Outsourced CFOs and the Power of Financial Modeling

Financial modeling empowers businesses to counter uncertainty with clarity. By constructing versatile financial models, outsourced CFOs transform raw data into strategic roadmaps that drive data-driven decision-making.

Of the SMEs that applied with CDFIs, 88% secured at least some financing, illustrating how robust financial planning enhances access to capital. Embracing financial planning and analysis, companies can optimize budgets, perform scenario analysis, and evaluate the benefits of financial modeling for businesses.

What is Financial Modeling and Why is it Important?

Before examining specific applications, it’s essential to ground our discussion in a clear definition of financial modeling and understand its pivotal role in strategic planning.

Defining Financial Modeling in Business

Financial modeling is the construction of abstract representations of a company’s financial performance using quantitative methods. Financial modeling integrates accounting data, market assumptions, and statistical techniques to forecast revenues, expenses, and cash flows.

According to BLS, employment of financial analysts, key model builders is projected to grow 9% from 2023 to 2033, much faster than average. An effective model becomes a decision-making engine, illuminating paths to optimizing working capital, evaluating investment opportunities, and assessing growth strategies.

The Role of Financial Modeling in Financial Planning and Decision-Making

Effective CFO financial modeling strategies emphasize integrating robust models into ongoing planning cycles. Financial models serve three primary functions:

- Forecast Accuracy: Enhances budgeting and financial forecasting precision, reducing variance between projected and actual results.

- Scenario Analysis empowers leaders to test “what-if” cases, examining the best, worst, and most likely outcomes, to inform risk mitigation.

- Strategic Alignment: Aligns capital allocation with growth objectives, ensuring resources drive the highest returns.

Learn More: Cash Flow Optimization: Tips from an Outsourced CFO

Types of Financial Models Used by Outsourced CFOs

Building on our understanding of financial Modeling, outsourced CFOs deploy specialized frameworks to translate assumptions into actionable forecasts. These business financial models underpin robust financial planning and analysis, guiding capital allocation and risk management across diverse scenarios.

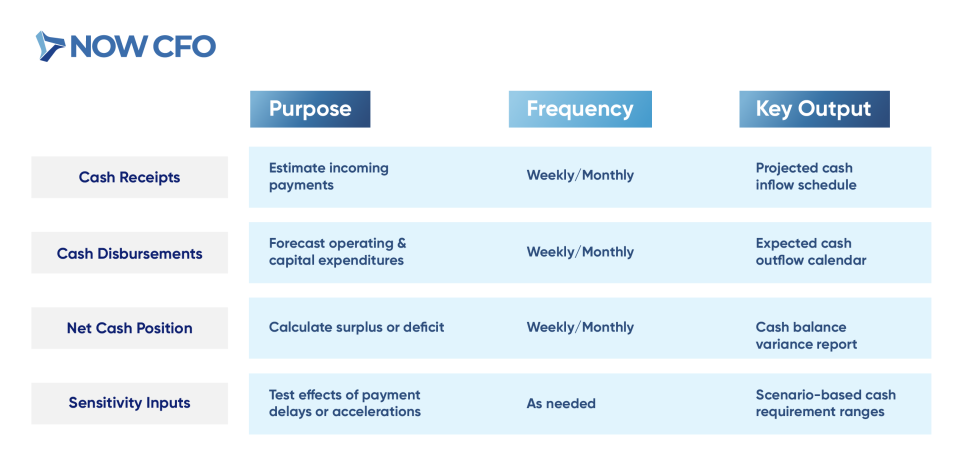

Cash Flow Forecasting Models

Outsourced CFOs create dynamic cash flow forecasting models to map inflows and outflows over time, ensuring businesses maintain adequate liquidity. By projecting receipts, disbursements, and timing gaps, CFOs anticipate shortfalls and optimize working capital.

Budgeting and Financial Planning Models

CFOs leverage budgeting models to align resources with strategic goals, layering expense categories against revenue drivers. These models enable iterative planning cycles, comparing actual results against budgets and refining forecasts.

| Budget Element | Planning Focus | Review Cycle | Decision Support |

|---|---|---|---|

| Revenue Drivers | Sales volumes, pricing strategies | Quarterly | Revenue variance analysis |

| Fixed Costs | Rent, salaries, utilities | Quarterly | Break-even and cost-control measures |

| Variable Costs | Materials, commissions | Quarterly | Margin enhancement opportunities |

| Capital Expenditures | Investments in equipment & technology | Annual | ROI and payback period calculations |

These financial planning and analysis models underpin strategic budgeting, enabling CFOs to adapt spending and investments as market conditions evolve.

Valuation and Investment Models

Valuation models estimate enterprise value using DCF, comparable, or precedent transactions. CFOs calculate free cash flows, apply appropriate discount rates, and perform sensitivity tests on terminal value assumptions. Investment models assess IRR and NPV for potential projects, guiding capital expenditure decisions.

Scenario and Sensitivity Analysis Models

Scenario models allow CFOs to simulate best-case, base-case, and worst-case outcomes by altering key assumptions such as growth rates, cost inflation, and financing terms.

Sensitivity analysis isolates individual drivers, like price changes or margin shifts, to quantify their impact on financial metrics, strengthening risk mitigation strategies.

Merger and Acquisition (M&A) Financial Models

When evaluating M&A opportunities, outsourced CFOs:

- Develop pro forma financial statements reflecting combined entities.

- Model purchase price allocations, goodwill, and tax impacts.

- Analyze accretion/dilution effects on EPS and cash flow.

- Stress-test integration scenarios to ensure post-deal synergies.

These types of financial models ensure stakeholders understand transaction value and risks before execution.

Learn More: CFOs and the Role of Financial Analytics

The Power of Financial Modeling in Business Growth

Having explored core model types, it’s clear that financial modeling drives tangible growth outcomes. Below, we examine how financial forecasting, scenario analysis, and data-driven decision-making empower companies to scale, adapt, and thrive.

Helping Businesses Forecast Future Performance

Outsourced CFOs employ cash flow forecasting and rolling forecasts to predict revenue streams and working capital needs precisely. They generate dynamic projections that adapt to real-time inputs by integrating historical data and market trends.

Accurate forecasts reduce variance between plan and reality, guiding timely pricing, inventory, and staffing adjustments. Over 48% of organizations use rolling forecasts to steer operations and financial plans, underscoring forecasting’s role in resilience and agility.

Source: American Journal of Business Education

Supporting Strategic Decision-Making with Data-Driven Insights

Connecting robust forecasts to high-level strategy, outsourced CFOs turn models into decision engines:

- Performance Dashboards: Visualize KPIs, such as revenue growth, margin trends, and cash conversion, to track strategy execution.

- Driver Analysis: Decompose revenue into volume, price, and mix to pinpoint growth levers.

- Investment Prioritization: Rank projects by NPV and IRR to allocate capital where it yields the highest returns.

These business financial models infuse data-driven decision-making into boardroom discussions, aligning financial plans with strategic ambitions.

Optimizing Resource Allocation and Capital Structure

To maximize ROI, CFOs leverage models that test financing mixes—debt versus equity—and capital deployment:

- Capital Budgeting Models: Evaluate CapEx proposals by forecasting cash flows and payback periods.

- Debt Capacity Analysis: Assess interest coverage ratios and covenant headroom for optimal leverage.

- Working Capital Optimization: Simulate receivables, payables, and inventory scenarios to free up cash.

This CFO financial modeling strategy ensures resources target high-impact initiatives while maintaining a healthy balance sheet.

Identifying Potential Risks and Opportunities

With scenario analysis, outsourced CFOs stress-test assumptions across multiple futures:

- Downside Scenarios: Model revenue shocks, cost inflation, or supply disruptions to gauge cash-burn rates.

- Upside Scenarios: Simulate market share gains or product launches to forecast incremental profits.

- Sensitivity Analysis: Vary one driver, price or volume, to quantify its effect on EBITDA and cash flow.

Such scenario analysis pinpoints vulnerabilities and uncovers upside potential, enabling proactive risk management.

Enhancing Long-Term Financial Planning and Strategy

Over multi-year horizons, CFOs build integrated models linking income statements, balance sheets, and cash flows. These strategic roadmaps incorporate growth targets, capital raises, and dividend policies.

By projecting ten-year horizons, companies align long-term financial planning with corporate vision, ensuring sustainable growth, robust liquidity, and shareholder value creation.

Learn More: Working Capital Management

How Outsourced CFOs Leverage Financial Modeling for Success

Transitioning from growth levels to execution, outsourced CFOs apply the power of financial modeling across processes, ensuring forecasts evolve into precise, strategic actions that drive performance.

Using Financial Models to Create Accurate Projections

Outsourced CFOs construct detailed projections by linking historical financials with forward-looking assumptions. They calibrate revenue drivers: pricing, volume, and seasonality, and model cash flow forecasting to predict liquidity needs.

These models integrate financial planning and analysis tools to update forecasts as new data arrives, reducing variance between projected and actual results. By embedding sensitivity checks, CFOs refine assumptions, enhancing projection accuracy and enabling proactive capital management.

In FY2023, small businesses in SBA’s 7(j) program achieved a 60% contract win rate, reflecting improved forecasting and planning capabilities. Those same businesses reported 45% average annual revenue growth, demonstrating the return on precise projection models.

Analyzing Different Business Scenarios for Strategic Insights

Connecting projections to decision frameworks, CFOs employ scenario analysis to stress-test plans under varied conditions:

- Base-Case Scenario: Uses management’s most likely assumptions for sales growth and cost trends.

- Upside Scenario: Models aggressive market penetration, higher financial forecasting accuracy, and improved margins.

- Downside Scenario: Simulates economic downturns, supply-chain disruptions, or pricing pressure.

Integrating Financial Models into Business Decision-Making Processes

To embed business financial models into operations, CFOs:

- Dashboard Integration: Link models to real-time dashboards, visualizing KPIs like cash conversion cycle and EBITDA variance.

- Decision Gates: Require model-backed justification for capex, hiring, or pricing changes.

- Board Reporting: Standardized model outputs inform executive and investor discussions.

Customizing Financial Models to Meet Business-Specific Goals

CFOs tailor financial modeling frameworks to unique firm objectives:

- Growth-Stage Startups: Emphasize burn-rate projections and fundraising milestones.

- Mature Companies: Focus on dividend policies, debt-service capacity, and scenario analysis for new product lines.

- Industry-Specific Drivers: Incorporate metrics like same-store sales for retailers or utilization rates for service firms.

Adjusting Financial Models as Market and Business Conditions Change

Outsourced CFOs routinely revise models to reflect evolving realities. They update assumptions for interest rates, commodity prices, or regulatory shifts, recalibrate growth forecasts, and re-run sensitivity analysis on key drivers.

This agility preserves model relevance, ensuring the financial modeling continues to inform strategic pivots and maintain competitive advantage.

Learn More: Outsourced CFO Services for Budgeting and Forecasting

Key Benefits of Financial Modeling for Business Leaders

With precise growth mechanics defined, business leaders harness the financial modeling to realize tangible advantages. Below, we explore how financial planning and analysis deliver clarity, precision, and strategic alignment.

Clearer Understanding of Financial Health and Performance

By constructing integrated business financial models, outsourced CFOs offer leaders a panoramic view of balance sheets, income statements, and cash flows. These models dissect profitability drivers, so executives grasp underlying trends.

With scenario overlays, companies visualize how shifts in pricing or volume ripple through liquidity and equity. This heightened transparency empowers stakeholders to spot efficiency gaps and monitor covenant compliance.

Improved Accuracy in Forecasting and Budgeting

Connecting financial clarity to precision planning, outsourced CFOs embed rigorous statistical methods into budgets:

| Metric | Pre-Model Variance | Post-Model Variance | Improvement (%) |

|---|---|---|---|

| Annual Revenue Forecast | ±12.5% | ±3.0% | 76% |

| Operating Expense Budget | ±15.0% | ±4.2% | 72% |

| Cash Flow Projection | ±18.0% | ±5.5% | 69% |

Enhanced Ability to Evaluate Business Scenarios and Opportunities

Outsourced CFOs strengthen decision agility by layering “what-if” analyses into models. Leaders compare expansion plans, new product launches, or pricing changes on metrics like NPV and IRR.

Better Preparedness for Uncertainty and Market Fluctuations

Through stress-testing and sensitivity matrices, financial models reveal how external shocks affect liquidity and solvency. CFOs set trigger thresholds for covenant breaches and cash reserves, ensuring rapid response protocols.

Stronger Alignment Between Financial Strategy and Business Goals

Outsourced CFOs embed financial metrics into corporate scorecards by translating strategic objectives into quantifiable targets. This alignment guarantees that budgeting, investment, and operational plans drive toward common goals.

The outcome is the seamless integration of financial strategy with growth ambitions, anchoring day-to-day decisions based on financial modeling.

Learn More: Benefits of hiring an outsourced CFO

How to Implement Financial Modeling in Your Business with an Outsourced CFO

To translate modeling power into practice, outsourced CFOs guide companies through a structured implementation process. Below, we outline the five critical steps to embed financial modeling into your operations and strategic planning.

Identifying Key Financial Metrics and Business Goals

First, the CFO collaborates with leadership to pinpoint key performance Indicators, revenue growth rates, gross margin percentages, and cash‐conversion cycles that align with corporate objectives. They then set targets for metrics such as:

- Revenue Growth Rate: Annual percentage increase benchmark.

- EBITDA Margin: Operating profitability goal.

- Working Capital Turnover: Days sales outstanding vs. days payables outstanding.

- Debt Service Coverage Ratio: Minimum covenant threshold.

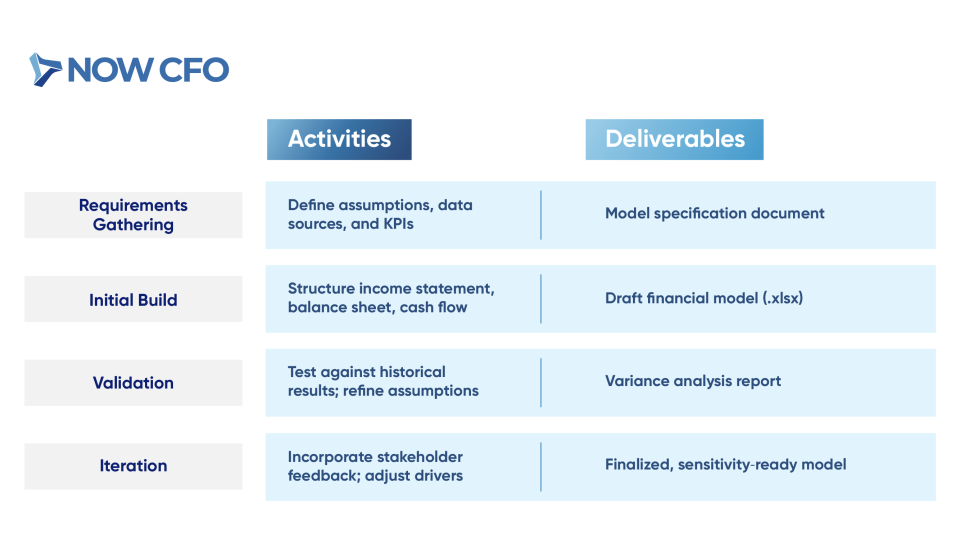

Collaborating With the CFO to Build and Refine Financial Models

Once metrics are set, the outsourced CFO leads model development in partnership with finance teams:

Using Financial Models to Guide Strategic Planning and Decision-Making

With a validated model, CFOs translate numbers into action plans. They run scenarios, launching new products, entering markets, or adjusting pricing. These business financial models inform board‐level discussions, ensure resource allocation aligns with growth strategies, and embed data‐driven decision‐making into corporate governance.

Continuously Monitoring and Adjusting Models Based on Performance

Effective modeling demands ongoing attention. Outsourced CFOs establish regular checkpoints:

- Monthly Variance Reviews: Compare forecast vs. actual for revenue and expenses.

- Quarterly Assumption Updates: Refresh market growth rates and cost‐inflation drivers.

- Ad Hoc Stress Tests: Re‐run downside scenarios when macro indicators shift.

Leveraging Financial Models for Investment, M&A, and Expansion Decisions

Finally, CFOs adapt core models for high‐stakes transactions. They build pro forma statements for acquisitions, simulate capital‐raise impacts, and assess greenfield expansions using discounted cash flow techniques.

By embedding scenario analysis and sensitivity tests, firms evaluate how to optimize business planning with financial models, ensuring every significant move rests on robust, numbers‐backed insights.

Learn More: Outsourced CFO supports mergers and acquisitions

Conclusion: Unlocking the Power of Financial Modeling with an Outsourced CFO

Harnessing the power of financial modeling positions your business for sustainable growth and competitive advantage. By partnering with an outsourced CFO, you can access sophisticated financial forecasting, CFO financial modeling strategies, and tailored scenario analyses that illuminate risks and opportunities.

Ready to elevate your financial planning and analysis? Schedule a complimentary strategy session with NOW CFO’s financial experts. Let’s translate complex data into clear, actionable insights that drive strategic decisions and unlock your company’s full potential.