Accurate financial reporting is fundamental to resilient business growth. Research shows that 90% of CFOs are outsourcing accounting functions, signaling a strong shift toward leveraging expert oversight for precise reporting.

With the importance of financial reporting at the core of this shift, companies gain access to seasoned professionals who ensure clarity, compliance, and credibility in every statement.

What is Financial Reporting Accuracy and its Importance

Accurate financial reporting forms the backbone of informed business decisions and strong compliance. Financial reporting demands precision in every statement. It connects directly to financial reporting accuracy, shaping trust and strategy.

Let’s define this key concept before exploring the consequences of inaccuracy.

Definition of Financial Reporting Accuracy

Financial reporting accuracy means that all financial statements, from balance sheets to cash flow reports, reflect true company performance without material errors or omissions. It ensures financial statement accuracy, clarifying actual assets, liabilities, revenues, and expenses.

An accurate report reduces misstatements, enhances transparency, and builds stakeholder confidence. Organizations with rigorous CFO accounting accuracy see a lower incidence of restatements due to material misstatements. It empowers leadership with clean data for planning and forecasting.

Impact of Inaccurate Financial Reports on Business Health

When financial reports are inaccurate, they put the business at risk:

- Misled decision-making due to distorted profitability or cash flow.

- Elevated legal and compliance risks from false disclosures.

- Damage to investor confidence and reduced capital access.

- Unreliable budgeting, forecasting, and performance tracking.

Inaccurate reporting erodes operational clarity, hampers outsourced CFO services, and weakens strategic execution. It jeopardizes compliance with standards like IFRS and GAAP, leading to penalties and audits. Ensuring financial compliance through accurate data is not optional, it’s essential.

The Role of an Outsourced CFO in Ensuring Accurate Financial Reporting

An outsourced CFO enhances the importance of financial reporting by embedding robust systems and oversight. Their strategic interventions ensure financial reporting accuracy at every stage, from data review to the preparation of stakeholder reports. Below are the essential functions they perform:

Reviewing Financial Statements for Completeness and Accuracy

An outsourced CFO meticulously examines each financial statement to verify data completeness and mathematical accuracy. They reconcile accounts, cross-check entries against source documents, and identify anomalies promptly.

This proactive review reinforces financial statement accuracy, enabling leaders to rely on precise data for decision-making.

Implementing Financial Controls to Prevent Errors

They design and deploy internal control frameworks to mitigate mistakes and fraud. By applying these financial compliance measures, the outsourced CFO ensures consistent CFO financial reporting strategies that prevent misstatements before they occur.

Ensuring Compliance with Accounting Standards and Regulations

To bridge into this core function, the outsourced CFO ensures that all financial outputs align with IFRS, GAAP, tax regulations, and relevant compliance mandates. They monitor regulatory updates, adapt policies accordingly, and implement training for staff. Specific responsibilities include:

- Reviewing new or revised accounting standards for applicability

- Updating financial procedures to comply with tax and reporting rules

- Coordinating with auditors and regulators to verify adherence

These efforts reinforce CFO accounting accuracy and ensure reporting remains legally sound and audit ready.

Managing Financial Data for Consistency and Transparency

They centralize and standardize financial data across systems, ERP, bookkeeping, and reporting tools. This unified approach enhances transparency and reduces discrepancies. Regular data validation routines ensure that reports reflect reliable and consistent metrics.

By ensuring financial reporting accuracy, they support financial reporting best practices that foster stakeholder trust and operational clarity.

Preparing Reports for Investors, Stakeholders, and Regulatory Bodies

To transition into stakeholder reporting, the outsourced CFO crafts polished, compliant reports tailored to each audience. They produce:

- Investor reports with key ratios and forecasts

- Stakeholder summaries that tell a narrative of performance

- Regulatory filings that meet format and deadline requirements

Their reports combine accuracy with clarity, ensuring alignment with both financial reporting and outsourced CFO services. This transparency supports investor confidence and regulatory compliance.

How Financial Reporting Accuracy Impacts Business Performance

Accurate reporting isn’t just compliance; it’s a strategic asset. When businesses maintain financial reporting accuracy, they empower decision-makers with trustworthy data and demonstrate the Importance of Financial Reporting. Here’s how it drives performance:

Improved Decision-Making with Reliable Financial Data

With importance of financial reporting at the forefront, accurate data enables executives to:

- Base strategy on facts, not guesswork.

- Allocate capital efficiently using precise projections.

- Respond rapidly to market shifts via real-time insights.

Enhanced Credibility with Investors and Stakeholders

When stakeholders receive accurate and consistent financial reports, trust builds organically. This credibility:

- Attracts investors via transparent profit trends and cash flow.

- Strengthens lender confidence, facilitating favorable credit terms.

- Enhances reputation among partners and regulators.

True financial reporting accuracy underpins stakeholder relations by validating outsourced CFO services and reinforcing financial compliance with fewer questions or adjustments.

Reduced Risk of Financial Penalties and Legal Issues

Accurate reporting minimizes the risk of non-compliance. Benefits include:

- Fewer errors triggering regulatory investigations or fines.

- Lower legal expense and reputation damage.

- Cleaner audit trails and documentation.

For example, non-compliance fines for tax and financial errors average 5–10% of annual earnings in small firms. Ensuring financial statement accuracy through precise reporting helps firms avoid costly penalties and legal complications.

Better Cash Flow Management Through Accurate Projections

They say forecasting is key, and accurate reports improve it:

- Realistic projections prevent liquidity crunches.

- Optimized working capital via timely payment strategies.

- Daily accuracy reduces short-term borrowing needs, per the FDIC.

Proper cash flow planning via financial reporting accuracy enhances financial stability and aligns with CFO financial reporting strategies that turn forecast precision into performance.

Increased Operational Efficiency with Clear Financial Insights

Clear financial insights from accurate reporting fuel efficiency:

- Pinpoint underperforming departments for targeted improvement.

- Identify cost-saving opportunities and reduce overhead.

- Streamline resource allocation using detailed, accurate metrics.

Solid financial reporting accuracy supports financial reporting best practices by giving management clarity, leading to smarter operations and stronger margins.

Key Steps to Ensure Financial Reporting Accuracy with an Outsourced CFO

When engaging an outsourced CFO, structured processes are vital to ensure financial reporting accuracy and uphold the Importance of financial reporting across the organization. These steps guide seamless integration and effective oversight.

Implementing Internal Financial Controls And Procedures

An outsourced CFO helps design and implement robust financial controls that reduce errors and strengthen financial compliance.

First, they segment duties, such as separating payment authorization from bookkeeping—to minimize fraud risks. Next, they establish approval chains with spend limits to prevent unauthorized transactions. Additionally, periodic reconciliations between ledgers, bank statements, and source documents uncover discrepancies early.

Organizations with strong internal control frameworks reduce material weaknesses. By reinforcing CFO financial reporting strategies through reliable procedures, companies build a foundation for accurate and transparent reporting.

Conducting Regular Financial Audits and Reviews

Routine audits and reviews help sustain financial statement accuracy by validating the integrity of financial records.

An outsourced CFO schedules quarterly internal audits and annual external audits to ensure compliance with GAAP or IFRS. They collaborate with audit teams to examine high-risk areas, such as inventory valuation, revenue recognition, and accruals. Findings are documented and tracked until resolved, creating accountability and continuous improvement.

Standardizing Financial Reporting Practices Across the Organization

To maintain consistency, the outsourced CFO develops standardized templates and processes for financial data entry, categorization, and reporting.

- Uniform chart of accounts ensures consistency in expense and revenue classification.

- Standard reporting calendars and deadlines align finance teams and stakeholders.

- Designed reconciliation and variance analysis schedules promote transparency.

With consistent processes, the CFO enables reliable comparisons across periods and departments, bolstering financial reporting accuracy and reinforcing the Importance of financial reporting.

Training Financial Teams on Compliance and Reporting Best Practices

To reinforce internal frameworks, the outsourced CFO provides tailored training on financial controls and financial compliance.

- Staff learn to apply GAAP/IFRS, draft accurate journal entries, and follow approval workflows.

- Workshops cover risk identification, such as recognizing anomalies or fraud indicators.

- Ongoing updates educate teams on regulatory changes and emerging accounting standards.

These training initiatives elevate CFO accounting accuracy and ensure every team member contributes to the organization’s financial integrity.

Using Technology to Automate Financial Data Collection and Reporting

Outsourced CFOs leverage modern financial technology to enhance financial reporting accuracy and streamline data flows.

They introduce automated integrations between ERP systems, CRM platforms, and bank feeds, reducing manual data entry and associated errors. Automated report generation, dashboards, and alerts flag unusual transactions in real time.

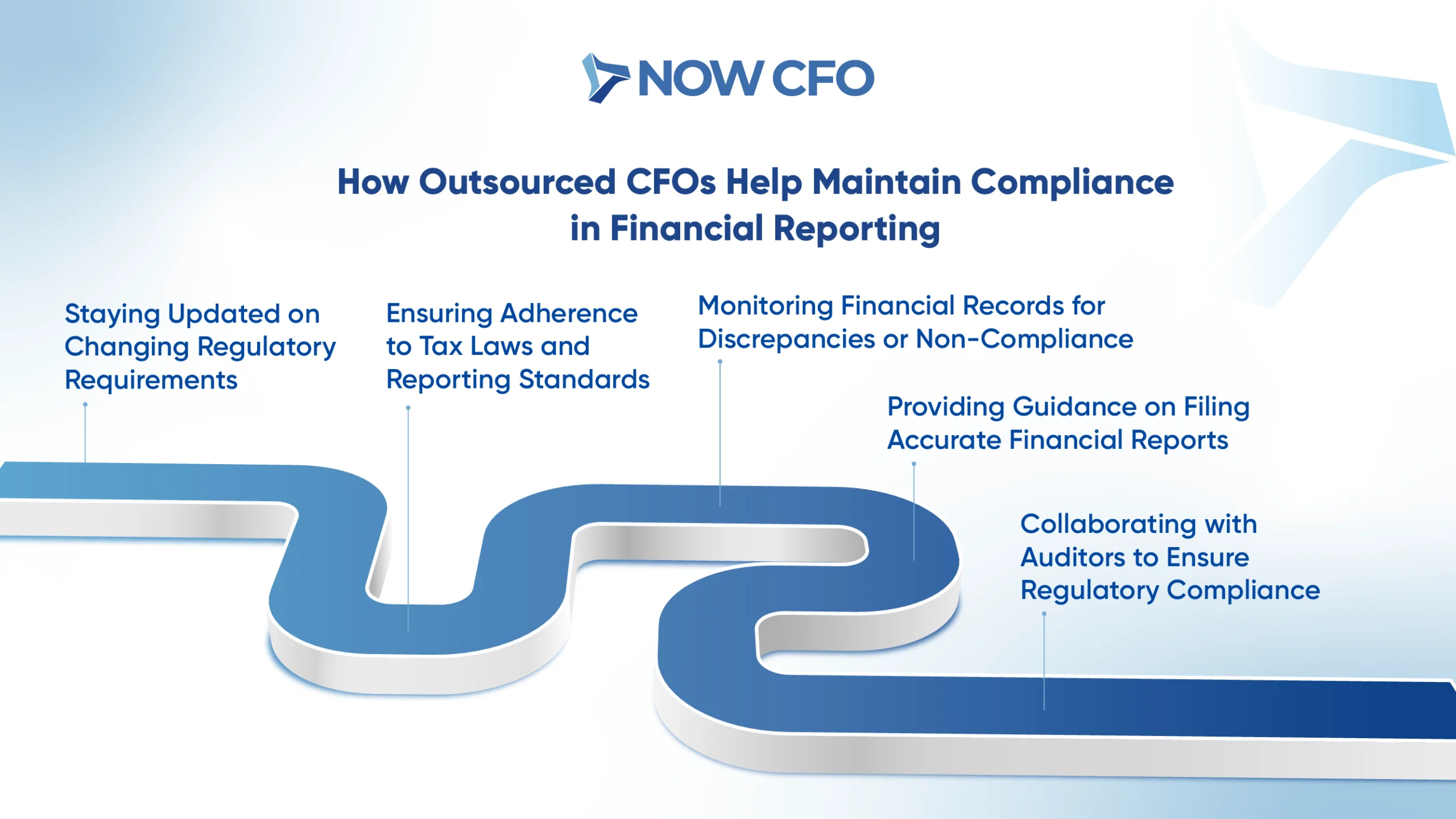

How Outsourced CFOs Help Maintain Compliance in Financial Reporting

Outsourced CFOs play a strategic role in maintaining financial reporting accuracy by enforcing importance of financial reporting through proactive regulatory oversight and robust compliance mechanisms. Here’s how they support compliance:

Staying Updated on Changing Regulatory Requirements

An outsourced CFO continuously monitors regulatory bodies, such as FASB, SEC, IRS, and international standard-setting organizations, for updates affecting reporting and tax compliance.

They subscribe to official updates, attend training webinars, and analyze proposed changes by quarter. Once new standards emerge, like recent revenue recognition or lease accounting updates, they adjust internal policies and train the finance team promptly.

Ensuring Adherence to Tax Laws and Reporting Standards

Building on regulatory monitoring, the outsourced CFO ensures the company follows all applicable tax and accounting rules.

They review corporate tax filings, ensure expense categorization aligns with local and federal laws, and confirm the use of correct tax codes.

Key actions include:

- Conducting quarterly tax provisioning reviews

- Verifying compliance with multi-jurisdictional tax regulations

- Documenting tax positions and monitoring deferred tax adjustments

Through these measures, the CFO reinforces financial compliance and CFO accounting accuracy, ensuring taxes and reports adhere to GAAP, IFRS, and local standards.

Monitoring Financial Records for Discrepancies or Non-Compliance

With robust internal systems, the outsourced CFO regularly reviews financial records to detect anomalies or non-compliance.

They analyze trends in journal entries and test for irregularities like unusual balances or round-dollar amounts, common red flags. They also generate exception reports and scrutinize vendor payments for duplicated entries.

Providing Guidance on Filing Accurate Financial Reports

The outsourced CFO supports teams during report preparation, ensuring clarity, accuracy, and timely filing.

They advise completing templates for tax return submissions and regulatory disclosures, including MD&A sections. They coordinate with finance staff to compile supporting schedules, reconcile accounts, and validate calculations.

By offering oversight, the CFO ensures that all financial filings; quarterly, annual, or specialized; meet legal formatting, disclosure, and deadline requirements. This helps maintain financial reporting accuracy and boosts stakeholder trust.

Collaborating with Auditors to Ensure Regulatory Compliance

To transition into audit coordination, the outsourced CFO engages directly with external auditors, facilitating smooth and compliant audits.

They prepare audit-ready documentation, arrange walkthroughs for key processes, and address auditor inquiries. They also integrate auditor recommendations into internal policies, improving future compliance.

Benefits of Accurate Financial Reporting with an Outsourced CFO

Engaging an outsourced CFO ensures financial reporting accuracy, reinforcing the importance of financial reporting and delivering measurable advantages across stakeholders, risk, stability, planning, and financing.

Increased Trust and Transparency with Stakeholders

Accurate reports foster confidence among investors, board members, and partners. With financial reporting accuracy, stakeholders access:

- Clear, verifiable data, free from guesswork or hidden liabilities.

- Regular updates that demonstrate accountability and build long-term credibility.

This transparency strengthens reputational capital and aligns with outsourced CFO services that prioritize stakeholder trust through open, consistent communication.

Proactive Risk Management and Legal Compliance

By shifting from reactive to proactive controls, an outsourced CFO helps businesses anticipate and mitigate compliance risks.

- Risk Identification: Using variance analyses and exception reports, they detect anomalies before they escalate.

- Compliance Assurance: They track evolving tax and accounting standards to keep financial statement accuracy current, avoiding penalties.

This proactive approach maintains financial compliance and shields companies from financial and reputational damage.

Enhanced Financial Stability and Performance

Clear, accurate financial situations translate into stronger business foundations:

- Stability: Reliable statements enable smarter cash reserves, reducing liquidity crises.

- Performance Improvement: Tracking financial trends helps optimize cost structures and increase profitability margins.

Improved Long-Term Business Planning and Forecasting

Accurate financial reporting lays the foundation for effective long-term business planning and forecasting. When a company maintains financial reporting accuracy, leadership can rely on real, consistent data to make strategic decisions.

This enables businesses to set achievable growth targets, plan capital investments, and identify future risks with confidence. An outsourced CFO plays a key role in refining this process by ensuring all financial statements reflect true company performance, which is critical for building reliable projections.

Better Access to Financing Through Transparent Financial Reports

Transparent, accurate reporting opens doors to capital:

- Lenders and investors assess financial health more favorably with clear statements and debt coverage ratios.

- Companies with strong financial governance secure loans at lower interest rates and quicker approval timelines.

How to Choose the Right Outsourced CFO for Financial Reporting Accuracy

Selecting an outsourced CFO with the right qualifications ensures financial reporting accuracy. Use the following criteria to guide your selection:

Look for Expertise in Financial Reporting and Compliance

Seek candidates with in-depth experience preparing GAAP or IFRS-compliant reports. They should have led year-end closes, managed multicurrency consolidations, and implemented transparent reporting frameworks.

Their grasp of financial compliance and CFO accounting accuracy ensures that your numbers align with formal standards and withstand scrutiny from stakeholders and regulators.

Assess Their Ability to Develop Strong Financial Controls

A seasoned outsourced CFO will outline and establish internal control systems designed to prevent errors and fraud. This includes implementing segregation of duties, approval workflows, and reconciliation processes.

Their skills in designing these controls directly support financial reporting accuracy and demonstrate how financial reporting best practices can be applied effectively in real-world settings.

Verify Their Track Record in Improving Financial Reporting Accuracy

To evaluate candidates past performance, ask about measurable outcomes:

- Percentage reduction in restatements or audit adjustments.

- Speed improvements in closing cycles.

- Enhanced accuracy in quarterly forecasts.

Ensure They Have Experience with Industry-Specific Regulations

Because compliance differs by sector, prioritize CFOs with experience in your domain:

- Healthcare: HIPAA, Medicare/Medicaid reporting

- Manufacturing: Cost accounting standards

- Non-profit: FASB ASC 958 requirements

- SaaS/Tech: Revenue recognition under ASC 606

Their sector-specific knowledge ensures financial compliance and financial reporting accuracy for your industry context.

Confirm Their Ability to Work with External Auditors and Regulators

A skilled outsourced CFO should have strong communication skills with third parties. They will:

- Coordinate audit scheduling

- Provide required documentation efficiently

- Implement auditor recommendations to refine controls

Conclusion: Strengthening Business Success Through Financial Reporting Accuracy

Ensuring financial reporting accuracy through the guidance of an outsourced CFO delivers a clear competitive edge. It boosts stakeholder confidence, ensures compliance, enhances financial stability, and drives smarter long-term planning.

To elevate your organization’s financial integrity, consider engaging with an outsourced CFO; schedule a free consultation with NOW CFO finance experts. This proactive step aligns your business with best-in-class financial reporting standards and paves the way for stronger investor relations.