Many SMEs struggle with financial planning. According to the U.S. Bank, 82% of business failures are due to poor cash flow management, making financial accuracy helpful and mission-critical. When internal forecasting processes fall short, errors compound, funding becomes uncertain, and opportunities slip by.

That’s where an outsourced CFO for financial modeling & forecasting steps in. With deep experience, advanced tools, and unbiased insight, outsourced CFOs can build models that help you plan, avoid financial pitfalls, and respond swiftly to market shifts.

The Importance of Financial Modeling and Forecasting

Financial modeling and forecasting are indispensable tools for organizations that navigate uncertainties and make informed decisions. By leveraging these techniques, businesses can anticipate future financial conditions, allocate resources efficiently, and align strategies with market realities.

Defining Financial Modeling and Forecasting

Business financial modeling involves constructing abstract representations of a company’s financial performance, typically through spreadsheets, to evaluate the impact of various scenarios on revenue, expenses, and profitability.

On the other hand, forecasting predicts future financial outcomes based on historical data, trends, and assumptions. These practices enable businesses to plan strategically, assess risks, and set realistic financial goals.

Why Forecasting Matters in Today’s Business Environment

Forecasting is pivotal in helping businesses anticipate market trends, manage cash flows, and make proactive decisions. Accurate forecasts allow companies to stay ahead of the curve in an era of rapid technological advancements and economic volatility.

For instance, a study by HBS highlights that financial forecasting informs critical hiring, budgeting, and strategic planning decisions, ensuring an organization’s forward-focused mindset.

Common Pitfalls in Internal Forecasting Processes

Despite its importance, internal forecasting is fraught with challenges that can compromise its accuracy and reliability.

- Overreliance on Historical Data: Many organizations depend heavily on past performance, neglecting external factors like market shifts or emerging competitors.

- Lack of Standardized Processes: Inconsistent methodologies across departments can lead to fragmented forecasts that are difficult to consolidate.

- Cognitive Biases: Personal biases and optimistic projections can skew forecasts, leading to unrealistic expectations.

- Inadequate Tools and Technology: Relying on outdated software or manual processes hampers the ability to analyze data effectively and adapt to changes swiftly.

The Link Between Financial Modeling and Strategic Decision Making

Financial modeling serves as a bridge between raw data and strategic decision-making. By simulating various economic scenarios, businesses can evaluate potential outcomes and make informed choices.

| Strategic Decision | Role of Financial Modeling |

|---|---|

| Investment Planning | Building long-range financial models to assess ROI and plan capital allocation. |

| Budgeting and Forecasting | Projecting revenues and expenses to set financial targets |

| Risk Management | Identifying financial vulnerabilities and stress-testing scenarios |

| Mergers and Acquisitions | Evaluating the financial impact of potential deals |

| Performance Monitoring | Tracking KPIs and adjusting strategies accordingly |

When Businesses Should Prioritize Forecasting

Recognizing the right moments to emphasize forecasting is crucial for maintaining financial health and achieving long-term objectives.

- During Rapid Growth Phases: To ensure scalability and manage increased operational demands.

- Before Major Investments: To evaluate potential returns and align with financial capabilities.

- In Times of Economic Uncertainty: To prepare contingency plans and mitigate risks.

- For Annual Budgeting Cycles: To set realistic financial goals and allocate resources effectively.

When entering new markets, it is vital to understand market dynamics and forecast demand accurately.

How an Outsourced CFO Enhances Financial Modeling

Engaging an outsourced CFO for financial modeling and forecasting transforms a company’s financial planning capabilities. Businesses can develop robust forecasting solutions that drive strategic decisions by leveraging specialized expertise.

Assessing Existing Financial Processes

An outsourced CFO begins by conducting a comprehensive evaluation of current financial operations. This includes reviewing accounting systems, financial reports, and internal controls to identify inefficiencies and areas for improvement. By understanding the existing framework, the CFO can tailor solutions that align with the company’s objectives.

Creating Dynamic and Scenario-Based Models

Developing dynamic financial models allows businesses to simulate various scenarios and assess potential outcomes. An outsourced CFO employs advanced modeling techniques to create flexible models that adapt to changing market conditions.

Key components of dynamic modeling include:

- Revenue projections

- Expense forecasting

- Cash flow analysis

- Break-even analysis

- Sensitivity analysis

Using Industry Benchmarks to Inform Projections

Incorporating industry benchmarks into financial models provides a comparative framework to assess performance. An outsourced CFO utilizes data from similar companies to set realistic targets and identify areas for improvement.

Leveraging Financial Software for Model Automation

Automation streamlines the financial modeling process, reducing manual errors and increasing efficiency. An outsourced CFO integrates advanced financial software to automate data collection, analysis, and reporting.

Benefits of leveraging financial software include:

- Real-time data access

- Enhanced accuracy

- Scalability

- Time savings

Modern financial forecasting tools also support dashboard visualization, scenario planning, and integrated real-time analytics.

Providing Strategic Assumptions and Sensitivity Analysis

An outsourced CFO brings a strategic perspective to financial modeling by incorporating well-informed assumptions and conducting sensitivity analyses. This process involves evaluating how changes in variables such as market conditions, pricing strategies, or cost structures affect financial outcomes.

Key aspects include:

- Assumption Development: Establishing realistic and data-driven assumptions for model inputs.

- Scenario Testing: Analyzing best-case, worst-case, and most likely scenarios.

- Risk Assessment: Identifying potential financial risks and their impact on the business.

Developing Investor-Ready Financial Models

Preparing for investment requires clear and compelling financial models demonstrating the company’s potential. An outsourced CFO crafts investor-ready models highlighting key metrics, growth projections, and financial strategies. These models are essential for securing funding and building investor confidence.

Forecasting Capabilities of an Outsourced CFO

Partnering with an outsourced CFO for financial modeling & forecasting equips businesses with advanced forecasting techniques, enabling them to navigate financial complexities with agility and precision.

Rolling Forecasts and Real-Time Updates

Unlike static annual budgets, rolling forecasts provide a continuous planning horizon, allowing businesses to update their financial projections regularly. This dynamic approach enables companies to respond swiftly to market changes and internal shifts.

Strategic forecasting with a virtual CFO ensures continuous optimization of financial plans in response to evolving business conditions.

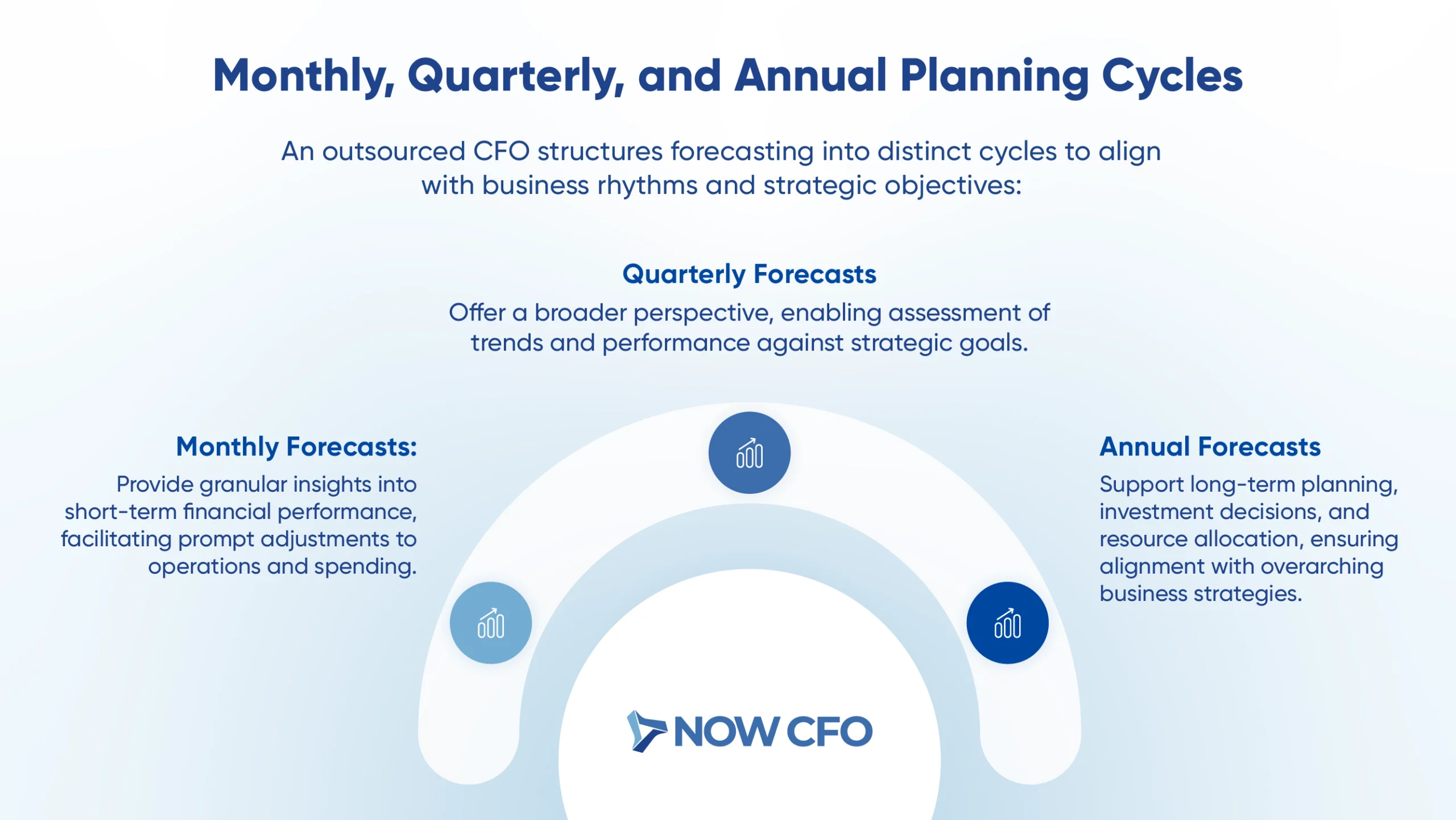

Monthly, Quarterly, and Annual Planning Cycles

An outsourced CFO structures forecasting into distinct cycles to align with business rhythms and strategic objectives:

- Monthly Forecasts: Provide granular insights into short-term financial performance, facilitating prompt adjustments to operations and spending.

- Quarterly Forecasts: Offer a broader perspective, enabling assessment of trends and performance against strategic goals.

- Annual Forecasts: Support long-term planning, investment decisions, and resource allocation, ensuring alignment with overarching business strategies.

Cash Flow Forecasting for Financial Health

An outsourced CFO plays a crucial role in modeling cash flow projections, which helps companies better manage liquidity and avoid shortfalls. Effective cash flow forecasting is essential for maintaining financial stability.

Forecasting Revenue Under Market Uncertainty

Forecasting revenue becomes challenging yet essential in volatile markets. Leveraging predictive financial analysis, outsourced CFOs can assess risks and uncover trends that might otherwise go unnoticed.

An outsourced CFO employs advanced techniques, such as scenario analysis and predictive modeling, to estimate revenue under varying market conditions.

Aligning Forecasting with Budgeting & Business Goals

Aligning forecasting with budgeting ensures financial plans are grounded in realistic projections and support strategic objectives. An outsourced CFO for budgeting and projections ensures alignment by integrating forecasting data into strategic financial plans.

Creating Forecasts for Fundraising and Investor Updates

For businesses seeking investment, robust financial forecasts are indispensable. An outsourced CFO prepares detailed projections that:

- Demonstrate the company’s growth potential and financial viability.

- Provide transparency and build investor confidence.

- Support valuation discussions and funding negotiations.

- Offer CFO support for investor reporting, ensuring data is audit-ready and aligned with investor expectations

Strategic Benefits of Outsourcing CFO Services

Engaging an outsourced CFO for financial modeling & forecasting offers businesses a range of strategic advantages, from cost savings to enhanced operational focus. Partnering with an outsourced finance team offers access to a diverse pool of financial professionals, providing broader expertise than a single hire.

The benefits of outsourcing CFO for forecasting include enhanced financial clarity, improved cash flow insights, and cost-effective strategic planning.

Cost-Efficiency vs. Hiring a Full-Time CFO

One of the primary considerations for businesses is the cost implication of hiring a full-time CFO versus outsourcing the role. The following table provides a comparative overview:

| Aspect | Full-Time CFO | Outsourced CFO |

|---|---|---|

| Annual Salary | $300,000 – $400,000 | $40,000 – $100,000 |

| Benefits & Overheads | An additional 20-30% of the salary | Minimal to none |

| Flexibility | Fixed schedule | Scalable hours based on need |

| Expertise Range | Company-specific experience | Diverse industry experience |

| Commitment | Long-term, full-time | Project-based or part-time |

On-Demand Access to Senior-Level Expertise

An outsourced CFO provides businesses with immediate access to seasoned financial professionals with a wealth of experience across various industries. This on-demand model ensures that companies can tap into strategic financial guidance precisely when needed, without the delays associated with traditional hiring processes.

These experts often act as financial strategy consultants, bringing operational financial advice and strategic insights that align with long-term growth goals.

Cross-Industry Insights to Guide Financial Strategy

Outsourced CFOs often work with clients across multiple sectors, allowing them to bring a broad perspective to financial strategy. This cross-industry experience enables creative approaches to economic challenges and opportunities.

Scalability as Business Needs Change

As businesses evolve, their financial management needs can fluctuate. An outsourced CFO offers the scalability to adjust services in line with these changing requirements:

- Growth Phases: During periods of expansion, the CFO can increase involvement to support strategic planning and capital raising.

- Downturns: In challenging times, services can be scaled back to focus on cost control and cash flow management.

- Project-Based Needs: The CFO’s role can be tailored to specific initiatives like system implementations or audits.

With a scalable finance infrastructure, businesses can expand operations without overhauling their financial systems.

Enhanced Focus on Core Business Operations

By delegating financial management to an outsourced CFO, business leaders can concentrate on core operations without being bogged down by complex financial tasks. Key areas where this focus is beneficial include:

- Product Development: Allocating more time to innovation and improving offerings.

- Customer Engagement: Enhancing relationships and service delivery.

- Market Expansion: Exploring new markets and growth opportunities.

Support During Mergers, Funding, or Restructuring

Successful corporate events require specialized financial expertise. An outsourced CFO plays a critical role in:

- M&A: Conducting due diligence, financial modeling, and integration planning.

- Fundraising: Preparing investor-ready financial statements and forecasts.

- Restructuring: Developing turnaround strategies and managing stakeholder communications.

This level of involvement goes beyond financial modeling; outsourced CFOs also deliver outsourced strategic advisory services critical during significant organizational change.

Learn More: Outsourced CFO Vs. In-House CFO

How NOW CFO Supports Financial Modeling & Forecasting

Partnering with an outsourced CFO for financial modeling & forecasting through NOW CFO provides businesses with tailored solutions that enhance financial clarity and strategic planning. Our comprehensive services are designed to address each client’s unique needs, ensuring accurate forecasting and informed decision-making.

Custom Model Creation for Your Business Type

NOW CFO specializes in developing financial modeling for small businesses and large enterprises, tailoring models to each company’s goals. Whether a startup seeks investor funding or an established company plans for expansion, our models incorporate relevant industry data and business dynamics.

This personalized approach ensures that financial projections are realistic and actionable, supporting effective strategic financial planning.

Expert-Led Financial Forecasting Workshops

To empower clients with the knowledge and tools necessary for effective forecasting, NOW CFO offers expert-led workshops that cover key aspects of financial planning:

- Understanding Financial Statements: Interpreting income, balance sheets, and cash flow statements to assess financial health.

- Scenario Analysis: Evaluating potential business scenarios and their financial implications to prepare for uncertainties.

- Budgeting Techniques: Developing budgets that align with strategic goals and adjusting them based on performance metrics.

Ongoing CFO Support and Reporting Services

Beyond initial model creation and workshops, we provide continuous support through regular financial reporting and analysis. This includes monthly and quarterly reports that track performance against forecasts, identify variances, and recommend corrective actions.

Such ongoing engagement ensures businesses remain aligned with our financial objectives and adapt effectively to changing conditions. With its ongoing reporting structure, NOW CFO’s approach is rooted in fractional CFO financial planning, offering scalable, executive-level guidance without the full-time overhead.

Technology Integration and Data Migration

Recognizing the importance of technology in modern financial management, NOW CFO assists clients in integrating advanced financial software and migrating existing data:

- Software Implementation: Selecting and deploying financial tools that enhance forecasting accuracy and efficiency.

- Data Consolidation: Merging historical and current financial data into unified systems to provide comprehensive insights.

Forecasting for Seasonal and Growth-Based Industries

NOW CFO’s expertise extends to industries with seasonal fluctuations and rapid growth trajectories. By analyzing historical trends and market indicators, we develop forecasts that account for:

- Seasonal Demand Variations: Adjusting projections to reflect peak and off-peak periods, ensuring optimal resource allocation.

- Growth Spurts: Scaling financial models to accommodate rapid expansion, including increased staffing, inventory, and capital expenditures.

Is Outsourced Financial Modeling the Right Move for You?

Determining whether to engage an outsourced CFO for financial modeling & forecasting hinges on recognizing specific indicators within your business operations. By identifying these signs, you can make informed decisions that align with your company’s strategic objectives.

Signs You Need Outside Financial Expertise

Recognizing the need for external financial expertise is crucial for business growth and stability. Understanding how outsourced CFOs help with planning can reveal gaps in your current financial strategies that are holding back growth.

- Inconsistent Cash Flow: If your business experiences fluctuating cash flow, it can hinder your ability to manage expenses and plan for the future. An outsourced CFO can develop strategies to stabilize cash flow and improve financial planning.

- Lack of Financial Planning: Operating without a comprehensive financial plan can lead to missed opportunities and unforeseen challenges. An outsourced CFO can assist in creating a financial roadmap that aligns with your business goals.

- Missed Financial Opportunities: Without the expertise to identify and capitalize on financial opportunities, your business may not reach its full potential. An outsourced CFO can provide insights to help you make informed decisions.

- Overwhelming Compliance Requirements: Navigating complex tax filings, audits, and compliance checks can be daunting. An outsourced CFO can manage these responsibilities, ensure compliance, and reduce risk.

- Rapid Business Growth: Experiencing swift growth without a solid financial foundation can lead to operational inefficiencies. Short-term leadership through interim CFO forecasting can provide immediate structure and oversight in such cases.

These signs indicate that leveraging outsourced CFO services can enhance your company’s financial health and strategic direction.

Questions to Ask Before Hiring an Outsourced CFO

Before engaging an outsourced CFO, assessing their suitability for your business needs is essential. Consider asking the following questions:

- What is your experience in our industry?

- How do you approach financial forecasting and modeling?

- Can you provide references from similar clients?

- What is your communication style and frequency?

- How do you ensure data security and confidentiality?

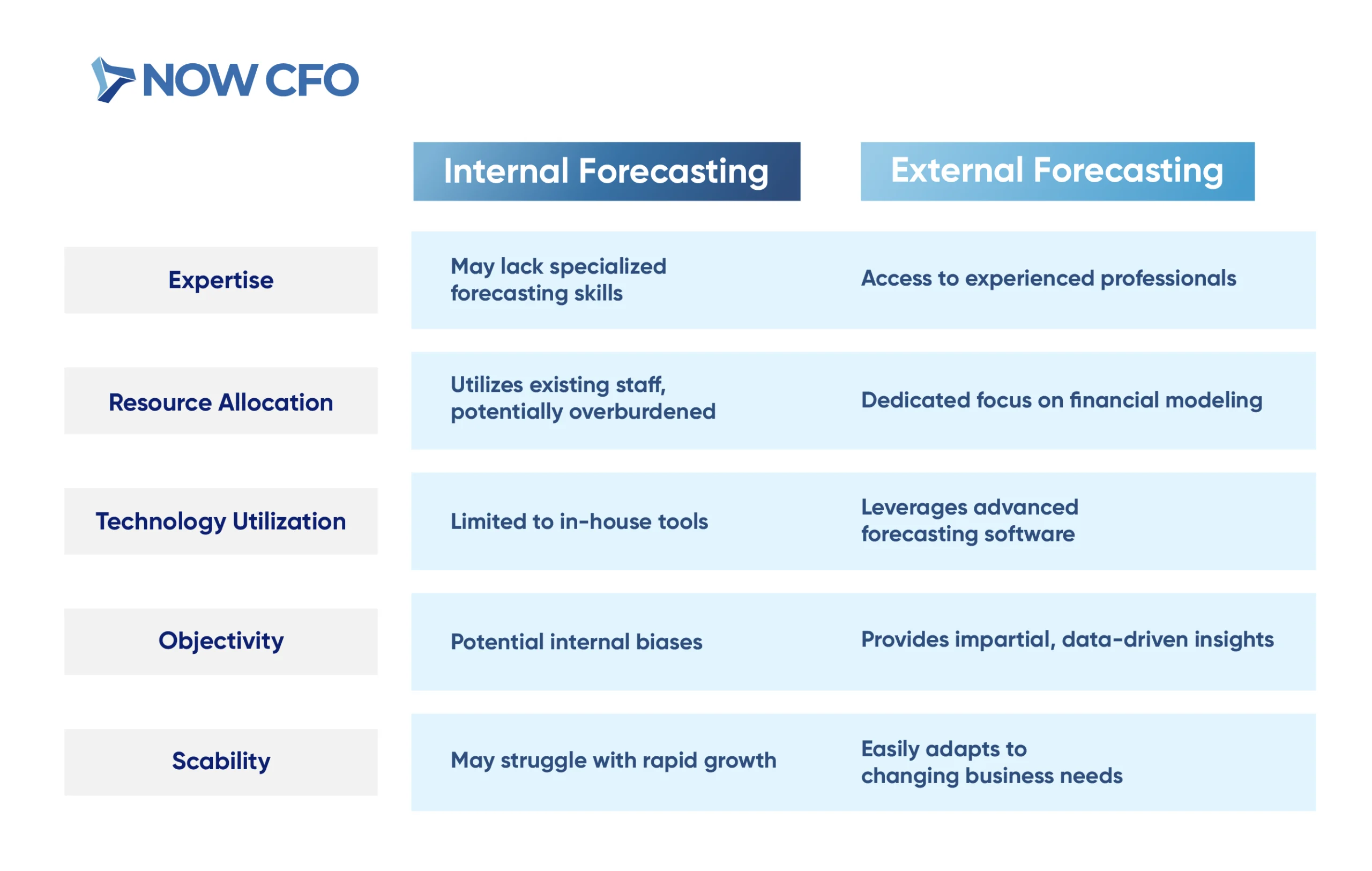

Comparing Internal vs. External Forecasting Capabilities

Evaluating the differences between internal and external forecasting can clarify the benefits of outsourcing.

How to Select the Right CFO Partner

Choosing the appropriate CFO partner is critical for achieving your financial goals. Consider the following factors:

- Industry experience

- Service scope

- Cultural fit

- Technology proficiency

- Communication skills

- References and testimonials

- Cost structure

- Flexibility

Preparing Your Team for a Smooth Transition

Integrating an outsourced CFO into your organization requires careful planning to ensure a seamless transition. Here are the steps to prepare your team:

- Clearly explain the reasons for outsourcing and the expected benefits to all stakeholders.

- Outline how the outsourced CFO will interact with existing team members to avoid confusion.

- Ensure the CFO has access to relevant financial data and systems.

- Set expectations for regular updates and meetings to maintain alignment.

- Foster a collaborative environment where internal staff and the outsourced CFO work towards common goals.

Conclusion: Unlock Smarter Growth Through Outsourced Forecasting

Partnering with an outsourced CFO for financial modeling & forecasting allows you to shift from reactive decision-making to proactive growth strategies. Whether managing uncertainty, seeking capital, or scaling operations, having the right financial expertise makes all the difference.

NOW CFO has helped thousands of businesses across industries implement transparent, scalable, and strategic financial models. Schedule a free consultation with our fractional CFOs to bring the depth of enterprise-level financial strategy on demand.