Fractional CFO vs Full-Time CFO

Choosing between a fractional CFO and a full-time CFO can significantly impact your financial strategy, operational efficiency, and overall growth trajectory. Businesses can achieve cost savings of up to 30% to 40% by utilizing fractional resources compared to employing full-time staff.

Whether you are a startup founder, business owner, or part of an internal finance team, understanding the intricacies of these models is crucial. Let’s explore the fundamental differences between these two financial leadership options, including fractional CFO benefits, full-time CFO advantages, and more.

Introduction to CFO Models

In any business, the role of the CFO is integral to ensuring financial stability, strategic planning, and overall growth. This section examines the roles, definitions, and context behind choosing the right CFO model.

Overview of CFO Roles in Business

CFOs are key players in managing a company’s financial health. They oversee everything from budgeting and forecasting to risk management and strategic investments. The role demands a blend of technical expertise and strategic vision, ensuring financial practices align with overall business objectives.

Whether you lean towards an outsourced CFO model or a more traditional approach, understanding these responsibilities is the first step in evaluating your options.

Definition of a Fractional CFO

A fractional CFO is a financial expert who works part-time or as needed with a company. This model offers cost-effective, flexible access to high-caliber financial guidance without the overhead of a full-time executive.

Fractional CFO vs full-time CFO discussions often highlight that a fractional CFO brings the necessary expertise on demand. This expertise can be especially beneficial for smaller companies or startups needing professional guidance but not ready for a full-time executive role.

Definition of a Full-Time CFO

By contrast, a full-time CFO is a permanent executive who is deeply integrated into the company’s operations. This role provides consistent and dedicated leadership with a comprehensive understanding of the organization.

Full-time CFOs often have in-depth organizational knowledge and long-term strategic planning capabilities, which are crucial for sustained growth and stability. When comparing fractional CFO vs full-time CFO, these dedicated roles are typically associated with more robust internal alignment and decision-making capabilities.

Context for Choosing the Right CFO Model

Choosing between a fractional CFO and a full-time CFO largely depends on your business needs, financial complexity, and growth objectives. The U.S. Small Business Administration reports 33.2 million SMEs in the United States, accounting for 99.9% of all U.S. businesses.

Questions such as, “What are the pros and cons of a Fractional CFO versus a Full-Time CFO?” and “How do fractional CFO services compare to full-time CFO roles?” naturally arise during this evaluation.

Businesses need to consider factors such as budget constraints, operational scale, and the scope of their financial challenges.

Importance of Strategic Financial Leadership

Strategic financial leadership guides a company through economic challenges and growth opportunities. Regardless of the CFO model chosen, companies benefit from expert financial oversight that drives efficiency and informed decision-making. SMEs employ approximately 61.7 million Americans, 46.4% of private sector employees.

Embracing strategic financial leadership options ensures your business remains agile and prepared to navigate competitive markets. Furthermore, integrated leadership establishes a strong financial foundation for long-term success, whether via CFO as a service or a dedicated full-time role.

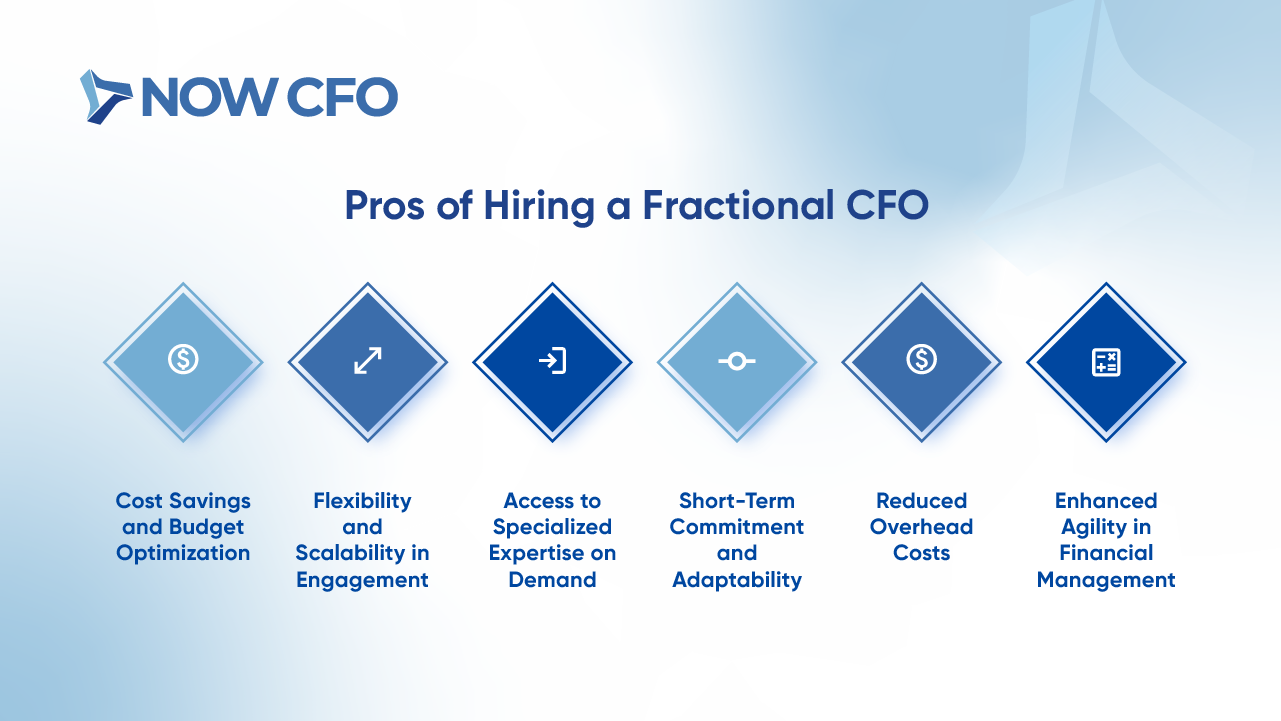

Pros of Hiring a Fractional CFO

Opting for a fractional CFO can provide significant benefits, particularly for companies that need expert guidance without committing to a full-time role. This section outlines the advantages, starting with cost efficiency and flexibility.

Cost Savings and Budget Optimization

One of the primary benefits of a fractional CFO is the cost savings associated with hiring part-time. Companies can avoid the high salary and benefits packages typical of full-time executives by engaging a fractional CFO.

This model allows you to access high-level expertise while optimizing your budget—ensuring you pay only for the services you need.

Flexibility and Scalability in Engagement

A fractional CFO offers the flexibility to scale their involvement up or down based on your business needs. This dynamic engagement model is ideal for companies experiencing rapid growth or seasonal fluctuations in financial activity.

Fractional CFO vs full-time CFO analysis often shows that the ability to adjust resource allocation on demand is a critical advantage, especially when considering cost comparison CFO models.

Access to Specialized Expertise on Demand

Fractional CFOs typically have broad experience across various industries, enabling them to offer specialized insights tailored to your unique challenges. Whether you are evaluating outsourced CFO vs. in-house CFO scenarios or considering virtual CFO services, these experts bring a wealth of knowledge to the table.

Their insights can drive significant improvements in financial strategy and operational efficiency.

Short-Term Commitment and Adaptability

For businesses not ready to commit to a long-term executive hire, a fractional CFO provides a short-term engagement that delivers immediate results. This model particularly appeals to startups or companies in transition, where financial challenges may be temporary or evolving.

The option for a short-term commitment also aligns with the query, “When should a business choose a Fractional CFO over a Full-Time CFO?” ensuring that your business can adapt quickly without a prolonged contractual obligation.

Reduced Overhead Costs

Hiring a fractional CFO means lower overhead costs in salary and ancillary expenses such as office space, benefits, and training. This cost-effective model supports lean operational structures, especially in the early stages of business development.

Enhanced Agility in Financial Management

Many companies favor this model because of the agility a fractional CFO offers. By pivoting quickly and addressing immediate financial challenges, these professionals contribute significantly to operational agility.

Cons of Hiring a Fractional CFO

While fractional CFOs offer many advantages, businesses must also consider potential challenges. Understanding these drawbacks is essential for a well-rounded perspective on the fractional CFO vs full-time CFO debate.

Limited Availability and Time Constraints

One of the primary concerns with fractional CFOs is their limited availability. As they juggle multiple clients, their time may be divided, potentially leading to conflicts of interest or delays in response times. This constraint can affect the depth of engagement, especially during critical financial periods.

Potential for Less In-Depth Organizational Knowledge

Because fractional CFOs typically serve multiple organizations, they might not develop the same in-depth knowledge about your company as a full-time CFO. This can lead to a less nuanced understanding of your business’s internal dynamics, potentially impacting strategic decisions.

When comparing fractional CFO vs full-time CFO, this aspect is crucial for companies requiring comprehensive internal oversight.

Coordination Challenges with Full-Time Teams

Integrating a fractional CFO into an existing full-time team can sometimes lead to coordination issues. The intermittent presence of a part-time executive might create communication gaps or alignment challenges, impacting overall team cohesion.

This is particularly relevant in scenarios comparing outsourced CFO vs. in-house CFO setups, where the flow of information is critical.

Risk of Fragmented Financial Oversight

Another potential downside of hiring a fractional CFO is the risk of fragmented financial oversight. Without consistent daily interaction, strategic financial decisions may lack cohesion in a full-time setup. This can result in disjointed financial strategies that may not fully align with long-term business goals.

Integration Issues with Existing Processes

Integrating a fractional CFO into your financial systems and processes can pose significant challenges. Their part-time engagement might not allow complete assimilation into the company’s operational culture, leading to misalignments in processes and communication.

This factor is particularly critical when considering cost-effective financial management with a fractional CFO who aims to streamline processes without disruption.

Pros of Hiring a Full-Time CFO

For many organizations, a full-time CFO represents a cornerstone of financial stability and long-term strategic planning. This section will examine the advantages of a dedicated, full-time financial executive.

In-depth Organizational Knowledge and Continuity

A full-time CFO is embedded within the company, offering deep organizational knowledge and continuity that is hard to match with a part-time executive. Their daily involvement enables them to develop a comprehensive understanding of every aspect of the business.

Consistent and Dedicated Leadership

One of the most significant full-time CFO advantages is their leadership consistency. A full-time CFO is available to steer the company through challenges and opportunities, ensuring that there is always a dedicated expert at the helm of financial strategy.

Centralized Decision-Making and Accountability

With a full-time CFO, decision-making is centralized, leading to more streamlined processes and clear accountability. This integration can be pivotal during critical financial periods, where quick, decisive actions are necessary. Centralized oversight ensures that financial policies are uniformly applied, leading to better operational outcomes.

Stronger Integration with Internal Teams

Full-time CFOs work closely with every department, ensuring financial strategies align with overall company objectives.

Their permanent presence allows them to build strong relationships with internal teams, leading to better collaboration and more effective execution of financial plans. This collaborative environment is crucial when evaluating outsourced CFO vs. in-house CFO models.

Long-Term Strategic Planning Capabilities

A dedicated CFO can focus on long-term strategic planning, positioning the company for sustained success. They can invest time in detailed financial forecasting, risk management, and capital allocation. Such long-term planning is essential for companies looking to achieve measurable growth, and it is a vital point of comparison in the fractional CFO vs full-time CFO debate.

Better Alignment with Company Culture

A full-time CFO is more likely to develop a strong rapport with the company’s leadership and workforce, ensuring that financial strategies align closely with the company’s culture.

This alignment fosters an environment of trust and collaboration, which is instrumental in driving the company forward. Integrating financial leadership into your business culture is also key to strategic financial leadership options.

Cons of Hiring a Full-Time CFO

While the benefits of a full-time CFO are significant, there are inherent challenges that businesses should consider when choosing a full-time financial executive.

Higher Salary and Benefit Costs

One of the most immediate drawbacks of hiring a full-time CFO is the high cost associated with a permanent executive salary and benefits package. According to the U.S. Bureau of Labor Statistics, the median annual wage for chief executives was $206,680 in May 2023.

These costs can be prohibitive for smaller companies or startups compared to the more flexible fractional model. This expense is critical when performing a cost comparison CFO model analysis.

Less Flexibility in Scaling Down

A full-time CFO represents a fixed resource allocation that is not easily scaled down if business needs change. This lack of flexibility can be a significant disadvantage for companies that experience seasonal or unexpected fluctuations in their financial demands.

The rigid nature of full-time roles makes it difficult to adjust quickly, particularly when compared to fractional CFO benefits that offer a more adaptable solution.

Fixed Resource Allocation

With a full-time CFO, resource allocation is set and may not be as responsive to dynamic business needs. Companies must commit to a long-term investment regardless of changing financial circumstances, which can limit agility.

This aspect is crucial when exploring “How do fractional CFO services compare to full-time CFO roles?” full-time roles offer depth but less flexibility.

Potential Overhead and Operational Constraints

The integration of a full-time CFO often brings additional operational constraints and overhead costs, including the need for a dedicated office, administrative support, and increased operational expenses. These factors can strain company resources, especially in smaller organizations where every dollar counts.

More extended Onboarding and Transition Periods

Hiring a full-time CFO involves a longer onboarding process, which can delay the implementation of critical financial strategies. The transition period may require significant adjustment as the new executive aligns with the company’s culture and systems. This delay can be a disadvantage compared to the swift deployment of a fractional CFO, particularly for businesses that need immediate financial oversight.

Key Differences Between Fractional and Full-Time CFOs

Understanding the fundamental differences between a fractional CFO and a full-time CFO is essential for any company looking to optimize its financial leadership. This section provides a detailed comparison across several key dimensions.

Engagement Duration and Commitment Levels

The commitment level differs significantly between the two models. A fractional CFO typically offers a flexible, part-time engagement, allowing businesses to scale their involvement as needed. In contrast, a full-time CFO represents a long-term commitment with continuous, in-depth involvement in the company’s operations.

Cost Structures and Budget Implications

Cost structures vary widely between fractional and full-time CFOs. Fractional CFOs generally come with lower fixed costs, making them a preferred option for companies looking to optimize their budgets.

On the other hand, full-time CFOs require a more substantial financial commitment, including salaries and benefits. When performing a cost comparison CFO models analysis, businesses must consider these budget implications carefully.

Scope of Strategic Involvement

A full-time CFO is usually involved in every aspect of the business’s financial strategy, from daily operations to long-term planning. In contrast, a fractional CFO offers targeted expertise for specific projects or challenges, which might limit their scope of strategic involvement.

This difference is particularly relevant when discussing key differences between outsourced CFO services and in-house financial leadership, as each model supports varying degrees of strategic depth.

Flexibility in Resource Allocation

Fractional CFOs provide greater flexibility in resource allocation, enabling companies to adjust the level of financial oversight as needed. Full-time CFOs, while offering stability, tend to be less flexible due to their fixed role within the organization.

This aspect is crucial for businesses that require cost-effective financial management with a fractional CFO to respond quickly to market changes.

Organizational Integration and Communication

Integration is often more seamless with a full-time CFO, who becomes an integral part of the internal team. Conversely, a fractional CFO might face challenges integrating existing processes due to their intermittent involvement.

Impact on Decision-Making and Oversight

Due to their constant presence, full-time CFOs tend to have a more significant impact on day-to-day decision-making, whereas fractional CFOs can provide high-level oversight during critical periods. This distinction can be pivotal when considering full-time CFO advantages in scenarios where continuous oversight and accountability are paramount.

When to Choose Each CFO Model

Deciding between a fractional CFO and a full-time CFO depends on business size, financial complexity, and long-term goals. This section offers a framework for determining the best fit for your organization.

Assessing Business Size and Financial Complexity

Smaller businesses or startups with limited financial complexities often benefit from the flexibility and fractional CFO benefits a part-time executive provides. Conversely, larger organizations with complex financial structures might find that a full-time CFO, with their deep organizational knowledge, is better suited to manage their needs.

Budget and Cost Considerations

Budget is a significant determinant in the fractional CFO vs full-time CFO decision. Companies with constrained financial resources might lean towards a fractional CFO to leverage expert guidance without the higher costs associated with a full-time hire.

Evaluating cost comparison CFO models helps you understand the potential savings and align them with your financial strategy.

Short-Term vs. Long-Term Financial Needs

A fractional CFO is an ideal choice if your business requires financial expertise for a short-term project or during a transitional period. Their ability to deliver results temporarily makes them a practical option.

On the other hand, if your business demands consistent, long-term financial leadership, hiring a full-time CFO might be more appropriate. This aligns with the query, “When should a business choose a fractional CFO over a full-time CFO?” ensuring that the chosen model supports your timeline and strategic goals.

Strategic Growth and Investment Requirements

For companies experiencing rapid growth or planning significant investments, deciding between a fractional CFO and a full-time CFO can impact strategic outcomes.

A full-time CFO is often better equipped for long-term strategic planning and sustained growth initiatives, while a fractional CFO provides nimble financial support to manage immediate challenges.

Evaluating Flexibility Versus Stability in Leadership

Balancing the need for flexible, adaptable financial leadership against the desire for consistent, long-term oversight is central to the fractional CFO vs full-time CFO decision.

Businesses prioritizing agility might find the fractional model more appealing, whereas those valuing stability and deep organizational integration will lean towards a full-time CFO. Both approaches have merits; the choice should reflect your company’s culture and strategic direction.

Case Scenarios and Decision Framework

Consider scenarios like a tech startup experiencing rapid market changes or an established manufacturing firm with stable operations. In the former, a fractional CFO may offer flexible financial leadership akin to CFO as a Service or virtual CFO services, providing expert advice without a long-term commitment.

In the latter, a full-time CFO might be necessary to manage the intricacies of a large organization and support sustained growth. These case scenarios illustrate the importance of aligning your choice with your business needs and operational realities.

Conclusion: Making the Right CFO Choice for Your Business

Choosing between a fractional CFO and a full-time CFO is a strategic decision that can influence your company’s financial health, operational efficiency, and long-term growth. This detailed exploration of fractional CFO vs full-time CFO models has highlighted the respective benefits and drawbacks.

The ultimate goal is to align your financial leadership model with your business objectives, ensuring you have the right expertise. We trust that the insights provided will empower you to make the best decision for your business’s financial future. Feel free to contact NOW CFO if you need help with business decisions.