Financial mismanagement remains a leading cause of failure among small enterprises. Notably, 82% of small businesses fail due to cash flow problems.

To mitigate such risks, many organizations are turning to fractional CFOs, seasoned financial professionals who provide strategic guidance on a part-time or contractual basis. This approach allows businesses to access high-level financial expertise without the commitment of a full-time executive.

Introduction to Fractional CFOs

Organizations increasingly seek flexible financial leadership to navigate complex financial landscapes. One solution to gain prominence is the fractional CFO. Understanding this role and its benefits can be pivotal for businesses aiming to optimize financial strategies without the commitment of a full-time executive.

Definition and Overview of a Fractional CFO

A fractional CFO, a part-time CFO, or an outsourced CFO is a financial expert engaged on a part-time or contractual basis to provide high-level financial guidance.

Unlike traditional full-time CFOs, fractional CFOs offer their expertise to multiple organizations, allowing businesses to access seasoned financial leadership without incurring the costs of a full-time executive position.

The Emergence of Outsourced Financial Leadership

Over recent years, the concept of outsourced financial leadership has gained traction. This trend allows businesses to focus on core competencies while leveraging external expertise for specialized functions.

Notably, more than half of firms allocate over 5% of their budgets to outsourced services, with over 10% dedicating more than 25%, highlighting the growing reliance on external partners for critical operations.

Key Differences Between Fractional and Full-Time CFOs

While both fractional and full-time CFOs aim to steer a company’s financial strategy, their engagement models differ:

- Engagement Scope: Full-time CFOs are deeply integrated into the company’s daily operations, whereas fractional CFOs focus on specific projects or strategic initiatives.

- Cost Implications: Employing a full-time CFO entails a significant salary and benefits package. In contrast, fractional CFOs provide expertise at a fraction of the cost, offering financial flexibility.

- Flexibility: Fractional CFOs offer scalable services, adjusting their involvement based on the company’s evolving needs, unlike full-time CFOs with fixed commitments.

Benefits of Flexible Financial Leadership for Modern Businesses

Embracing flexible financial leadership through fractional CFOs offers several advantages:

- Cost Efficiency: Companies can access top-tier financial expertise without the overhead of a full-time salary, optimizing resource allocation.

- Diverse Expertise: Fractional CFOs often bring experience from various industries, providing fresh perspectives and innovative solutions.

- Scalability: Businesses can adjust the level of financial oversight based on current needs, ensuring agility in decision-making processes.

How NOW CFO Pioneers Tailored Fractional CFO Services

NOW CFO stands at the forefront of providing customized fractional CFO services. By understanding each client’s unique challenges, we deliver strategic financial guidance that aligns with specific business goals.

Incorporating a fractional CFO can be a strategic move for businesses aiming to enhance financial management without the commitment of a full-time executive. This model offers flexibility, cost savings, and access to specialized knowledge, making it an attractive option.

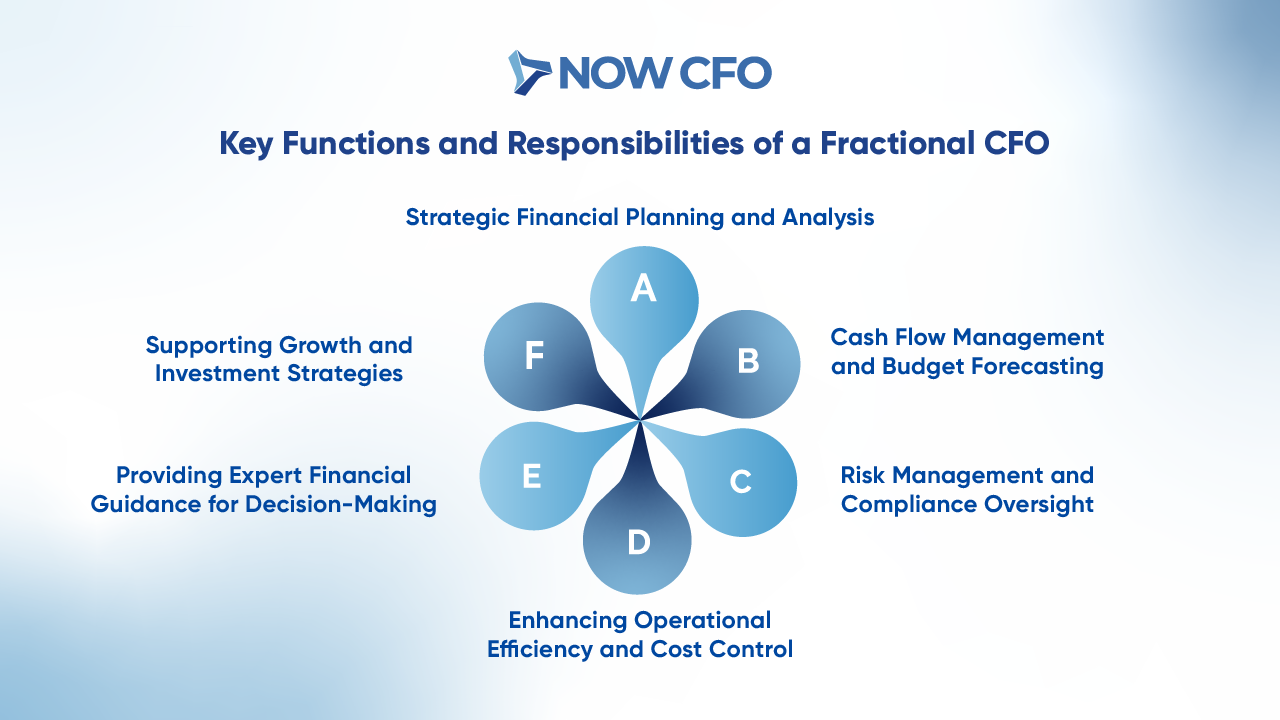

Key Functions and Responsibilities of a Fractional CFO

Understanding their key functions and responsibilities is essential for businesses aiming to optimize financial performance.

Strategic Financial Planning and Analysis

A primary responsibility of a fractional CFO is to develop and implement comprehensive financial strategies. They analyze financial data to identify trends, opportunities, and potential challenges, ensuring that the company’s financial goals align with its overall business objectives.

By leveraging their expertise, fractional CFOs assist in crafting long-term plans that drive sustainable growth and profitability.

Cash Flow Management and Budget Forecasting

Effective cash flow management is crucial for maintaining a company’s financial health. Fractional CFOs monitor cash inflows and outflows, ensuring that the organization can meet its obligations and invest in growth opportunities.

They also develop accurate budget forecasts, providing a financial roadmap that guides decision-making and resource allocation.

Risk Management and Compliance Oversight

Navigating financial risks and ensuring compliance with regulatory standards are critical aspects of a fractional CFO’s role. They identify potential financial risks, such as market fluctuations or credit risks, and develop strategies to mitigate these threats.

Additionally, they ensure that the company’s financial practices adhere to legal standards and regulatory requirements, maintaining the organization’s integrity and reputation.

Enhancing Operational Efficiency and Cost Control

Fractional CFOs play a vital role in improving operational efficiency and controlling costs. They analyze existing processes to identify inefficiencies and implement strategies to streamline operations. By optimizing resource allocation and reducing unnecessary expenses, they enhance the company’s profitability and competitiveness.

Providing Expert Financial Guidance for Decision-Making

Informed decision-making is facilitated by the expert financial guidance provided by fractional CFOs. They offer insights into various financial matters, from investment opportunities to cost management, enabling leadership to make decisions that align with the company’s financial objectives.

Supporting Growth and Investment Strategies

Fractional CFOs support business growth by developing and implementing effective investment strategies. They assess the financial viability of expansion plans, mergers, or acquisitions, ensuring that such initiatives align with the company’s financial goals and risk tolerance.

Benefits of Hiring a Fractional CFO

Engaging a fractional CFO offers numerous benefits that can significantly enhance a company’s financial health and strategic direction.

Cost Savings and Budget Flexibility

One of the primary advantages of hiring a fractional CFO is the potential for substantial cost savings. Engaging a fractional executive allows companies to access top-tier financial expertise without the financial commitment of a full-time position. This approach provides budget flexibility, enabling businesses to allocate resources more efficiently.

Access to Specialized Financial Expertise on Demand

Fractional CFOs bring a wealth of specialized knowledge and experience across various industries. This on-demand access to expertise allows companies to address specific financial challenges, implement best practices, and make informed decisions that drive growth and profitability.

Scalability and Flexibility in Engagement Models

The engagement models of fractional CFO services offer unparalleled scalability and flexibility. Businesses can tailor the scope and duration of the CFO’s involvement based on their unique needs, adjusting the level of support as the company evolves.

This adaptability ensures that financial leadership aligns seamlessly with organizational goals and market conditions.

Improved Financial Reporting and Transparency

Accurate financial reporting and transparency are critical for building stakeholder trust and making strategic decisions. Fractional CFOs enhance these aspects by implementing robust reporting systems, ensuring compliance with regulatory standards, and providing clear insights into the company’s financial performance.

Enhanced Strategic Insights and Data-Driven Decision Making

With their extensive experience, fractional CFOs offer enhanced strategic insights that facilitate data-driven decision-making. They analyze financial data to identify trends, opportunities, and potential risks, empowering businesses to make proactive decisions that support long-term success.

How NOW CFO’s Fractional CFO Services Deliver Measurable Value

NOW CFO specializes in providing tailored fractional CFO services that deliver measurable value to businesses. By offering customized financial solutions, NOW CFO helps organizations achieve cost savings, access specialized expertise, and enhance financial operations.

Our commitment to flexibility and excellence ensures clients receive the strategic support necessary to thrive in today’s competitive landscape.

Learn More: How to Choose the Right Fractional CFO for Your Organization

How Fractional CFOs Differ from Traditional CFO Roles

Organizations often face the decision between engaging a fractional CFO or hiring a traditional full-time CFO. Understanding the distinctions between these roles is crucial for aligning financial leadership with a company’s specific needs and resources.

Engagement Models: Part-Time vs. Full-Time

A fundamental difference lies in the engagement structure:

- Fractional CFOs: These professionals offer their expertise on a part-time or contractual basis, serving multiple clients simultaneously. This arrangement allows businesses to access high-level financial guidance without committing to a full-time position.

- Full-Time CFOs: In contrast, full-time CFOs are dedicated exclusively to one organization, deeply involved in daily operations and long-term strategic planning.

Learn More: Fractional CFO vs Full-Time CFO

Cost Structures and Financial Impact

The financial implications of each role are significant:

- Fractional CFOs: Engaging a fractional CFO is often more cost-effective, as businesses pay only for the services they need. This model eliminates the expenses associated with a full-time salary and benefits package, making it an attractive option for small to medium-sized enterprises.

- Full-Time CFOs: Hiring a full-time CFO entails a substantial financial commitment, including a competitive salary, benefits, and other employment-related costs. While this investment may be justified for larger organizations with complex financial needs, it can strain the budgets of smaller companies.

Flexibility and Adaptability to Changing Business Needs

Flexibility is another critical factor:

- Fractional CFOs: These professionals offer scalable services, adjusting their involvement based on the company’s evolving requirements. This adaptability is particularly beneficial for businesses experiencing growth phases or facing specific financial challenges.

- Full-Time CFOs: While dedicated to the organization, full-time CFOs may have less flexibility to scale their efforts up or down in response to changing business needs, potentially leading to inefficiencies.

Integration with In-House Financial Teams

The working relationship with existing financial teams varies:

- Fractional CFOs: They collaborate with in-house staff on a project basis, bringing specialized expertise without disrupting established workflows. This collaboration can enhance the team’s capabilities and provide mentorship opportunities.

- Full-Time CFOs: As permanent team members, they have the advantage of building long-term relationships and a deep understanding of the company’s culture and processes, fostering seamless integration.

Learn More: Integrating a Fractional CFO into Your Financial Team

Long-Term Strategic Value vs. Immediate Financial Requirements

Considerations of strategic value include:

- Fractional CFOs: Ideal for addressing immediate financial needs, such as system implementations or fundraising efforts, they provide targeted expertise without a long-term commitment.

- Full-Time CFOs: They are better suited for ongoing strategic initiatives, offering continuous oversight and alignment with the company’s long-term vision.

Learn More: Understanding the Strategic Role of a Fractional CFO

The Competitive Advantage of Outsourced CFO Solutions

Engaging a fractional CFO can confer several competitive advantages:

- Access to Diverse Expertise: Fractional CFOs often have experience across various industries, bringing fresh perspectives and innovative solutions to the table.

- Cost Efficiency: By paying only for the services required, businesses can allocate resources more effectively, investing in other critical areas.

- Agility: The ability to scale services up or down enables companies to respond swiftly to market changes and internal developments.

Conclusion

Embracing the services of a fractional CFO can significantly enhance your company’s financial health and strategic direction. By offering flexible engagement models and specialized expertise, fractional CFOs empower businesses to navigate financial complexities with confidence.

If you’re ready to strengthen your financial foundation and drive sustainable growth, consider partnering with NOW CFO. Explore how this strategic move can transform your business by reaching out to our team for a personalized consultation.