Outsourced CFO Services for Audit Preparation: A Step-by-Step Guide

Ensuring audit readiness is more critical than ever. Engaging outsourced CFO services for audit preparation offers businesses a strategic advantage, providing expert guidance and meticulous attention to financial details.

Recent findings by the Public Company Accounting Oversight Board (PCAOB) reveal that approximately 39% of audits reviewed in 2024 contained one or more deficiencies, down from 46% in 2023. This statistic underscores the importance of thorough audit preparation.

By leveraging outsourced CFOs’ expertise, companies can confidently navigate the complexities of financial audits. These professionals assist in reviewing and reconstructing financial records, creating comprehensive pre-audit documentation/checklists, and ensuring compliance with GAAP and regulatory standards.

Why Audit Preparation Matters for Growing Companies

As businesses expand, the complexity of financial operations increases, making audit readiness not just a regulatory requirement but a strategic imperative. Ensuring meticulous audit preparation can significantly impact a company’s financial health and reputation.

The Importance of Audit Readiness

Audit readiness is crucial for growing companies aiming to maintain financial integrity and stakeholder trust. Proper preparation ensures that financial statements are accurate, complete, and compliant with applicable standards. This facilitates smoother audits and enhances the company’s credibility with investors and regulatory bodies.

Common Audit Triggers and Business Scenarios

- Rapid Revenue Growth: Sudden increases in revenue can raise questions about revenue recognition and financial controls.

- Significant Changes in Business Operations: Due to complexities, mergers, acquisitions, or restructuring activities often attract auditor scrutiny.

- High Volume of Cash Transactions: Businesses dealing primarily in cash, such as restaurants or salons, are more susceptible to audits due to the potential for unreported income.

- Inconsistent Financial Statements: Discrepancies or financial report fluctuations can trigger audits without clear explanations.

- Previous Audit Findings: Companies with a history of audit issues are more likely to be audited again to ensure compliance improvements.

Risks of Poor Preparation and Inadequate Documentation

- Increased Audit Costs: Lack of preparedness can lead to longer audit durations and higher fees.

- Regulatory Penalties: Inadequate documentation may lead to non-compliance with financial reporting standards, attracting penalties.

- Reputational Damage: Audit findings can harm a company’s reputation, affecting investor confidence and market position.

- Operational Disruptions: Audits can divert management attention from core business activities, impacting productivity.

- Financial Misstatements: Poor documentation increases the risk of errors in financial statements, leading to incorrect business decisions.

Implementing accounting compliance support through outsourced CFO services can address these risks by ensuring thorough documentation and adherence to financial reporting standards.

The Role of Financial Controls in Audit Success

Adequate financial controls are the backbone of a successful audit. They ensure that monetary transactions are accurately recorded, authorized, and reviewed as part of audit risk mitigation. Strong internal controls also demonstrate to auditors that the company has robust processes.

Effective internal control over financial reporting provides reasonable assurance regarding the reliability of financial statements. This assurance is critical for stakeholders who rely on these statements for decision-making.

Engaging outsourced CFO audit support services enhances financial controls by bringing expertise to assess and strengthen existing processes, ensuring compliance with regulatory requirements.

Regulatory and Stakeholder Expectations During Audits

Regulatory bodies and stakeholders expect transparency, accuracy, and compliance during audits. Failure to meet these expectations can lead to penalties, loss of investor confidence, and damage to the company’s reputation.

Auditors assess whether companies have adhered to applicable accounting standards and regulatory requirements, making thorough preparation essential. Stakeholders, including investors and board members, rely on audit outcomes to make informed decisions. They expect timely and accurate financial reporting, with any issues promptly addressed.

Meeting these expectations requires a proactive approach to audit preparation, including regular financial reviews and updates to internal controls. Incorporating external audit planning strategy via outsourced CFO services can help align company practices with stakeholder expectations, ensuring a smoother audit process and maintaining trust.

How an Outsourced CFO Prepares You for an Audit

An outsourced CFO is pivotal in ensuring a company’s accurate and audit-ready financial records. Their expertise is instrumental in navigating the complexities of financial audits, ensuring compliance, and facilitating effective communication with auditors.

Reviewing and Reconstructing Financial Records

The initial step in audit preparation involves a meticulous review and reconstruction of financial records. An outsourced CFO examines historical financial data to identify discrepancies, omissions, or errors that could impact the audit’s outcome.

Furthermore, the CFO ensures GAAP readiness of financial records, providing a solid foundation for the audit process. This thorough review facilitates smoother audits and enhances the company’s financial transparency and integrity.

According to the GAO, inadequate support for financial records can lead to significant weaknesses in financial statement preparation, underscoring the importance of this step i audit readiness.

Creating a Pre-Audit Checklist and Timeline

Outsourced CFO audit support services develop a comprehensive pre-audit checklist and timeline:

- Identify Key Audit Areas: Determine critical financial areas that require thorough review.

- Assign Responsibilities: Allocate tasks to appropriate team members to ensure accountability.

- Set Milestones: Establish clear deadlines for each phase of the audit preparation.

- Document Review Schedule: Plan regular reviews of financial documents to ensure accuracy and completeness.

- Communication Plan: Outline strategies for effective communication with auditors throughout the process.

Identifying and Addressing Red Flags in Financial Reports

An outsourced CFO is adept at spotting anomalies in financial reports that could raise concerns during an audit:

- Unusual Revenue Fluctuations: Sudden spikes or drops in revenue without clear justification.

- Inconsistent Expense Reporting: Discrepancies in expense categorization or unexpected increases in certain expense areas.

- Delayed Financial Closures: Consistent delays in closing financial periods indicate potential underlying issues.

- Unreconciled Accounts: Balances that do not align with supporting documentation.

- Lack of Supporting Documentation: Missing invoices, receipts, or contracts for recorded transactions.

Addressing these red flags proactively ensures that potential issues are resolved before the audit, reducing the risk of findings that could impact on the company’s financial credibility.

Organizing Key Documentation and Workpapers

Effective documentation organization is crucial for a successful audit. An outsourced CFO ensures that all necessary documents, such as financial statements, ledgers, and supporting materials, are systematically compiled and easily accessible.

Moreover, maintaining well-organized workpapers that detail the company’s financial activities provides a clear audit trail. The Texas Comptroller of Public Accounts emphasizes the importance of detailed documentation in the audit plan, including descriptions of business activities and planned audit procedures.

Ensuring GAAP and Regulatory Compliance

Compliance with GAAP and relevant regulations is a cornerstone of audit readiness. An outsourced CFO reviews financial statement audits to ensure they conform to these standards.

GAAP satisfies regulatory requirements and instills stakeholders’ confidence regarding the company’s financial integrity. The Washington State Auditor’s Office outlines specific GAAP reporting requirements, including presenting required supplementary information, to guide entities in maintaining compliance.

In regulated industries or companies planning to go public, an outsourced CFO supports SOX compliance preparation, ensuring that financial controls meet the stringent standards required under the Sarbanes-Oxley Act.

Communicating with External Auditors Effectively

An outsourced CFO facilitates effective communication with external auditors through several key practices:

- Regular Updates: Provide timely information on financial developments and potential issues.

- Transparent Discussions: Engage in open dialogues about financial practices and decisions.

- Prompt Responses: Address auditor inquiries swiftly to maintain the audit’s momentum.

- Comprehensive Audit Documentation: Ensure all requested documents are complete and readily available.

- Feedback Integration: Incorporate auditor feedback into financial processes to enhance future compliance.

- Internal Audit Liaison Role: An outsourced CFO often functions as an internal audit liaison, bridging communication between internal teams and external auditors to ensure alignment, transparency, and timely information sharing.

Learn More: Benefits of hiring an outsourced CFO

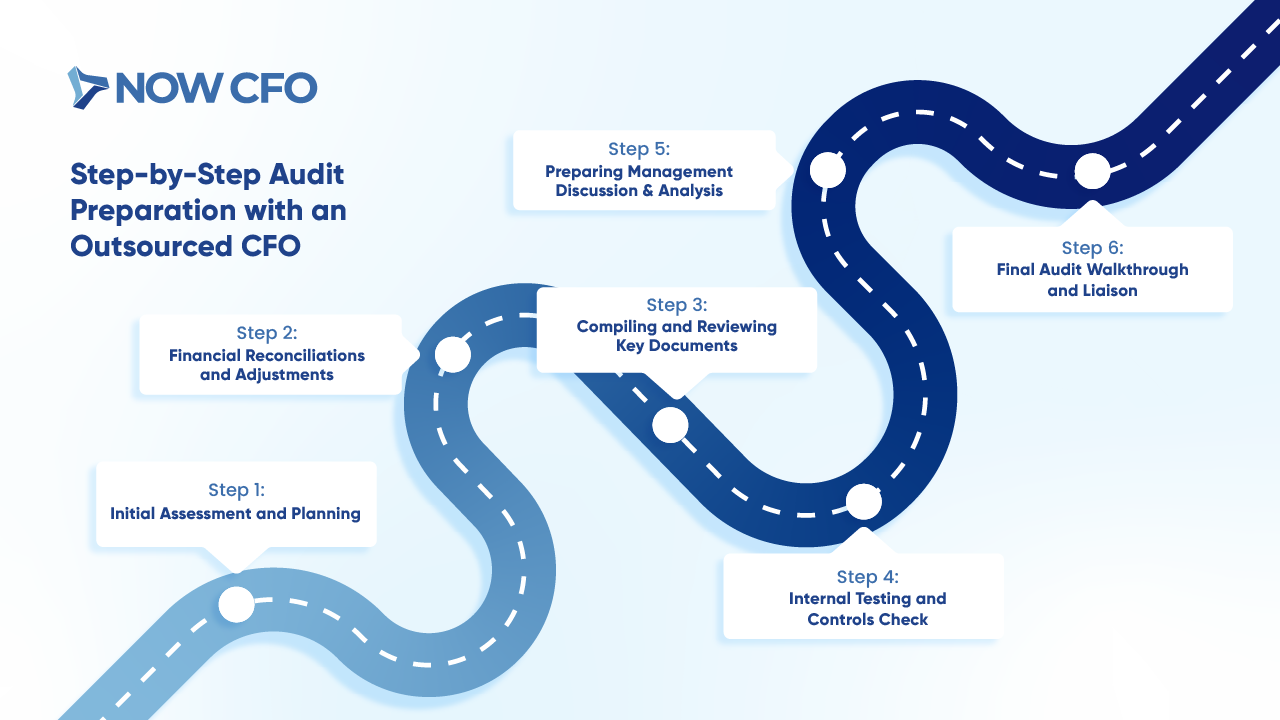

Step-by-Step Audit Preparation with an Outsourced CFO

Engaging outsourced CFO services for audit preparation offers a structured approach to ensure financial accuracy and compliance. This step-by-step process enhances audit readiness and facilitates a smoother audit experience.

Step 1: Initial Assessment and Planning

The first step involves a comprehensive evaluation of the company’s finances. An outsourced CFO thoroughly reviews existing financial records, internal controls, and compliance with accounting standards.

Subsequently, a detailed audit plan is developed, outlining timelines, responsibilities, and resource allocation. This proactive planning emphasizes the importance of early and detailed audit planning to address potential issues effectively.

Step 2: Financial Reconciliations and Adjustments

In this phase, the outsourced CFO ensures that all financial accounts are accurately reconciled. This includes verifying bank statements, accounts receivable and payable, and inventory records.

Discrepancies are identified and corrected to reflect the company’s actual financial position. This phase also involves refining the financial close process, ensuring that monthly and year-end closes are efficient, accurate, and aligned with audit timelines.

Adjustments are made to align financial statements with GAAP. This meticulous process ensures compliance and enhances the credibility of financial reports. Accurate reconciliations are vital for reliable financial reporting and effective decision-making.

Step 3: Compiling and Reviewing Key Documents

The outsourced CFO compiles all essential documents required for the audit, including financial statements, tax filings, and internal policies. Each document is meticulously reviewed to ensure accuracy and completeness.

This organized and smoother audit process documentation provides auditors with readily accessible and reliable information. Thorough documentation is important in audit preparation to support financial assertions and compliance.

Step 4: Internal Testing and Controls Check

Evaluating internal controls is an essential component of audit preparation. The outsourced CFO conducts tests to assess the effectiveness of financial controls and identify any weaknesses. This includes reviewing authorization processes, segregation of duties, and access controls.

Identified deficiencies are addressed promptly to strengthen the control environment. Internal control testing is significant in ensuring the integrity of financial reporting and compliance with regulations.

Step 5: Preparing Management Discussion & Analysis

The outsourced CFO assists in crafting the Management Discussion & Analysis (MD&A) section, providing insights into the company’s financial performance and outlook. This narrative complements the financial statements by explaining significant trends, risks, and uncertainties.

A well-prepared MD&A enhances transparency and gives stakeholders a comprehensive understanding of the company’s financial health.

Step 6: Final Audit Walkthrough and Liaison

In the final stage, the outsourced CFO conducts a walkthrough of the audit process, ensuring all preparations are complete and addressing any last-minute concerns. They act as a liaison between the company and external auditors, facilitating effective communication and resolving queries promptly.

Learn More: Outsourced CFO vs In-House CFO

Benefits of Using Outsourced CFO Services for Audit Prep

Engaging outsourced CFO services for audit preparation offers numerous advantages, streamlining the audit process and enhancing financial accuracy. These benefits are particularly valuable for businesses aiming to optimize their financial operations and ensure compliance.

Reduced Internal Workload and Time Savings

Implementing outsourced CFO services for audit preparation significantly alleviates the internal team’s workload. Companies can focus on core operations without compromising audit readiness by delegating complex financial tasks to seasoned professionals.

Moreover, these services expedite the audit process by ensuring that all financial documents are accurate and readily available. This efficiency saves time and reduces the stress associated with audit preparations.

Enhanced Accuracy and Audit Trail Integrity

- Comprehensive Documentation: Outsourced CFOs ensure that all financial transactions are thoroughly documented with audit trail accuracy.

- Error Reduction: With expert oversight, the likelihood of errors in financial statements decreases, enhancing overall accuracy.

- Regulatory Compliance: These professionals stay updated with the latest financial regulations, ensuring all records meet compliance standards.

- Efficient Reconciliation: Regular account reconciliations are conducted to maintain consistency and accuracy in financial records.

- Secure Data Handling: Outsourced CFOs implement robust data security measures to protect sensitive financial information.

On-Demand Access to Senior Financial Expertise

One significant advantage of outsourced CFO services for audit preparation is the immediate access to experienced financial professionals. These experts bring a wealth of knowledge and offer strategic insights and guidance tailored to the company’s needs.

This on-demand expertise is particularly beneficial during audits, where timely and informed decisions are crucial. Companies can leverage this resource without the long-term commitment and expense of hiring a full-time CFO.

The U.S. Bureau of Labor Statistics notes that the demand for financial managers is projected to grow 17% from 2020 to 2030, indicating the increasing value of financial expertise in business operations.

Improved Communication with External Auditors

Effective communication with auditors is vital for a smooth audit process. Outsourced CFO services for audit preparation facilitate this by liaising between the company and auditors, ensuring that all queries are addressed promptly and accurately.

These professionals understand the auditors’ requirements and can present financial information clearly and organized, reducing misunderstandings and expediting the audit process. Their involvement ensures the company’s financial narrative is consistently and effectively communicated.

Scalable Support During High-Stakes Audit Seasons

- Flexible Resource Allocation: Outsourced CFO services can scale up or down based on the company’s needs, providing additional support during peak audit periods.

- Specialized Expertise: Access to professionals with specific skills relevant to the audit enhances the quality and efficiency of the process.

- Cost-Effective Solutions: Companies can manage expenses by utilizing services only when necessary, avoiding the costs associated with full-time hires.

- Rapid Response: Outsourced CFOs can quickly address unexpected issues or requirements that arise during the audit.

- Continuous Support: Beyond audits, these services can provide ongoing financial guidance, ensuring sustained compliance and operational efficiency.

Strategic Insights to Strengthen Financial Operations

- Performance Analysis: Outsourced CFOs evaluate financial data to identify trends, strengths, and areas for improvement.

- Budget Optimization: They assist in creating and adjusting budgets to align with the company’s strategic goals.

- Risk Management: They develop strategies to mitigate potential issues by assessing financial risks.

- Growth Planning: These professionals provide insights into investment opportunities and expansion strategies.

- Process Improvement: They recommend and implement financial processes that enhance efficiency and accuracy.

Learn More: Outsourced CFO Improves Financial Planning & Business Growth

When to Engage an Outsourced CFO for Compliance Audit Services

Determining the optimal time to engage outsourced CFO services for audit preparation is crucial for ensuring a smooth and compliant audit process. Various business scenarios necessitate the expertise of an outsourced CFO to navigate the complexities of financial audits effectively.

Preparing for Your First Financial Statement Audit

Embarking on your first financial statement audit can be a daunting experience. Engaging outsourced CFO services for audit preparation can help you navigate this uncharted territory. These professionals assist in organizing financial records, ensuring compliance with accounting standards, and facilitating communication with auditors.

Companies often require their first audit when seeking external investment or financing, as stakeholders demand assurance on financial accuracy. An outsourced CFO ensures that your financial statements are audit-ready, mitigating risks and enhancing credibility with investors and lenders.

Experiencing Rapid Growth or Restructuring

Rapid business expansion or organizational restructuring introduces complexities that necessitate professional financial oversight. Engaging outsourced CFO services for audit preparation during such transitions ensures financial stability and compliance.

- Integration of New Operations: An outsourced CFO facilitates the seamless integration of new business units or acquisitions, aligning financial practices and reporting standards.

- System Upgrades: They oversee the implementation of advanced financial systems to accommodate increased transaction volumes and complexity.

- Policy Development: Outsourced CFOs establish robust financial policies and procedures to govern the expanded organization effectively.

- Risk Management: They identify and mitigate financial risks associated with rapid growth or structural changes.

Getting Ready for M&A or Due Diligence Reviews

M&A and due diligence reviews require meticulous financial scrutiny. Engaging outsourced CFO services for audit preparation ensures that your financial records withstand the rigorous examination inherent in these processes.

- Financial Statement Preparation: Outsourced CFOs prepare comprehensive and accurate financial statements reflecting the company’s financial position.

- Compliance Assurance: They ensure that all financial practices comply with relevant laws and regulations, reducing the risk of legal complications.

- Risk Identification: These professionals identify potential financial risks and liabilities that could affect the transaction’s success.

- Strategic Advisory: Outsourced CFOs provide strategic advice on financial structuring to optimize the outcomes of M&A deals.

Navigating a Complex or Multi-Entity Structure

Operating within a complex or multi-entity structure presents unique financial management challenges. Engaging outsourced CFO services for audit preparation offers the expertise needed to manage these complexities effectively.

Outsourced CFOs assist in consolidating financial reports across various entities, ensuring consistency and compliance with accounting standards. They implement systems that facilitate accurate tracking of intercompany transactions and streamline financial reporting processes.

Meeting PE or Lender Reporting Requirements

Private equity firms and lenders impose stringent reporting requirements to safeguard their investments. Engaging outsourced CFO services for audit preparation ensures adherence to these demands.

- Timely Financial Reporting: Outsourced CFOs ensure timely delivery of accurate financial statements, maintaining investor confidence.

- Compliance with Covenants: They monitor and ensure compliance with financial covenants stipulated by lenders, preventing breaches that could jeopardize funding.

- Transparency Enhancement: These professionals enhance financial transparency, providing stakeholders with clear insights into the company’s financial health.

- Audit Facilitation: Outsourced CFOs coordinate audit processes, ensuring that private equity firms’ and lenders’ requirements are met efficiently.

Conclusion: Set Your Audit Up for Success

Partnering with our outsourced CFO services for audit preparation empowers businesses to approach audits with a structured and strategic mindset. NOW CFO offers comprehensive support to ensure companies are well-equipped to meet regulatory requirements and stakeholders’ expectations.

To enhance your audit readiness and financial compliance, consider exploring the benefits of outsourced CFO services. Reach out to our team to discover how we can tailor our expertise to your unique business needs and help you achieve a seamless and successful audit experience.

Learn More: Overcoming Common Challenges When Hiring an Outsourced CFO