M&A are among the most powerful strategies a business can use to accelerate growth, enter new markets, or achieve competitive advantage. However, the path to a successful transaction is rarely straightforward.

Financial complexities, due diligence gaps, and integration challenges frequently derail deals. A report from HBS estimates that between 70% and 90% of M&A transactions fail to deliver their intended strategic goals.

Given these odds, executive teams can’t afford to treat the financial component of a deal as a secondary concern. That’s where an outsourced CFO for mergers & acquisitions becomes indispensable. Let’s deep dive into how an outsourced cfo supports mergers and acquisitions.

The Strategic Importance of a CFO in M&A

The CFO role in corporate transactions is more critical than ever. An outsourced CFO for M&A brings a wealth of expertise and strategic insight, ensuring that every financial aspect of the transaction is meticulously analyzed and aligned with the company’s overarching goals.

Acting as a Financial Advisor and Strategist

An outsourced CFO for M&A is a pivotal financial advisor, guiding businesses through the intricate M&A landscape. Their strategic oversight encompasses evaluating potential deals, forecasting financial outcomes, and ensuring each decision aligns with the company’s long-term objectives.

By leveraging their extensive experience, they provide invaluable insights that drive informed decision-making and enhance shareholder value creation.

Evaluating the Financial Health of Target Companies

A thorough assessment of a target company’s financial health is paramount in any M&A transaction. To identify potential red flags, an outsourced CFO examines financial statements, cash flow patterns, and debt structures.

Aligning M&A Objectives with Business Strategy

Ensuring that M&A objectives align seamlessly with the overarching business strategy is crucial for long-term success. An outsourced CFO plays a vital role in this alignment by:

- Assessing the strategic fit of the target company within the existing business model.

- Potential synergy analysis and growth opportunities that the acquisition presents.

- Analyzing the impact of the acquisition on the company’s financial health and operational efficiency.

Supporting Buy-Side vs. Sell-Side Perspectives

An outsourced CFO for buy-side and sell-side M&A adeptly navigates both sides of the table, tailoring their approach to meet each transaction’s specific financial, strategic, and reporting demands.

Offering Objective, Third-Party Insights

An outsourced CFO provides impartial, third-party insights invaluable during M&A transactions. Their external position allows them to:

- Offer unbiased evaluations of the target company’s financial health.

- Identify potential risks and opportunities without internal biases.

- Facilitate transparent communication between all stakeholders.

Pre-Deal Support: Due Diligence and Risk Mitigation

The pre-deal phase is pivotal. Engaging an outsourced CFO for mergers & acquisitions during this stage ensures meticulous due diligence and robust risk mitigation, laying a solid foundation for transaction success.

Understanding how an outsourced CFO supports M&A due diligence clarifies their critical role in uncovering financial inconsistencies and risk factors before a deal closes.

Analyzing Historical Financials and Red Flags

A comprehensive review of a target company’s financial history is essential. An outsourced CFO meticulously examines:

- Revenue Trends: Assessing consistency and growth over time.

- Expense Patterns: Identifying irregularities or unexpected spikes.

- Debt Obligations: Evaluating the structure and sustainability of existing debts.

- Asset Valuations: Ensuring assets are accurately valued and free from encumbrance.

- Contingent Liabilities: Uncovering potential obligations that may not be immediately apparent.

Verifying Revenue, Profitability, and Liabilities

Ensuring the accuracy of financial representations is crucial. An outsourced CFO undertakes:

- Revenue Verification: Cross-referencing reported revenues with customer contracts and payment records to confirm legitimacy.

- Profitability Analysis: Evaluate profit margins across product lines and market segments to identify sustainable income sources.

- Liability Assessment: Reviewing all liabilities, including off-balance-sheet items, to understand the full scope of financial obligations.

Assessing Working Capital and Cash Flow Dynamics

Effective management of working capital and cash flow is vital for operational stability. An outsourced CFO for mergers & acquisitions analyzes the target’s liquidity position, examining accounts receivable, inventory turnover, and accounts payable cycles. This assessment determines the company’s ability to meet short-term obligations and sustain operations post-acquisition.

Identifying Deal Risks and Hidden Liabilities

Uncovering potential risks and concealed liabilities is essential to avoid post-deal surprises. An outsourced CFO for M&A focuses on:

- Legal Exposures: Pending litigations or regulatory compliance issues.

- Environmental Liabilities: Obligations arising from environmental regulations or past violations.

- Tax Risks: Unsettled tax disputes or aggressive tax positions that may not withstand scrutiny.

- Contractual Obligations: Clauses in existing contracts that could be detrimental post-acquisition.

A significant benefit of engaging an outsourced CFO is their ability to drive CFO-led risk mitigation during acquisitions, identifying issues early, and helping stakeholders avoid costly missteps.

Preparing Financial Schedules and Due Diligence Checklists

Organized documentation is key to a smooth due diligence process. An outsourced CFO for mergers & acquisitions prepares:

- Comprehensive Financial Schedules: Detailed statements outlining historical financial performance.

- Due Diligence Checklists: Customized lists covering all necessary areas of investigation, including legal, operational, and financial aspects.

- Data Room Organization: Ensuring all relevant documents are readily accessible for review by stakeholders.

Collaborating with Legal, Tax, and Audit Partners

An outsourced CFO is a central coordinator, liaising with legal, tax, and audit professionals to ensure a cohesive due diligence process. This collaboration ensures that all aspects of the transaction are thoroughly examined and potential issues are addressed proactively, reducing the risk of post-deal complications.

Financial Modeling, Valuation & Deal Structure Analysis

An outsourced CFO plays a crucial role in financial modeling and forecasting during a merger, constructing pro forma models that integrate historical data with forward-looking assumptions to forecast revenue, expenses, and post-acquisition cash flows.

Building Pro Forma Financial Models

An outsourced CFO plays a crucial role in constructing pro forma financial models, essential for projecting a potential deal’s financial impact. These pro forma financials serve as a blueprint for projecting performance, aligning stakeholders on future expectations post-acquisition.

These models also include cash flow impact projections, helping stakeholders evaluate whether the deal supports long-term liquidity and operational goals. Outsourced CFO for merger & acquisitions simulates various scenarios and helps stakeholders understand potential outcomes and make informed decisions.

Performing EBITDA Adjustments and Forecasting

Accurate assessment of a company’s earnings is vital in M&A transactions. An outsourced CFO meticulously adjusts EBITDA to reflect the actual operating performance by excluding non-recurring, irregular, or non-operational items.

Supporting Negotiations with Financial Insights

An outsourced CFO provides invaluable financial insights during negotiations, ensuring that deal terms are grounded in solid financial rationale.

Key contributions include:

- Valuation Analysis: Assessing the target company’s worth using various valuation methods to determine a fair purchase price. Creating robust models to ensure a realistic and defensible purchase price based on forward-looking projections.

- Deal Structure Evaluation: Analyzing different deal structures to identify the most financially advantageous arrangement.

- Risk Assessment: Identify potential financial risks and propose mitigation strategies to protect the acquiring company.

Analyzing Synergies and Cost-Saving Opportunities

Identifying and quantifying synergies are a critical component of M&A planning. An outsourced CFO conducts thorough analyses to uncover areas where the combined entity can achieve cost savings and efficiency gains. Key areas of focus include:

- Operational Efficiencies: Streamlining processes and eliminating redundancies to reduce operating costs.

- Revenue Enhancements: Leveraging combined resources to increase sales and market share.

- Procurement Savings: Consolidating purchasing to negotiate better terms with suppliers.

Determining Optimal Deal Structures and Payment Terms

Structuring the deal appropriately is essential to balance risk and reward. An outsourced CFO evaluates various deal structures. Additionally, the CFO negotiates payment terms that align with the company’s cash flow capabilities and risk tolerance, ensuring financial stability post-transaction.

Advising on Financing Strategy and Capital Requirements

Securing the necessary financing and conducting effective capital structuring is critical in executing an M&A deal. An outsourced CFO assesses the transaction’s capital requirements and explores various financing options, including debt, equity, or hybrid instruments.

The CFO recommends a financing strategy that supports the company’s long-term financial health and strategic objectives by evaluating the cost of capital, repayment terms, and impact on financial ratios.

Post-Merger Integration Planning and Execution

Effective integration planning led by a CFO helps establish a structured roadmap for combining operations, financial systems, and policies. The role of CFO in merger and acquisition integration is fundamental, overseeing the financial alignment between merged entities while ensuring compliance, efficiency, and stability.

Consolidating Financial Systems and Reporting Processes

Integrating disparate financial systems is a complex yet essential task in post-merger scenarios. An outsourced CFO leads the consolidation of accounting platforms, ensuring that financial data from both entities is harmonized.

This process involves standardizing the chart of accounts, aligning reporting calendars, and unifying budgeting procedures. By establishing a cohesive financial infrastructure, the CFO enables accurate and timely reporting, crucial for informed decision-making and regulatory compliance.

Establishing New Internal Controls and Policies

Post-merger, it’s imperative to reassess and redesign internal controls to reflect the combined entity’s operational realities. An outsourced CFO evaluates existing control frameworks, identifies gaps, and implements robust risk mitigation policies.

This includes setting up approval hierarchies, segregation of duties, and compliance protocols. Such measures safeguard assets and instill confidence among stakeholders regarding the integrity of financial operations.

Managing Cash Flow and Working Capital Post-Deal

Ensuring liquidity and optimizing working capital are paramount after a merger. An outsourced CFO focuses on:

- Cash Flow Forecasting: Developing detailed projections to anticipate funding needs and avoid shortfalls.

- Receivables Management: Streamlining invoices and collections to accelerate cash inflows.

- Payables Optimization: Negotiating favorable terms with suppliers to manage outflows effectively.

Supporting HR, Payroll, and Benefits Transitions

Merging human resources functions requires careful planning and execution. An outsourced CFO collaborates with HR teams to integrate payroll systems, harmonize compensation structures, and align benefits programs.

This includes ensuring compliance with labor laws, managing employee data migration, and facilitating communication to address staff concerns. A smooth transition in these areas is vital for maintaining morale and productivity.

Ensuring Compliance and Regulatory Alignment

Navigating the regulatory landscape post-merger is complex. An outsourced CFO for mergers & acquisitions ensures adherence to applicable laws and standards by:

- Conducting Compliance Audits: Assessing the combined entity’s adherence to financial regulations.

- Updating Policies: Revising internal policies to reflect new regulatory requirements.

- Training Staff: Educating employees on compliance obligations and ethical practices.

Providing Ongoing CFO-Level Financial Oversight

Beyond initial integration, sustained financial leadership is essential. An outsourced CFO offers continuous oversight by monitoring financial performance, advising on strategic investments, and refining financial processes. This ongoing involvement ensures the merged entity remains agile, compliant, and positioned for long-term success.

Benefits of Using an Outsourced CFO for M&A

Leveraging the expertise of an outsourced CFO offers a multitude of strategic advantages. These benefits encompass flexibility, specialized knowledge, objective insights, enhanced efficiency, cost-effectiveness, and scalability, all of which are pivotal for successful transactions.

Flexibility Without Long-Term Commitment

Engaging an outsourced CFO allows businesses to access high-level financial expertise on a project-by-project basis. This arrangement eliminates the need for long-term employment contracts, allowing companies to tailor the CFO’s involvement to the specific demands of each M&A deal.

Access to Specialized M&A Expertise

An outsourced CFO brings a wealth of specialized knowledge, honed through diverse transactional experiences across various industries. This expertise encompasses critical areas such as M&A due diligence, financial modeling for mergers, and M&A valuation consulting.

Objective, Unbiased Advice

The impartiality of an outsourced CFO for mergers & acquisitions is invaluable during M&A processes. The CFO provides candid assessments and recommendations free from internal politics and vested interests, focusing solely on the transaction’s success.

Enhanced Transaction Speed and Accuracy

An outsourced CFO’s proficiency in handling complex financial tasks accelerates the M&A timeline. Their expertise often mirrors high-level transaction advisory services, offering critical financial guidance without the hefty fees of large M&A firms.

Reduced Cost Compared to Full-Time Executive Hire

Opting for an outsourced CFO is a cost-effective alternative to hiring a full-time executive. Businesses can access top-tier financial expertise without incurring expenses related to salaries, benefits, and long-term commitments.

Scalability for Future Deals

The services of an outsourced CFO are inherently scalable, adapting to the evolving needs of a business. Whether managing a single acquisition or overseeing multiple transactions, the CFO can adjust their involvement accordingly.

This scalability ensures consistent financial oversight and strategic guidance, supporting sustained growth and facilitating seamless transitions during successive M&A activities.

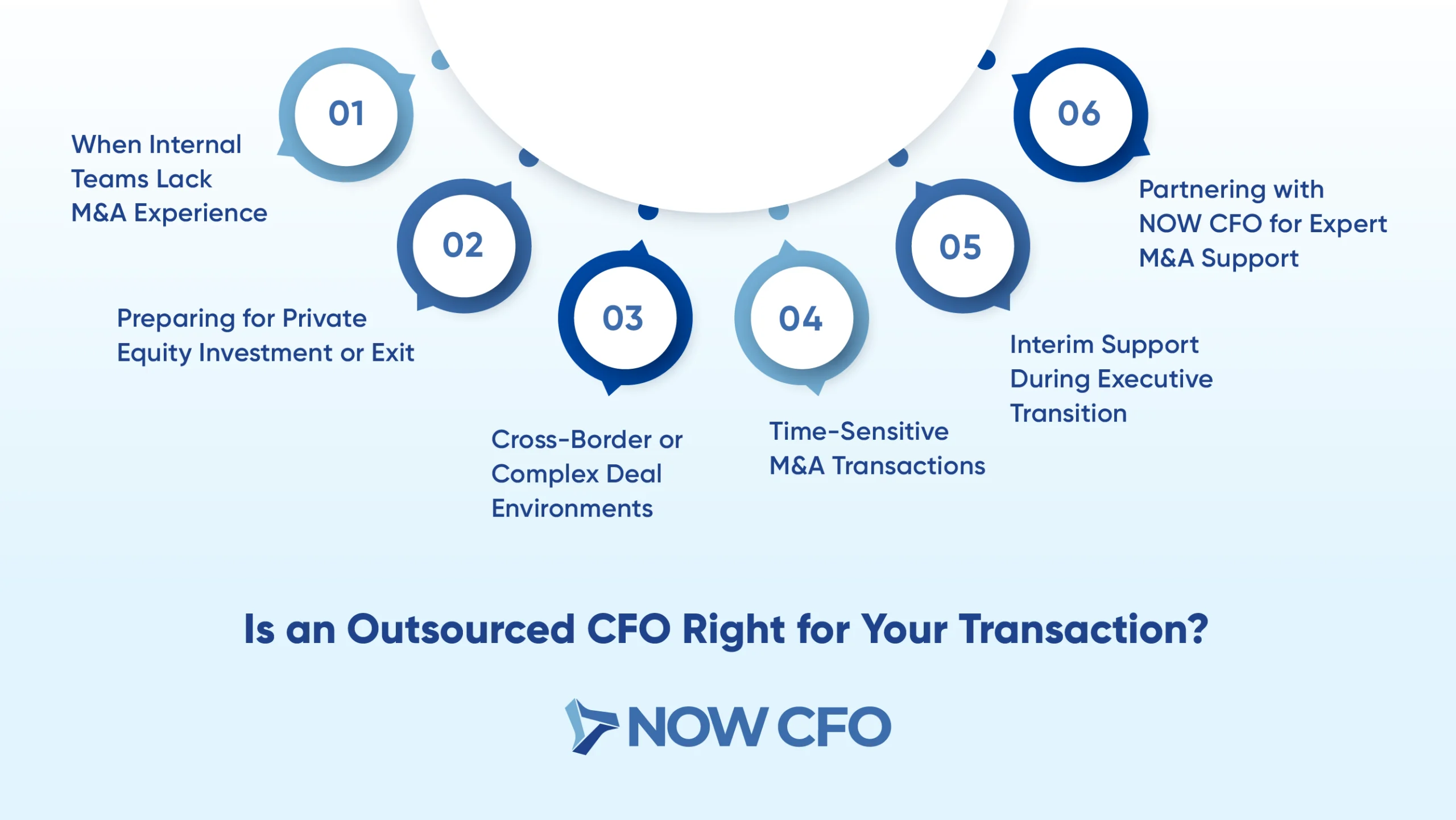

Is an Outsourced CFO Right for Your Transaction?

Determining whether an outsourced CFO suits your transaction hinges on several critical factors. This section delves into scenarios where engaging such expertise can be particularly advantageous.

When Internal Teams Lack M&A Experience

Navigating the complexities of M&A requires specialized knowledge that internal teams may lack. An outsourced CFO brings seasoned expertise in M&A due diligence, financial modeling for mergers, and post-merger integration finance, ensuring that all financial aspects are meticulously managed.

Preparing for Private Equity Investment or Exit

Engaging an outsourced CFO is particularly beneficial when preparing for private equity investment or planning an exit strategy. Their proficiency in M&A valuation consulting and strategic CFO services for acquisitions ensures that your company is accurately valued and positioned attractively to potential investors.

Cross-Border or Complex Deal Environments

Cross-border M&A transactions introduce additional layers of complexity, including varying regulatory landscapes, cultural differences, and currency risks. An outsourced CFO adept in outsourced finance support for M&A can navigate these challenges, ensuring compliance and strategic alignment across jurisdictions.

Time-Sensitive M&A Transactions

In scenarios where time is of the essence, such as competitive bidding situations or distressed sales, the agility of an outsourced CFO becomes a significant asset. They have the ability to swiftly conduct M&A due diligence, develop financial modeling for mergers, and provide immediate strategic insights.

Interim Support During Executive Transition

During periods of executive transition, maintaining financial stability is paramount. An outsourced CFO for M&A offers interim leadership, ensuring continuity in financial operations and strategic planning. Their involvement reassures stakeholders and maintains momentum in ongoing M&A activities, bridging the gap until a permanent executive is in place.

Partnering with NOW CFO for Expert M&A Support

Engaging with NOW CFO ensures access to top-tier outsourced CFO M&A support. Our team of seasoned professionals specializes in strategic CFO services for acquisitions, offering tailored solutions that align with your company’s unique needs.

Conclusion: Elevate M&A Success with Strategic CFO Leadership

The financial stakes of an M&A deal are too high to rely solely on internal resources or generalist advisors. An outsourced CFO for mergers & acquisitions brings deep transactional experience and an unbiased perspective, helping organizations make data-driven decisions at every stage.

If your business is considering a merger, acquisition, or private equity transition, it’s time to equip your leadership team with the needed expertise. NOW CFO offers tailored M&A support, delivering strategic outsourced CFO services that align with your business goals and transaction timelines.