Maintaining solid credit management is vital for business stability, and an outsourced CFO can elevate this essential function with expertise and strategic oversight. The latest data from the Department of the Treasury confirms that over 20% of SME loan applications are rejected, with an additional 28% receiving only partial funding.

That statistic underscores why companies strive to improve credit management, as poor credit structures directly limit access to capital and stunt growth. An outsourced CFO brings proven credit risk management, analytics, and forecasting capabilities to rebuild credit health.

What is Credit Management and Why Is It Important?

Effective credit management underpins strong financial health, especially for businesses aiming to improve credit management.

Defining Credit Management and Its Impact on Business Health

Credit management is the structured process of granting credit, establishing payment terms, collecting receivables, and enforcing credit policy. A robust credit management approach directly affects business health.

Studies show that 27 % of small firms couldn’t secure needed financing due to weak credit systems , while 46 % rely on personal credit cards, exposing them to risk. Strong credit management reduces default risk, prevents cash flow disruptions, and supports credit risk management.

The Role of Credit Management in Ensuring Cash Flow and Stability

As the business transitions into operational strategies, credit management becomes essential for safeguarding liquidity and CFO cash flow management. A strategic approach ensures timely collections, avoids extended cash conversion cycles, and sustains working capital.

Key components include:

- Monitoring Days Sales Outstanding (DSO): Reducing DSO accelerates cash inflows.

- Balancing Receivables & Payables: Minimizing cash gaps between customer payments and supplier obligations strengthens stability.

- Utilizing Cash Flow Forecasting: Predicting shortfalls enables proactive credit control.

- Maintaining Adequate Liquidity: Holding 2–3 months of operating expenses helps buffer delays in receivables.

The Role of an Outsourced CFO in Credit Management

An outsourced CFO brings focused financial expertise to improve credit management, aligning credit policy with overall credit management strategies. By analyzing current practices, identifying weaknesses, and deploying targeted solutions, they strengthen credit risk frameworks and enhance CFO cash flow management.

Reviewing Current Credit Policies and Identifying Areas for Improvement

A skilled outsourced CFO starts by auditing existing credit policies, including terms, approval workflows, and enforcement. They identify gaps in collection procedures or inconsistent credit limits. They benchmark policies against best practices and regulatory standards.

- Map Policy Effectiveness: Identify approvals causing delays or defaults.

- Spot Inconsistent Terms: Varying credit durations impact cash flow.

- Benchmark Policies: Ensure compliance and consistency.

Implementing Credit Risk Mitigation Strategies

An outsourced CFO then embeds risk mitigation strategies into daily operations. They use credit scoring tools to assess customer risk, adjusting terms accordingly. They also advocate for credit insurance or factoring for high-risk accounts.

By integrating dynamic risk profiles and insurance, businesses significantly reduce exposure to bad debt. This approach reinforces credit management services and supports business resilience through proactive risk oversight.

Optimizing Cash Flow Through Better Credit Control

Optimizing credit control is vital to supply liquidity and improve credit management. An outsourced CFO sets clear credit limits, adjusts terms based on payment history, and automates reminders.

This discipline directly enhances CFO cash flow management, ensuring consistent revenue inflows and minimizing reliance on external working capital.

Managing Accounts Receivable and Reducing Late Payments

To bridge credit policy and improved payments, an outsourced CFO refines receivable processes:

- Implement automated invoicing and reminders to increase on-time payments.

- Set escalation protocol and apply late fees systematically.

- Conduct regular receivables reviews, follow-ups on aging balances.

Enhancing Credit Reporting and Financial Forecasting

Finally, an outsourced CFO enhances credit reporting systems—tracking KPIs like DSO, aging buckets, and bad-debt ratios. They integrate credit metrics into financial forecasting models. This enables predictive insights into cash flow, allowing businesses to adjust credit strategies before issues arise.

Key Strategies for Improving Credit Management with an Outsourced CFO

To fully improve credit management, an outsourced CFO deploys targeted strategies across risk assessment, receivables, credit terms, client monitoring, and reporting. Each plays a key role in strengthening your financial controls.

Analyzing and Managing Credit Risks

An outsourced CFO begins by quantifying and segmenting credit risk across customer portfolios. They apply standardized scoring systems and categorize clients into low, medium, and high-risk buckets. They then tailor credit exposure limits, adjust terms proactively, and monitor macroeconomic signals that affect client solvency.

Streamlining Accounts Receivable Processes

Next, the outsourced CFO optimizes accounts receivable through disciplined process workflows. They centralize invoicing, implement scheduled follow-ups, and segment aging invoices by risk level.

They define escalation protocols for overdue accounts and ensure collections are consistent and appropriately escalated. By refining credit management services and reducing DSO, businesses enjoy faster cash realization and strengthened working capital cycles.

Establishing Clear Payment Terms and Credit Limits

Building on these foundations, an outsourced CFO crafts unambiguous credit agreements that drive reliable cash flow.

- Standardized payment terms (e.g., Net 30/60/90) based on client risk.

- Define credit caps correlated to client financial strength.

- Include incentives or penalties for early or late payments.

Monitoring Client Creditworthiness and Payment Histories

To maintain control, regular review of client financial health is essential. An outsourced CFO sets periodic assessments, leveraging updated credit scores, payment timeliness, and financial trends. They use this data to re-evaluate credit limits, pause risky accounts, or offer revised terms.

Improving Financial Reporting for Better Credit Control

Finally, the outsourced CFO integrates credit metrics; like DSO, aging buckets, and bad-debt ratios. They prepare dashboards that highlight aging risks, credit exposures by client, and trends in payment behavior.

These insights feed into monthly forecasts, enabling predictive adjustments to credit programs before issues arise. With transparent credit management services reporting, leadership gains clarity and confidence in the health of receivables.

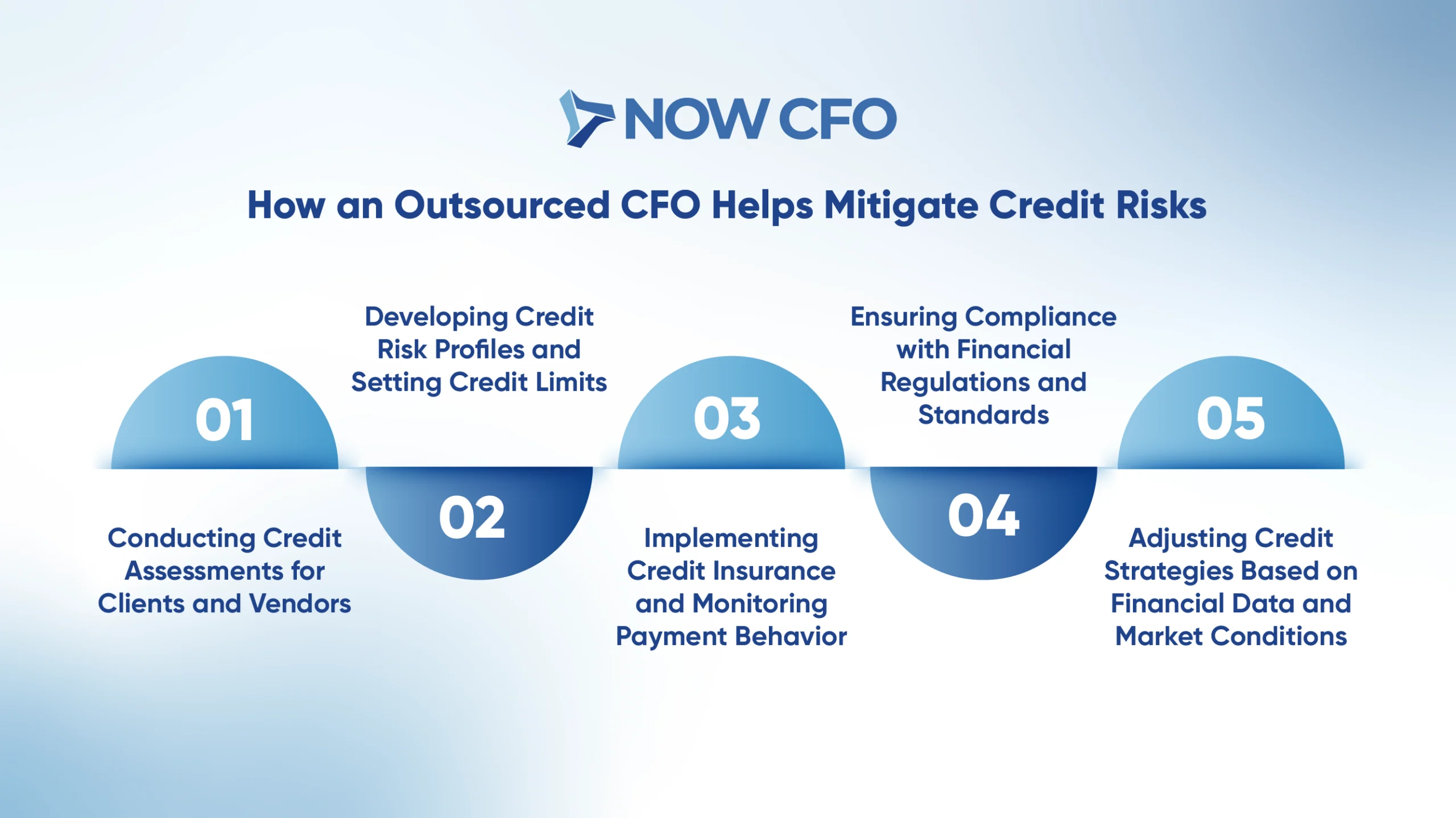

How An Outsourced CFO Helps Mitigate Credit Risks

An outsourced CFO plays an indispensable role in improving credit management by embedding risk mitigation into your financial core. They begin with thorough credit assessments, profiling each customer’s creditworthiness through financial analysis, credit scoring, and payment history review. Based on these insights, they develop risk profiles and set client-specific credit limits.

Learn More: Outsourced CFO For Your Business

How an Outsourced CFO Helps Mitigate Credit Risks

An outsourced CFO plays a pivotal role in improving credit management by implementing structured processes and strategic oversight. By conducting in-depth assessments, setting risk-based limits, and continuously adjusting policies, they drive stronger credit risk management.

Conducting Credit Assessments for Clients and Vendors

An outsourced CFO establishes formal credit assessment procedures to evaluate both clients and vendors. They analyze financial statements, review credit scores, and evaluate debt-to-equity ratios.

- Standardized Credit Checks: Use D&B or FICO-based models to assess applicant creditworthiness.

- Verify Financial Health: Review of recent audits, cash flow, and profitability trends.

- Check Payment History: Investigate data on late payments or defaults.

Developing Credit Risk Profiles and Setting Credit Limits

With thorough assessments in hand, an outsourced CFO constructs risk profiles categorizing customers by default probability, credit exposure, and payment behavior. They then align credit limits accordingly higher limits for low-risk clients and tighter terms for risky ones.

By calibrating profiles with industry benchmarks and client analysis, they fortify overall credit risk management and minimize unexpected write-offs.

Implementing Credit Insurance and Monitoring Payment Behavior

An outsourced CFO recommends credit insurance to protect significant receivables, especially in international transactions. They also monitor payment trends, flagging customers with increasing DSO or late trends, and trigger corrective actions like payment plan adjustments or limit reductions.

Ensuring Compliance with Financial Regulations and Standards

An outsourced CFO aligns credit policies with pertinent regulations; GAAP, Basel III, SEC, OCC standards; and mandates adherence throughout operations. They ensure allowances for doubtful accounts match GAAP’s aging-based methodology.

Routine policy reviews and compliance audits prevent regulatory breaches and reinforce disciplined credit management strategies.

Adjusting Credit Strategies Based on Financial Data and Market Conditions

Building on monitoring frameworks, an outsourced CFO continuously refines credit tactics based on evolving financial and market conditions.

- Reassess limits quarterly: Adjust based on updated financials or sales volatility.

- Stress-test scenarios: Simulate economic downturns or interest rate hikes to gauge credit risk.

- Alter payment terms: Tighten or relax terms based on changing market dynamics or customer segments.

Benefits of Improving Credit Management with an Outsourced CFO

Delivering strong credit practices through an outsourced CFO enhances overall financial stability. By improving credit management, companies experience smoother liquidity, better risk control, and empowered decision-making.

Enhanced Cash Flow and Liquidity

An outsourced CFO tightens credit policies, accelerates receivables, and reduces working capital gaps, delivering measurable liquidity gains. For instance, firms that optimized cash conversions saw decrease in reliance on short-term credit lines. These improvements directly support CFO cash flow management and credit management strategies, ensuring ample funds for growth.

Reduced Risk of Bad Debts and Late Payments

Tighter policy enforcement drives down payment delays and bad debts:

- Automated overdue alerts decrease late payments by up to 20 %.

- Regular reviews flag high-risk accounts early.

- Escalation protocols enforce consistent action.

Improved Client Relationships Through Transparent Credit Policies

Clear, transparent credit terms foster stronger client trust and smoother interactions:

- Written payment schedules prevent surprises.

- Open communication builds understanding and loyalty.

- Flexibility—like early-payment discounts—rewards reliability.

These strategies balance firm boundaries and customer goodwill, enhancing business relationships and supporting credit management services.

Stronger Financial Stability and Risk Management

Outsourced CFOs embed robust credit oversight into broader risk frameworks. They analyze liquidity buffers, stress-test credit outcomes, and align practices with industry benchmarks.

Sound liquidity planning critically improves institutional resilience during downturns. These efforts advance CFO financial health optimization and reinforce credit management strategies at all levels.

Better Decision-Making with Accurate Financial Data

Accurate credit metrics empower data-driven strategy. Outsourced CFOs integrate KPIs into reporting dashboards. Timely, precise data enables strategic credit-limit adjustments, investment decisions, or liquidity planning

Steps to Improve Credit Management with an Outsourced CFO

By partnering with an outsourced CFO, your business can systematically improve credit management, ensuring each step builds stronger credit control and supports credit management strategies.

Conducting a Comprehensive Review of Credit Policies

An outsourced CFO initiates a deep audit of existing credit policies. They examine payment terms, approval workflows, and enforcement measures. This review identifies inconsistencies and uncovers gaps in collection tactics.

They also assess alignment with industry standards and internal objectives. This structured evaluation lays the groundwork to improve credit, ensuring policies drive efficient receivables, consistent risk oversight, and sustainable liquidity.

Setting Clear Credit Terms and Conditions

To bridge policy clarity and operations, the outsourced CFO establishes precise, standardized credit agreements:

- Define payment windows (e.g., Net 30, Net 45) and penalties for late payments.

- Clarify credit limits based on client profile and payment history.

- Include early-payment discounts to encourage timely settlement.

This clarity streamlines collections, builds trust, and improves credit risk management by setting transparent expectations and reducing disputes.

Monitoring Client Creditworthiness Regularly

The outsourced CFO sets up routine reviews to reassess client risk. They track updated financials, payment behaviors, and external credit scores. They also monitor macroeconomic indicators affecting sectors of exposure.

By revisiting credit limits quarterly, businesses can preemptively adjust terms or tighten controls. Systematic monitoring reduces delinquency among SMBs. This vigilance helps improve credit management and strengthens liquidity management.

Implementing Technology to Automate Credit Control

Automation accelerates collections and enriches CFO cash flow management. The outsourced CFO introduces tools like integrated billing platforms, automated reminder systems, and aging-bucket analytics. These systems generate overdue notifications and escalate accounts based on predefined thresholds.

Adjusting Credit Limits Based on Business Performance

An outsourced CFO ensures credit limits remain dynamic and aligned with performance. They correlate client payment trends, sales volumes, and internal cash flow metrics to adjust limits, tightening for riskier clients, increasing for reliable partners.

This ongoing calibration prevents default exposure while supporting loyal customers’ growth. By adapting limits based on real-time data, businesses improve credit management and sustain optimized liquidity ratios.

Learn More: Benefits of hiring an outsourced CFO

How to Choose the Right Outsourced CFO for Credit Management

Hiring the right outsourced CFO ensures your company can effectively improve credit management and elevate credit risk management. The following sections guide you through key selection criteria, expertise, track record, analytical skills, and alignment with your goals.

Look For Experience in Credit Risk and Cash Flow Management

A top-tier outsourced CFO must demonstrate proven strength in credit risk management and CFO cash flow management. Seek candidates who have navigated credit assessment, risk modeling, and liquidity optimization.

- Industry Experience: Ideal candidates should manage these aspects in similar-sized firms or your sector.

- Tangible Results: Ask for metrics, e.g., percentage reduction in DSO or improved liquidity ratios.

- Risk Frameworks: Familiarity with tools such as credit scoring or insurance to mitigate credit risk management.

Assess Their Expertise in Developing Customized Credit Policies

An effective outsourced CFO adapts credit policy to your unique business needs, your sales cycle, customer segments, and risk appetite. They design tailored credit terms, limits, and enforcement structures.

They integrate industry with best practices, compliance mandates, and align policies with strategic goals. This depth ensures your credit management strategies are not generic but precisely optimized for your operations and risk profile.

Verify Their Track Record in Improving Financial Health

Look for CFOs who have demonstrably transformed companies’ credit performance. Request past case studies showing improved cash flow, reduced bad debt, or optimized credit limits.

- Verified Improvement: E.g., “increased cash-on-hand by 20 % through tightened credit policy.”

- Documented Outcomes: Financial reports or references confirming results.

Ensure Strong Analytical and Negotiation Skills

A savvy outsourced CFO combines analytical rigor—interpreting credit metrics and market data; with negotiation finesse.

- Analytical Capability: Ability to evaluate DSO trends, aging reports, and forecast impacts.

- Negotiation Skill: Can renegotiate terms or credit limits with clients.

Confirm Their Alignment with Your Financial Goals

Your outsourced CFO should fully understand and align with your long-term financial ambitions, whether rapid growth, stable liquidity, or gearing for investment. They assess your business model, stage, and cash flow patterns, and tailor credit strategies accordingly.

Conclusion: Enhancing Financial Stability Through Improved Credit Management

Strengthening your credit infrastructure with an outsourced CFO offers more than just polished financial reports. By choosing to improve credit management through expert oversight, you reduce financing roadblocks, solidify relationships with lenders, and open doors for growth.

Ready to amplify your credit control and liquidity strategy? Schedule a complimentary consultation with NOW CFO’s finance team today, take the next confident step toward financial strength.