Maintaining accurate financial records is vital for businesses. Yet, 59% of accountants admit to making multiple monthly errors, often due to increased workloads and mounting pressures. Though seemingly minor, these mistakes can lead to significant financial discrepancies, regulatory penalties, and loss of stakeholder trust.

An outsourced CFO offers a strategic solution to this pervasive issue. By bringing in external expertise, businesses can ensure their financial statements are meticulously reviewed and corrected, aligning with industry standards and regulatory requirements.

What Is Accounting Clean-Up and Why Does It Matter?

Accounting clean-up involves reviewing and correcting financial records to ensure accuracy and compliance. This process is essential for businesses to make informed decisions, maintain investor confidence, and comply with regulatory requirements.

Common Signs Your Books Need Cleaning

Identifying issues in your financial records early can prevent larger problems. Unreconciled accounts are a clear sign that your business needs professional support with accounting reconciliation.

Here are some indicators that your need to fix messy books:

- Unreconciled Accounts: Bank statements and accounting records don’t match.

- Frequent Adjusting Entries: Regular corrections indicate underlying issues.

- Inconsistent Financial Statements: Discrepancies between income statements, balance sheets, and cash flow statements.

- Delayed Financial Reporting: Consistently missing reporting deadlines.

- Unusual Transactions: Unexpected or unexplained entries in the ledger.

The Risks of Operating with Inaccurate Financial Data

Inaccurate financial data can lead to misguided business decisions, regulatory penalties, and loss of stakeholder trust. For instance, a study by the FTC highlighted that errors in small business credit reports can hinder access to loans, affecting growth opportunities.

Moreover, unreliable data can result in overestimating revenue, underestimating expenses, and misallocating resources. An outsourced CFO can help identify and rectify these issues, ensuring data integrity.

How Clean Financials Support Decision-Making and Compliance

Accurate financial records are the foundation for strategic planning and regulatory compliance. Benefits include:

- Informed Decision-Making: Reliable data enables better budgeting and forecasting.

- Regulatory Compliance: Ensures adherence to tax laws and financial regulations.

- Investor Confidence: Transparent records build trust with stakeholders.

- Operational Efficiency: Identifies cost-saving opportunities and streamlines processes.

Key Triggers That Signal It’s Time for Accounting Clean-Up

Certain events can prompt the need for a thorough review of your financial records:

- Business Expansion: Entering new markets or launching products increases financial complexity.

- Mergers and Acquisitions: Requires accurate valuations and financial transparency.

- Regulatory Changes: New laws may necessitate adjustments in accounting practices.

- Leadership Changes: New management may seek a clear financial picture.

- Audit Preparation: Ensuring records are accurate before external reviews.

Clean-Up vs. Ongoing Bookkeeping: Know the Difference

Understanding the distinction between accounting clean-up services and regular bookkeeping is essential:

| Aspect | Accounting Clean-Up | Ongoing Bookkeeping |

|---|---|---|

| Purpose | Rectify past errors and discrepancies | Maintain current financial records |

| Frequency | One-time or periodic, as needed | Continuous, daily, or weekly |

| Scope | Comprehensive review of historical data | Recording daily transactions |

| Expertise Required | High-level analysis, often by an outsourced CFO | Routine data entry can be handled by in-house staff |

| Outcome | Accurate, compliant financial statements | Up-to-date financial records for operational use |

How an Outsourced CFO Tackles Accounting Clean-Up

An outsourced CFO in accounting clean-up ensures that financial records are accurate, compliant, and useful for decision-making. This section delves into the steps and strategies outsourced CFOs employ to tackle accounting clean-up effectively.

Initial Assessment and Financial Records Review

At the outset, an outsourced CFO comprehensively evaluates the company’s financial records. This involves reviewing balance sheets, clean-up financial statements, income statements, cash flow statements, and general ledger entries.

The goal is to identify discrepancies, outdated information, and areas lacking compliance with GAAP standards. This initial assessment sets the foundation for a structured clean-up process, ensuring that subsequent steps are targeted and effective.

Identifying Errors and Inconsistencies in the General Ledger

A meticulous examination of the general ledger is crucial. Common issues identified include:

- Duplicate Entries: An outsourced CFO performs general ledger correction to fix duplicate, outdated, or misclassified entries.

- Misclassifications: Expenses or revenues miscategorized, affecting financial statements.

- Unreconciled Accounts: Bank statements do not match ledger entries, indicating potential errors.

- Outdated Entries: Transactions from previous periods that haven’t been adjusted or appropriately closed.

- Non-compliance with GAAP standards: Entries that don’t adhere to established accounting principles.

Adjusting Entries to Align with GAAP or Tax Standards

Following the identification of discrepancies, the outsourced CFO makes necessary adjustments to the entries to align financial records with GAAP standards. This involves correcting misclassified transactions, updating depreciation schedules, or adjusting for accrued expenses.

Such adjustments are vital for presenting an accurate and fair view of the company’s financial position. Through precise adjusting journal entries, an outsourced CFO aligns your records with tax obligations and GAAP standards.

Furthermore, serious discrepancies require a financial restatement, where prior financial statements are revised to reflect corrected data.

Rebuilding the Chart of Accounts

An outdated or overly complex chart of accounts can hinder financial clarity. Outsourced financial leadership will remodel the chart of accounts to accurately reflect the company’s current operations.

This involves consolidating redundant accounts, standardizing naming conventions, and ensuring the chart facilitates meaningful financial analysis. An effective chart of accounts reorganization simplifies financial tracking and ensures that all accounts accurately reflect the company’s current operations.

Rectifying Misclassified Transactions and Reconciliations

Correct classification of transactions is fundamental to accurate financial reporting. The outsourced CFO addresses this by:

- Reviewing Transaction Histories: Ensuring each transaction is recorded under the appropriate account.

- Revenue Recognition: Complex issues like revenue recognition adjustments are carefully addressed to ensure your income is reported in the proper periods.

- Reclassifying Entries: Moving transactions to correct accounts where misclassifications are identified.

- Reconciling Accounts: Matching ledger entries with bank statements and other external records to confirm accuracy.

- Implementing Controls: Establishing procedures to prevent future misclassifications and ensure ongoing accuracy.

- Expense Classification: Proper expense classification helps prevent overstating profits and ensures deductions are accurately applied during tax season.

Collaborating with Bookkeepers and Controllers for Execution

The success of the accounting clean-up process relies on effective collaboration. The outsourced CFO works closely with in-house bookkeepers and controllers to implement the necessary changes.

Such collaboration fosters a culture of accuracy and accountability within the finance department, laying the groundwork for sustainable financial management. Outsourced CFOs also help implement robust financial controls, promoting accuracy and reducing the likelihood of future errors or fraud.

Learn More: How an Outsourced CFO Supports Fiscal Year-End Planning

Benefits of Hiring an Outsourced CFO in Accounting Clean-Up

An outsourced CFO brings specialized expertise to the accounting clean-up process, offering numerous benefits that enhance financial integrity and operational efficiency. Let’s explore the advantages of engaging an outsourced CFO in accounting clean-up.

Restored Trust in Financial Reports

Engaging an outsourced CFO in accounting clean-up reinstates confidence in financial statements. By meticulously reviewing and correcting financial records, they ensure that reports accurately reflect the company’s financial position.

Moreover, accurate financial reporting aligns with compliance requirements, reducing the risk of legal issues and penalties. A study by the GAO highlighted that material weaknesses in internal control over financial reporting can lead to unreliable financial statements.

Enhanced Audit Readiness and Due Diligence

An outsourced CFO is essential in clean-up before audits and due diligence processes. Their expertise ensures financial records are accurate, complete, and compliant with relevant standards.

Key contributions include:

- Comprehensive Documentation: Ensuring all financial transactions are well-documented and easily traceable.

- Compliance Alignment: Verifying that financial practices adhere to GAAP standards and other regulatory requirements.

- Risk Identification: Detecting and addressing potential financial discrepancies before audits.

- Stakeholder Confidence: Assuring investors and partners through transparent financial reporting.

An outsourced CFO ensures your books are clean and well-documented, significantly boosting your company’s audit readiness and reducing risks.

Time and Cost Savings Compared to Internal Fixes

Utilizing an outsourced CFO in accounting clean-up can lead to significant time and cost efficiencies. Their specialized skills allow quicker identification and resolution of financial issues, minimizing disruptions to daily operations.

Additionally, outsourcing eliminates the need for extensive training or hiring of internal staff for complex financial tasks. According to a MIT study, strategic outsourcing can substantially lower costs and risks while expanding flexibility.

Objective, Expert Oversight Uninfluenced by Internal Bias

An outsourced CFO offers impartiality and specialized knowledge, ensuring financial assessments are free from internal biases. Key advantages include:

- Unbiased Analysis: Providing an external perspective that identifies issues internal teams may overlook.

- Specialized Expertise: Bringing in-depth knowledge of accounting standards and best practices.

- Conflict Resolution: Mediating discrepancies between departments with an objective stance.

- Strategic Recommendations: Offering insights based on experience across various industries and financial scenarios.

Improved Forecasting and Planning After Clean-Up

Post clean-up, an outsourced CFO enhances a company’s ability to forecast and plan effectively. With accurate and up-to-date financial data, businesses can:

- Develop Reliable Budgets: Creating financial plans reflecting operational costs and revenues.

- Identify Growth Opportunities: Analyzing financial trends to pinpoint areas for expansion or investment.

- Mitigate Risks: Anticipating potential financial challenges and developing contingency plans.

- Optimize Resource Allocation: Ensuring funds are directed toward initiatives with the highest return on investment.

Learn More: The Benefits of Hiring an Outsourced CFO for Your Business

When Should a Business Consider Accounting Clean-Up Support?

An outsourced CFO provides critical support during various business transitions and challenges, ensuring accurate and compliant financial records. Recognizing the right moments to engage such expertise can significantly impact a company’s financial health and strategic decisions.

Before Mergers, Acquisitions, or Funding Events

Engaging an outsourced CFO before significant financial events like mergers, acquisitions, or funding rounds is essential. These professionals ensure that all financial records are accurate, up-to-date, and compliant with relevant standards, providing potential investors or partners with confidence in the company’s financial integrity.

Moreover, accurate financial statements are crucial for valuation and due diligence processes, and any discrepancies can lead to delays or even derail deals. By proactively addressing financial clean-up, businesses can present themselves as reliable and well-managed entities.

When Preparing for an External Audit

An outsourced CFO is pivotal in preparing a company for an external audit. Their expertise ensures that financial records are meticulously reviewed and adjusted to meet auditing standards, reducing the risk of discrepancies and potential penalties.

Key benefits of involving an outsourced CFO in audit preparation:

- Comprehensive Documentation: Ensures all financial transactions are well-documented and easily traceable.

- Compliance Alignment: Verifies that financial practices adhere to GAAP standards and other regulatory requirements.

- Risk Identification: Detects and addresses potential financial discrepancies before audits.

- Stakeholder Confidence: Assures investors and partners through transparent financial reporting.

Businesses can navigate audits with greater confidence and efficiency by involving an outsourced CFO.

Following Leadership or Accounting Staff Turnover

Leadership or accounting staff turnover can disrupt financial continuity and lead to inconsistencies in record-keeping. An outsourced CFO offers stability during such transitions, ensuring that financial operations continue seamlessly.

They assess existing financial records, identify gaps or errors introduced during the turnover, and implement corrective measures. Moreover, their external perspective brings objectivity, helping to establish robust financial processes and controls that mitigate future risks associated with staff changes.

After a System or ERP Transition

Implementing a new ERP system can introduce complexities while reconstructing financial data. An outsourced CFO ensures the transition does not compromise data integrity. They oversee the migration process, validate accounting records accuracy, and adjust financial records to align with the new system’s structure.

This oversight is crucial, as errors during ERP transitions can lead to significant financial misstatements. By leveraging their expertise, businesses can achieve a smoother transition, maintaining accurate financial reporting and operational efficiency.

If You’ve Fallen Behind on Monthly or Annual Closes

Falling behind on financial closings can obscure a company’s financial position, hindering strategic decision-making. An outsourced CFO addresses this challenge by streamlining the closing process, ensuring timely and accurate financial reporting.

This intervention brings current financial records up to date and sets the foundation for consistent and reliable reporting moving forward. An outsourced CFO streamlines the monthly close process, ensuring that your financials are completed accurately and on time, month after month.

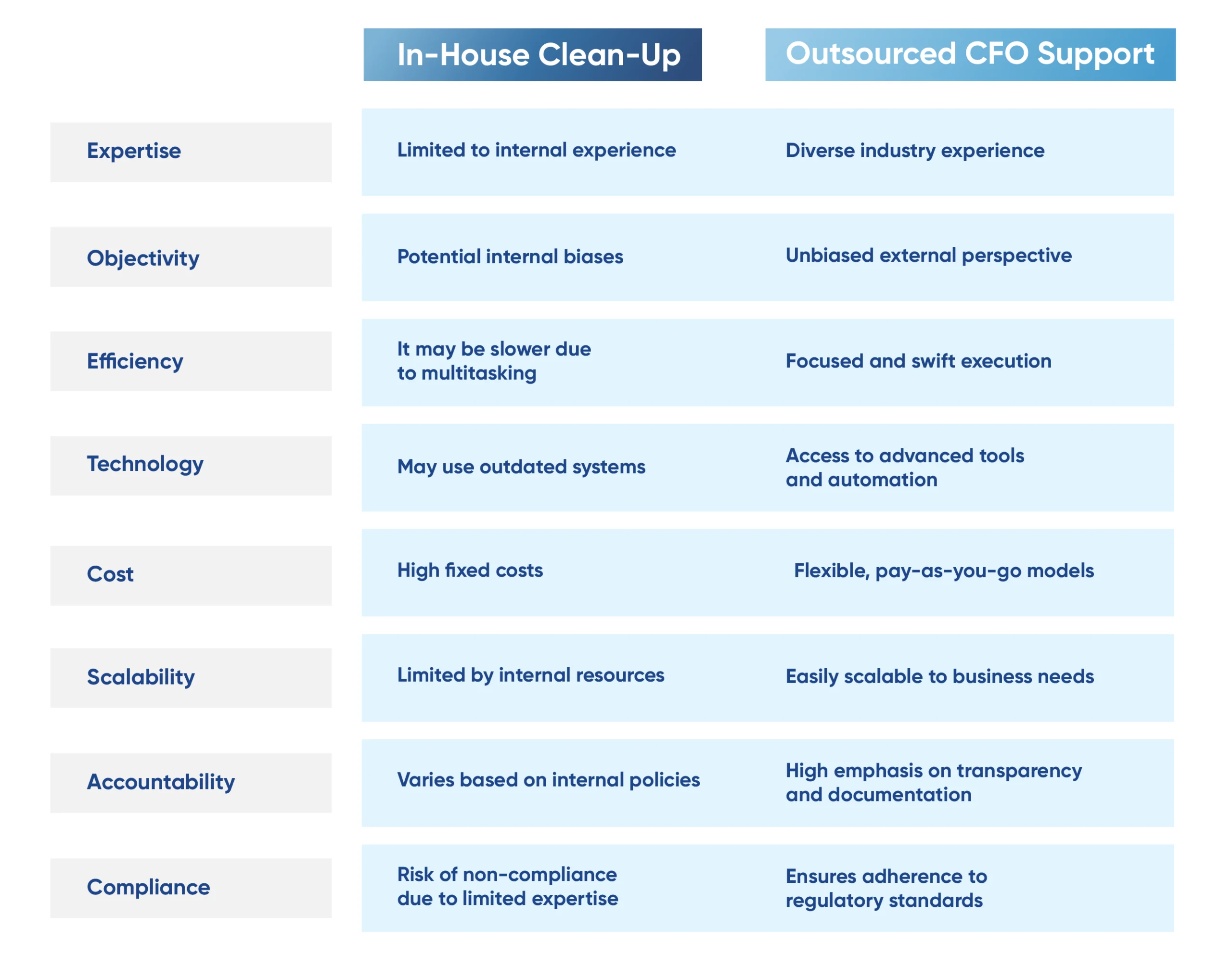

Key Differences: In-House Clean-Up vs. Outsourced CFO Support

An outsourced CFO provides specialized expertise and objectivity in financial management, offering distinct advantages over in-house accounting clean-up efforts. Understanding the key differences between these approaches can help businesses make informed decisions.

Expertise and Objectivity

An outsourced CFO brings a wealth of experience working with diverse industries, ensuring a broad perspective on financial challenges. This external viewpoint allows for unbiased analysis, free from internal politics or preconceived notions.

In contrast, in-house teams may lack this level of objectivity, potentially overlooking systemic issues due to familiarity or internal pressures.

Efficiency and Speed of Execution

Engaging a CFO can accelerate the outsourced accounting clean-up process. Their focused approach and specialized tools enable them to identify and rectify issues swiftly. In-house teams, balancing multiple responsibilities, may take longer to achieve the same results, potentially delaying strategic initiatives.

Use of Technology and Tools

- Advanced Software: Outsourced CFO in accounting clean-up services utilizes cutting-edge financial software, enhancing accuracy and efficiency.

- Automation: They implement automated processes for reconciliation and reporting, reducing manual errors.

- Real-Time Reporting: Access to real-time financial data allows for timely decision-making.

- Scalability: Their systems can easily adapt to the growing needs of a business.

In contrast, in-house teams rely on legacy systems, limiting their ability to leverage technological advancements.

Cost Comparison Over Time

Now, let’s look into the const comparisons.

In-House CFO

- High fixed costs, including salaries, benefits, and overhead, around $400,00 annually.

- Additional expenses for training and software updates.

- Potential for increased costs during periods of growth or transition.

Outsourced CFO

- Flexible pricing models, paying only for services needed, around $12,500 monthly.

- Reduced overhead, as there’s no need for office space or equipment.

- Access to a team of experts without the costs of full-time hires.

Learn More: Outsourced CFO vs In-House CFO

Accountability and Process Documentation

An outsourced CFO emphasizes transparency and thorough documentation. They establish transparent processes, ensuring consistency and compliance with regulatory standards. This level of accountability can be challenging for in-house teams, especially in smaller organizations where roles may overlap, and documentation practices vary.

Conclusion: Set the Foundation for Growth with Accurate Financials

Engaging an outsourced CFO is more than a corrective measure; it’s a strategic investment in your company’s future. Beyond rectifying financial discrepancies, these professionals offer insights that drive growth, enhance compliance, and foster investor confidence.

If your organization deals with outdated books, audit preparation, or financial uncertainty, NOW CFO is here to help. Our team of experienced outsourced CFO in accounting clean-up provides tailored, hands-on support that aligns with your specific business goals and industry requirements.

Take the first step toward cleaner financials and greater control. Schedule a free consultation with NOW CFO to assess your accounting needs and learn how expert guidance can position your business for sustained success.

Learn More: Outsourced CFO Services for Audit Preparation