How an Outsourced CFO Supports Fiscal Year-End Planning

Fiscal year-end marks a pivotal period for businesses of all sizes. However, the complexities of financial reporting, tax preparation, and strategic planning can overwhelm internal teams, particularly for growing companies.

This is where outsourced CFO services become invaluable. By offering expert guidance, they streamline processes, improve accuracy, and enable businesses to focus on growth. Outsourced CFO role in year-end reporting extends beyond compliance; they help companies align year-end activities, ensuring stability and progress.

With their experience and tools, outsourced CFOs are the key to navigating year-end complexities efficiently and effectively.

The Importance of Fiscal Year-End Planning

Transitioning into the fiscal year-end is a pivotal phase for businesses. This period requires careful fiscal year-end planning to maintain financial stability, regulatory compliance, and strategic growth opportunities. A well-structured approach during this time ensures accurate financial reporting and sets the tone for a productive new fiscal year.

Why Proper Year-End Planning is Essential for Business Health

Proper planning during this critical time is essential for long-term business health. Financial records need to be meticulously reviewed, errors corrected, and accounts reconciled. This helps ensure transparency in reporting and supports informed decision-making.

For example, 40% of US businesses that undergo financial audits discover issues in their reporting that need correction. Proactive planning can prevent such costly errors, saving businesses valuable resources.

Moreover, structured year-end preparation aids in improving cash flow management by identifying wasteful spending and redirecting resources toward growth-oriented activities.

Impact on Financial Reporting, Compliance, and Strategic Decisions

Year-end planning significantly affects financial reporting quality and accuracy; clarity and precision are non-negotiable for businesses preparing financial statements for stakeholders. Organizations may fail to meet regulatory deadlines without proper planning, resulting in penalties or damaged reputations.

Strategically, year-end planning creates an opportunity to assess business performance, align it with goals, and adjust operational strategies. This reflective period allows businesses to pivot based on trends and insights, providing a competitive edge in the new fiscal year.

How Year-End Planning Aligns Business Goals for the Coming Year

Alignment between year-end planning and business goals is crucial. Effective planning offers a roadmap for resource allocation and ensures that financial strategies reinforce overarching objectives. Companies can better navigate the upcoming fiscal year-end preparation by updating forecasts and identifying potential risks.

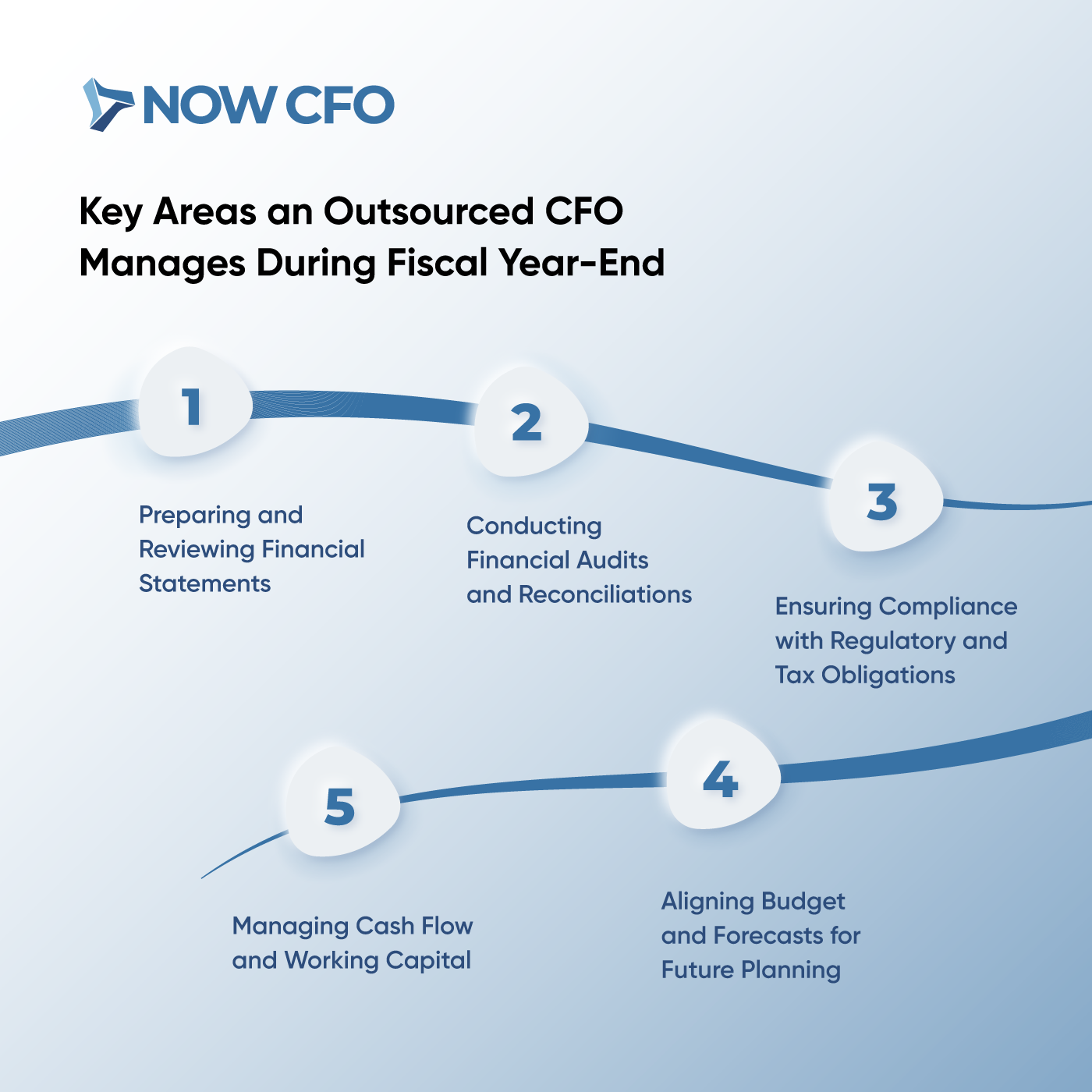

Key Areas an Outsourced CFO Manages During Fiscal Year-End

As the fiscal year-end approaches, businesses must address many financial activities, often under tight deadlines. This is where outsourced CFO services step in, offering expertise to streamline and enhance these processes. Let’s explore the critical areas they manage to ensure seamless fiscal year-end planning.

Preparing and Reviewing Financial Statements

First, an outsourced CFO prepares and reviews vital financial statements. Some of them are:

- Balance sheet

- Income statement

- Cash flow statement

Accurate and transparent financial statements meet regulatory standards and clearly represent the company’s financial health.

Conducting Financial Audits and Reconciliations

Next, an outsourced CFO manages financial audits and reconciliations. Ensuring all transactions are accounted for, and discrepancies resolved provides a robust foundation for year-end reporting. Their expertise minimizes errors and enhances trust among stakeholders.

Ensuring Compliance with Regulatory and Tax Obligations

Regulatory compliance is another critical responsibility. An outsourced CFO ensures the business adheres to all relevant tax codes, labor laws, and financial regulations. This reduces the risk of penalties and keeps the company’s reputation intact. The CFO also coordinates with tax advisors to optimize deductions and minimize liabilities.

Aligning Budget and Forecasts for Future Planning

Looking ahead, outsourced CFOs align budgets and forecasts based on year-end insights. They adjust financial projections to reflect past performance and market conditions, ensuring the business is well-positioned for the next fiscal year.

Managing Cash Flow and Working Capital

Outsourced CFOs focus on managing cash flow and working capital. They identify ways to optimize liquidity, ensuring the business has sufficient resources to meet obligations and invest in growth opportunities. For example, they may recommend restructuring payment schedules to improve cash availability.

Financial Reporting and Statements for Fiscal Year-End

Transitioning from regular operations to the fiscal year-end requires a sharp focus on financial reporting. Clear, accurate, timely reporting satisfies compliance requirements and gives stakeholders a transparent view of a company’s financial standing. Here’s how this critical process unfolds with the support of an outsourced CFO.

Preparing Balance Sheets, Income Statements, and Cash Flow Statements

Preparing critical financial statements is the foundation of effective fiscal year-end planning. An outsourced CFO meticulously compiles balance sheets, income statements, and cash flow statements, which provide a snapshot of the company’s financial health, profitability, and liquidity.

Assessing Business Performance with Year-End Financial Data

An outsourced CFO analyzes year-end financial planning data using these statements to assess business performance. They compare actual results against budgets and forecasts, identifying key trends or anomalies. This helps businesses understand what drove success or caused setbacks during the year.

For instance, they may find that specific product lines exceeded profit expectations while others underperformed. Such insights can inform strategic decisions for the upcoming year.

Improving Reporting Accuracy and Transparency for Stakeholders

Accurate and transparent reporting is essential to build trust with stakeholders, including investors, creditors, and regulatory bodies. Outsourced CFO services ensure compliance with accounting standards, such as GAAP or IFRS, and provide clear documentation to back up financial results. This level of clarity reassures stakeholders and supports business growth.

Identifying Key Financial Metrics for Decision-Making

Lastly, an outsourced CFO pinpoints financial metrics that drive decision-making, such as EBITDA, operating cash flow, and profit margins. Businesses can create actionable plans for the next fiscal year-end preparation by focusing on these critical indicators.

Tax Planning and Strategy at Fiscal Year End

As the fiscal year draws to a close, tax planning becomes a focal point for businesses aiming to minimize liabilities and maximize savings. Effective year-end tax planning at year-end ensures compliance with tax laws while leveraging opportunities for deductions and credits.

Optimizing Deductions and Expenses for Tax Savings

An outsourced CFO begins by identifying deductible expenses and tax credits that align with the business’s operations. These may include employee benefits, R&D credits, or asset depreciation. Timing is critical; ensuring that eligible expenses are recorded before the year closes can significantly reduce taxable income.

For instance, purchasing office equipment or prepaying certain expenses might be strategically timed to maximize deductions. According to the IRS, businesses that optimize deductions can reduce their tax bills by up to 20% annually.

Coordinating with Tax Advisors for Compliance and Optimization

Collaboration with tax advisors is another essential step. An outsourced CFO

- Bridges the company and its tax professionals and ensures all documentation is in order and meeting deadlines.

- Review tax filings for accuracy and completeness, preventing errors that could trigger audits or penalties.

- Keep businesses informed about changing tax laws.

For example, new federal tax regulations or state-specific incentives might offer opportunities for further savings.

Timing Expenses and Revenue for Tax Efficiency

Strategically timing income recognition and expenses is a powerful tool for tax efficiency. An outsourced CFO evaluates the company’s cash flow and revenue cycle to determine optimal timing. For example:

- Accelerating expenses in high-income years can lower taxable income.

- Deferring revenue recognition to the next fiscal year may push tax liabilities to a later period.

Reviewing Tax Liabilities and Preparing Filings

An outsourced CFO performs a detailed review of tax liabilities, verifying the accuracy of all reported figures. They prepare comprehensive filings, reducing the risk of discrepancies that could lead to penalties. This includes cross-referencing tax forms with financial statements to ensure consistency.

Strategic Planning for New Fiscal Year

A well-executed fiscal year-end planning doesn’t just close the books; it sets the stage for a strategic planning for the new fiscal year. By focusing on data-driven decision-making, fiscal year-end planning transitions into crafting actionable goals and strategies for growth.

Setting Financial Goals and Budgeting for Growth

Strategic planning begins with defining clear financial goals for the upcoming year. An outsourced CFO works with leadership teams to identify revenue growth, profit margins, or market share expansion targets. These goals form the backbone of the budgeting process.

The CFO ensures budgets align with these objectives by allocating resources effectively. For instance, they may recommend increased spending on technology upgrades to boost productivity or marketing initiatives to capture new customers.

A report found that businesses with clear financial plans are 30% more likely to achieve year-over-year growth.

Updating Forecasts Based on Year-End Financial Analysis

Accurate forecasts are essential for navigating the uncertainties of the business landscape. An outsourced CFO updates projections using insights from year-end financial planning to reflect current trends and conditions.

For example, they may adjust sales forecasts if the business has experienced a consistent growth trajectory or revise cost estimates to account for inflationary pressures. These refined forecasts provide a realistic roadmap, helping companies to stay agile and prepared for challenges.

Implementing Cost Control and Efficiency Strategies

Efficiency is at the heart of effective planning. An outsourced CFO identifies cost-saving opportunities that support long-term goals without compromising operational integrity. This includes:

- Streamlining processes

- Renegotiating vendor contracts, or

- Cutting redundant expenses

Reviewing Investment Opportunities for Long-term Success

Ultimately, an outsourced CFO evaluates potential investments to drive sustainable growth. They assess opportunities such as expanding into new markets, acquiring complementary businesses, or upgrading infrastructure. Each investment is weighed against the company’s risk tolerance and long-term strategy.

How an Outsourced CFO Streamlines the Year-End Process

Transitioning smoothly into the fiscal year-end requires expertise, organization, and strategic foresight. An outsourced CFO is pivotal in making this process efficient and error-free, ensuring the business is positioned for success in the upcoming year.

Organizing Financial Data for Efficient Reporting

An outsourced CFO’s first step is organizing financial data into a cohesive structure. They

- Consolidate accounts

- Reconcile discrepancies

- Categorize transactions to prepare for accurate reporting

This streamlined approach reduces the risk of missed entries or errors, ensuring compliance with standards like GAAP or IFRS.

Using Financial Systems to Improve Year-End Accuracy

Another strategy an outsourced CFO employs is leveraging advanced financial tools and software. These systems, from accounting platforms to data analytics tools, enhance accuracy and reduce manual errors. For example, automated reconciliations can identify inconsistencies within seconds, allowing for quicker resolutions.

According to a study by ACCA, businesses that integrate financial automation reduce manual error by 90% and increase financial reporting for fiscal year-end speed by 70% on year-end processes.

Enhancing Communication with Key Stakeholders

Clear communication is essential during any mid-year or year-end review process. An outsourced CFO liaises with auditors, tax professionals, and internal teams to ensure alignment. They build trust and eliminate last-minute bottlenecks by facilitating timely updates and proactively addressing queries.

Establishing a Timeline for Fiscal Year-End Completion

An outsourced CFO develops a detailed timeline for year-end activities, including deadlines for reconciliations, tax filings, and reporting. This structured timeline keeps all stakeholders accountable and ensures the process runs on schedule.

Benefits of Outsourcing CFO Support for Fiscal Year-End Planning

As businesses approach the fiscal year-end, financial reporting, compliance, and strategic planning challenges often become overwhelming. This is where the expertise of an outsourced CFO can make a significant difference.

An outsourced CFO delivers several critical benefits, simplifying and enhancing the year-end process by providing cost-effective, professional financial leadership. Also, 83% of senior leaders reported a talent shortage in 2024, up from 70% in 2022 and 63% in 2020.

Access to Financial Expertise Without Full-Time Costs

One of the most significant advantages of outsourcing a CFO is access to high-level financial expertise without incurring the expense of a full-time executive. SMEs, in particular, can benefit from this arrangement, gaining insights into tax strategies, compliance, and reporting while maintaining cost efficiency.

Objective Perspective on Financial and Strategic Decisions

An outsourced CFO offers an unbiased viewpoint, helping businesses make data-driven decisions during the fiscal year-end. Whether assessing financial risks or evaluating investment opportunities, their independent perspective ensures that decisions are free from internal biases and align with long-term goals.

Reduced Compliance Risk Through Accurate Reporting

Compliance is non-negotiable, especially during the year-end. An outsourced CFO ensures all reports meet regulatory standards, minimizing the risk of errors that could trigger penalties or audits. Their expertise in tax codes and financial regulations provides peace of mind during this critical period.

Faster and More Efficient Year-End Closing Process

With their experience and streamlined processes, outsourced CFOs expedite the year-end closing. Organizing data and liaising with auditors help businesses complete their financial reporting accurately and on time, reducing stress for internal teams.

More Muscular Foundation for Growth in the New Fiscal Year

Outsourced CFO services do more than close the books; it lays the groundwork for future growth. Addressing inefficiencies and implementing strategic solutions ensures the business is poised for success in the new fiscal year.

How to Choose the Right Outsourced CFO for Year-End Planning

Selecting the right outsourced CFO is crucial for effective fiscal year-end planning. The ideal CFO should possess technical expertise and align with your business’s strategic vision. Here are vital factors to consider when making your choice.

Look for Experience in Year-End Financial Reporting and Compliance

When evaluating candidates, prioritize those with proven year-end reporting and regulatory compliance expertise. A seasoned outsourced CFO will understand the intricacies of tax laws, financial standards like GAAP or IFRS, and audit demands.

Verify Their Ability to Manage Strategic Financial Planning

Beyond compliance, outsourced CFO services should excel in strategic financial planning. They should demonstrate an ability to analyze financial data and translate it into actionable growth strategies. Ask for examples of successfully aligning financial plans with business objectives.

Confirm Their Track Record in Supporting Year-End Success

Review case studies or references to gauge their track record in handling year-end processes. Look for evidence of past successes, such as timely financial reporting, improved cash flow management, or optimized tax outcomes.

Ensure Alignment with Your Business’s Long-Term Goals

Therefore, choose a CFO whose approach aligns with your company’s long-term goals. Their strategies should support growth, innovation, and financial stability. This alignment ensures a partnership that drives success well beyond the year-end.

Conclusion: Achieving Year-End Success with an Outsourced CFO

As the fiscal year draws close, businesses must prioritize effective year-end planning to ensure accuracy, compliance, and strategic alignment. An outsourced CFO is pivotal in simplifying this complex process, from preparing financial reports to optimizing tax strategies and guiding forward-thinking planning for the upcoming fiscal year.

Ultimately, supporting outsourced CFO services equips organizations with the tools to navigate fiscal year-end planning confidently and enter the new year with a solid financial foundation. For businesses seeking efficiency, accuracy, and strategy, partnering with an outsourced CFO is an intelligent investment in sustained growth and resilience.