions that enhance profitability and sustainability.

Liquidity Ratios

Liquidity ratios are essential indicators determining a company’s ability to meet its short-term financial obligations. These ratios provide a snapshot of financial health in the near term, ensuring businesses can access enough liquid assets to cover their liabilities. Effective liquidity management is critical for maintaining smooth operations and safeguarding against financial crises.

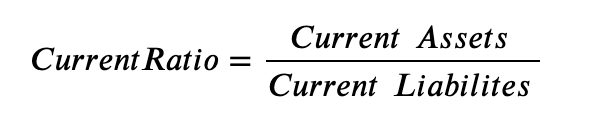

1. Current Ratio: This ratio, calculated by dividing current assets by current liabilities, is a fundamental measure of liquidity. A current ratio greater than 1 means the company has sufficient assets to fulfill its short-term obligations, which is crucial for operational continuity and financial stability. Consistently high current ratios indicate prudent financial management and a buffer against unexpected expenses or downturns.

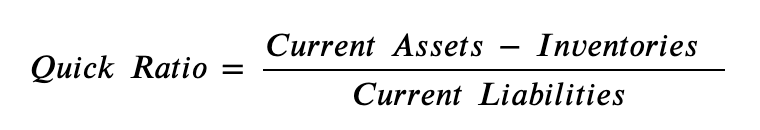

2. Quick Ratio (Acid-test Ratio): The quick ratio refines the current ratio by excluding inventory from current assets, thus focusing only on the most liquid assets. It is then divided by current liabilities to determine if a company can meet short-term financial obligations without relying on inventory sales. This ratio is particularly important in industries where liquidating inventory quickly may be challenging, offering a clearer view of a company’s immediate financial health.

Solvency Ratios

Solvency ratios are essential to a company’s financial stability and capacity to meet long-term obligations. These ratios evaluate how much a company relies on debt for its operations and its ability to sustain operations in the face of financial obligations. A healthy solvency position protects a company against economic downturns and enhances its creditworthiness.

1. Debt to Equity Ratio: This ratio compares a company’s total liabilities to its shareholder equity, providing insight into the level of leverage used. A lower debt-to-equity ratio is often preferred as it indicates that a company is not overly dependent on borrowing and can weather financial storms with its resources.

2. Interest Coverage Ratio: This ratio measures how often a company can cover its interest expenses with earnings before interest and taxes (EBIT). It’s a direct measure of a company’s financial health, reflecting its ability to service its debt comfortably without jeopardizing its operational efficiency. A higher interest coverage ratio means the company can manage its debt well, even if earnings fluctuate.

Profitability Ratios

Profitability ratios are essential indicators that help stakeholders evaluate the efficiency of a company in generating earnings relative to its sales, assets, and equity. These ratios are pivotal for assessing a company’s operational success and financial health, as they directly reflect the effectiveness of management strategies in turning resources into profits.

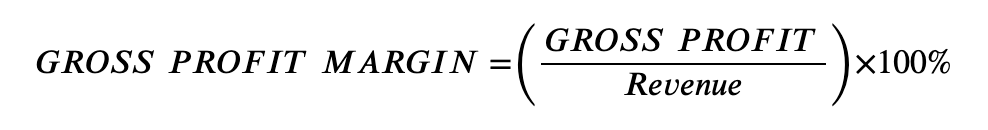

1. Gross Profit Margin: This ratio reveals what percentage of sales remains after covering the cost of goods sold. It not only gauges the efficiency of production processes and pricing strategies but also highlights the company’s core profitability. A healthy gross profit margin suggests a strong position to cover operating expenses and invest in growth opportunities.

2. Net Profit Margin: By illustrating how much of each dollar earned translates into actual profits, this ratio measures a company’s overall efficiency in managing all aspects of its operations, from production to administration. A higher net profit margin indicates better cost control and operational effectiveness, which is crucial for maintaining a competitive advantage in the market.

3. Return on Assets (ROA): ROA indicates if a company uses its assets well to generate revenue, measuring the profitability per dollar of assets owned. This ratio is especially important for comparing the performance of companies within the same industry, offering insights into how well a company is utilizing its asset base relative to its peers.

Efficiency Ratios

Efficiency ratios are critical in assessing how well a company manages its assets and liabilities to support operations and generate revenue. These ratios provide insights into various aspects of operational performance, such as inventory management, credit control, and overall asset utilization. A company can improve its cash flow, reduce costs, and enhance profitability by optimizing these areas.

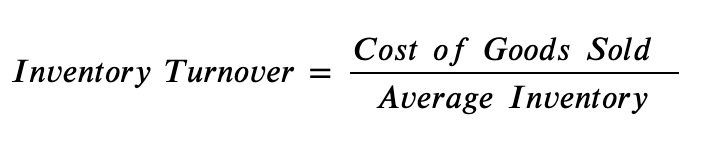

1. Inventory Turnover: This ratio measures how frequently a company’s inventory is sold and replenished within a specific period. A high inventory turnover rate typically indicates strong sales and effective inventory management, suggesting the company successfully meets consumer demand without overstocking. Conversely, a low turnover rate might indicate overstocking or inadequate sales, which can tie up capital and increase storage costs.

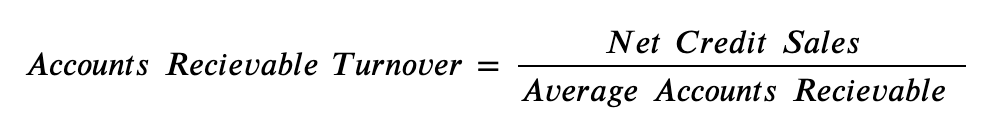

2. Accounts Receivable Turnover: This ratio illustrates how effectively a company collects customer debts. A high accounts receivable turnover ratio means the company collects its credit sales efficiently, contributing to better liquidity and cash flow. It reflects a company’s effectiveness in extending credit and collecting debts on time, essential for maintaining continuous cash inflows and minimizing credit risk.

Market Value Ratios

Market value ratios are pivotal for investors looking to gauge the relative value of a company’s stock in the marketplace. These ratios provide critical insights into a company’s performance from an investment perspective, helping determine if a stock is correctly valued based on its current and projected earnings.

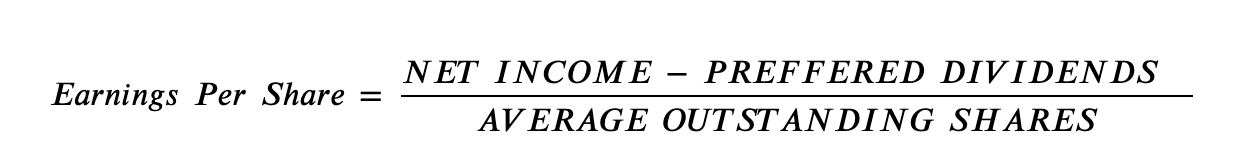

1. Earnings Per Share (EPS): EPS represents the portion of a company’s profits allocated to their outstanding share of common stock, which indicates a company’s profitability. Investors often use it to compare the financial performance of similar companies. A higher EPS means a company is more profitable and has more profits to return to shareholders.

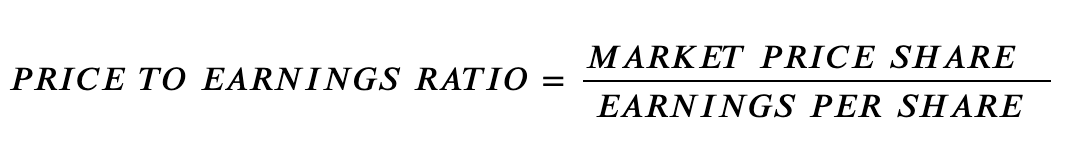

2. Price-to-Earnings Ratio (P/E): This ratio compares a company’s current share price to its per-share earnings. The P/E ratio is instrumental in assessing whether a stock trades on par with, below or above its earnings performance, indicating if the market expects future growth. A lower P/E might indicate that the stock is currently undervalued, assuming the company’s earnings prospects are stable.

By incorporating financial ratios into their analyses, businesses can make more informed decisions that ensure financial stability and growth. Financial ratios are not just numbers but reflections of a company’s strategy, operations, and market performance, which are important for creating competitive advantages and long-term success.

Need help with your financial ratios? Contact a NOW CFO specialist for more information.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Unlocking the Secrets of Financial Statements